Nope. There is another case ongoing against the practice of offsetting things from the 2008(?) Reform. If that passes, then the new reform would also be void. But well.. it's 2022.. maybe we get a ring this year or next*** this is currently being contest infront of the highest courts in Germany, as the loss-limit is €20.000- I'm ignoring this implication, as I believe it will be amended @Drezil have your heard of an update on this?

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Wiki Selling TSLA Options - Be the House

- Thread starter adiggs

- Start date

One thing to keep in mind is that if you live and pay taxes in Belgium, you'll be hit by the beurstaks on shares you've had less than a year.I've been thinking about converting a substantial part of my TSLA shares to cash in order to generate capital by weekly/biweekly OTP BPS selling.

In a perfect world where you could time everything perfectly, you'd make this switch after a huge SP rally, hoping to sell at a local top.

The main consideration is "can you get a safe minimum weekly return that outperforms the stock in the long run?".

In the short term the stock can rally hard and no amount of safe spread selling will net you similar results. On weeks where TSLA is down, even by a large amount but not insanely large, the cash based approach will win out hugely.

After running some numbers, I'd like to present them here in order to get some feedback.

Currently a 2% weekly return seems doable with safe spreads. Safe in my mind is either very wide (+650p/-1050p-) or far OTM (+750p/-900p). Both of these will net me more than 2% return. Combining the safety nets of width and distance OTM is more difficult. After all, once you get too far OTM (below 850 for example) the premiums are basically the same in $ value, even if you go $100 further OTM. So a super safe +500p/-900p will not get you the desired weekly returns to outperform the stock in the long run.

By the way, the reason I have 2% minimum in the back of my mind is because, starting from $1068 SP today this would mean the stock would have to reach over $2900 by end of 2022 in order for the cash route to be less profitable.

At 1% weekly returns HODLING seems safer: the SP only needs to go to around $1800 by year end and that is within the possibilities IMO. ($2900 is also 'possible' but way more unlikely if you ask me).

Also, if you get minimum 2% per week you might go over some other weeks. There are relatively safe spread to be found with 3% weekly returns as well, and if you can get some of these in from time to time (depending on the current position of the SP withing the trading channel) it truly seems difficult for the stock to outperform cash.

Of course, if I were to do this, I'd have very strict rules in order to preserve capital, way stricter than I'm currently trading options. To scratch the "trading itch" I think I would use (for example) 2/3 of my cash for safe income generation and the other 1/3 could act as a seperate options trading (virtual) account like I'm doing now. (Right now my balance is: 3/4 TSLA HODL , 1/4 cash which I grow with options).

Another benefit of going cash is recession. IF there were a recession and the markets all give back 30%, I could buy back more TSLA than I sold. Of course this is A) timing the market which I don't believe anyone is capable of and B) a non-argument since the opposite can happen as well: a 2 year bull market after you convert to cash in which your stock returns would've been higher than "safe" options selling. So this argument seems to only matter if you convert TSLA to cash on ATH.

Pardon my ramblings, I'm just sharing my internal reasoning. I've been dipping my toes into this thread and option selling since May 2021 and checking my returns I notice they are much higher than I expect the stock to gain (in the long term, short term anything can happen for example if FSD were to release or something). I am aware of the fact that this is only true for TSLA option selling. I've dipped my toes into selling options for other underlying, but these returns are abysmal compared to TSLA. Volatility and volume are king.

I started out very small in May (only $15k cash or so). After some learning I (on purpose) let a cc expire and I've been using that cash for option selling also.

Now I'm wondering if I should convert some more shares but I keep thinking there must be a catch. As we always say: If the risk is unclear, it's because you didn't look hard enough.

Therefore I would appreciate some feedback regarding my thought process and mainly:

- is 2% per week truly possible on consistent basis? Or higher, lower?

- what risks am I not seeing?

- will the TSLA options market dry up in a couple of years when TSLA stabilizes? WDYT?

Good day to all.

That's why when I moved my portfolio from DeGiro to IBKR, I intend to not touch these shares, but use their value as part of my liquidity.

Now, I do think that selling options are suitable for the current case where SP isn't moving much upward, but I haven't done the calculations yet on what would happen if another stock split would happen. As far as I can see, doing better with selling options than the 2021 SP is doable, but 2020 is something else.

Last edited:

The calculations I've done in the past and posted in this thread (ages back) also showed that selling options would outstrip share appreciation. I was earning much more than 2% at the time but even at 2% your calcs seem reasonable. I haven't gone down the all cash route due to a sentimental attachment to my TSLA stock and a habit of using them as a yard stick. The approach I use allows me to HODL and trade options and really the equity from the shares would allow me to earn more than enough income from option sales. However I'm currently not putting any profits into more shares or long options. I do like the ability to keep a cash balance as it's much easier to move funds around (plus the added excess liquidity) than face the tax implications of liquidating shares.Therefore I would appreciate some feedback regarding my thought process and mainly:

- is 2% per week truly possible on consistent basis? Or higher, lower?

- what risks am I not seeing?

- will the TSLA options market dry up in a couple of years when TSLA stabilizes? WDYT?

Good day to all.

The main risks are a big mistake or black swan event causing a major loss in your options and then cash position. I've had some of these and they really put your future projections back a lot. But then pulling back to just 2% per week should prove safer and less likely to be caught out in a major event. I don't see the TSLA options market drying up completely, although I expect the pirates will eventually move onto a new play thing. Hopefully by then I have enough of a balance that the reduced volatility and premiums won't be an issue.

Last edited:

jeewee3000

Active Member

That's why when I moved my portfolio from DeGiro to IBKR, I intend to not touch these shares, but use their value as part of my liquidity.

That indeed is an ability I do not possess with my broker. My TSLA shares do not provide any margin. Neither do I have margin by other means.

All options I sell are backed by cash. But I'm used to it and I like the safety net created by it.

jeewee3000

Active Member

I do remember your calculations, but at the time I surely wasn't ready for cash so I glanced over them. My bad. I'll have to go dig.The calculations I've done in the past and posted in this thread (ages back) also showed that selling options would outstrip share appreciation. I was earning much more than 2% at the time but even at 25 your calcs seem reasonable. I haven't gone down the all cash route due to a sentimental attachment to my TSLA stock and a habit of using them as a yard stick. The approach I use allows me to HODL and trade options and really the equity from the shares would allow me to earn more than enough income from option sales. However I'm currently not putting any profits into more shares or long options. I do like the ability to keep a cash balance as it's much easier to move funds around (plus the added excess liquidity) than face the tax implications of liquidating shares.

The main risks are a big mistake or black swan event causing a major loss in your options and then cash position. I've had some of these and they really put your future projections back a lot. But then pulling back to just 2% per week should prove safer and less likely to be caught out in a major event. I don't see the TSLA options market drying up completely, although I expect the pirates will eventually move onto a new play thing. Hopefully by then I have enough of a balance that the reduced volatility and premiums won't be an issue.

I've been thinking about converting a substantial part of my TSLA shares to cash in order to generate capital by weekly/biweekly OTP BPS selling.

In a perfect world where you could time everything perfectly, you'd make this switch after a huge SP rally, hoping to sell at a local top.

The main consideration is "can you get a safe minimum weekly return that outperforms the stock in the long run?".

In the short term the stock can rally hard and no amount of safe spread selling will net you similar results. On weeks where TSLA is down, even by a large amount but not insanely large, the cash based approach will win out hugely.

After running some numbers, I'd like to present them here in order to get some feedback.

Currently a 2% weekly return seems doable with safe spreads. Safe in my mind is either very wide (+650p/-1050p-) or far OTM (+750p/-900p). Both of these will net me more than 2% return. Combining the safety nets of width and distance OTM is more difficult. After all, once you get too far OTM (below 850 for example) the premiums are basically the same in $ value, even if you go $100 further OTM. So a super safe +500p/-900p will not get you the desired weekly returns to outperform the stock in the long run.

By the way, the reason I have 2% minimum in the back of my mind is because, starting from $1068 SP today this would mean the stock would have to reach over $2900 by end of 2022 in order for the cash route to be less profitable.

At 1% weekly returns HODLING seems safer: the SP only needs to go to around $1800 by year end and that is within the possibilities IMO. ($2900 is also 'possible' but way more unlikely if you ask me).

Also, if you get minimum 2% per week you might go over some other weeks. There are relatively safe spread to be found with 3% weekly returns as well, and if you can get some of these in from time to time (depending on the current position of the SP withing the trading channel) it truly seems difficult for the stock to outperform cash.

Of course, if I were to do this, I'd have very strict rules in order to preserve capital, way stricter than I'm currently trading options. To scratch the "trading itch" I think I would use (for example) 2/3 of my cash for safe income generation and the other 1/3 could act as a seperate options trading (virtual) account like I'm doing now. (Right now my balance is: 3/4 TSLA HODL , 1/4 cash which I grow with options).

Another benefit of going cash is recession. IF there were a recession and the markets all give back 30%, I could buy back more TSLA than I sold. Of course this is A) timing the market which I don't believe anyone is capable of and B) a non-argument since the opposite can happen as well: a 2 year bull market after you convert to cash in which your stock returns would've been higher than "safe" options selling. So this argument seems to only matter if you convert TSLA to cash on ATH.

Pardon my ramblings, I'm just sharing my internal reasoning. I've been dipping my toes into this thread and option selling since May 2021 and checking my returns (+5% per week on average) I notice they are much higher than I expect the stock to gain (in the long term, short term anything can happen for example if FSD were to release or something). I am aware of the fact that this is only true for TSLA option selling. I've dipped my toes into selling options for other underlying, but these returns are abysmal compared to TSLA. Volatility and volume are king.

I started out very small in May (only $15k cash or so). After some learning I (on purpose) let a cc expire and I've been using that cash for option selling also.

Now I'm wondering if I should convert some more shares but I keep thinking there must be a catch. As we always say: If the risk is unclear, it's because you didn't look hard enough.

Therefore I would appreciate some feedback regarding my thought process and mainly:

- is 2% per week truly possible on consistent basis? Or higher, lower?

- what risks am I not seeing?

- will the TSLA options market dry up in a couple of years when TSLA stabilizes? WDYT?

Good day to all.

You have a great analytical framework for making your decision. May I suggest you consider a partial conversion to cash as a “hedge”?

I have gone to 50% shares and 50% LEAPs, although I add 4-6 month calls occasionally as rage buys and have another 1/3x in temporary shares within a buy-write with aggressive CC strikes which both nudge the ratio. Still trying to figure out how and when to rebalance.

Your long position increases and is free from paying taxes as long as you don’t realize a capital gain.I've been thinking about converting a substantial part of my TSLA shares to cash in order to generate capital by weekly/biweekly OTP BPS selling.

In a perfect world where you could time everything perfectly, you'd make this switch after a huge SP rally, hoping to sell at a local top.

The main consideration is "can you get a safe minimum weekly return that outperforms the stock in the long run?".

In the short term the stock can rally hard and no amount of safe spread selling will net you similar results. On weeks where TSLA is down, even by a large amount but not insanely large, the cash based approach will win out hugely.

After running some numbers, I'd like to present them here in order to get some feedback.

Currently a 2% weekly return seems doable with safe spreads. Safe in my mind is either very wide (+650p/-1050p-) or far OTM (+750p/-900p). Both of these will net me more than 2% return. Combining the safety nets of width and distance OTM is more difficult. After all, once you get too far OTM (below 850 for example) the premiums are basically the same in $ value, even if you go $100 further OTM. So a super safe +500p/-900p will not get you the desired weekly returns to outperform the stock in the long run.

By the way, the reason I have 2% minimum in the back of my mind is because, starting from $1068 SP today this would mean the stock would have to reach over $2900 by end of 2022 in order for the cash route to be less profitable.

At 1% weekly returns HODLING seems safer: the SP only needs to go to around $1800 by year end and that is within the possibilities IMO. ($2900 is also 'possible' but way more unlikely if you ask me).

Also, if you get minimum 2% per week you might go over some other weeks. There are relatively safe spread to be found with 3% weekly returns as well, and if you can get some of these in from time to time (depending on the current position of the SP withing the trading channel) it truly seems difficult for the stock to outperform cash.

Of course, if I were to do this, I'd have very strict rules in order to preserve capital, way stricter than I'm currently trading options. To scratch the "trading itch" I think I would use (for example) 2/3 of my cash for safe income generation and the other 1/3 could act as a seperate options trading (virtual) account like I'm doing now. (Right now my balance is: 3/4 TSLA HODL , 1/4 cash which I grow with options).

Another benefit of going cash is recession. IF there were a recession and the markets all give back 30%, I could buy back more TSLA than I sold. Of course this is A) timing the market which I don't believe anyone is capable of and B) a non-argument since the opposite can happen as well: a 2 year bull market after you convert to cash in which your stock returns would've been higher than "safe" options selling. So this argument seems to only matter if you convert TSLA to cash on ATH.

Pardon my ramblings, I'm just sharing my internal reasoning. I've been dipping my toes into this thread and option selling since May 2021 and checking my returns (+5% per week on average) I notice they are much higher than I expect the stock to gain (in the long term, short term anything can happen for example if FSD were to release or something). I am aware of the fact that this is only true for TSLA option selling. I've dipped my toes into selling options for other underlying, but these returns are abysmal compared to TSLA. Volatility and volume are king.

I started out very small in May (only $15k cash or so). After some learning I (on purpose) let a cc expire and I've been using that cash for option selling also.

Now I'm wondering if I should convert some more shares but I keep thinking there must be a catch. As we always say: If the risk is unclear, it's because you didn't look hard enough.

Therefore I would appreciate some feedback regarding my thought process and mainly:

- is 2% per week truly possible on consistent basis? Or higher, lower?

- what risks am I not seeing?

- will the TSLA options market dry up in a couple of years when TSLA stabilizes? WDYT?

Good day to all.

If you transfer all your shares to a broker that let you have a margin against your TSLA shares, then you could keep your TSLA shares and would have 70% if that value as a margin to sell far OTM BPS. That is what I am intending to do with IBKR. However, you have to stay safe with margin to avoid your position being liquidated.

With cash position, you are safer in case of a black swan. A deleveraging recession might happen in 3 years, 5 years or more. That would let you the opportunity to buy back is the stock collapse, however timing the bottom perfectly is impossible.

InTheShadows

Active Member

I've been thinking about converting a substantial part of my TSLA shares to cash in order to generate capital by weekly/biweekly OTP BPS selling.

In a perfect world where you could time everything perfectly, you'd make this switch after a huge SP rally, hoping to sell at a local top.

The main consideration is "can you get a safe minimum weekly return that outperforms the stock in the long run?".

In the short term the stock can rally hard and no amount of safe spread selling will net you similar results. On weeks where TSLA is down, even by a large amount but not insanely large, the cash based approach will win out hugely.

After running some numbers, I'd like to present them here in order to get some feedback.

Currently a 2% weekly return seems doable with safe spreads. Safe in my mind is either very wide (+650p/-1050p-) or far OTM (+750p/-900p). Both of these will net me more than 2% return. Combining the safety nets of width and distance OTM is more difficult. After all, once you get too far OTM (below 850 for example) the premiums are basically the same in $ value, even if you go $100 further OTM. So a super safe +500p/-900p will not get you the desired weekly returns to outperform the stock in the long run.

By the way, the reason I have 2% minimum in the back of my mind is because, starting from $1068 SP today this would mean the stock would have to reach over $2900 by end of 2022 in order for the cash route to be less profitable.

At 1% weekly returns HODLING seems safer: the SP only needs to go to around $1800 by year end and that is within the possibilities IMO. ($2900 is also 'possible' but way more unlikely if you ask me).

Also, if you get minimum 2% per week you might go over some other weeks. There are relatively safe spread to be found with 3% weekly returns as well, and if you can get some of these in from time to time (depending on the current position of the SP withing the trading channel) it truly seems difficult for the stock to outperform cash.

Of course, if I were to do this, I'd have very strict rules in order to preserve capital, way stricter than I'm currently trading options. To scratch the "trading itch" I think I would use (for example) 2/3 of my cash for safe income generation and the other 1/3 could act as a seperate options trading (virtual) account like I'm doing now. (Right now my balance is: 3/4 TSLA HODL , 1/4 cash which I grow with options).

Another benefit of going cash is recession. IF there were a recession and the markets all give back 30%, I could buy back more TSLA than I sold. Of course this is A) timing the market which I don't believe anyone is capable of and B) a non-argument since the opposite can happen as well: a 2 year bull market after you convert to cash in which your stock returns would've been higher than "safe" options selling. So this argument seems to only matter if you convert TSLA to cash on ATH.

Pardon my ramblings, I'm just sharing my internal reasoning. I've been dipping my toes into this thread and option selling since May 2021 and checking my returns (+5% per week on average) I notice they are much higher than I expect the stock to gain (in the long term, short term anything can happen for example if FSD were to release or something). I am aware of the fact that this is only true for TSLA option selling. I've dipped my toes into selling options for other underlying, but these returns are abysmal compared to TSLA. Volatility and volume are king.

I started out very small in May (only $15k cash or so). After some learning I (on purpose) let a cc expire and I've been using that cash for option selling also.

Now I'm wondering if I should convert some more shares but I keep thinking there must be a catch. As we always say: If the risk is unclear, it's because you didn't look hard enough.

Therefore I would appreciate some feedback regarding my thought process and mainly:

- is 2% per week truly possible on consistent basis? Or higher, lower?

- what risks am I not seeing?

- will the TSLA options market dry up in a couple of years when TSLA stabilizes? WDYT?

Good day to all.

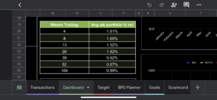

What I have learned is 1% on the entire portfolio per week is doable most weeks.

I target 1.5-2% per trade.

I have some accounts that are all cash and others that are a mix of leaps and cash and others shares and cash.

I like having a base of shares because if things go terribly wrong and everything is tied up in BPS you could get wiped out.

IMO targeting 2-3% weekly returns would expose one’s self to much more risk than I am willing to take.

Here are my trailing weekly return averages based on entire portfolio. This is over somewhere between 700-800 trades.

Knightshade

Well-Known Member

I've been thinking about converting a substantial part of my TSLA shares to cash in order to generate capital by weekly/biweekly OTP BPS selling.

In a perfect world where you could time everything perfectly, you'd make this switch after a huge SP rally, hoping to sell at a local top.

The main consideration is "can you get a safe minimum weekly return that outperforms the stock in the long run?".

In 2020? Probably not.

But after that and ongoing? Probably yes.

Tesla gained about 50% in 2021, even QUITE conservative 1% per week would've (slightly) beaten that.

I think it's POSSIBLE the stock will close up another 50% for 2022- but certainly not a sure thing- while that 1% a week is a lot more likely to happen (and 1.5% even staying quite conservative seems pretty likely- some folks been safely returning 2% or better so far with wider spreads or more active management)

And longer term, the stock CAN'T keep going up 50% every year, because before long it'd be worth more than the entire economy.

What I've done for now (in an IRA so no tax concerns and also no ability to leverage via margin) is replace my shares with a comparable delta of LEAPs so I can still get that 50% share gain if it happens, but it also freed up half the value of the account in cash for spreads.

In my taxable account I'm instead using margin (though not all of it!) as "cash" to back spreads at no interest cost, my actual "holdings" there are currently a comparable amount of shares and LEAPs which are all LT holdings for tax purposes- but I expect as stock growth slows in future years I'd convert more of that to cash for spread income as well (additionally that's the $ that'll fund my retirement for the years before I can take anything from the IRA)

FS_FRA

Member

Nope. There is another case ongoing against the practice of offsetting things from the 2008(?) Reform. If that passes, then the new reform would also be void. But well.. it's 2022.. maybe we get a ring this year or next

I have some (little) faith in our new finance minister....

FS_FRA

Member

A request regarding %-returns (and I know this has been discussed before):

In my case, I looked at my 2021 Sept - Dec performance / week as a % of the entire portfolio (100% TSLA + cash) and found that with the conservative BPS (far OTM, 200 wide spreads) and occasional CC (far OTM) I've not managed to hit 1% / week , more like 0.6%.

, more like 0.6%.

- when referring to %-return (i.e. 2% weekly), please always state clearly what the % is of

- is it % of total portfolio / % of available margin / % of available cash / % of TSLA holding etc.

In my case, I looked at my 2021 Sept - Dec performance / week as a % of the entire portfolio (100% TSLA + cash) and found that with the conservative BPS (far OTM, 200 wide spreads) and occasional CC (far OTM) I've not managed to hit 1% / week

To me the only thing that really matters is return on the money at risk. Could be total portfolio or margin or whatever, doesn't really matter. What matters is what you put on the line. Based on my experience over the past months, 1.5-2% per week return on the amount of money at risk seems fairly doable without a ton of stress, but there are so many factors involved that it is definitely an average. I think .5% per week is doable with practically no stress.A request regarding %-returns (and I know this has been discussed before):

I think that will really help everyone out who is looking at weekly performance targets to benchmark against

- when referring to %-return (i.e. 2% weekly), please always state clearly what the % is of

- is it % of total portfolio / % of available margin / % of available cash / % of TSLA holding etc.

In my case, I looked at my 2021 Sept - Dec performance / week as a % of the entire portfolio (100% TSLA + cash) and found that with the conservative BPS (far OTM, 200 wide spreads) and occasional CC (far OTM) I've not managed to hit 1% / week, more like 0.6%.

Knightshade

Well-Known Member

Speaking personally I only use it to refer to % gain on risked money.

If I backed a $100 spread I had $10,000 at risk, if I got a $100 net credit that's a 1% gain for the week.

I don't understand why $ that wasn't involved in the trade would factor into computing gains on a trade.

If I backed a $100 spread I had $10,000 at risk, if I got a $100 net credit that's a 1% gain for the week.

I don't understand why $ that wasn't involved in the trade would factor into computing gains on a trade.

Zhelko Dimic

Careful bull

Have you been burnt seriously in your options trading so far? So bad, you couldn't sleep. For me that was 93% draw-dawn of my main account end of '15 into the '16...I've been thinking about converting a substantial part of my TSLA shares to cash in order to generate capital by weekly/biweekly OTP BPS selling.

In a perfect world where you could time everything perfectly, you'd make this switch after a huge SP rally, hoping to sell at a local top.

The main consideration is "can you get a safe minimum weekly return that outperforms the stock in the long run?".

In the short term the stock can rally hard and no amount of safe spread selling will net you similar results. On weeks where TSLA is down, even by a large amount but not insanely large, the cash based approach will win out hugely.

After running some numbers, I'd like to present them here in order to get some feedback.

Currently a 2% weekly return seems doable with safe spreads. Safe in my mind is either very wide (+650p/-1050p-) or far OTM (+750p/-900p). Both of these will net me more than 2% return. Combining the safety nets of width and distance OTM is more difficult. After all, once you get too far OTM (below 850 for example) the premiums are basically the same in $ value, even if you go $100 further OTM. So a super safe +500p/-900p will not get you the desired weekly returns to outperform the stock in the long run.

By the way, the reason I have 2% minimum in the back of my mind is because, starting from $1068 SP today this would mean the stock would have to reach over $2900 by end of 2022 in order for the cash route to be less profitable.

At 1% weekly returns HODLING seems safer: the SP only needs to go to around $1800 by year end and that is within the possibilities IMO. ($2900 is also 'possible' but way more unlikely if you ask me).

Also, if you get minimum 2% per week you might go over some other weeks. There are relatively safe spread to be found with 3% weekly returns as well, and if you can get some of these in from time to time (depending on the current position of the SP withing the trading channel) it truly seems difficult for the stock to outperform cash.

Of course, if I were to do this, I'd have very strict rules in order to preserve capital, way stricter than I'm currently trading options. To scratch the "trading itch" I think I would use (for example) 2/3 of my cash for safe income generation and the other 1/3 could act as a seperate options trading (virtual) account like I'm doing now. (Right now my balance is: 3/4 TSLA HODL , 1/4 cash which I grow with options).

Another benefit of going cash is recession. IF there were a recession and the markets all give back 30%, I could buy back more TSLA than I sold. Of course this is A) timing the market which I don't believe anyone is capable of and B) a non-argument since the opposite can happen as well: a 2 year bull market after you convert to cash in which your stock returns would've been higher than "safe" options selling. So this argument seems to only matter if you convert TSLA to cash on ATH.

Pardon my ramblings, I'm just sharing my internal reasoning. I've been dipping my toes into this thread and option selling since May 2021 and checking my returns (+5% per week on average) I notice they are much higher than I expect the stock to gain (in the long term, short term anything can happen for example if FSD were to release or something). I am aware of the fact that this is only true for TSLA option selling. I've dipped my toes into selling options for other underlying, but these returns are abysmal compared to TSLA. Volatility and volume are king.

I started out very small in May (only $15k cash or so). After some learning I (on purpose) let a cc expire and I've been using that cash for option selling also.

Now I'm wondering if I should convert some more shares but I keep thinking there must be a catch. As we always say: If the risk is unclear, it's because you didn't look hard enough.

Therefore I would appreciate some feedback regarding my thought process and mainly:

- is 2% per week truly possible on consistent basis? Or higher, lower?

- what risks am I not seeing?

- will the TSLA options market dry up in a couple of years when TSLA stabilizes? WDYT?

Good day to all.

If you haven't, continue small, or rather evolutionary. Because you will not know your limits until you get burnt

what i did is to get the best of both worlds:I've been thinking about converting a substantial part of my TSLA shares to cash in order to generate capital by weekly/biweekly OTP BPS selling.

In a perfect world where you could time everything perfectly, you'd make this switch after a huge SP rally, hoping to sell at a local top.

The main consideration is "can you get a safe minimum weekly return that outperforms the stock in the long run?".

In the short term the stock can rally hard and no amount of safe spread selling will net you similar results. On weeks where TSLA is down, even by a large amount but not insanely large, the cash based approach will win out hugely.

After running some numbers, I'd like to present them here in order to get some feedback.

Currently a 2% weekly return seems doable with safe spreads. Safe in my mind is either very wide (+650p/-1050p-) or far OTM (+750p/-900p). Both of these will net me more than 2% return. Combining the safety nets of width and distance OTM is more difficult. After all, once you get too far OTM (below 850 for example) the premiums are basically the same in $ value, even if you go $100 further OTM. So a super safe +500p/-900p will not get you the desired weekly returns to outperform the stock in the long run.

By the way, the reason I have 2% minimum in the back of my mind is because, starting from $1068 SP today this would mean the stock would have to reach over $2900 by end of 2022 in order for the cash route to be less profitable.

At 1% weekly returns HODLING seems safer: the SP only needs to go to around $1800 by year end and that is within the possibilities IMO. ($2900 is also 'possible' but way more unlikely if you ask me).

Also, if you get minimum 2% per week you might go over some other weeks. There are relatively safe spread to be found with 3% weekly returns as well, and if you can get some of these in from time to time (depending on the current position of the SP withing the trading channel) it truly seems difficult for the stock to outperform cash.

Of course, if I were to do this, I'd have very strict rules in order to preserve capital, way stricter than I'm currently trading options. To scratch the "trading itch" I think I would use (for example) 2/3 of my cash for safe income generation and the other 1/3 could act as a seperate options trading (virtual) account like I'm doing now. (Right now my balance is: 3/4 TSLA HODL , 1/4 cash which I grow with options).

Another benefit of going cash is recession. IF there were a recession and the markets all give back 30%, I could buy back more TSLA than I sold. Of course this is A) timing the market which I don't believe anyone is capable of and B) a non-argument since the opposite can happen as well: a 2 year bull market after you convert to cash in which your stock returns would've been higher than "safe" options selling. So this argument seems to only matter if you convert TSLA to cash on ATH.

Pardon my ramblings, I'm just sharing my internal reasoning. I've been dipping my toes into this thread and option selling since May 2021 and checking my returns (+5% per week on average) I notice they are much higher than I expect the stock to gain (in the long term, short term anything can happen for example if FSD were to release or something). I am aware of the fact that this is only true for TSLA option selling. I've dipped my toes into selling options for other underlying, but these returns are abysmal compared to TSLA. Volatility and volume are king.

I started out very small in May (only $15k cash or so). After some learning I (on purpose) let a cc expire and I've been using that cash for option selling also.

Now I'm wondering if I should convert some more shares but I keep thinking there must be a catch. As we always say: If the risk is unclear, it's because you didn't look hard enough.

Therefore I would appreciate some feedback regarding my thought process and mainly:

- is 2% per week truly possible on consistent basis? Or higher, lower?

- what risks am I not seeing?

- will the TSLA options market dry up in a couple of years when TSLA stabilizes? WDYT?

Good day to all.

- in my main trading acct, i moved to all-cash setting. The last time i checked, i think growth was 59%(?) better than HODL.

- in my retirement accts, they are strictly HODL and 30% OTM Covered Calls at 14 DTE (ie weekly prems are too low); this is my backup plan in case i blow up my trading acct. Growth is painfully slow but at least shares are accumulating. I purposely don't look at the YTD% gain coz it's depressing.

- BTC% (value 80%) - in the real world, you would ideally be closing your position early and not bring it to expiry. If the credit is $100 and you close it at 80% profit, the net portfolio gain is $80, not $100. Therefore, the "2% per week" is actually lower than that (for ex, 1.6%).

- Win% (value 80%) - i am assuming that not all 52 weeks are Wins. At 80%, 40 W and 12 for rolling. The annual gain would then be 40 weeks x 1.6.

Last edited:

I do use money at risk in one of my performance calculations, but that performance is meaningless to see how your cash/options investment is comparing to stock performance if that money were left in stock.Speaking personally I only use it to refer to % gain on risked money.

If I backed a $100 spread I had $10,000 at risk, if I got a $100 net credit that's a 1% gain for the week.

I don't understand why $ that wasn't involved in the trade would factor into computing gains on a trade.

Knightshade

Well-Known Member

I do use money at risk in one of my performance calculations, but that performance is meaningless to see how your cash/options investment is comparing to stock performance if that money were left in stock.

Maybe I'm not understanding but it seems just the opposite to me.

That number (% gain on $ at risk) is the exact number you'd compare to the performance of money left in the stock.

If I made 1% on the amount risked in options investing (as in the example) per week, that's 52% gains a year (assuming you invest every week and we're ignoring compounding which can make this # even higher).

Did the stock go up 52% or more for the year? If not, you did better having that $ in options trading. If the stock went up more, you did worse.

Since the increase in the stock is easily available info you don't even need to have any in your account to compute the comparison.

(disclaimer- depending on the account there may be a modifier you need to make for tax purposes--if it's a fully taxable account for example you'd probably have to compare your options gains after paying short term rates vs shares profit at long term tax rates-- but the general principle is the same)

In 2020? Probably not.

But after that and ongoing? Probably yes.

Tesla gained about 50% in 2021, even QUITE conservative 1% per week would've (slightly) beaten that.

I think it's POSSIBLE the stock will close up another 50% for 2022- but certainly not a sure thing- while that 1% a week is a lot more likely to happen (and 1.5% even staying quite conservative seems pretty likely- some folks been safely returning 2% or better so far with wider spreads or more active management)

And longer term, the stock CAN'T keep going up 50% every year, because before long it'd be worth more than the entire economy.

What I've done for now (in an IRA so no tax concerns and also no ability to leverage via margin) is replace my shares with a comparable delta of LEAPs so I can still get that 50% share gain if it happens, but it also freed up half the value of the account in cash for spreads.

In my taxable account I'm instead using margin (though not all of it!) as "cash" to back spreads at no interest cost, my actual "holdings" there are currently a comparable amount of shares and LEAPs which are all LT holdings for tax purposes- but I expect as stock growth slows in future years I'd convert more of that to cash for spread income as well (additionally that's the $ that'll fund my retirement for the years before I can take anything from the IRA)

In tax free trading account it is interesting to compare. However, I would argue that comparing a taxable account would have to be adjusted after tax deductions. Would be more interesting for me to have 50% stock increase on a buy n Hold position than 75% on a cash backed trading account. On a margin account it is a different story since I would not use that margin backed account to buy stock anyway.Maybe I'm not understanding but it seems just the opposite to me.

That number (% gain on $ at risk) is the exact number you'd compare to the performance of money left in the stock.

If I made 1% on the amount risked in options investing (as in the example) per week, that's 52% gains a year (assuming you invest every week and we're ignoring compounding which can make this # even higher).

Did the stock go up 52% or more for the year? If not, you did better having that $ in options trading. If the stock went up more, you did worse.

Since the increase in the stock is easily available info you don't even need to have any in your account to compute the comparison.

(disclaimer- depending on the account there may be a modifier you need to make for tax purposes--if it's a fully taxable account for example you'd probably have to compare your options gains after paying short term rates vs shares profit at long term tax rates-- but the general principle is the same)

Knightshade

Well-Known Member

That's what my disclaimer you quoted specifically points points out though....

The modifier you'd need to use would depend on your specific tax situation of course, not just federal rate, but possibly state too (my state doesn't care if your gains are LT or not for example-so that would NOT factor into the comparison- but SOME states do tax LT gains lower and would need to be included in that modifier)

The modifier you'd need to use would depend on your specific tax situation of course, not just federal rate, but possibly state too (my state doesn't care if your gains are LT or not for example-so that would NOT factor into the comparison- but SOME states do tax LT gains lower and would need to be included in that modifier)

jeewee3000

Active Member

Thanks for all the thoughtful replies.

Some thoughts:

- to @CHGolferJim : if I were to switch to cash in the near future, it would indeed only be part of my share holding. Thanks for the tip. I think by playing with larger sums/positions, the maths/results would work out differently and I'd like very much to be able to benchmark this long term against shares. Also, the shares are a nice backup for my retirement in case I blow up (the cash part of) my trading account.

- to @OrthoSurg : indeed, timing the market/bottom is impossible. But a rough reloading of shares after they've dropped a lot is good enough IMO. Regarding switching brokers, I'll look into it. Last time I did (few months ago), it seemed costly and a big hassle. Also I prefer not to use margin against my shares since in that case, if the sky falls you are truly boned. Right now if things turn sour, I just lose all my trading cash and my cc's execute. Leftover: decent cash position. (with a huge loss, but I could build back up again).

- to @InTheShadows : wow, thank you for sharing. May I ask what % of cash you sell options against and what kind of trades you make? (BPS, puts?) I'll follow your specific trades more closely from now on to get a sense.

- to @Zhelko Dimic : not burnt hugely yet, no. I have been caught off guard twice (Hertz announcement and Elon TSLA-selling-twitter-poll) but I just rolled out my ITM BPS far out in time (March 18th we better be over $1150, lol), widening my spreads. So nothing truly lost yet, except loss of possible returns.

- to @Yoona : great info, thanks. As mentioned above, I'd indeed prefer to keep and shares and cash. I'm just rethinking the balance between the two. Regarding the calculations: compounding is included in my forecasts. The other points you bring up however are not, and I will have a closer look. Indeed a position rarely goes 99%-100% green before closing, more often it's 60-90% so this adds up. Also good point about losing weeks. However, by going that safe my belief is that 50 around 52 weeks should be winners. Maybe I'm too optimistic, I need years of experience instead of months to get a better intuition regarding this.

I have decided that for now I'll wait a tiny bit longer, testing out safe positions with my available cash. Upon reaching next ATH or so (let's say +$1200) I'll convert a small part of my shares (20% max I think) to cash to get more practice with bigger positions and to derisk in case of a recession.

Thanks again. Now bring on Q4 earnings already!

Some thoughts:

- to @CHGolferJim : if I were to switch to cash in the near future, it would indeed only be part of my share holding. Thanks for the tip. I think by playing with larger sums/positions, the maths/results would work out differently and I'd like very much to be able to benchmark this long term against shares. Also, the shares are a nice backup for my retirement in case I blow up (the cash part of) my trading account.

- to @OrthoSurg : indeed, timing the market/bottom is impossible. But a rough reloading of shares after they've dropped a lot is good enough IMO. Regarding switching brokers, I'll look into it. Last time I did (few months ago), it seemed costly and a big hassle. Also I prefer not to use margin against my shares since in that case, if the sky falls you are truly boned. Right now if things turn sour, I just lose all my trading cash and my cc's execute. Leftover: decent cash position. (with a huge loss, but I could build back up again).

- to @InTheShadows : wow, thank you for sharing. May I ask what % of cash you sell options against and what kind of trades you make? (BPS, puts?) I'll follow your specific trades more closely from now on to get a sense.

- to @Zhelko Dimic : not burnt hugely yet, no. I have been caught off guard twice (Hertz announcement and Elon TSLA-selling-twitter-poll) but I just rolled out my ITM BPS far out in time (March 18th we better be over $1150, lol), widening my spreads. So nothing truly lost yet, except loss of possible returns.

- to @Yoona : great info, thanks. As mentioned above, I'd indeed prefer to keep and shares and cash. I'm just rethinking the balance between the two. Regarding the calculations: compounding is included in my forecasts. The other points you bring up however are not, and I will have a closer look. Indeed a position rarely goes 99%-100% green before closing, more often it's 60-90% so this adds up. Also good point about losing weeks. However, by going that safe my belief is that 50 around 52 weeks should be winners. Maybe I'm too optimistic, I need years of experience instead of months to get a better intuition regarding this.

I have decided that for now I'll wait a tiny bit longer, testing out safe positions with my available cash. Upon reaching next ATH or so (let's say +$1200) I'll convert a small part of my shares (20% max I think) to cash to get more practice with bigger positions and to derisk in case of a recession.

Thanks again. Now bring on Q4 earnings already!

Similar threads

- Replies

- 50

- Views

- 8K

- Replies

- 10

- Views

- 4K

- Replies

- 106

- Views

- 11K

- Replies

- 5

- Views

- 6K