Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Short-Term TSLA Price Movements - 2015

- Thread starter Robert.Boston

- Start date

-

- Tags

- TSLA

- Status

- Not open for further replies.

anticitizen13.7

Not posting at TMC after 9/17/2018

Personally, I did not think that the D option on the standard 85 adds enough performance or range enhancement to merit the $5000. 0-60 in 5.2s for 85D vs. 5.4s for 85. Same HP, slight improvement in range. If you truly need AWD, it would be worth it, but I did not find it compelling on any other attribute. It's too bad it did not come with a modest performance gain to put it midway between the 85 and P85D. I do hope other buyers will be more enthusiatic about the D option than I was. Maybe Tesla will find some way to squeeze a little more performance or range through software enhancements. Anyway, I'm excited to get my standard 85 right at the end of Q1.

I live in an area that gets plenty of snow and AWD cars are popular here. I think that Model S 85D will probably outsell the standard RWD 85 at my local Tesla store.

I definitely agree that the extra 5k is worth it mostly if one needs AWD.

mejojo

Active Member

..... but the assumption that the Model 3 would be limited to about 4 mi/kWh is to be rejected.

Indeed, a 2012 Volt gets a nominal 4 mi/kWh. I get about 3.3 with a 1000 foot rise over 33 miles and 5 on the return trip. So, I would hope Model 3 will show significant increases to that.

jhm

Well-Known Member

I am envisioning other enhancements to justify the price steps. For example, dual motors is standard on 55kWh and 70kWh, and performance inverter on the 70kWh. Imagine 0-60 at 5.5s, 4.5s and 3.5s for the three versions. Aesthetic enhancements as well come standard with higher versions. Finally, if this is all well justified, the versions could target different GM levels, say 20%, 30% and 40%. This way consumers that want a really e onomical car can be satisfied, while people who need excess performance and luxury to meet ego needs can gravitate to the other end. So if the volume the 40s matches the volume of 70s, then Tesla achieves a 30% GM. This allows wealthier customers to cross-subside to some extent a more affordable version for others.Why such a dramatic increase from the 40 to 55 to 70 kWh models? I would think that if a person wanted the exact same features/options on a 3 and just wanted the maximum range, the price difference would not be THAT significant. Comparing the difference in the S between the 60 and 85 shows a price increase of $400 per kWh ($80k - $70k = $10,000/85-60 = $400). So, with the additional 15 kWH, that would seem to indicate a $6000 increase. However, since the 3 won't come out until the GF is online, the price of batteries should be at least 30% cheaper. So, if we use $280 (70% of $400) instead of $400, that would seem to indicate a price difference of $4200 for each of the models (or battery options). I can't imagine Tesla charging that much of a premium just to acquire more range. If so, they will price the car right out of a lot of buyer's budgets.

MartinAustin

Active Member

The lack of volume is amazing. We are all awaiting Model X and some other good news.

We did jump from $202 to $206 in 20 minutes though, so maybe some new news is coming down the pike.

I think generally FUDsters are finding it harder and harder to anti-sell Tesla Motors. Each new quarter that passes shows increased production of cars and superchargers. This is causing TSLA to swing around less, I believe.

Max pain this week is still $207.50. I think with the low volume, we're seeing a slow speed short covering as the stock didn't drop as many shorts expected and we drift towards max pain. However, anything significant will obviously move the stock either direction (ie. oil price dropping significantly), but I think anything positive could bring in a short squeeze - maybe not of epic proportions due to Q1 outlook, but something nevertheless.

Max pain this week is still $207.50. I think with the low volume, we're seeing a slow speed short covering as the stock didn't drop as many shorts expected and we drift towards max pain. However, anything significant will obviously move the stock either direction (ie. oil price dropping significantly), but I think anything positive could bring in a short squeeze - maybe not of epic proportions due to Q1 outlook, but something nevertheless.

How is max pain derived? I think it is great information, but I'd like to be able to obtain that information myself. I use Ameritrade if that matters.

Bobbyducati

Member

+1, on etradeHow is max pain derived? I think it is great information, but I'd like to be able to obtain that information myself. I use Ameritrade if that matters.

edit:

found this site http://www.optionistics.com/quotes/strike-pegger

edit 2:

another good website: http://maximum-pain.com/

Last edited:

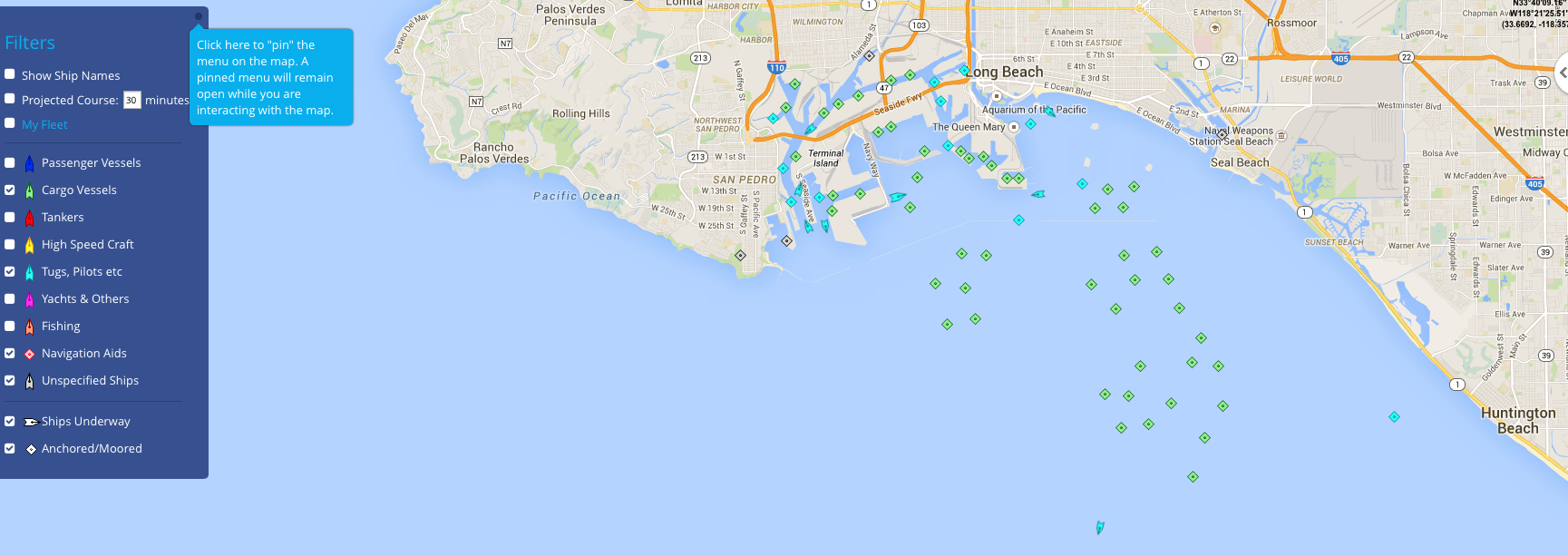

West coast port shutdown live ship map Live Ships Map - AIS - Vessel Traffic and Positions - AIS Marine Traffic

From Zero Hedge

From Zero Hedge

Things on the West Coast Ports are going from bad to worse (for those who missed it read "Catastrophic Shutdown Of America's Supply Chain" Begins: Stunning Photos Of West Coast Port Congestion), and with no resolution in sight, it is now beginning to cripple the US economy. Here is a brief summary, courtesy of the WSJ, of how the near-strike is already impacting various businesses across the US:

And so on, as more and more distributors, retailers, producers, manufacturers, and ordinary mom and pop business, decide that the time has come to blame something - last year it was the Polar Vortex which compared to the current climate conditions was a spring breeze - for what is a global economic depression, one from which the US is not decoupling. That something being the west coast port strike this time, coming soon to a Wall Street scapegoating "analyst" near you soon.

- Ocean carrier Maersk Line has canceled some sailings, while China Ocean Shipping (Group) Co. said it will skip at least one port

- Shipping line CMA CGM Group said it has “adapted its schedule and has been modifying its ports call order.” China Ocean Shipping said it has canceled some port stops.

- Truckers that normally haul an average of five containers a day away from the Port of Oakland, Calif., are lucky to haul one.

- At the Port of Oakland, truck drivers can spend up to three days waiting in line before hauling one container out of the yard, says Henry Osaki, an employee at an Oakland-based trucking company.

- A West Coast customs broker said that her customers are being assessed as much as $300 a day for containers that sit too long on the docks, though the containers are trapped there.

- Levi Strauss & Co. said it was concerned it wouldn’t receive some products in time for spring deliveries.

- As of Monday, Honda Motor Co. was experiencing parts shortages at plants in Ohio, Indiana and Canada that will affect its production on multiple days over the next week.

- The Agriculture Transportation Coalition estimates that port delays and congestion have reduced U.S. agricultural exports by $1.75 billion a month, while the North American Meat Institute put losses to U.S. meat and poultry producers at more than $85 million a week, including hides and skins.

- The delays could cost retailers alone as much as $3.8 billion this year, according to an analysis by consulting firm Kurt Salmon. Adding in rerouting and carrying costs and other expenses could bring retailers’ total costs to $7 billion this year, the firm said.

- Bert von Roemer, owner of Serengeti Trading Co., a Dripping Springs, Texas, coffee importer began rerouting coffee beans he intended to ship to the West Coast to Houston, Norfolk, Virginia and New York. “I’m railing the coffee across” to roasters in California, he said. “It’s costing me about $2,000 extra per container,”

+1, on etrade

edit:

found this site http://www.optionistics.com/quotes/strike-pegger

still not 100% clear on what it means tho...

The explanation on that page is pretty good actually. Read that first.

In practice, it means that there is a lot of incentive for the market makers to move the stock price in order to profit from options traders. In situations where there is a high interest in the options and relatively low volume in trading of the stock, it is in the market makers interest nudge the stock price towards max pain. Max pain is not always a factor in the stock movements, but I think this week for TSLA, it might very well be in play assuming no other major news/catalysts.

Bobbyducati

Member

yeah it makes a lot more sense to me now, i had added a second link that confirmed what i thought i was getting out of the first. thanks for further clarifying.The explanation on that page is pretty good actually. Read that first.

In practice, it means that there is a lot of incentive for the market makers to move the stock price in order to profit from options traders. In situations where there is a high interest in the options and relatively low volume in trading of the stock, it is in the market makers interest nudge the stock price towards max pain. Max pain is not always a factor in the stock movements, but I think this week for TSLA, it might very well be in play assuming no other major news/catalysts.

The short term significance may be that this demonstrates what Tesla may do with the Model 3. 340 miles plus 20 to spare on a 70 kWh pack shows that Tesla is capable of 5 mi/kWh. If they reach 400 miles, that's 5.7 mi/kWh! Can they translate this to the Model 3 design and get 230 mile range on 40kWh starting at $35k, 315 miles on 55 kWh at $45k and 400 miles on 70kWh at $55k? That would be an awesome line up. I don't think the auto industry sees this coming, but Tesla is proving that it is technically feasible.

Hold up - hate to be the party pooper but from a physics point of view I don't think the upgraded Roadster is a good frame of reference for Model 3 range/kWh. The Roadster is a small two-door, two-seater with a small aerodynamic cross section. Model 3 is tentatively a four door sedan that's only 20-30% smaller than a Model S...

GenIIIBuyer

Member

The short term significance may be that this demonstrates what Tesla may do with the Model 3. 340 miles plus 20 to spare on a 70 kWh pack shows that Tesla is capable of 5 mi/kWh. If they reach 400 miles, that's 5.7 mi/kWh! Can they translate this to the Model 3 design and get 230 mile range on 40kWh starting at $35k, 315 miles on 55 kWh at $45k and 400 miles on 70kWh at $55k? That would be an awesome line up. I don't think the auto industry sees this coming, but Tesla is proving that it is technically feasible.

It's also important to keep in mind that there is a minimum battery pack size necessary to send enough power from batteries to electric motor for electric motor to achieve its full HP number. I forget what it is offhand, but I think batteries are limited to discharge at maximum of about a 4C rate.

Not enough power was one reason that the 40KwH Model S was discontinued (other than low order rate). With Model 3 it may be small enough that power from 40KwH is enough, Tesla seems to err on the side of overpowering though.

GenIIIBuyer

Member

IMO a Volt, with 10kWH usable of a 16kWH pack, has sufficient power capacity for a "regular" Model 3. Perhaps an HPO version needs more, but I don't think minimum battery pack size will be a constraint.

Volt must be able to drawdown power from the batteries at faster than 4C. 10kWH*4C = 40,000 watts /745 watts/Horsepower = 53.7 Horsepower.

Unless you are happy driving 54 HP

GenIIIBuyer

Member

"The 2015 Chevrolet Volt is powered by two electric motors that produce 149 horsepower combined".

It goes much quicker than a Camry, I can tell you that! And I believe that's sufficient for a "regular" model.

Thanks, then if my math is right, the Volt can draw as high as 12C! Hope one of the battery tech guys chimes in, I know this is the wrong thread though. I feel the mods circling.

JRP3

Hyperactive Member

You need to subtract the $2K for SC access that is included in the 85, and any other options. At one point there was a tire and wheel upgrade included with the 85 as well. If that's still in effect then the price different works out to around $280/kWh.Comparing the difference in the S between the 60 and 85 shows a price increase of $400 per kWh ($80k - $70k = $10,000/85-60 = $400).

Hold up - hate to be the party pooper but from a physics point of view I don't think the upgraded Roadster is a good frame of reference for Model 3 range/kWh. The Roadster is a small two-door, two-seater with a small aerodynamic cross section. Model 3 is tentatively a four door sedan that's only 20-30% smaller than a Model S...

On the other hand the Roadster has a worse cd than the S, and presumably the 3, and aerodynamics are a factor of cd and area.

Thanks, then if my math is right, the Volt can draw as high as 12C! Hope one of the battery tech guys chimes in, I know this is the wrong thread though. I feel the mods circling.

Different lithium chemistries can put out different C rates. A123 can do 40C, Lithium Polymer can do 90C. Can't remember what the Volt is using but obviously it's capable of a higher C rate than the NCA chemistry Tesla uses.

GenIIIBuyer

Member

Different lithium chemistries can put out different C rates. A123 can do 40C, Lithium Polymer can do 90C. Can't remember what the Volt is using but obviously it's capable of a higher C rate than the NCA chemistry Tesla uses.

Thanks!

You need to subtract the $2K for SC access that is included in the 85, and any other options. At one point there was a tire and wheel upgrade included with the 85 as well. If that's still in effect then the price different works out to around $280/kWh.

The tire and wheel upgrade is no longer included when upgrading from the 60 to the 85. However, it is strange that you don't account for Tesla's profit margin. After subtracting $2000 for the supercharger package and dividing the remaining price of $8000 by 25 kWh difference, you get a battery price of $320. However, the implication of this is that Tesla's gross margin is lower for the base 85 kWh Tesla than the base 60 kWh Tesla. This makes absolutely no sense, and is highly unlikely. If we assume a profit margin of 25%, the battery price works out to be $240/kWh, which is a much more believable number.

- Status

- Not open for further replies.

Similar threads

- Replies

- 23

- Views

- 793

- Replies

- 21

- Views

- 6K

- Replies

- 0

- Views

- 218

- Locked

- Replies

- 0

- Views

- 3K