erha

Member

I'm trying to look at the numbers for energy storage, and so far I'm only getting confused. Elon and JB (and a lot of people on this forum) seem really, really excited for energy storage. However, I can't really make the numbers add up.

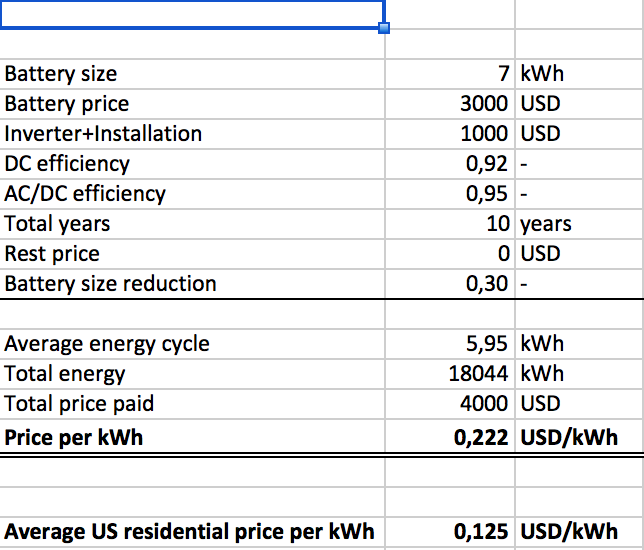

I took a screenshot of my spreadsheet where I end up with 22 cents per stored kWh. (I assume a linear decrease in capacity of the battery and that the battery is worth 0 USD after 10 years. Putting in a couple of hundred dollars here, og assuming zero decrease in capacity doesn't make a huge change.)

The average electricity price in the US is about 12.5 cents. A combination of solar cells and battery is, as far as I can see, not financial viable at all. I tried to find rates for peak and off-peak, but couldn't find any good numbers. Can the difference be more than 22 cents?

UPDATE: I did this really fast, so there might be some errors in the calculations. The efficiencies are quite confusing for example. They are part of the total energy number. If you set all efficiencies to 100 % you end up with 18.4 cents/kWh, so it really doesn't matter that much.

I took a screenshot of my spreadsheet where I end up with 22 cents per stored kWh. (I assume a linear decrease in capacity of the battery and that the battery is worth 0 USD after 10 years. Putting in a couple of hundred dollars here, og assuming zero decrease in capacity doesn't make a huge change.)

The average electricity price in the US is about 12.5 cents. A combination of solar cells and battery is, as far as I can see, not financial viable at all. I tried to find rates for peak and off-peak, but couldn't find any good numbers. Can the difference be more than 22 cents?

UPDATE: I did this really fast, so there might be some errors in the calculations. The efficiencies are quite confusing for example. They are part of the total energy number. If you set all efficiencies to 100 % you end up with 18.4 cents/kWh, so it really doesn't matter that much.

Last edited: