Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

- Status

- Not open for further replies.

Crowded Mind

Member

I'm starting to get a headache refreshing Twitter feed every few seconds.

Elon, give us a break!

Get the Twitter app, you can get push notifications for any specific user's tweets.

racer26

Active Member

I keep getting all excited every time my twitter tab says there's new Elon tweets, only to find that they're about SpaceX. Any other day, I'm happy to read about SpaceX, and think what they're doing is super-awesome. Today, I just want to see SMP2

doggusfluffy

Closed

It might work out better to let Trump and the convention news cycle dominate tonight, assuming they're fine still tuning...

You guys just scare me. SMP2 is good for the long term viability of Tesla. It will not likely have any immediate impact on TSLA stock price. Time to get sober and temper your expectations.

Failure makes some people bitter.Trust me: no one is taking it seriously. This guy needs to look in the mirror and say hi to a true loser.

racer26

Active Member

I don't expect its going to be huge, but when the SP gains $8 at Elon's suggesting that he is working on it, for release later, it would be naive to think its not going to move the SP needle at all. This *is* the Short-Term thread...You guys just scare me. SMP2 is good for the long term viability of Tesla. It will not likely have any immediate impact on TSLA stock price. Time to get sober and temper your expectations.

And while I don't expect it to be huge, the ridiculous levels of shorting going on could make it bigger than it really ought to be.

I think that this guy, aka known as Logical Thought, will loose his castle by the end of 2016.

dmckinstry

Model X 2019

Well, let me elaborate...

NFLX is the ticker symbol of Netflix. Netflix announced today, that it acquired the exclusive international distribution rights to the upcoming new Star Trek TV series. Star Trek is a science fiction franchise that was heavily referenced/made fun of in the comedy Spaceballs. Spaceballs features space ships capable of insane and ludicrous speeds. Teslas are the only vehicles known to man actually capable of those speeds. TSLA is the ticker symbol of Tesla.

See? So obvious...

I believe Spaceballs was a spoof of Star Wars, not Star Trek. e.g., Rick Moranis (Darth Vader character) and John Candy (Chewbacca Charcter)

I don't expect its going to be huge, but when the SP gains $8 at Elon's suggesting that he is working on it, for release later, it would be naive to think its not going to move the SP needle at all. This *is* the Short-Term thread...

And while I don't expect it to be huge, the ridiculous levels of shorting going on could make it bigger than it really ought to be.

By the way, I do not want shorties to cover so soon. Higher the stock price on secular long accumulation, larger the pain shorts endure. Shorts are in deep denial and will likely stay put until it is too late.

My take is that stock price will gradually grind up all the way up to $280 right before Q3 production and delivery update in early October. I am expecting very good production/delivery numbers for Q3 (~24K). If they meet or exceed it, it is all fireworks from then on! Short squeeze happening then will be a lot more powerful and propel SP all the way up to $400.

Last edited:

Replying to something a few pages back: It isn't a short squeeze unless the volume is abnormally high. That's because in a true short squeeze, the shorts (and there are multiple days of normal trading of them out there) are trying to cover, and weak longs are selling, and Joe on the Street is saying "hey, what's this Telsa [sic] thing? I should buy some!", and shorts who covered twenty minutes ago are thinking "it's gotta go down again... short!".

Today was just a nice upward day because SCTY got more cash and looks better, and a rocket landed.

Today was just a nice upward day because SCTY got more cash and looks better, and a rocket landed.

dha

Member

OctoberMy take is that stock price will gradually grind up all the way up to $280 right before Q3 production and delivery update in earlySeptember

wsucougz

Member

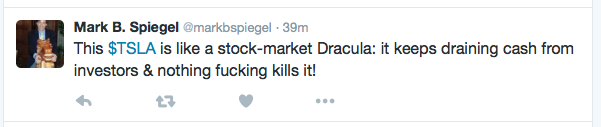

In the last day alone he has angrily tweeted about tesla approx. 20 times to no audience. If I were Musk I'd look into getting an extra bodyguard or two.

The dude is now tweeting abt the renewed referral program! Nuts.

"$TSLA quickly renews its referral program with a $1,000 discount & increases the limit http://electrek.co/2016/07/18/tesla-renews-referral-program-1000-discount/… DUE TO OVERWHELMING DEMAND."

"$TSLA quickly renews its referral program with a $1,000 discount & increases the limit http://electrek.co/2016/07/18/tesla-renews-referral-program-1000-discount/… DUE TO OVERWHELMING DEMAND."

jak

Member

I love reading his tweets. They're all very humorous rants and not to be taken seriously at all. It's all funny and he's a joke.

dha

Member

I love reading his tweets. They're all very humorous rants and not to be taken seriously at all. It's all funny and he's a joke.

The guy is a joke, but he apparently manages $4.5M of other people moneys invested in his Pooled Investment Hedge Fund.

I have to say that amount of stink he releases into the Internets is grossly out of proportion with the amount of money he manages.

neroden

Model S Owner and Frustrated Tesla Fan

Daily volume, you mean. In a big short-covering rally or a short squeeze, you'll actually have very very choppy minute-by-minute volume. Just to clarify. You have wide bid-ask spreads, and huge numbers of orders, so you get periods when none of them are crossing and no trades are made alternating with periods when enormous numbers of shares trade hands very quickly. (This always happens in a certain sense, but it gets magnified in a short-covering rally.) You can also start to witness the computer systems failing and orders getting backlogged and delayed, so it's a dangerous time to trade...Replying to something a few pages back: It isn't a short squeeze unless the volume is abnormally high.

(This is by contrast to another situation where you can have very high *steady* daily volume which isn't choppy, with fairly little price movement. I've been been quite sure why that happens, but I've heard it suggested that it happened when stocks are added to or removed from indexes.)

...and the market makers are trying to collect on the big spreads; and most of the algos are trying to bail out because their algorithms can't handle the short squeeze, while a few squeeze-focused algos are trying to get in...That's because in a true short squeeze, the shorts (and there are multiple days of normal trading of them out there) are trying to cover, and weak longs are selling, and Joe on the Street is saying "hey, what's this Telsa [sic] thing? I should buy some!", and shorts who covered twenty minutes ago are thinking "it's gotta go down again... short!".

That's the time when I like to be a long-term investor who is relaxing in a hot tub and ignoring the stock until the next morning.

Today was just a nice upward day because SCTY got more cash and looks better, and a rocket landed.

Wonder if those people know he is an unhinged troll?The guy is a joke, but he apparently manages $4.5M of other people moneys invested in his Pooled Investment Hedge Fund.

I have to say that amount of stink he releases into the Internets is grossly out of proportion with the amount of money he manages.

- Status

- Not open for further replies.

Similar threads

- Locked

- Replies

- 0

- Views

- 4K

- Replies

- 2

- Views

- 1K

- Replies

- 19

- Views

- 1K

- Replies

- 20

- Views

- 3K