jhm

Well-Known Member

Cool! I was just about to post on Adam Browning's tweet. These deals are incredible.

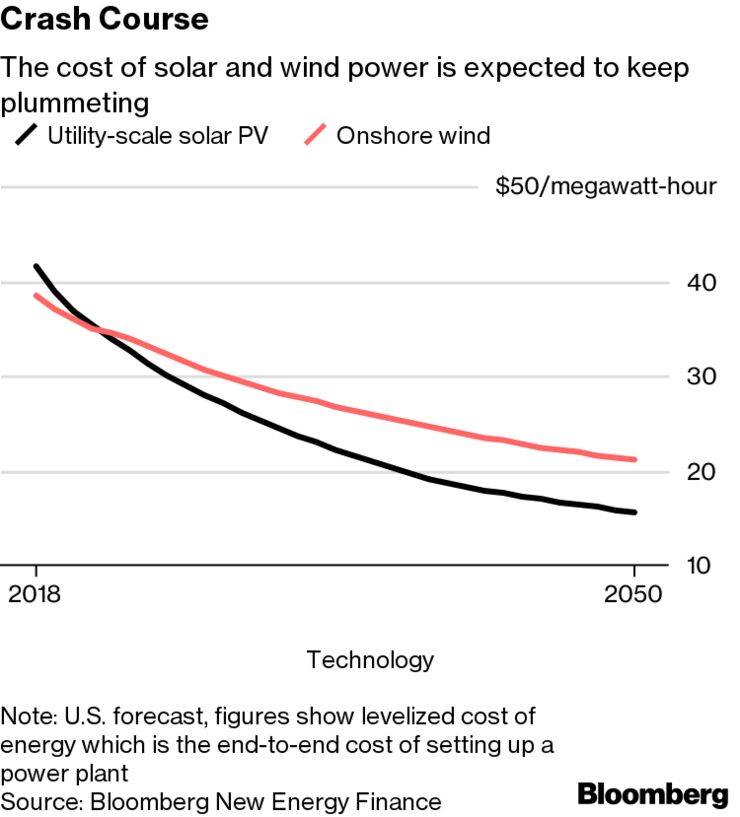

Notice the pricing scheme in many of these. There is a per MWh price solar energy plus a per MW-month price on battery capacity. So a typical set up is like 100 MW PV at $27/MWh plus 25 MW / 100 MWh battery at $6200/MW-month. The capacity payment comes close to covering interest plus maybe a little principal on battery capex, say about 7.5% on $1M for a 1MW battery. So the developer/operator seems to be able to take whatever battery revenue from selling services and power at pure profit. Basically any power price above $27/MWh they can get with sores solar is pure profit, but naturally they will discharge when prices are highest.

This is simply going to crush peak gas power. They will be completing with fully charged batteries that are willing to take the peak power price down to about $30/MWh. The cost of fuel alone does not even allow a gas peaker to go that low. This is going to be brutal on gas and coal.

Notice the pricing scheme in many of these. There is a per MWh price solar energy plus a per MW-month price on battery capacity. So a typical set up is like 100 MW PV at $27/MWh plus 25 MW / 100 MWh battery at $6200/MW-month. The capacity payment comes close to covering interest plus maybe a little principal on battery capex, say about 7.5% on $1M for a 1MW battery. So the developer/operator seems to be able to take whatever battery revenue from selling services and power at pure profit. Basically any power price above $27/MWh they can get with sores solar is pure profit, but naturally they will discharge when prices are highest.

This is simply going to crush peak gas power. They will be completing with fully charged batteries that are willing to take the peak power price down to about $30/MWh. The cost of fuel alone does not even allow a gas peaker to go that low. This is going to be brutal on gas and coal.