I'm HODL these, but it was very hard this morning when they were very red...

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Wiki Selling TSLA Options - Be the House

- Thread starter adiggs

- Start date

4 of 4. I forget what this one was now  Nothing more to add.

Nothing more to add.

Good stuff. However, many of us made the same mistake on Monday and I don't think we were necessarily being overly greedy. I know I pride myself on trading TSLA specifically because I believe that I understand the stock and how it moves, especially around earnings. We all believed that 1100 was pretty safe knowing what we know about the upcoming earnings. But what this last week has reminded us, is that the market can be irrational longer than we can remain solvent. Hopefully we will all be correct in our thinking in the end (in two weeks) and we will come out in the green (even if not as far in the green as we could have been had we just gone for lower strikes last Monday). I think the bigger lesson is not that we were too greedy, but that even when we know a lot about TSLA, Macros and stupidity in the market can rob us of our earnings and capital - so leave a bigger buffer for others to be stupid without wiping us out.3 of 4. FOMO and Greed.

More NOT-ADVICE.

From the first 2 of these posts it looks like the new year is working out ok for me. It is very much not unfortunately. And I can easily point to the specific trade and the bad thinking / personal rule violation I made that has me in deep. Like offset 2021 gains deep, with a good running start at the 2020 education gains as well.

An observation about this for everybody to be clear on - especially anybody reading along and thinking "easy money". Our dominant strategy in these parts is to open defined maximum gain positions with undefined losses (or at least really high % losses). Throw in some leverage of which margin, purchased calls, and spreads are all forms of, and the undefined losses can get really really big, really really fast. Like wipe out 20 months of gains in 1 week big.

This isn't "easy or free money".

On Monday Jan 3 with the big move to 1200 after P&D I closed my 800/1000 put spreads for an 80 or 90% gain. Life was good, a routine trade with an early and desirable close. Wondrous.

Then I repeated a mistake I've made before - one that usually works, but when it hasn't worked out, it REALLY hasn't worked out (both times). I opened new put spreads that same day with the same expiration. And I got aggressive - I figured we weren't coming back to 1100 no way, no how, and while I was at it - I also tightened up my spread width to $150 from my recent $200s. Open 950/1100 put spreads for Jan 7 expiration. A bunch of them (though mostly consistent with my own portfolio management strategy - a bit too aggressive in one account; so I only somewhat lost my mind).

OOPS. I've rolled those once to 950/1100s on Jan 14 for a $1ish credit and then rolled again today when shares were $980ish for a $5 debit to Jan 28. I'm pretty sure this is the first time I've taken a debit on a roll. The credit roll would have been to a 970/1120 kind of position and I figured the $5 debit was a better plan. On the second roll I wanted to stay away from the Jan 21 expiration, I wanted more time for the shares to turn around, and I wanted to be on the other side of earnings. I was also worried about the shares continuing to go down (and still am!) and had the thought that today might be my last good chance at a roll to buy time for a reversal. I figure these things all give me the best chance of the share price getting back over 1100 (and hopefully a lot over).

After reviewing my decision making the two rolls were the right call for me for those situations. I don't like having Jan 28 1100 strike expiration instead of Jan 14 (this week) expiration, but I had hit my limit this morning and was creating a defense against the shares continuing down from 970 to 930 or further. Which they still can - I'm far from out of the woods yet. Just because we have, and use, management techniques on positions doesn't mean that they work.

The roll today has bought me time to the other side of earnings, which I continue to expect to be much better than wall street expects, and for the share price to go up significantly as a result. Now I have the time for all of that to play out and don't need to worry about being in an effectively unrollable situation. I do still have way too high of a chance at a max loss though; much too high for a dividend / income objective.

I made this bad trade because of FOMO / Greed. I kind of had the thought at the time, but Greed drowned out that voice.

The rule violation - don't "roll" a position towards the share price within the same expiration week (a roll would be on the same day). "Chasing" after the share price to pick up a few extra $$ is just not worth it (at least for me).

The solution for the rule violation is pretty easy - don't open a replacement position on the same expiration day, the same day that I close a position. It might work and yield a few extra $$ on the same expiration date. Its like double dipping! Unfortunately when the rather common reversal happens, and if its a big one, then a good situation can go radically bad, really fast. Like $120ish ITM on a $150 wide spread.

With an income/dividend point of view, even if this only goes bad 1 in 100, that's too much. New rule - don't do that.

But the other mistake is more subtle. How to recognize when FOMO / Greed has me in its clutches? It rarely does, but I succumb at times like I believe anybody and everybody does. I don't know how to avoid it except to be cognizant of the possibility and realize that when I do this right, I'll make money at any share price, and in low or high IV environments. I don't need to make hay while the sun is shining - at least so far the sun is always shining and I can make hay steadily any time that I want. Just be patient, let a whole single stinking day go by before opening the new position.

Others have different verbiage but the same idea.

The (newish) rule for me above is one effort to stop FOMO/Greed even when I don't recognize it. The "open into strength / close into weakness" guidance is another mechanism.

For some its some %OTM. There are plenty of others attempting to get at this.

Its nice to have rules to stop FOMO/Greed before it happens, but the reality is that there isn't a set of rules that will take care of it all of the time. Its not all that hard to rationalize bending a rule now and then because the setup is just too good to pass up. The only thing I see for this - be self-aware, be conscious about the actual objective / goal, and if I'm making trades designed to handily exceed my target outcome, then there's a really good chance FOMO/Greed has me in its grips.

Oh - and its ok to not have put or call positions open. It really is

Good point, this week it’s taught me a bit about how much money Is being held in the stock by short term traders. In other words, how much cushion is there in the stock for a big macro dip (evergrande, etc)…. I suppose another way of thinking of this is how to identify the accumulation prices of deeper pocketed institutions which seems fine and dandy and easy enough… but wow, after blowout delivery numbers, it shows me how much twitchy short term traders impact the stock…. Last Monday it felt like 1400 was imminent…. This week it just seemed like it was pretty clear that once the market stopped falling, people will jump back on that bandwagon. I think we will see a big day Wednesday if Powell doesn’t throw a turd tomorrowGood stuff. However, many of us made the same mistake on Monday and I don't think we were necessarily being overly greedy. I know I pride myself on trading TSLA specifically because I believe that I understand the stock and how it moves, especially around earnings. We all believed that 1100 was pretty safe knowing what we know about the upcoming earnings. But what this last week has reminded us, is that the market can be irrational longer than we can remain solvent. Hopefully we will all be correct in our thinking in the end (in two weeks) and we will come out in the green (even if not as far in the green as we could have been had we just gone for lower strikes last Monday). I think the bigger lesson is not that we were too greedy, but that even when we know a lot about TSLA, Macros and stupidity in the market can rob us of our earnings and capital - so leave a bigger buffer for others to be stupid without wiping us out.

ChefBoyardee

Member

I made the same trade for the same reason. Closed my spreads and opened new ones near 1100, thinking there’s no way we revisit.3 of 4. FOMO and Greed.

More NOT-ADVICE.

From the first 2 of these posts it looks like the new year is working out ok for me. It is very much not unfortunately. And I can easily point to the specific trade and the bad thinking / personal rule violation I made that has me in deep. Like offset 2021 gains deep, with a good running start at the 2020 education gains as well.

An observation about this for everybody to be clear on - especially anybody reading along and thinking "easy money". Our dominant strategy in these parts is to open defined maximum gain positions with undefined losses (or at least really high % losses). Throw in some leverage of which margin, purchased calls, and spreads are all forms of, and the undefined losses can get really really big, really really fast. Like wipe out 20 months of gains in 1 week big.

This isn't "easy or free money".

On Monday Jan 3 with the big move to 1200 after P&D I closed my 800/1000 put spreads for an 80 or 90% gain. Life was good, a routine trade with an early and desirable close. Wondrous.

Then I repeated a mistake I've made before - one that usually works, but when it hasn't worked out, it REALLY hasn't worked out (both times). I opened new put spreads that same day with the same expiration. And I got aggressive - I figured we weren't coming back to 1100 no way, no how, and while I was at it - I also tightened up my spread width to $150 from my recent $200s. Open 950/1100 put spreads for Jan 7 expiration. A bunch of them (though mostly consistent with my own portfolio management strategy - a bit too aggressive in one account; so I only somewhat lost my mind).

OOPS. I've rolled those once to 950/1100s on Jan 14 for a $1ish credit and then rolled again today when shares were $980ish for a $5 debit to Jan 28. I'm pretty sure this is the first time I've taken a debit on a roll. The credit roll would have been to a 970/1120 kind of position and I figured the $5 debit was a better plan. On the second roll I wanted to stay away from the Jan 21 expiration, I wanted more time for the shares to turn around, and I wanted to be on the other side of earnings. I was also worried about the shares continuing to go down (and still am!) and had the thought that today might be my last good chance at a roll to buy time for a reversal. I figure these things all give me the best chance of the share price getting back over 1100 (and hopefully a lot over).

After reviewing my decision making the two rolls were the right call for me for those situations. I don't like having Jan 28 1100 strike expiration instead of Jan 14 (this week) expiration, but I had hit my limit this morning and was creating a defense against the shares continuing down from 970 to 930 or further. Which they still can - I'm far from out of the woods yet. Just because we have, and use, management techniques on positions doesn't mean that they work.

The roll today has bought me time to the other side of earnings, which I continue to expect to be much better than wall street expects, and for the share price to go up significantly as a result. Now I have the time for all of that to play out and don't need to worry about being in an effectively unrollable situation. I do still have way too high of a chance at a max loss though; much too high for a dividend / income objective.

I made this bad trade because of FOMO / Greed. I kind of had the thought at the time, but Greed drowned out that voice.

The rule violation - don't "roll" a position towards the share price within the same expiration week (a roll would be on the same day). "Chasing" after the share price to pick up a few extra $$ is just not worth it (at least for me).

The solution for the rule violation is pretty easy - don't open a replacement position on the same expiration day, the same day that I close a position. It might work and yield a few extra $$ on the same expiration date. Its like double dipping! Unfortunately when the rather common reversal happens, and if its a big one, then a good situation can go radically bad, really fast. Like $120ish ITM on a $150 wide spread.

With an income/dividend point of view, even if this only goes bad 1 in 100, that's too much. New rule - don't do that.

But the other mistake is more subtle. How to recognize when FOMO / Greed has me in its clutches? It rarely does, but I succumb at times like I believe anybody and everybody does. I don't know how to avoid it except to be cognizant of the possibility and realize that when I do this right, I'll make money at any share price, and in low or high IV environments. I don't need to make hay while the sun is shining - at least so far the sun is always shining and I can make hay steadily any time that I want. Just be patient, let a whole single stinking day go by before opening the new position.

Others have different verbiage but the same idea.

The (newish) rule for me above is one effort to stop FOMO/Greed even when I don't recognize it. The "open into strength / close into weakness" guidance is another mechanism.

For some its some %OTM. There are plenty of others attempting to get at this.

Its nice to have rules to stop FOMO/Greed before it happens, but the reality is that there isn't a set of rules that will take care of it all of the time. Its not all that hard to rationalize bending a rule now and then because the setup is just too good to pass up. The only thing I see for this - be self-aware, be conscious about the actual objective / goal, and if I'm making trades designed to handily exceed my target outcome, then there's a really good chance FOMO/Greed has me in its grips.

Oh - and its ok to not have put or call positions open. It really is

The last part about it being ok to not have positions open is important. One thing that I’ve noticed in my trading is that I’ve been accumulating cash since BPS has been a better return than stock, but that creates a situation where you need positions open or you’ll underperform stock during bull runs. That was the thought that went through my head as I opened the positions - “damn those numbers are good, I better move my strikes up or I’ll regret sitting on all this uninvested cash”. It’s counterintuitive but cash-secured can add risk in that way.

The rules to avoid greedy trades are good too. One that has been effective for me is to plan for a bad scenario up front. For me that means to look at how far I’d have to roll a potential position out in time to get it under the bottom of the channel (adjusted for margin used, since free buying power allows for rolling down). More than 1 month is too much. To put it in context, following that rule last week would have led to selling something like the 950 strike. While not perfect (i failed to follow it last week), this rule seems easier to stick too since it forces you to think about what could happen if you’re wrong

FS_FRA

Member

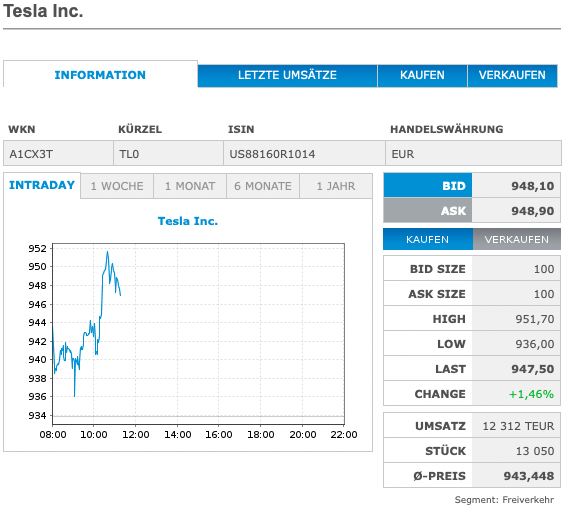

Let's hope this can maintain itself into US market open - €947.50 = $1,073

2 or 4. When to Enter a Roll.

Those calls I mentioned above - the Jan 7 1100s that I rolled to Jan 14 1150s on Monday the 3rd. I really didn't want to roll them on that Monday but with the shares going to the moon (1170ish share price when I rolled, and later just over 1200 on the day) I decided to proceed. That roll worked out well as the shares reversed heavily (as we well know) and the rolled position was closable early, so it worked out. With my evolving lcc strategy though this was the wrong choice and won't be a roll I'll choose in the future (details below).

MORE NOT-ADVICE (I have lots of that)

But it got me thinking about when to enter a roll. Something I've figured out for myself pretty quickly is that my roll criteria for the two types of trades I'm doing (put credit spreads and lcc) are different.

The general observation is that everything else being equal I want to be rolling as close to expiration, and more precisely very low extrinsic value, rather than earlier. The problem with rolling at "high" extrinsic value is that in the roll, step 1 is to buy back all of that extrinsic value. I then get to sell that time value in the new position, but that big extrinsic buy-back puts the new position further behind.

Mostly this means Thu/Fri instead of Monday, and my two recent rolls on Mondays are re-enforcing "don't roll on Monday". That's not a rule for me though as I -have- been caught out on big moves where the good roll was on Monday and it got significantly worse as the week went along. But that does lead to more detailed logic that is different (for me) between puts and calls.

On the call side I am selling lcc, and I want to (start) selling pretty aggressive covering call strikes. Like ATM or as much as 5% OTM, and even ITM at times. The first thing I've figured out on calls - if the strike I'm selling is > leap strike + purchase price (so my 900s I paid $198 for; I want to sell the 1100 strike or higher), then I'm pretty much ready and willing to sell ATM or even a bit ITM. The relationship means that if I hit my worst case and need to 'take assignment' then my strike to strike change on the purchased and sold call will be roughly $0, leaving me in possession of all of the (high) premiums I've been collecting. Above that level is nice of course, but I won't chase the share price upwards all that aggressively. It comes back most of the time and with my income focus I don't need the big capital gain on the purchased calls. And the aggressive covering call strikes are going to generate a lot of income

The corollary is that I have a hard time identifying any time (now) that I will roll a call much before expiration when ITM. So that Jan 7 1100 strike call above - I would have held that to Jan 7 instead of rolling on Jan 3 and would have kept the credit. I would not have rolled for the big strike gain and minimal credit, thereby leaving a week of income generation on the table.

But this is a learning for me from the trade listed above. Using my new criteria I wouldn't have rolled those 1100s to 1150 on Monday and even if the shares were still say 1200 on that Jan 7 expiration I wouldn't do a max strike roll. I'd roll for $7ish weekly credit and whatever strike improvement is available after that. Or even more weekly credit and less strike improvement. I'm giving up the big win (shares head to 1500) in exchange for the more likely price movement of the big weekly credits and the shares eventually coming back (which took all of 1 day in this situation).

This is consistent with my income focus. Its also why I don't / won't do call credit spreads any more. The primary risk we think about - shares head to the moon and I miss out on that doesn't represent a loss of capital risk. And the rest of the time the big credits will comfortably beat whatever gyrations the share price is going through.

The put side is different. I'm using put credit spreads (BPS) and those do have permanent and high % loss of capital risk (as do any credit spreads). I still have a preference for not rolling on Mondays but I'm more aggressive about rolling these early. I want to avoid reaching the midpoint of the spread and would rather roll closer to the 1/4th mark.

The larger strategy here is to be far OTM at open so that most of these trades are easy and regular wins, with preparation ahead of time for the big moves against. When to roll - with a wide spread in the first place I can allow these to go fairly deeply ITM, but then I roll however far to expiration when I reach 1/4th ITM. I will also roll for max strike improvement and might roll earlier.

So - I'll hold calls until nearly expiration. This is new for me and I'll be reporting on how that goes.

I'll roll the put spreads early and often. The bias is to waiting until I hit my break point, but when I get there I roll - no questions asked. Worth noting is that so far this criteria is helping me identify pretty significant low spots / bad times to roll. But that's ok - I'm protecting against the much rarer "and it just keeps on going".

A wrinkle I’m doing and you might consider is to do some of your CC ATM and some well OTM. In my case, the ATM are in a buy-write which are incremental shares to my core position that I won’t mind having assigned occasionally when the SP gets past where I can roll/rescue (I would then simply rebuy the underlying the next week). I will roll when it’s easy to capture a credit and higher strike, and the best timing is generally as late in the week as possible. Lately there has been a big benefit when rolling to BTC at a low cost Thu/Fri and wait until Mon/Tue to do the STO due to an SP rise during the 4-5 days. The OTM are on a strict limit of 60% of total core shares and $100-$125 OTM. So far this year it’s looking like 2/3 of the income potential is in the ATM CC (in other words, the OTM even though a larger number of contracts offer a +50% opportunity over ATM element alone). I’m passing on the OTM portion the next two weeks in case of a surge into ER (which chasing that in Nov killed most of my 2021 CC + long call gains).

* Actually, “ATM” is loosely defined. With basis of $1073, I don’t go below $1075, and I add some cushion for appreciation when the trend supports that (e.g., this week’s $1100 strike was executed when SP was ~$1040).

Last edited:

You're gonna see... By the end of the week, I'll be again fretting my Jan21 1200/1300bcs... And knowing I had 2x jan14 1100/980bps last week.

I rolled the single I had left over to next week, and added a jan21 1050/980bps for extra enjoyment.

For this week, I'm still looking at a jan14 1000/800bps which I'll enjoy.

I rolled the single I had left over to next week, and added a jan21 1050/980bps for extra enjoyment.

For this week, I'm still looking at a jan14 1000/800bps which I'll enjoy.

strago13

Member

I was fishing in the Gulf of Mexico yesterday and had no internet access from about 15 miles off shore. I knew we were going to dip under 1,000 and my 990 1/14 puts we’re at risk, but I didn’t do anything about them and just said eff it, I’ll deal with it when I’m back on shore. I also missed a chance to buy more sub 1000 shares which I also would have done. This is all to say I didn’t have to do anything because I was following @adiggs rules and I didn’t chase the SP higher with new puts last Monday. I just opened new positions at my income level 12% ish OTM.

All this talk of breaking rules about double dipping sounds very familiar to me after last week. I just wish that was the only rule I broke.

So after trading for ages using only 'unwritten rules' I decided to write down my own Options Trading Rules as a continual reminder. Others have similar rules, I just thought I'd share mine as a reminder and possible help to others.

Chenkers Option Trading Rules

•Don’t Get Greedy

•Preserve and Build Capital - be patient and conservative

•Don’t chase premium - go further OTM when Volatility is high

(15% OTM is typically safe, 20% even safer)

•Use wider spreads to manage rolling risk

•Don’t double dip in a week – focus on the long term

•Don't use more than 35-40% of available Excess Liquidity

•Don’t put too much trust in Put/Call Walls - MM’s don’t always get their own way

•Pay close attention to any Macro impacts and news that can impact the stock

•Don’t hope for a recovery - be decisive to preserve capital

•Roll or Manage Options Well before reaching 50% into the spread

•Roll early in the week, before the last day and never in the last hour of trading.

So after trading for ages using only 'unwritten rules' I decided to write down my own Options Trading Rules as a continual reminder. Others have similar rules, I just thought I'd share mine as a reminder and possible help to others.

Chenkers Option Trading Rules

•Don’t Get Greedy

•Preserve and Build Capital - be patient and conservative

•Don’t chase premium - go further OTM when Volatility is high

(15% OTM is typically safe, 20% even safer)

•Use wider spreads to manage rolling risk

•Don’t double dip in a week – focus on the long term

•Don't use more than 35-40% of available Excess Liquidity

•Don’t put too much trust in Put/Call Walls - MM’s don’t always get their own way

•Pay close attention to any Macro impacts and news that can impact the stock

•Don’t hope for a recovery - be decisive to preserve capital

•Roll or Manage Options Well before reaching 50% into the spread

•Roll early in the week, before the last day and never in the last hour of trading.

Granted that simply selling the 1100's puts don't make the choice greedy / FOMO inspired. Only that I know that they were for meGood stuff. However, many of us made the same mistake on Monday and I don't think we were necessarily being overly greedy. I know I pride myself on trading TSLA specifically because I believe that I understand the stock and how it moves, especially around earnings. We all believed that 1100 was pretty safe knowing what we know about the upcoming earnings. But what this last week has reminded us, is that the market can be irrational longer than we can remain solvent. Hopefully we will all be correct in our thinking in the end (in two weeks) and we will come out in the green (even if not as far in the green as we could have been had we just gone for lower strikes last Monday). I think the bigger lesson is not that we were too greedy, but that even when we know a lot about TSLA, Macros and stupidity in the market can rob us of our earnings and capital - so leave a bigger buffer for others to be stupid without wiping us out.

Since I'd closed put spreads that day on the big rise, and I've previously had big problems with 'chasing' the big share price moves, I've already had personal guidance to stop doing that. I did it anyway when my guidance said "wait for tomorrow and evaluate then". The greed / FOMO was being worried I would wake up on Tuesday to a 1250 share price, and still going up. That's also how I got into trouble last time - selling 830ish puts when shares had spiked to 900 in Jan/Feb about a year ago.

Lot's of good info the past few pages.

These lessons bear (right use of bare?) repeating since we all get stars in our eyes when we are hitting home runs!

Re-learning our previous lessons either the easy way or the hard way are going to happen over and over, and hopefully in a way we can recover from.

Hit singles, don't chase, don't be greedy!

If you can do all of the above and still win, remember, you will get bitten. The long term gains and income will come from hitting singles and just making it on base.

I rolled my $1135P's yesterday around 3:30 for $12 each and down to $1120P's - nice little net credit. These are not a spread though, as I am cautious when we are up or down big and only go with straight Puts or if doing calls - I like the Buy/Write for them and worst thing that happens is I own more shares.

Loaded up on February $1100's (purchased) and now have a looooot of them. If we pop over $1100 I will have made my enough to not have to trade anymore this year.... but I will anyway because it's just to hard to HODL and not add the gravy!

And if we don't hit over $1100, I will just roll them out and up for a small credit till they do hit!

Time is on our side - just make sure you have time left in your contracts!

These lessons bear (right use of bare?) repeating since we all get stars in our eyes when we are hitting home runs!

Re-learning our previous lessons either the easy way or the hard way are going to happen over and over, and hopefully in a way we can recover from.

Hit singles, don't chase, don't be greedy!

If you can do all of the above and still win, remember, you will get bitten. The long term gains and income will come from hitting singles and just making it on base.

I rolled my $1135P's yesterday around 3:30 for $12 each and down to $1120P's - nice little net credit. These are not a spread though, as I am cautious when we are up or down big and only go with straight Puts or if doing calls - I like the Buy/Write for them and worst thing that happens is I own more shares.

Loaded up on February $1100's (purchased) and now have a looooot of them. If we pop over $1100 I will have made my enough to not have to trade anymore this year.... but I will anyway because it's just to hard to HODL and not add the gravy!

And if we don't hit over $1100, I will just roll them out and up for a small credit till they do hit!

Time is on our side - just make sure you have time left in your contracts!

Last edited:

bearLot's of good info the past few pages.

These lessons bare (right use of bare?) repeating since we all get stars in our eyes when we are hitting home runs!

scubastevo80

Member

Likewise - we traded BPS at -1050/+960 thinking $1100 was the new floor and that TSLA would claw its way up towards $1200 as we moved towards earnings. The math is easy right - deliveries are known and TSLA is printing cash. Well, macros and other forces come into play and can really impact, in a negative way, the trader. This is why we shifted towards a safety (or safer) options strategy with a portion reserved for opportunistic trades. The key is to be honest with oneself about those opportunistic trades and take losses early if one is wrong about stock price direction. There was a point yesterday where we were down 33% and ready to panic, but luckily we are only down about 10% now and can ride most of this out through earnings.I made the same trade for the same reason. Closed my spreads and opened new ones near 1100, thinking there’s no way we revisit.

The last part about it being ok to not have positions open is important. One thing that I’ve noticed in my trading is that I’ve been accumulating cash since BPS has been a better return than stock, but that creates a situation where you need positions open or you’ll underperform stock during bull runs. That was the thought that went through my head as I opened the positions - “damn those numbers are good, I better move my strikes up or I’ll regret sitting on all this uninvested cash”. It’s counterintuitive but cash-secured can add risk in that way.

The rules to avoid greedy trades are good too. One that has been effective for me is to plan for a bad scenario up front. For me that means to look at how far I’d have to roll a potential position out in time to get it under the bottom of the channel (adjusted for margin used, since free buying power allows for rolling down). More than 1 month is too much. To put it in context, following that rule last week would have led to selling something like the 950 strike. While not perfect (i failed to follow it last week), this rule seems easier to stick too since it forces you to think about what could happen if you’re wrong

We'd rather get the same end result with 1% a week than have some weeks up 4-8%, others down 10%, etc. The volatility leads to stress and this strategy is about slow and steady.

@adiggs - thanks for sharing your insights. Definitely helpful on the call side of things.

Took advantage of the morning dip and rolled my deep "in the red" Jan 14 1080/1100 BCS to -1000/+960 Jan 14 BPS. I took a loss but could have been so much worse. Thanks JPow!

+8 from my notesAll this talk of breaking rules about double dipping sounds very familiar to me after last week. I just wish that was the only rule I broke.

So after trading for ages using only 'unwritten rules' I decided to write down my own Options Trading Rules as a continual reminder. Others have similar rules, I just thought I'd share mine as a reminder and possible help to others.

Chenkers Option Trading Rules

•Don’t Get Greedy

•Preserve and Build Capital - be patient and conservative

•Don’t chase premium - go further OTM when Volatility is high

(15% OTM is typically safe, 20% even safer)

•Use wider spreads to manage rolling risk

•Don’t double dip in a week – focus on the long term

•Don't use more than 35-40% of available Excess Liquidity

•Don’t put too much trust in Put/Call Walls - MM’s don’t always get their own way

•Pay close attention to any Macro impacts and news that can impact the stock

•Don’t hope for a recovery - be decisive to preserve capital

•Roll or Manage Options Well before reaching 50% into the spread

•Roll early in the week, before the last day and never in the last hour of trading.

- Avoid strike creep - after opening a position, have the self-discipline of sticking to the plan and resist the temptation to slowly adjust into SP because the SP can reverse before you know it

- Avoid noise - just because 100 people and 25 pages are saying the same thing and have the same sentiment, it doesn't mean it's true; rely on your own TA that has been working for you; don't just copy/paste... markets are never wrong but opinions often are

- Pay attention to how others are fixing/managing their positions - save it into your vault and learn from their mistakes

- It is acceptable to have days where there are no positions open (especially on volatile days); you're not missing out on the action even if you're temporarily resting on the bench watching the game

- Sometimes, doing nothing is more profitable - be patient and let a losing position play out especially if there are still lots of DTE, you don't need to be fixing something every time... time is your friend, theta is your friend

- Don't gamble - options is based on statistical probabilities; if you are hoping that something will work and it's not based on facts/numbers but based on feelings, then you are not the casino

- It is OK to exit a position with little profit - it's not a bad trade if you earned some money out of it

- Max loss is real - defend your capital by staying away from the "tallest walls"; they will fall on bad macros or black swan... it only takes ONE fall and your gains/capital is wiped out; you will never see it coming and it is impossible to predict when it is coming - remember the losses from Hertz? Evergrande? Covid-19? Aggressive positions won't have defense against black swan.

This is the hardest one for me....

- It is acceptable to have days where there are no positions open (especially on volatile days); you're not missing out on the action even if you're temporarily resting on the bench watching the game

bkp_duke

Well-Known Member

These little pops up today have been great for me.

Rolled 980/1030 BPS Exp 1/14 to 950/1000 Exp 1/28 - $5.40 credit

Rolled 960/1010 BPS Exp 1/14 to 925/975 Exp 1/28 - $5.60 credit

Opened 900/950 BSP Exp 1/21 - $5.40 credit

Plan to close the 1/28 positions right before or right after earnings and take advantage of the IV crush that typically happens.

I'm "down" for the month b/c of the price action, but I believe I'm setup well now to make a good chunk of change by the end of the month.

Not advice.

Rolled 980/1030 BPS Exp 1/14 to 950/1000 Exp 1/28 - $5.40 credit

Rolled 960/1010 BPS Exp 1/14 to 925/975 Exp 1/28 - $5.60 credit

Opened 900/950 BSP Exp 1/21 - $5.40 credit

Plan to close the 1/28 positions right before or right after earnings and take advantage of the IV crush that typically happens.

I'm "down" for the month b/c of the price action, but I believe I'm setup well now to make a good chunk of change by the end of the month.

Not advice.

InTheShadows

Active Member

My main strategy involves double and sometimes triple dipping. The rules I broke last week because I too thought 1100 was in the rear view mirror for good and got greedy.

I narrowed my spreads from a min of 200 on all but small accounts to 100, AND I also violated my delta rule of always less than 10 unless sub 40 daily RSI, then up to 1 std deviation. I sold most of those narrowed spreads last week between 16 and 20 delta.

I managed to roll everything and I think everything will be ok. The thing is, training myself to not break the rules again.

I narrowed my spreads from a min of 200 on all but small accounts to 100, AND I also violated my delta rule of always less than 10 unless sub 40 daily RSI, then up to 1 std deviation. I sold most of those narrowed spreads last week between 16 and 20 delta.

I managed to roll everything and I think everything will be ok. The thing is, training myself to not break the rules again.

juanmedina

Active Member

All this talk of breaking rules about double dipping sounds very familiar to me after last week. I just wish that was the only rule I broke.

So after trading for ages using only 'unwritten rules' I decided to write down my own Options Trading Rules as a continual reminder. Others have similar rules, I just thought I'd share mine as a reminder and possible help to others.

Chenkers Option Trading Rules

•Don’t Get Greedy

•Preserve and Build Capital - be patient and conservative

•Don’t chase premium - go further OTM when Volatility is high

(15% OTM is typically safe, 20% even safer)

•Use wider spreads to manage rolling risk

•Don’t double dip in a week – focus on the long term

•Don't use more than 35-40% of available Excess Liquidity

•Don’t put too much trust in Put/Call Walls - MM’s don’t always get their own way

•Pay close attention to any Macro impacts and news that can impact the stock

•Don’t hope for a recovery - be decisive to preserve capital

•Roll or Manage Options Well before reaching 50% into the spread

•Roll early in the week, before the last day and never in the last hour of trading.

The 15-20% OTM applies to what DTE? DTE is important here.

Last edited:

Similar threads

- Replies

- 50

- Views

- 8K

- Replies

- 10

- Views

- 4K

- Replies

- 106

- Views

- 11K

- Replies

- 5

- Views

- 6K