This year, and this quarter in particular, I think will give new meaning to the traditional TMC 'end-of-quarter toss a coin to your Witcher' purchases.

Absolutely.

One TMC thread with a small option, and

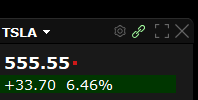

invite link. Hopefully many of us are planning to ramp up the charitable giving as we close out this year. Who would have thought in January (TSLA $86.05) or March COVID-teenth (TSLA $72.24) we'd be ending as we are?

Well, off topic for this thread, but since we're talking about charitable donations, I'll remind everyone of the tax advantage of donating appreciated stock. The rest of this post is from a letter written to the board and large donors of a 501c3 charity I was involved in. It was written a few years ago, but after the last tax changes, so as far as I know it's still correct.

Suppose for a moment that you want to give some money to your favorite 501c3 (that is, tax deductible) charity. For sake of argument and easy calculation, let’s say $1000. Let’s also assume that you make enough money that you’re in the top tax bracket, live in California, and have some of it invested in stocks, and that you itemize your deductions. The IRS encourages people to give to charities, to the extent that they allow you to deduct that donation from your taxable income. So next year, when you file your taxes, the IRS/FTB will actually give you back about $505(*) of that money. They actually paid more to your charity than you did!

But that $1000 had to come from somewhere. If you take it out of your work pay cheque, the IRS already deducted the same amount, so really when the dust settles it just means you paid your tax to the charity instead of the IRS and California. A more worthy cause, anyway.

If you have stocks that you’ve held for more than one year, and sell them to raise the money, the profits from the sale are deemed Long Term Capital Gains, and are taxed at a lower rate (20%). At this point I need to use a concrete example. At the end of 2012 I bought some Intel stock for about $20 per share. Last week (2016 when I originally wrote this) Intel was about $33 per share. If I sell 30 of these shares of Intel, I raise $990 cash to give to AC… errr, ummm, charity. Of that money, some of it is just my own capital back, but $13 per share is profit: that’s $390 profit taxed at about 27%, call it $105 tax. So you’ve paid a lot less tax, but the IRS still lets you deduct the whole amount for the full benefit.

So far everything I have said about the tax you pay is just standard. But the IRS likes charities and has an even better benefit. If I just give the

stock directly to the charity, without selling it first, the charity will send me a letter saying that the value of the stock was $990, and I still get to deduct that whole amount from next year’s income.

But I never sold the stock, and don’t owe any capital gains tax! So I’m $105 better off than selling the stock and then donating the money. In case you’re wondering, this is perfectly legitimate and was the intent of the law. In fact, the 2017 tax law just

increased the amount of charitable donations you’re allowed to deduct to 60% of your total income.

My example of Intel is fine enough, but if you happen to have some year old vintage TSLA in your portfolio, the advantage to you of giving the stock instead of cash becomes huge. Basically the more profit you are sitting on in the stock, the better off you are donating rather than selling. If you didn’t make a profit on the stock, though, you are conversely better off selling it to take the capital loss as a deduction too.

Donating stock is a little bit more of a hassle than just writing a cheque, but the development staff of the charity will happily help you with the numbers you need. Then just fax a form to your stockbroker, and it will happen. It usually takes a week or two, so don’t wait to do it at the end of December. Also don't forget to specify the stock with the greatest capital gain, and make sure that they transfer what you tell them (Looking at you, ETrade!). All stocks look alike to me, but not to the IRS.

*: Approximate numbers based on current (2017 after the Tax Cuts and Jobs Act) tax rates, including CA state tax. I am not an accountant.