Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Short-Term TSLA Price Movements - 2013

- Thread starter Robert.Boston

- Start date

- Status

- Not open for further replies.

kevin99

Member

It has been very quiet on this thread here. Posting something just to be sure that the website is still working.

Any thoughts on the close today? Looked pretty weak. Although you can say it is the second highest close, which can be viewed as pretty encouraging.

For any other stock, the last two days closing price should be cheered by many. Why they seems so boring as for TSLA? We've been spoiled.

I can't believe it. My limit order to sell to open sep2(weekly) call @170 for $6.5 get executed! And it was the absolute high of the moment. It is at $5.3 now.

I didn't make any move except the short call Sep2(weekly) @170 I reported yesterday. It is actually a roll from a Sep @175 since I like to exit the short call sooner. It is been a "walk" up from after Q2 and suffer paper loss every time I walk to a further call. So nothing major changed. It is a burden I want to get rid of, however discipline tells me to keep it.

I am a bit shameless to report despite the quiet movement of the stock, my performance is outstanding. On both days, I am up 2+% each day, although the number is skewed a bit by my P/L on SCTY. SCTY was down big yesterday and up today, affecting about -0.5 and +0.5%. Excluding the effect of SCTY, my performance on TSLA is 3% and 1.5% in the last two days. How is it possible to be both up when the stock is one up and one down? That is the power of time value decay. When the price is locked in between the strike price of my short put and short call, what matter is those options dwindle in values as time goes by: the stock is not moving fast enough for short term options to appreciate, which is true in most cases and how the option is priced.

When you talk about 4.5% of total gain of my trading size in 2 days, it is a big deal. I would love to have everyday just like the last 2 days, stress free. Up and down and slightly trending up.

My strategy going forward would be mostly selling both OTM puts and calls, with the expectation of trending up. I certainly want to weight on the long side, i.e. a bit close to strike price on the puts I am selling, and farther out on the calls I sell.

I knew the strategy will work in the next phase/period until more momentum and catalyst appears, however I am still surprised how well it works. This is the first time I implemented it with such scale, quite big. Combined with the fact that TSLA options has one of the most pricy premium, if not the most pricy, the strategy does work wonder.

Meanwhile, I am starting to write my "Tezillionaire" story. I got up early at 4am, partly encouraged by the support I received. Sometime I still need a push to do things

Last edited:

MartinAustin

Active Member

For any other stock, the last two days closing price should be cheered by many. Why they seems so boring as for TSLA? We've been spoiled. :smile: Yesterday up 1%, today down 0.7%, albeit the intra-day swing is 4% and 2.5% respectively.

Exactly! It's basically around its all-time high. (yes I know it was really 173) Yesterday was the all-time high close. We're right where we want to be... every day that we're up here at these levels, it strengthens the foundation for more upwards movement.

In fact I have seen some TSLA detractors bemoan the distance between the 200-day moving average and the current level. Well, every day it does more or less nothing (like today) is a day when the averages close in, which to me says stability, if anything.

I think if we need to find a reason to be worried, it would be that the momentum has slowed down. We're about 27% over the closing price prior to the Q2 earnings report, 20 trading days after that report. If we go back a quarter, 20 days after the Q1 earnings report the stock had risen about 71%. OK, sure, that's a lot more dramatic and make the stock look pretty pedestrian by comparison. We're just no longer the new kid on the block, and have to show some maturity, which I think it is doing. I'm perfectly happy to see 27% every 4 weeks! (FYI three more jumps of 27% are $214, $272 and $346)

Exactly! It's basically around its all-time high. (yes I know it was really 173) Yesterday was the all-time high close. We're right where we want to be... every day that we're up here at these levels, it strengthens the foundation for more upwards movement.

Yeah, I think this is consolidation for something... up or down. 170 has been major resistance. It has been trending up so long sideways movement looks weird:

justthateasy

Member

We're virtually flat, though in the red, in pre-market trading. Last price was 169.50 from yesterday's close of 169.93.

My prediction today is we'll hit the low end of the pivot area, 166-170, then finish flat but in the red, around 168.

I also think there's a 20% chance of seeing level 1 support, 164-166, get tested a bit today.

My prediction today is we'll hit the low end of the pivot area, 166-170, then finish flat but in the red, around 168.

I also think there's a 20% chance of seeing level 1 support, 164-166, get tested a bit today.

We're virtually flat, though in the red, in pre-market trading. Last price was 169.50 from yesterday's close of 169.93.

My prediction today is we'll hit the low end of the pivot area, 166-170, then finish flat but in the red, around 168.

I also think there's a 20% chance of seeing level 1 support, 164-166, get tested a bit today.

weekly options expire today and there is lot's of 165/170 open interest puts.

i wouldn't be suprise to see a peak at the start of trading then going down to 168 area and late finish above 170

justthateasy

Member

We're virtually flat, though in the red, in pre-market trading. Last price was 169.50 from yesterday's close of 169.93.

My prediction today is we'll hit the low end of the pivot area, 166-170, then finish flat but in the red, around 168.

I also think there's a 20% chance of seeing level 1 support, 164-166, get tested a bit today.

weekly options expire today and there is lot's of 165/170 open interest puts.

i wouldn't be suprise to see a peak at the start of trading then going down to 168 area and late finish above 170

In addition to what I wrote earlier, I forgot to factor in the jobs report which just came out. TSLA along with everything else was trading lower prior to the report but picked up a bit since its release a few minutes ago. TSLA is still flat but in the red in pre-market as I write this.

I really think we'll see the pivot get tested today and maybe touch level 1 but move back to being flat by the end of the day.

In addition to what I wrote earlier, I forgot to factor in the jobs report which just came out. TSLA along with everything else was trading lower prior to the report but picked up a bit since its release a few minutes ago. TSLA is still flat but in the red in pre-market as I write this.

I really think we'll see the pivot get tested today and maybe touch level 1 but move back to being flat by the end of the day.

Im guessing we'll get through the 173 resistance today and end up in the mid 170s going into the weekend. My guess is there are some nervous shorts who will close going into the weekend as they know one of these weekends will be some catalytic announcement to the stock price gapping up.

Am I the only one thinking this is institutional support that will last only long enough for the bonds to become convertible? I'm thinking we'll see some 150s in October though I also think Q3 will be a good report which will drive the stock back up either before or after the next earnings announcement.

Acmykguy

Member

Yes agree 100%. The tone has been flat to neg here lately which tends to precede a rise in priceIm guessing we'll get through the 173 resistance today and end up in the mid 170s going into the weekend. My guess is there are some nervous shorts who will close going into the weekend as they know one of these weekends will be some catalytic announcement to the stock price gapping up.

Cameron

Member

Am I the only one thinking this is institutional support that will last only long enough for the bonds to become convertible? I'm thinking we'll see some 150s in October though I also think Q3 will be a good report which will drive the stock back up either before or after the next earnings announcement.

Not the only one. My guess is we trade fairly flat through the rest of September, then come October suffer a quick pull back into the 150s like you said, followed by a steady climb back to the 170s then into the 200s after Q3.

emupilot

Active Member

Am I the only one thinking this is institutional support that will last only long enough for the bonds to become convertible? I'm thinking we'll see some 150s in October though I also think Q3 will be a good report which will drive the stock back up either before or after the next earnings announcement.

My TSLA predictions have a poor track record, but the current price level is suspicious to me and I suspect exactly this scenario. I will limit my exposure after 9/23 (the last of the 20 days needed above 161.88 if we don't have an intervening drop) and after the start of the next quarter.

kevin99

Member

Short-Term TSLA Price Movements

I close the sep2(weekly) call @170 for $3.5. Could've done better but it is good enough.

Dave, this is one of several exit possibilities as I mentioned earlier, in this case with a profit.

Discipline is right in this case - protecting me from a linear proportional loss - my overall loss percentage is less than the stock price. Now if TSLA continues to bounce back(@166.5 now, from low of $165.1), I could see my account green before TSLA makes it. At that point, I might sell to open a call with more room to run. Sep2 Call @170 ($6.5) is pretty tight so I am a bit lucky on this one. In retrospect, It was an accident as I set the limit order with no expectation for it to be executed that day!

- - - Updated - - -

Yes at $168, my account is already green and then some! and the stock is down 1%! It seems I have a 1.5% cushion.

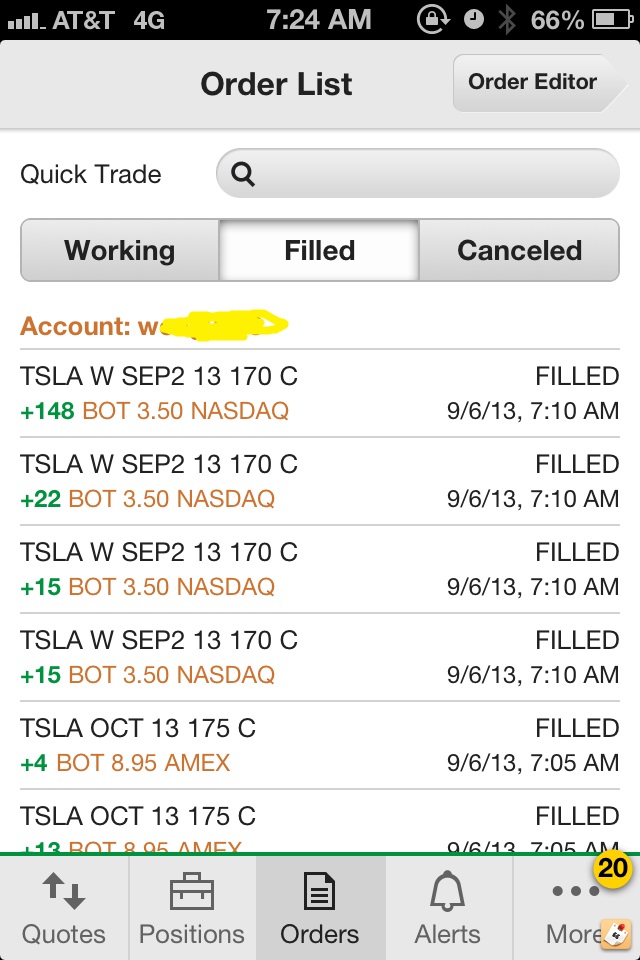

I can't believe it. My limit order to sell to open sep2(weekly) call @170 for $6.5 get executed! And it was the absolute high of the moment. It is at $5.3 now. You can calculate my gain of the 200 calls, just on paper:

View attachment 29906

This is the first time I ever execute an option trade at the best price, so I am a bit excited.For option, you always suffer the ask/bid split a lot more severe than the shares. Typically as soon as the trade executed, you would already incur a loss immediately.

I close the sep2(weekly) call @170 for $3.5. Could've done better but it is good enough.

Dave, this is one of several exit possibilities as I mentioned earlier, in this case with a profit.

I didn't make any move except the short call Sep2(weekly) @170 I reported yesterday. It is actually a roll from a Sep @175 since I like to exit the short call sooner. It is been a "walk" up from after Q2 and suffer paper loss every time I walk to a further call. So nothing major changed. It is a burden I want to get rid of, however discipline tells me to keep it.

Discipline is right in this case - protecting me from a linear proportional loss - my overall loss percentage is less than the stock price. Now if TSLA continues to bounce back(@166.5 now, from low of $165.1), I could see my account green before TSLA makes it. At that point, I might sell to open a call with more room to run. Sep2 Call @170 ($6.5) is pretty tight so I am a bit lucky on this one. In retrospect, It was an accident as I set the limit order with no expectation for it to be executed that day!

- - - Updated - - -

Yes at $168, my account is already green and then some! and the stock is down 1%! It seems I have a 1.5% cushion.

Last edited:

sleepyhead

Active Member

Kevin - I am glad that your strategy is working well and I appreciate that you are sharing all of this with us, so keep it coming.

For discussion purposes, I wanted to point out that you have been extremely lucky with your strategy, since TSLA has been trading in a range for the first time in months. If it moves up big time, then you will miss out a lot. I guess that your main job is limiting downside, but I feel that it would be a lot better to buy TSLA stock and hold for 10 years then to play the same way you are doing, but time will tell. Sooner or later you will miss out big time.

On the flip side, if TSLA corrects 20%+ in the near future, your strategy will look genius and you will be able to pick up some shares/options really cheap.

I don't see TSLA going down though, there is just way too much momentum for this stock and it looks like Q3 is going to be a huge blowout quarter.

I just went (even more) long TSLA today as well as yesterday, because this stock is going a lot higher in the near future.

Just wait till the China reservation nubmers come out, or when TSLA preannounces earnings because it delivered over 6,000 cars vs. 5,000 estimate, etc.

For discussion purposes, I wanted to point out that you have been extremely lucky with your strategy, since TSLA has been trading in a range for the first time in months. If it moves up big time, then you will miss out a lot. I guess that your main job is limiting downside, but I feel that it would be a lot better to buy TSLA stock and hold for 10 years then to play the same way you are doing, but time will tell. Sooner or later you will miss out big time.

On the flip side, if TSLA corrects 20%+ in the near future, your strategy will look genius and you will be able to pick up some shares/options really cheap.

I don't see TSLA going down though, there is just way too much momentum for this stock and it looks like Q3 is going to be a huge blowout quarter.

I just went (even more) long TSLA today as well as yesterday, because this stock is going a lot higher in the near future.

Just wait till the China reservation nubmers come out, or when TSLA preannounces earnings because it delivered over 6,000 cars vs. 5,000 estimate, etc.

Noble Ninja

Member

My TSLA predictions have a poor track record, but the current price level is suspicious to me and I suspect exactly this scenario. I will limit my exposure after 9/23 (the last of the 20 days needed above 161.88 if we don't have an intervening drop) and after the start of the next quarter.

I'm thinking the same thing as well. Added more at $135 and may take some profits around then and buy back on any dips before Q3.

By the way, I just recently signed up to this forum after being a fan and supporter of the company since I first saw the Model S at CES 2012 (nVidia booth)! This forum has provided some great insight into Tesla that helps to cut the BS in the media and to make better investment decisions. Thanks everyone, and I hope to return the favour!

kevin99

Member

Kevin - I am glad that your strategy is working well and I appreciate that you are sharing all of this with us, so keep it coming.

For discussion purposes, I wanted to point out that you have been extremely lucky with your strategy, since TSLA has been trading in a range for the first time in months. If it moves up big time, then you will miss out a lot. I guess that your main job is limiting downside, but I feel that it would be a lot better to buy TSLA stock and hold for 10 years then to play the same way you are doing, but time will tell. Sooner or later you will miss out big time.

On the flip side, if TSLA corrects 20%+ in the near future, your strategy will look genius and you will be able to pick up some shares/options really cheap.

I don't see TSLA going down though, there is just way too much momentum for this stock and it looks like Q3 is going to be a huge blowout quarter.

I just went (even more) long TSLA today as well as yesterday, because this stock is going a lot higher in the near future.

Just wait till the China reservation nubmers come out, or when TSLA preannounces earnings because it delivered over 6,000 cars vs. 5,000 estimate, etc.

sleephead, your points well taken. I think there are some differences worth pointing out for everyone's benefit. You bring up a notion I want to emphasize: someone's wonderful strategy may not work for others; also one strategy may not work forever, it only works in certain scenario. Nothing beats a good read of the price movement.

First of all I have a large account to manage. My primary concern is to guard against a 10% and more drop as it happens a few times before. That is why I hedge tightly and aggressively.

Second is I do intentionally start doing the tight hedging only until now, hence the 'extreme lucky'. I did mentioned that after the ATH of $174 2 weeks ago. I think we are entering a period of slower movement on the stock. I don't see a strong rally in the near future. How long will the new catalyst emerge? I don't know that is why I adjust the positions very closely.

So that is my read of the price movement and my strategy ensue. If I am right on the spot, then it works wonder. If I am wrong, the strategy still gives me quite a cushion.

Third is I give market more uncertainty as a way to respect the unknown force moving the stock. I don't have the same confidence saying:

"

I don't see TSLA going down though, there is just way too much momentum for this stock and it looks like Q3 is going to be a huge blowout quarter.

I just went (even more) long TSLA today as well as yesterday, because this stock is going a lot higher in the near future.

"

The only few time that I am confident is Qr earning time. With intense research, I might be pretty sure how it will comes out. If I have a good confidence level, I bet big. That is the case for Q2 earning. My story is coming out soon.

Other than that, if one starts a competition on predicting daily up or down, I wonder anyone can score more than 55% being right.

Last one is the trading cost. If someone trade the same as me but with only 1 call, then the cost of trading will cut severely into the gain. For a regular broker, a round trip option will cost $25, almost 10% of the the $300 total profit. Consider that was an excellent trade, there will be mediocre trades that the cost of trading will tip the balance of profit and loss.

Last edited:

Norbert

TSLA will win

Just wait till the China reservation nubmers come out, or when TSLA preannounces earnings because it delivered over 6,000 cars vs. 5,000 estimate, etc.

Not sure about "delivered" with the shipments to Europe, but in terms of "produced", they are saying they produce 500/week for a while now, and with 13 weeks this quarter, that might be 6,500.

- Status

- Not open for further replies.

Similar threads

- Replies

- 0

- Views

- 215

- Locked

- Replies

- 0

- Views

- 3K

- Poll

- Replies

- 16

- Views

- 2K

- Replies

- 21

- Views

- 6K