Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

- Status

- Not open for further replies.

Is Elon going to throw a pie at Cramer & the rest of naysayers on Wall Street?Elon being interviewed by Cramer tomorrow

Its actually during the 11 am ET Squawk Alley show, not Cramers.

Last edited:

Three articles from Australia that, to me, affect the Tesla Energy stock price positively UP, short and long term

1) 1.5 gigawatt brown (soft) coal plant to close in next 5 months “…New CEO Isabelle Kocher has recognised that within a few decades, half of all electricity demand will come from local sources – rooftop solar and battery storage paramount among them....

Hazelwood to close as energy transition gathers pace in Australia

2) “…14kWh Powerwall 2 is nearly half the installed cost/kWh of its trail-blazing predecessor – making it less like the home battery storage of the future, and more like the home battery storage of the here and now…”

What the "Tesla effect" means for Australian battery storage prices - One Step Off The Grid

3) “As with the Apple product ecosystem, this aims to establish Tesla as a single entry point for energy generation and storage systems in the home environment,” he writes. “Tesla has both the name and the resources to become a strong player in this realm.”

Rivals fear Tesla may become the Apple of battery storage - One Step Off The Grid

Australia from my reading has a high uptake on PV and storage, a recalcitrant government hostile to renewable and a very fractious, independent minded population fed up with them and willing to defy.

My read on this is other renewable companies are worried, Tesla Energy is integrated and can supply virtual turnkey systems, Australians are also doing VPP’s.

1) 1.5 gigawatt brown (soft) coal plant to close in next 5 months “…New CEO Isabelle Kocher has recognised that within a few decades, half of all electricity demand will come from local sources – rooftop solar and battery storage paramount among them....

Hazelwood to close as energy transition gathers pace in Australia

2) “…14kWh Powerwall 2 is nearly half the installed cost/kWh of its trail-blazing predecessor – making it less like the home battery storage of the future, and more like the home battery storage of the here and now…”

What the "Tesla effect" means for Australian battery storage prices - One Step Off The Grid

3) “As with the Apple product ecosystem, this aims to establish Tesla as a single entry point for energy generation and storage systems in the home environment,” he writes. “Tesla has both the name and the resources to become a strong player in this realm.”

Rivals fear Tesla may become the Apple of battery storage - One Step Off The Grid

Australia from my reading has a high uptake on PV and storage, a recalcitrant government hostile to renewable and a very fractious, independent minded population fed up with them and willing to defy.

My read on this is other renewable companies are worried, Tesla Energy is integrated and can supply virtual turnkey systems, Australians are also doing VPP’s.

CALGARYARSENAL

Member

This is so huge. The stock will scream. I may take the day off to get some $ transferred. I am not kidding. This will be CNBCs highest rated show ever. Buy before the Fast Money gang. I tweeted last week to both of them and CNBC recommending this and that they were missing a huge opportunity! The stock is done going down.Elon being interviewed by Cramer tomorrow

Krugerrand

Meow

Is Elon going to throw a pie at Cramer & the rest of naysayers on Wall Street?

I think we're past pie and onto something a bit more convincing. I vote bat.

CALGARYARSENAL

Member

If Cramer is positive, and god forbid he makes a recommendation, Tesla will be the hottest trade around for the next year. He really does have that much influence. Now this.....will get the shorts running to the hills. I am in shock.

larmor

Active Member

Is cramer/cnbc a leading or lagging indicator for a security?

CALGARYARSENAL

Member

Mostly leading. I don't like him but he moves stocks. Why else is Tesla rallying today? I think his daughter beat him up over Tesla negativity and he will recommend tomorrow.Is cramer/cnbc a leading or lagging indicator for a security?

Well, we did also see reports about some positive analysts output earlier today. Every little bit helps!Mostly leading. I don't like him but he moves stocks. Why else is Tesla rallying today? I think his daughter beat him up over Tesla negativity and he will recommend tomorrow.

TrendTrader007

Active Member

I agree with you that margin is a mistake"007", I think many things that you said in the past, including this post, are right to the point. Your conviction combined with the ability to find the high growth companies, and the laser focus allocation, make it possible for you to become a billionaire. I know a guy who bought one million shares of a small company watched the company grew more than 1000 fold. Not sure if he still have all the shares, the gain should be more than 1 billion dollars. (I also watched the whole thing, except I hesitated when I had the chance to buy at the low point).

There are at least 300 common mistakes in trading and investment. I have personally experienced 200 of them. Lots of them are based on human instinct. It seems the only way to learn a mistake is to make the mistake. Long time ago, I promised to myself: don't make the same mistake repeatedly, otherwise, I will have thousands of mistakes waiting on my way.

I think buying stocks with margin is a mistake. There are two signs that indicate my margin is a trouble: 1. I feel stressful; 2. I am forced to sell. My answer for this is I always keep 10% cash, assume the worst is yet to come.

You have to know what's right what's wrong, then have the discipline to do the right things.

The only reason why I go on margin is frankly because I'm addicted to it and the constant stress I find actually a thrill

Sometimes I make a ton sometimes I pay the price but it all evens out in the end

I can't defend going on margin though

I do keep it 20% or so never higher

Australia from my reading has a high uptake on PV and storage, a recalcitrant government hostile to renewable and a very fractious, independent minded population fed up with them and willing to defy.

My read on this is other renewable companies are worried, Tesla Energy is integrated and can supply virtual turnkey systems, Australians are also doing VPP’s.

I am Australian and can confirm there is strong demand for off-grid solutions for power. For the last 1-2 decades we have had crazy increases in electricity prices due to the way the network (i.e. poles and wires) is managed. The management company received performance fees aligned with how much the spent on strengthening the network and the inevitable result is sky high electricity prices.

We already have one of the highest uptakes of solar in the world. As soon as there is a relatively cheap battery that can sustain off-grid use you can expect Australians to flock to it. We also have the advantage of being relatively close to the equator (compared to EU, US) so solar/battery provides a more reliable year round energy source than for those that live closer to the poles.

I agree with you that margin is a mistake

The only reason why I go on margin is frankly because I'm addicted to itr

My friend, don't ruin your life for a dopamine hit - there are places that can help. No stock is worth your sanity / financial security.

Mod Note:

Let's try to wrap up Flux's & 007's topic in the next couple of posts - this isn't the best venue for such a conversation. Thanks.

...and remember: only 209 weeks until the next thrilling Presidential election!

Let's try to wrap up Flux's & 007's topic in the next couple of posts - this isn't the best venue for such a conversation. Thanks.

...and remember: only 209 weeks until the next thrilling Presidential election!

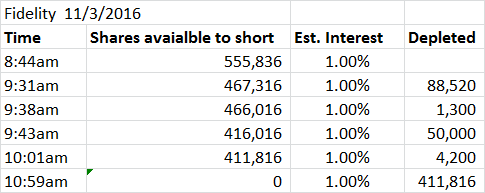

Interestingly enough, there were less than usual (last several days) shares available for shorting at Fidelity, and they are down to zero as of 10:59am. May be today will be a doji day to mark a reversal tomorrow.

Last edited:

Few link I think are important:

White House announces new ‘EV corridors’ to accelerate deployment of electric vehicles and charging stations

Strange enough, Tesla isn't mentioned.

Some new details on Tesla & SolarCity roof:

Here Are Important New Details About Tesla's Solar Roof

White House announces new ‘EV corridors’ to accelerate deployment of electric vehicles and charging stations

Strange enough, Tesla isn't mentioned.

Some new details on Tesla & SolarCity roof:

Here Are Important New Details About Tesla's Solar Roof

dennis

Model S Plaid

And Tesla deliberately chose not to do that because those would have been AP1 cars being delivered after the AP2 announcement. They built AP1 inventory cars instead that will be sold at a small discount to help make the Q4 goal.They would have been able to deliver approximately double the amount of Model S in Europe in October if those inventories had been custom builds for customers.

Last edited:

MitchJi

Trying to learn kindness, patience & forgiveness

How long do you think the Cramer effect will last?If Cramer is positive, and god forbid he makes a recommendation, Tesla will be the hottest trade around for the next year. He really does have that much influence. Now this.....will get the shorts running to the hills. I am in shock.

Stop with Cramer, we don't know who is doing the interview tomorrow since its taking place after Cramer is off air during 11 am ET. Its at the Ron Barron Conference & EM isn't listed as a scheduled speaker so likely a last minute appearance to drum up votes.

Agenda 2016 - Baron Funds - Mutual Funds - Baron Funds - Mutual Funds

Once again Ron Barron has underperformed his benchmark & the S&P 500 for over the past decade.

Agenda 2016 - Baron Funds - Mutual Funds - Baron Funds - Mutual Funds

Once again Ron Barron has underperformed his benchmark & the S&P 500 for over the past decade.

Last edited:

FredTMC

Model S VIN #4925

Few link I think are important:

White House announces new ‘EV corridors’ to accelerate deployment of electric vehicles and charging stations

Strange enough, Tesla isn't mentioned.

Public has large misconception about charge stations...

Ask any tesla owner how often they go to a public charge station and the answer is almost never.

Bottom-line: once your EV has 200mi+ range, you don't need public charge stations in your local daily travel. You charge at home at night.

For long distance travel, Fast Level-3 chargers (Superchargers) are crucial.

Public has large misconception about charge stations...

Ask any tesla owner how often they go to a public charge station and the answer is almost never.

Bottom-line: once your EV has 200mi+ range, you don't need public charge stations in your local daily travel. You charge at home at night.

For long distance travel, Fast Level-3 chargers (Superchargers) are crucial.

Good point. One related nugget from the Q3 10Q that I have not seen mentioned, Tesla added 54 Supercharger locations in Q3 -- up to 715 from 661 at the end of Q2. So ramping up nicely without a major impact on financials.

As of September 30, 2016 and December 31, 2015, the net book value of our Supercharger network was $193.9 million and $166.6 million, and as of September 30, 2016 our Supercharger network included 715 locations globally. We plan to continue investing in our Supercharger network for the foreseeable future, including in North America, Europe and Asia, and expect such spending to continue to be a minimal portion of total capital spending during 2016. During 2016, we expect that this investment will grow our Supercharger network over 40%. We allocate Supercharger related expenses to cost of total automotive revenues and selling, general, and administrative expenses. These costs were immaterial for all periods presented.

Last edited:

- Status

- Not open for further replies.

Similar threads

- Locked

- Replies

- 0

- Views

- 4K

- Replies

- 2

- Views

- 1K

- Replies

- 19

- Views

- 1K

- Replies

- 20

- Views

- 3K