Elon seems to want to settle this union question once and for all.

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

Artful Dodger

"Neko no me"

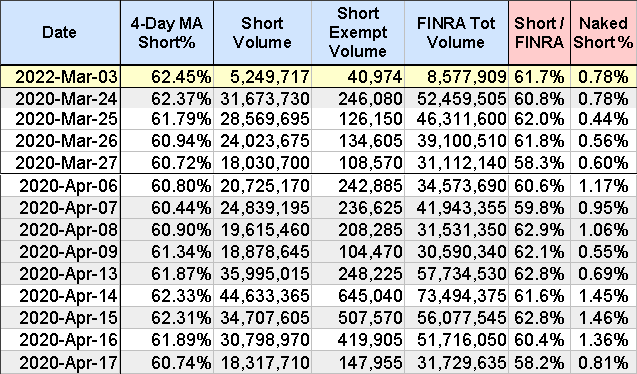

If you have been reading Papafox's Daily TSLA Trading Charts it won't surprise you to learn that sustained TSLA short selling has now reached its highest level in my dataset (-Jan 31, 2020 or 25 mths of FINRA data):

2nd Column above is the 4-day moving average of short-sales as a percentage of daily TSLA volume. The two next highest periods of sustained short-selling were in March and April of 2020 (during the Fremont plant shutdown for Covid)

What's triggering all this shorting? Is it the war, or the imminent opening of Giga Berlin?

Info: @Papafox

Regards,

Lodger

2nd Column above is the 4-day moving average of short-sales as a percentage of daily TSLA volume. The two next highest periods of sustained short-selling were in March and April of 2020 (during the Fremont plant shutdown for Covid)

What's triggering all this shorting? Is it the war, or the imminent opening of Giga Berlin?

Info: @Papafox

Regards,

Lodger

Last edited:

If you have been reading Papafox's Daily TSLA Trading Charts it won't surprise you to learn that sustained TSLA short selling has now reached its highest level in my dataset (-Jan 31, 2020 or 25 mths of FINRA data):

View attachment 776453

2nd Column above is the 4-day moving average of short-sales as a percentage of daily TSLA volume. The two next highest periods of sustained short-selling were in March and April of 2020 (during the Fremont plant shutdown for Covid)

What's triggering all this shorting? Is it the war, or is it them imminent opening of Giga Berlin? Paging @Papafox for your report.

Regards,

Lodger

We had quite the run since April 17, 2020. With two factories likely to come online within the month the cherry on top of this would be another split. Considering spacex recently announced a 10:1 split for spacex private stock valued at $560 it would not surprise most of us here to hear a similar announcement for Tesla before the year is over.

Would hate to be short at this point in time, but shed a tear for them I will not.

thesmokingman

Active Member

TSMC from what I've read do not use much palladium at all and they have local sources. As for neon gas they have plenty of stock on the island and can also source that locally. I'm not worry about TSMC. Now the fabs in Europe will probably be in a pinch like Intel, GF in Dresden, that one in France, etc etc. But the euro fabs are not cutting edge lithographies so not sure how it's gonna impact the devices we're interested in?In terms of Neon, Taiwan chip manufacturers have already said they don't get their Neon from Ukraine and that they expect no impacts from the Ukraine situation on their production.

I have no clue about the Palladium and how it affects ICE vehicles.

StealthP3D

Well-Known Member

Cool, thanks. I'm assuming about the same. Tesla is taking an new optimal path in this transition.

With dusruption already inevitable, the marketplace taking their sweet time has forced Tesla to go for margin-share, not market share.

I suspect Cybertruck will be sold at around $100-120k in the quad variant for it's first couple years of production. This is how you ratchet up the pressure on Ford and GM, eat the entire top of the line market where they make all their profits.

Like everyone else who speculates on this, I have no good data to draw reliable or even very meaningful conclusions from as to how Tesla might price the 4 motor variant and whether they will re-price the other variants. But If I were to guess based upon Tesla's past history and what I know about about inflationary pressures, I would say Tesla is not going to be jacking prices as high as most people are assuming but will use options that were not originally announced at the reveal to drive margins while trying their darndest to maintain pricing on configurations most closely matching the reveal versions and capabilities (range, performance, payload and towing and number of wheels driven).

For example, the early production versions might be quad motor with four-wheel steering and other high-end goodies for around $100K. Tesla might not produce the the formerly top-of-the-range Tri-motor, replacing it with a quad motor that's been limited to Tri-motor specs at the announced pricing of $69K\. But they will drive margins higher by offering things like 4-wheel steering with tank turns, higher performance options, etc. Tesla has lots of potential demand strings to pull to encourage upgrading to higher margin variants without re-negging on their announced pricing. And if FSD is more mature by then the margins on that can cover for a lot of inflationary pressure on materials and components.

I have little doubt, with the recent inflation, that Tesla is under hardship to meet their announced prices while maintaining good margins but, unlike most people who speculate on this, I think Tesla will be more creative so reservationists on a budget will be able to buy something equal or better in specs to that which they reserved and at the price they reserved it at, as long as they are willing to wait, and those with higher budgets will want to upgrade to higher margin variants which can result in very juicy margins for Tesla. I know that even if I were on a tight budget and had ordered the dual motor, it would be very tempting to pay a lot more, like perhaps even $25K more, to take earlier delivery and get independent quad motor, 4x4 rather than a dual motor with two open differentials. A quad motor AWD will eliminate two differentials and cost Tesla very little extra vs. a dual motor AWD so everyone wins and Tesla can avoid a fiasco like Rivian recently experienced.

The entry level single motor was not very popular and, like entry level pricing of most cars and trucks of all manufacturers, I think it might be largely a mythical beast that is only available to the truly dedicated. It may be that Tesla replaces the single motor RWD with a dual motor RWD (to leverage the engineering and parts required in the 4 motor AWD variant) and price it as low as $39.9K if the buyer is willing to wait for Tesla to burn through all the higher margin reservationists and not opt for some special functionality that two rear motors can enable. Since most people will not want a version that doesn't offer (for example) a simulated locking rear differential and some additional performance/range, the most common entry-level version might be $49K without FSD, even if you could technically buy a $39,9K RWD dual motor version that had been nerfed to the single motor specs announced at the reveal. The idea here is that all Cybertrucks could be one of two drive configurations, a RWD dual motor or an AWD quad motor. This will greatly simplify production while allowing a wide range of performance, capabilities and pricing. There is also a range benefit from eliminating the differentials. Of course, there would be at least two battery sizes available as well as different performance options.

The investor and the Tesla fan inside me want Tesla to make good on the capabilities and prices announced at the reveal even if they decide not to release a single motor RWD or a dual motor AWD for simplicity sake (and replace them with variants with two drive motors on each axle that is driven). A RWD Cybertruck with two motors in the rear would be very capable for most people's usage (regardless of whether the truck buyer might not believe they would be happy with RWD). On the other hand, the selfish and impatient Cybertruck reservationist inside me wants Tesla to jack up all the prices sky-high and release only a $180K ultra-awesome 4 motor version with maximum performance and range and all the bells and whistles as the only intro version so I can jump ahead of all the people not wanting to pay that much!

StealthP3D

Well-Known Member

Oklahoma??? Isn't that the state where lawmakers are trying to kick out Tesla stores and service centers???For me that would be a deal-breaker.

On the other hand, ignoring the lawmakers silliness is a good way to tell them they are irrelevant. And they truly are, because you cannot stop an idea whose time has come.

StealthP3D

Well-Known Member

Redlich is weird. He thinks TSLA can be worth more than USA GDP.

I think TSLA could eventually be worth more than the current US GDP. Time is an amazing thing. What do you think prevents Tesla from growing into a valuation greater than the current USD GDP?

Please be specific because it makes little sense to compare two almost entirely unrelated things like a company's future value with one country's current GDP. It would make more sense to look at Tesla's projected future valuation vs. the entire worlds future GDP. But who knows what the world's GDP will be in 2030 or beyond.

MSFT's current market cap is 1/10th the 2020 US GDP today and all they make is software. You are basically saying that you don't think the value of TSLA could ever be 10X the value of MSFT today and anyone who thinks it might be is "weird". That's just silly and irrational.

Buckminster

Well-Known Member

Market cap and GDP are very different. Linked by pe ratio multiple and therefore rate of growth. S&P500 value (up 25% in a year) is twice US GDP.Watch this

12 minutes 30 seconds in.

TSLA had similar clauses.

Redlich is weird. He thinks TSLA can be worth more than USA GDP.

ARK doesn't worry about it:

Total enterprise value for disruptive innovation companies - 2030 Estimate: $210 Trillion (10x current US GDP)

Economy (GDP) is not zero sum either.

Lol @ sawyers tweet. Thankfully he’s here to regurgitate what Troy is tweeting, and than spread said useless information over 15 tweets. I feel dumber after reading that. Actually, AM dumber. Oh really the Giga press is operating already? There’s a feather in my cap! I thought those cars and videos of operation were just make believe. Wait their going to expand the factory after they open too? Hold the phones, Where’s the donate button?

Sorry for my negativity I know he means well/to make money.

Take my money……from my cold dead & clammy hands

Sorry for my negativity I know he means well/to make money.

Take my money……from my cold dead & clammy hands

I think TSLA could eventually be worth more than the current US GDP. Time is an amazing thing. What do you think prevents Tesla from growing into a valuation greater than the current USD GDP?

Please be specific because it makes little sense to compare two almost entirely unrelated things like a company's future value with one country's current GDP. It would make more sense to look at Tesla's projected future valuation vs. the entire worlds future GDP. But who knows what the world's GDP will be in 2030 or beyond.

MSFT's current market cap is 1/10th the 2020 US GDP today and all they make is software. You are basically saying that you don't think the value of TSLA could ever be 10X the value of MSFT today and anyone who thinks it might be is "weird". That's just silly and irrational.

Sorry I went to take a look at what his actual price target which is 200k a share. It's 7 times US GDP. So 70 times the value of MSFT. Which is also 4 times the value of the entire US stock market. I think in this case can you tell me why you think TSLA could one day be worth 70 times MSFT and worth 4 times the entire US stock market? Where would this money come from? It can't come from the USA + China because it's 4 times the entire stock market and 5 times the value of the entire US property market or 2 times the value of the entire USA and Chinese property market.

Market cap and GDP are very different. Linked by pe ratio multiple and therefore rate of growth. S&P500 value (up 25% in a year) is twice US GDP.

ARK doesn't worry about it:

Total enterprise value for disruptive innovation companies - 2030 Estimate: $210 Trillion (10x current US GDP)

Economy (GDP) is not zero sum either.

Refer to above.

TSLA worth 5 times the entire S & P 500. Unlikely

Also I have no idea where Ark is getting their 2030 estimated of 210 trillion from. There isn't enough money in the USA to invest in that.

Gigapress

Trying to be less wrong

The money supply can be expanded along with the economy. In fact, this is necessary to prevent problems from deflation. That's why every central bank in the history of the world does this.Sorry I went to take a look at what his actual price target which is 200k a share. It's 7 times US GDP. So 70 times the value of MSFT. Which is also 4 times the value of the entire US stock market. I think in this case can you tell me why you think TSLA could one day be worth 70 times MSFT and worth 4 times the entire US stock market? Where would this money come from? It can't come from the USA + China because it's 4 times the entire stock market and 5 times the value of the entire US property market or 2 times the value of the entire USA and Chinese property market.

Refer to above.

TSLA worth 5 times the entire S & P 500. Unlikely

Also I have no idea where Ark is getting their 2030 estimated of 210 trillion from. There isn't enough money in the USA to invest in that.

When people are saying the economy is not zero sum, it means that new ways of adding value are developed that expand the overall value. Thus it makes no sense to compare Tesla's potential future value with today's stock market or GDP totals. The entire point is that Warren Redlich's $200k share price model would apply only if the Tesla Network fleet and Optimus Bot are both massively successful to the extent that TSLA would become the majority of the economy.

Will this actually happen? I think no one really can know because this whole situation is unprecedented. Speculating on the likelihood that the technology succeeds is easier than speculating on how society will react to it. Like Elon said when introducing Optimus, the foundation the economy is allocating finite labor supply, but when labor isn't scarce anymore, it's hard to foresee what the new world will look like.

Furthermore, the existence of functional robotaxis and bots would indirectly increase the value of other assets by making them more productive. For example, bots could hypothetically perform landscaping tasks for a suburban home and make it nicer and thus more valuable. Same land, more value. Or we could look at the value of businesses relying on manual labor. They will become more productive and thus more valuable if they have bots helping out. This would increase GDP even more than Tesla's direct contribution.

Finally, Tesla can't possibly have a market cap 5x the entire S&P 500 because Tesla is a component of the S&P 500. If TSLA increases, so does the S&P 500. At the limit it could theoretically approach 1x the S&P 500.

petit_bateau

Active Member

In the UK, a couple of days ago Google fed me and advert from Ford, trying to sell me used Ford MachE from their massed ranks of early-returned vehicles. Given the length of time the MachE has been on sale in the UK it would seem a little early for them to be selling dealer-approved used, unless buyer-regret is kicking in hard and early.Anyone surprised?

US: Ford Mustang Mach-E Sales Down Significantly In February 2022

Ford Mustang Mach-E sales in February amounted to 2,001 - surprisingly 46.5% less than in February 2021.insideevs.com

This is much the same trajectory as the Jaguar i-Pace where sales are now down 67% yoy. Both the JLR i-Pace and the Ford MachE seem to be reasonably first goes at a BEV by legacy dino-juice firms, provided they had been brought to market 4-5 years ago and accompanied by a viable charger network (widely available, easily used, reliable, dependable), and sold by people who know & understand them. However here in 2022 both vehicles are underspecced vs the Tesla 3/Y, underranged vs the 3/Y, over priced, sold by legacy ICE-dealers who don't get-it and don't want to get-it, and the charger network for the average non-Tesla user is pants.

Jaguar I-PACE Sales Shrunk To Below 10,000 In 2021

In 2021, Jaguar sold 9,970 I-PACE. That's the worst result since its launch and 39% lower than in 2020.

dgodfrey

Member

I'd never really thought about it like that but I can see 4D chess being played here by Musk.On the other hand, ignoring the lawmakers silliness is a good way to tell them they are irrelevant. And they truly are, because you cannot stop an idea whose time has come.

Using Austin as an example, not only does your petty and feeble attempts to stifle Tesla's growth bounce off like bullets on Superman's chest, "we will rub your nose in it as we flex our muscles in your front yard". As the local gals take a gander, not only will they swoon to what they've been missing, but your influence and power will be seen as flaccid as the product you're trying to save. Good luck and thanks for playing.

Todesbuckler

Member

The Giga Berlin press conference in 2 hours (9.30 am ET) will be streamed live from this Twitter Account (State Chancellery of Brandenburg):

SageBrush

REJECT Fascism

When you actually look at what’s the average of miles driven in each location, we kinda all pay the same to transport ourselves.

You guys in NZ are driving around 12k km and an average US driver is above 12k miles. Do the math. We should all freak out!

You are forgetting MPG in your calc, which gives 'Merkins even *more* to whine about

WADan

Member

Sony and Honda announce plan to build EVs together

Sony and Honda have signed a memorandum of understanding to design and market electric vehicles together, the companies announced. The deal isn't final, but the aim is to establish a joint venture this year and start selling vehicles by 2025. Honda would design, manufacture and market the first...

news.google.com

news.google.com

Intriguing?

A Tesla car came to a complete stop on an interstate, police say, causing a 3-car crash that killed the driver

Police in Independence, Missouri are investigating and haven't determined what caused the Tesla to come to a stop in the center lane of I-70.

brace for incoming FUD

Late to the party is an understatement. Perhaps will actually be producing by 2027? Let’s hope the cars are worthy and sell well.

Sony and Honda announce plan to build EVs together

Sony and Honda have signed a memorandum of understanding to design and market electric vehicles together, the companies announced. The deal isn't final, but the aim is to establish a joint venture this year and start selling vehicles by 2025. Honda would design, manufacture and market the first...news.google.com

Intriguing?

Redleich is a good cheerleader, that's it. No substance.Sorry I went to take a look at what his actual price target which is 200k a share. It's 7 times US GDP. So 70 times the value of MSFT. Which is also 4 times the value of the entire US stock market. I think in this case can you tell me why you think TSLA could one day be worth 70 times MSFT and worth 4 times the entire US stock market? Where would this money come from? It can't come from the USA + China because it's 4 times the entire stock market and 5 times the value of the entire US property market or 2 times the value of the entire USA and Chinese property market.

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Replies

- 11

- Views

- 10K

- Replies

- 6

- Views

- 5K

- Locked

- Poll

- Replies

- 1

- Views

- 12K