Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

Johan

Ex got M3 in the divorce, waiting for EU Model Y!

So; I commented before trading started that these "very negative news" would push TSLA down today, and with the macros as backdrop that downforce was highly exaggerated resulting in an 8% (!) drop. Then, also like I though, Tesla comments (through Elon's twitter feed which apparently again has become Tesla's main PR communications channell - which I'm all for) and we'll see the price go back up again tomorrow... right...?

And a comment on the macros: So the 10-year yield topped out just above 1,6% today which is higher than in recent memory. BUT c'mon, a company like Tesla with the growth opportunities/trajectory and execution record in the last 8 years should get a more than 5% hit to their market cap just because "you could instead of investing in TSLA buy US Treasury bonds that will yield a whopping 1,6% per year" (Yes I understand that Yield and the Yield curve signals much more than this but in essence this is what it boils down to, yes?).

And a comment on the macros: So the 10-year yield topped out just above 1,6% today which is higher than in recent memory. BUT c'mon, a company like Tesla with the growth opportunities/trajectory and execution record in the last 8 years should get a more than 5% hit to their market cap just because "you could instead of investing in TSLA buy US Treasury bonds that will yield a whopping 1,6% per year" (Yes I understand that Yield and the Yield curve signals much more than this but in essence this is what it boils down to, yes?).

Last edited:

Proof Elon doesn't care about the share price. I mean he could have tweeted that two days ago.

If they had gone 2 days and then been back up for a day and nobody ever made it news on twitter it would have been the best case scenario for the stock imo

I learn so much from all of you.... and when the ICE age ended humans flourished.

Am I right or am I right?

Thank you all! (no really)

We weren't.

Well well... look who believes "evidence" from "scientists".

So nobody wants to talk about this? The fast rise on "Factory Open" news is understood, but a return so quickly I call manipulation. (I would expect some selling, but not back to the bottom so fast.)

If it's the M word, why the push to keep it so far below Max Pain? As if people expect heavy buying tomorrow and need to keep it down? Calling Cathie W.

If it's the M word, why the push to keep it so far below Max Pain? As if people expect heavy buying tomorrow and need to keep it down? Calling Cathie W.

ByeByeJohnny

Active Member

Did that really happen though? The highest Marketwatch shows is from 675 > 690So nobody wants to talk about this? The fast rise on "Factory Open" news is understood, but a return so quickly I call manipulation. (I would expect some selling, but not back to the bottom so fast.)

If it's the M word, why the push to keep it so far below Max Pain? As if people expect heavy buying tomorrow and need to keep it down? Calling Cathie W.

View attachment 640008

chronoreverse

Member

Yeah, single minute spikes like that are almost always just artifacts in data reporting.

Great article! I snipped three sections for the TL;DR-ers.

"This time, more than in any previous bubble, investors are relying on accommodative monetary conditions and zero real rates extrapolated indefinitely. This has in theory a similar effect to assuming peak economic performance forever: it can be used to justify much lower yields on all assets and therefore correspondingly higher asset prices. But neither perfect economic conditions nor perfect financial conditions can last forever, and there’s the rub."

"My best guess as to the longest this bubble might survive is the late spring or early summer, coinciding with the broad rollout of the COVID vaccine. At that moment, the most pressing issue facing the world economy will have been solved. Market participants will breathe a sigh of relief, look around, and immediately realize that the economy is still in poor shape, stimulus will shortly be cut back with the end of the COVID crisis, and valuations are absurd. “Buy the rumor, sell the news.” But remember that timing the bursting of bubbles has a long history of disappointment."

"Value stocks have had their worst-ever relative decade ending December 2019, followed by the worst-ever year in 2020, with spreads between Growth and Value performance averaging between 20 and 30 percentage points for the single year! Similarly, Emerging Market equities are at 1 of their 3, more or less co-equal, relative lows against the U.S. of the last 50 years. Not surprisingly, we believe it is in the overlap of these two ideas, Value and Emerging, that your relative bets should go, along with the greatest avoidance of U.S. Growth stocks that your career and business risk will allow. "

I disagree (mostly)

Whole industries of value stocks are disappearing: retail, fossil fuels; are being disrupted: car manufacturing, energy; or are in serious financial trouble due to debt: travel, hospitality. They have relied on dividends to keep their stock price up, despite low growth, it looks like they will struggle for a long time. Within each sector there will be a few winners, but a lot of losers.

The largest corporations, especially those with both high growth and profits should do well: so Apple, Microsoft, Amazon (Tesla just scrapes in to that category at the moment, with very high growth rates making up for modest profits). There has been a long term trend for the largest global tech companies to capture more of world GDP and profit, this will probably continue. Regional players, even for regions as large as the US, EU or China will gradually be squeezed out.

The companies that may suffer are those which are small to medium with no profits and a high valuation based on future potential earnings. Any company that depends on issuing stock to fund growth or even worse for continuing operation is possibly going to get hammered.

Inflation risk remains low, deflation is more of a concern. EVs (lower cost of ownership), renewable energy (now cheapest, with far fewer externalities) and robotaxis (far cheaper per mile, coming in a few years), there is also the long term price reduction / improvement in capability of technological goods. Wage inflation has been subdued for a long time. With low inflation there is no need for central banks to raise interest rates, bond yields may rise a bit, but central banks will continue to buy them to inflate the money supply to counteract the deflationary tendencies. There is no direct link between this and asset prices, but secondary effects will continue to inflate assets, especially stocks.

A post COVID boom is likely, partly because of delayed spending, partly because of increased efficiency of the entire economy (EVs, renewables, robotaxi, tech). Governments around the world have higher than desirable levels of debt, but as long as inflation (and hence interest rates) remain low that is not really a problem. As long as they do not do austerity and instead depend on surging tax receipts from the boom then all should be well among the major economies. the UK has the added headwinds of Brexit but despite that should be OK (unless the government goes back to austerity).

mickificki

Member

I does explain it better, but occured at the same time the factory opened tweet? (Or at least right before I read it here which is pretty timely news).Yeah, single minute spikes like that are almost always just artifacts in data reporting.

So wait, I bought on an artifact? "Hey everyone... follow my expert trades here for free!" lol.

Tomorrow!

Stretch2727

Engineer and Car Nut

And a comment on the macros: So the 10-year yield topped out just above 1,6% today which is higher than in recent memory. BUT c'mon, a company like Tesla with the growth opportunities/trajectory and execution record in the last 8 years should get a more than 5% hit to their market cap just because "you could instead of investing in TSLA buy US Treasury bonds that will yield a whopping 1,6% per year" (Yes I understand that Yield and the Yield curve signals much more than this but in essence this is what it boils down to, yes?).

It's all about a fear higher inflation will cause companies to hold back hiring to make up for increased input costs as we come out of this mess. I think the bond market has it wrong, but even if there is higher inflation I don't think it will have a big effect on Tesla just like we saw last year with the economic pull back.

Right that's what I'm sayin' is there a way to find out who initiated the position? Just curious how hard/easy it is.Over my head, but wasn't that to create the reverse gamma squeeze and selling. It worked if so.

No clue, but I suspect it was Bill Gates. Yes that's my final answer.Right that's what I'm sayin' is there a way to find out who initiated the position? Just curious how hard/easy it is.

So you think this bounce back within a month? Usually does in 3 days.

You're buying calls bc the economy is ? Not sure I follow.

I am buying calls because I am a gambler for short term stuff and I think the bounce back can be swift and massive, as we have already seem. The calls expire about a month out. My long terms are untouched.

The market can decide to move on from the ten year yield pretty fast if is just stops moving. But I am concerned that the yield can go up more pretty fast, it took out 1.5 so easily is probably looking for 2. I think that would probably be ten percent more down from here for the stonks. At least.... In that sense, disconcerting.

Would love a hard dip below 1.5 tomorrow and so would the markets.

kengchang

Active Member

Artful Dodger

"Neko no me"

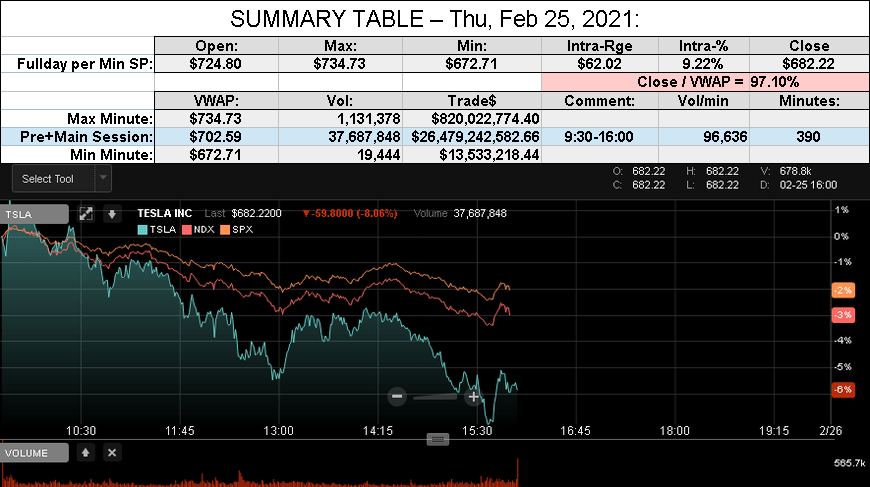

After-action Report: Thu, Feb 25, 2021: (Pre+Main Session Trading)

Headline: "TSLA 2.3x Macros on 10-Yr Fears"

Pre-Market:

Main Session:

TSLA S&P 500 Weight: 1.697727% (Feb 23)

Mkt Cap: TSLA / FB $654.832B / $725.273B = 90.29%

NB: Yahoo & Google have updated Mkt Cap re 10-K shares (Feb 10, 2021)

CEO Comp. Status: (est'd Mkt Cap including 10-K (Feb 01) shares)

QOTD: @PeterJA 'Practitioners of the dismal science are emperors with no clothes'

Comment: "Synthesizing is the 3rd step to Wisdom"

View all Lodger's After-Action Reports

Cheers!

Headline: "TSLA 2.3x Macros on 10-Yr Fears"

Pre-Market:

Volume: 905,258

SP High $742.02

SP Low $713.75

SP High $742.02

SP Low $713.75

Main Session:

Traded: $26,479,242,582.66 ($26.48B)

Volume: 37,687,848

VWAP: $702.59

Close: $682.22 / VWAP: 97.10%

TSLA closed BELOW today's Avg SP

TSLA MaxPain (7:00 A.M.): $750 (N/C from Wed)

Volume: 37,687,848

VWAP: $702.59

Close: $682.22 / VWAP: 97.10%

TSLA closed BELOW today's Avg SP

TSLA MaxPain (7:00 A.M.): $750 (N/C from Wed)

TSLA S&P 500 Weight: 1.697727% (Feb 23)

Mkt Cap: TSLA / FB $654.832B / $725.273B = 90.29%

NB: Yahoo & Google have updated Mkt Cap re 10-K shares (Feb 10, 2021)

CEO Comp. Status: (est'd Mkt Cap including 10-K (Feb 01) shares)

TSLA 30-day Closing Avg Market Cap: $775.63B

TSLA 6-mth Closing Avg Market Cap: $554.91B

Mkt Cap req'd for 10th tranche ($550B) likely achieved Tue, Feb 23, 2021

Mkt Cap req'd for 9th tranche ($500B) likely achieved Wed, Feb 03, 2021

Mkt Cap req'd for 8th tranche ($450B) likely achieved Tue, Jan 19, 2021

Nota Bene: Operational milestones req'd (chart at link).

'Short' Report:TSLA 6-mth Closing Avg Market Cap: $554.91B

Mkt Cap req'd for 10th tranche ($550B) likely achieved Tue, Feb 23, 2021

Mkt Cap req'd for 9th tranche ($500B) likely achieved Wed, Feb 03, 2021

Mkt Cap req'd for 8th tranche ($450B) likely achieved Tue, Jan 19, 2021

Nota Bene: Operational milestones req'd (chart at link).

FINRA Volume / Total NASDAQ Vol = 47.0% (46th Percentile rank FINRA Reporting)

FINRA Short / Total Volume = 56.6% (54th Percentile rank Shorting)

FINRA Short Exempt ratio was 1.08% of Short Volume (51th Percentile Rank Exempt)

FINRA Short / Total Volume = 56.6% (54th Percentile rank Shorting)

FINRA Short Exempt ratio was 1.08% of Short Volume (51th Percentile Rank Exempt)

QOTD: @PeterJA 'Practitioners of the dismal science are emperors with no clothes'

Comment: "Synthesizing is the 3rd step to Wisdom"

View all Lodger's After-Action Reports

Cheers!

Proof Elon doesn't care about the share price. He could have tweeted that two days ago.

But then we would have missed out on this great summary of the day:

https://twitter.com/28delayslater/status/1365058940703297539

Attachments

TheTalkingMule

Distributed Energy Enthusiast

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Replies

- 6

- Views

- 5K

- Replies

- 6

- Views

- 11K

- Locked

- Replies

- 27K

- Views

- 3M