The directions apparently have changed. Watch out for thoseYou guys have to help me out, english is not my first language, so yesterday we had: all time high, then today would be: all time higher? tomorrow: all time highest ??

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

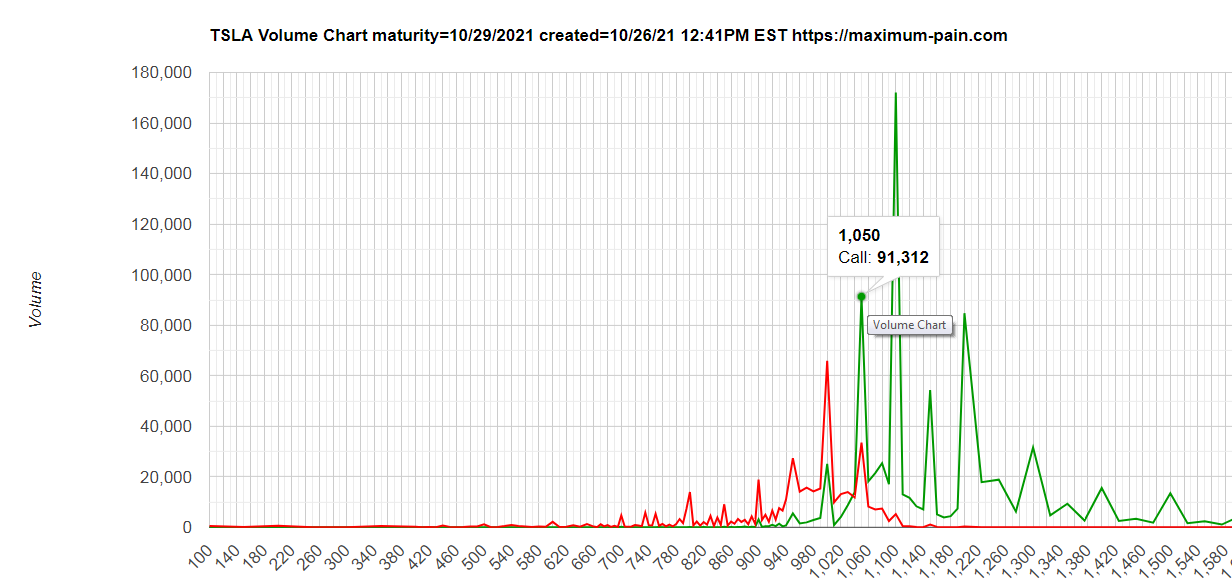

I think the battle is all about 1050 now (Edit: Later in the week).

thesmokingman

Active Member

Nah, he's right. The Hertz cars will be LFP. LFP is cheaper, hard to kill, no issues with thermal runaway ie. safe, and can be max charged. They are perfect for rental, taxi fleets. Using the the higher end chemistry would put Hertz into tight spots when they don't have to be.I'm behind on which batteries are going into which cars manufactured where, and I'm not saying LFP batteries won't be used, but your other point is easily overcome.

Just use s/w to lock down changing the max charge level to 90% in all Hertz cars. And display projected 'mileage' instead of % battery remaining. No non-Tesla owner will notice or care. Even the charge screen could easily be customized to avoid showing the battery charge only going to 90%.

There are a lot of opportunities for Tesla on the Hertz deal, many of which can leverage Tesla's software-centric design. This is just the start.

SageBrush

REJECT Fascism

I know all the different strategies that can be deployed. Personally I've always been a risk taker. In my older years I have adopted what I call the "barbell approach".

I do just about exactly the same: a few high risk/high gain stocks, and more than enough cash to lose all my investments or enjoy a massive stock market crash. This approach has developed since I retired.

Your other comment mirrors me too: my wife wants me to invest in indexes, but I don't want legacy auto or fossil fuels.

TheTalkingMule

Distributed Energy Enthusiast

So this is screaming $1049 close on Friday. And the MM work, now that volume dipped a bit, seems to be maneuvering us in that direction.

I guess normally I'd buy some $1050c for Friday, but I just transitioned to a conservative spread seller so that's off the menu.

StarFoxisDown!

Well-Known Member

Just a FYI, there's no real gap to fill. Practically all over TSLA's gains over the past month or so have come intraday. You have that 910-930 gap up at the open on Monday opening bell but that's tiny compared to the other moves the rest of this month. Even the move after earnings was an intraday move, not a gap up.taking small profits will make you happy even if prices go down.

Dry powder if there are some gap fills ......

MTL_HABS1909

Active Member

Any chance part of it is Elon selling shares at these high prices to pay taxes?

Stone_Watcher

Member

Prob just KathieAny chance part of it is Elon selling shares at these high prices to pay taxes?

I think we see another concerted push down to $1,000 to fish for stop losses. Last push was about $1.50 away

BitJam

Active Member

Sounds like high school.Yesterday was an all time high. Today is a new all time high.

Krugerrand

Meow

Nope. Today would be head fake sea of red.You guys have to help me out, english is not my first language, so yesterday we had: all time high, then today would be: all time higher? tomorrow: all time highest ??

Tesla/Hertz/other Robotaxi operators will be buying closed down auto dealer locations. Mark my words. Large parking lots, service/wash facilities, located near population centers but in relatively undesirable (cheap) land and easy access to major highways.So far Tesla appears in control with full pricing on Hertz vehicles. But I also agree with you because he did say we should be able to capture $30K annual income per vehicle off the Tesla FSD Network. One thing for sure, it's getting harder and harder to predict how this transition plays out. I mean, what the heck is the difference between car rental and ride-share anymore? Today only constrained by vehicle location which disappears on FSD. And why would Hertz even keep their spot in the parking garage? Even that won't make sense soon.

I also recall someone smart saying that often the most entertaining outcome is what will happen.

2

22522

Guest

Hi I am more of a Yogi Berra fan than an expert here. I looked this up.Oh great idea!!! A GTC order for 100 shares at $900. I’ll try it. Thank you

"Will GTC orders fill after hours?

It's important to note that a GTC order is not active during after hours trading and will only execute during normal market hours."

So to take advantage of anomalies after hours, the after hours buy order may need to be placed every day.

Vanguard let's you trade until 6:30 and since they are big enough to make a market they have reached down to make some below market purchases to complete a larger order. In other words, I have seen transactions made below the recorded low of that time period.

If you choose Fidelity, they let you trade until 8:30. They may be able to do the same thing to close a larger order, but I have not seen it.

The key point being a big brokerage does not appear to take all their trades all the way to the market if they can execute internally.

At least that is what it looks like is happening.

Someone here actually knows. I am just observing.

10/22 10/25?Just a FYI, there's no real gap to fill. Practically all over TSLA's gains over the past month or so have come intraday. You have that 910-930 gap up at the open on Monday opening bell but that's tiny compared to the other moves the rest of this month. Even the move after earnings was an intraday move, not a gap up.

It depends on the Broker and the trading options (not those options) they have. For example TDAmeritrade has GTC and GTC+extended hours. The second one will execute during after hours, the first one will not.Hi I am more of a Yogi Berra fan than an expert here. I looked this up.

"Will GTC orders fill after hours?

Will Vanguard or Fidelity let you trade OPTIONS after 6:30/8:30 or only shares?Hi I am more of a Yogi Berra fan than an expert here. I looked this up.

"Will GTC orders fill after hours?

It's important to note that a GTC order is not active during after hours trading and will only execute during normal market hours."

So to take advantage of anomalies after hours, the after hours buy order may need to be placed every day.

Vanguard let's you trade until 6:30 and since they are big enough to make a market they have reached down to make some below market purchases to complete a larger order. In other words, I have seen transactions made below the recorded low of that time period.

If you choose Fidelity, they let you trade until 8:30. They may be able to do the same thing to close a larger order, but I have not seen it.

The key point being a big brokerage does not appear to take all their trades all the way to the market if they can execute internally.

At least that is what it looks like is happening.

Someone here actually knows. I am just observing.

The next hour or two have always struck me as lulls in the market with action picking up later. No strong feelings about price action today, I do not expect a big drop, though it could happen. I favor at least slightly higher. 10% odds bigger drop, 20% close here, 30% or so chance of closing a bit higher, 40% chance near the 1050 range. Yesterday we closed 30 higher than VWAP. VWAP currently 1050.

OK, truth be told... at retirement age, I'm at about 25% in cash, up from an ongoing 20% this past year. For me, it was always about having a cushion while anticipating a market crash (which is still pending IMO.) Plus the fact that I'm launching a product soon means some of that is already tagged and I'm my own investor there. But I agree that the peace of mind was worth more than any opportunity lost. (I might add that relative numbers matter, as for some on TMC, just 5% in cash would represent a ridiculous amount just depreciating for no reason.)I do just about exactly the same: a few high risk/high gain stocks, and more than enough cash to lose all my investments or enjoy a massive stock market crash. This approach has developed since I retired.

Your other comment mirrors me too: my wife wants me to invest in indexes, but I don't want legacy auto or fossil fuels.

Today, my wife wishes she had bought even more Tesla (as her Intel investment dropped on lowered guidance last earnings). She'd have to quit Intel to sell those - could be a strategy there. We're now debating exercising any existing INTC options and shift that over to TSLA. I'm not bearish Intel, but compared to Tesla it's night and day on innovation and execution - both!

StarFoxisDown!

Well-Known Member

10/22 10/25?

It closed at 909 on 10/22 and opened at 947 on 10/25. Sorry but I don't consider that a noticeable gap up considering the volume since open on 1/25 and especially given the context of the rally in the past 2-3 months

But if you think it's really to drop more than 12% just to fill that small gap by all means wait to buy

thesmokingman

Active Member

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Replies

- 6

- Views

- 5K

- Replies

- 6

- Views

- 11K

- Locked

- Replies

- 27K

- Views

- 3M