Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

They say it's the thought that counts...

Knightshade

Well-Known Member

So glad I starting selling off ARKK weeks ago. She has really lost her judgement

Still haven't seen much evidence she ever had any worth writing about.

As noted before by others- if you back out her Tesla gains she's had poor results compared to just buying an index fund.

She made a bunch of educated-guess bets, and got lucky one of them was on TSLA. (and increasingly with a model that makes less and less sense- so it really was that she got lucky) and everything else has been downhill/worse than the broad market.

There's a reason Buffett gives the advice he does....

Best is invest, for a really long time, in a very small # of great companies you understand (and you'll be lucky to find 6 in your lifetime per one of his speeches). Most folks here are doing this with TSLA (and some did previously with a few others).

Next best is invest in an S&P500 ndex fund, because almost nobody- including professional investment managers- can beat an index fund long term by picking a large # of individual stocks (see his million dollar bet on this he won).

ZachF

Active Member

We could have it worse. We could all be Rivian investors.

RIVN ATH 179

RIVN today 22

88% off it’s ATH

Rivian’s enterprise value (market cap + bond debt - cash) is approaching zero…

henchman24

Active Member

Mester's statement (not taking 75 bps off the table) reinforces the need for CPI to not come in hot tomorrow. If it comes in hot, nobody will believe the Powell's 75bps statement that sent the markets up and the bets of it happening soon will increase.

insaneoctane

Well-Known Member

Sorry, my first posting of this had a bad link…

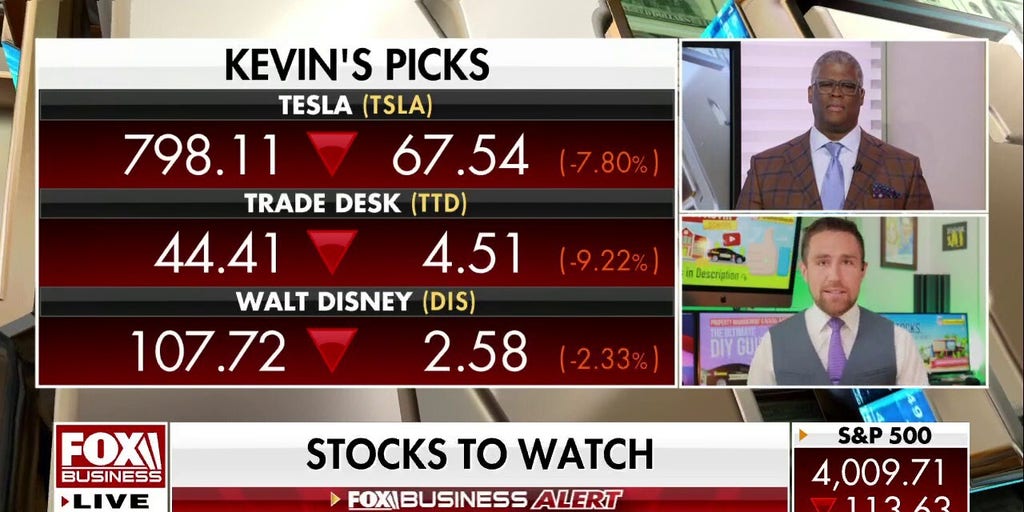

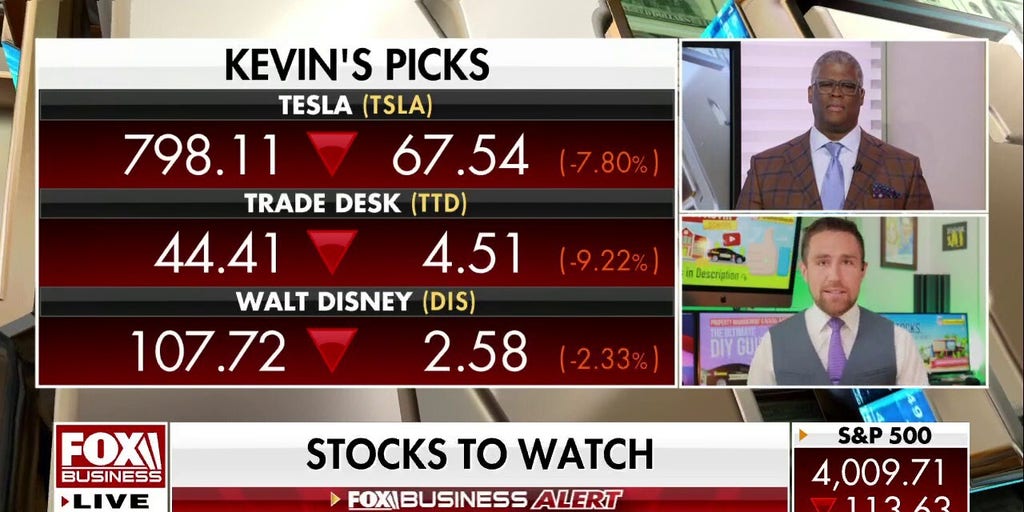

Agree with most of what Kevin says here about TSLA on Making Money with Charles Payne, around the 7 minute mark…

video.foxbusiness.com

video.foxbusiness.com

Agree with most of what Kevin says here about TSLA on Making Money with Charles Payne, around the 7 minute mark…

Expert reveals this is the perfect opportunity for investors to buy | Fox Business Video

Andrew Thrasher and Kevin Paffrath provide insight on the state of the stock market on 'Making Money.'

JRP3

Hyperactive Member

She definitely got lucky. When I found out where she gets her "inspiration" for investments I got out of her funds soon after.She made a bunch of educated-guess bets, and got lucky one of them was on TSLA. (and increasingly with a model that makes less and less sense- so it really was that she got lucky) and everything else has been downhill/worse than the broad market.

ZachF

Active Member

Mester's statement (not taking 75 bps off the table) reinforces the need for CPI to not come in hot tomorrow. If it comes in hot, nobody will believe the Powell's 75bps statement that sent the markets up and the bets of it happening soon will increase.

My guess is that since Biden made a kinda speech yesterday about tackling inflation, the administration may have got an advanced reading showing it already peaked.

Here in the US, strong dollar and weakening market are also doing much of the feds work for it.

Politicians often time these things to build narratives, so that they can set up victory claims.

I'm not so sure. ARK is betting on what wall street wants... which is day trading on rumors and news essentially. I think they're investing in the BS with eyes wide open, and counting on the media and public to react accordingly - betting the public perception.So glad I starting selling off ARKK weeks ago. She has really lost her judgement

Yes, there is still a perception issue, but it's weakening. Case and point, my UPS driver last week says "I keep hearing how bad Tesla is but everyone keeps buying them... I don't understand." Pure cognitive dissonance in that fellow. And the followup... "Where do you charge it on long trips?" So Cathie is betting this guy doesn't quite catch on then starts watching GM commercials.

To be clear, I'm not taking that route (and don't even agree with it), but I also don't have investors to answer to (outside this home anyway).

Considering the amount of cash they are holding, maybe Ford should have gone the other way and just bought them out.Rivian’s enterprise value (market cap + bond debt - cash) is approaching zero…

Still haven't seen much evidence she ever had any worth writing about.

As noted before by others- if you back out her Tesla gains she's had poor results compared to just buying an index fund.

She made a bunch of educated-guess bets, and got lucky one of them was on TSLA. (and increasingly with a model that makes less and less sense- so it really was that she got lucky) and everything else has been downhill/worse than the broad market.

Yeah, the more I watch Cathie in action the more I feel her fund simply throws darts at disruptive technology stocks and balances the ratios between their holdings as they go. To me the ARK funds seem to contain very few good companies but a LOT of little gambles I'd never buy into in the shape they are today.

Can't believe she actually sold TSLA to buy GM. Looking at both fundamentals from my point of view that is an UTTERLY TERRIBLE decision to make!

I, and most others usually discount the idea of Tesla acquiring some of these EV companies, but I wonder just how cheap they need to get to make it attractive.Rivian’s enterprise value (market cap + bond debt - cash) is approaching zero…

I don’t think Tesla will buy them regardless. It does become an attractive target for others with that big of a cash position.I, and most others usually discount the idea of Tesla acquiring some of these EV companies, but I wonder just how cheap they need to get to make it attractive.

ZachF

Active Member

Considering the amount of cash they are holding, maybe Ford should have gone the other way and just bought them out.

I’m buying a little bit at these prices, cause it’s so beaten down there is actually room for the price to grow (unlike when it was worth $100b+ lol), and I think the downside is capped at acquisition or liquidation value in the near term.

larmor

Active Member

So what you are saying is production in volume is hard, EVs run on batteries and costco does not have enough, and that continued profits in the auto sector is hard.We could have it worse. We could all be Rivian investors.

RIVN ATH 179

RIVN today 22

88% off it’s ATH

henchman24

Active Member

My guess is that since Biden made a kinda speech yesterday about tackling inflation, the administration may have got an advanced reading showing it already peaked.

Here in the US, strong dollar and weakening market are also doing much of the feds work for it.

Politicians often time these things to build narratives, so that they can set up victory claims.

Yeah I agree. I think we see a core of .3% (though I don't think .2% is out of the question either) vs the .4% expected and that sets off a rally. Coming in at or above .5% though would raise the potential of a 75 bps raise dramatically and Mester's statement is pretty much confirmation of that idea.

ZachF

Active Member

I, and most others usually discount the idea of Tesla acquiring some of these EV companies, but I wonder just how cheap they need to get to make it attractive.

I could see Apple or Toyota buying it if it drops too low. Toyota is has lots of $$$ and is behind on EVs, and Apple just has buckets of cash.

henchman24

Active Member

Same... I think they have a good product and will have major growing pains, but if we basically get below cash value a lot of the risk is off the table. That said, not real happy with their op ex... though that might look better with Q1 results.I’m buying a little bit at these prices, cause it’s so beaten down there is actually room for the price to grow (unlike when it was worth $100b+ lol), and I think the downside is capped at acquisition or liquidation value in the near term.

Artful Dodger

"Neko no me"

What a surreal time to be living in. A company growing earnings well over 100% annually that has a forward P/E of 65

It's the power of lies. I don't mean the little one about lowballing Tesla's growth by 3x. I mean the BIG LIE, that "we have money in trust to cover the naked shorting were doing."

And the even bigger lie that there IS enough money to cover the naked shorting they're doing. Wall St. hedgies are naked shorting the entire U.S. Market right now, and have well over $30T at risk right now.

If something unforseen happened, do you think they're good for it? Or would they cry out for another juicy bailout? Perhaps that's their preferred endgame anyway.

BONUS Question: Which one of these is the macros, and which one is TSLA? (no peeking until u guess)

Yep, Wall St. is fuggling wiff every body.

Sorry, my first posting of this had a bad link…

Agree with most of what Kevin says here about TSLA on Making Money with Charles Payne, around the 7 minute mark…

Expert reveals this is the perfect opportunity for investors to buy | Fox Business Video

Andrew Thrasher and Kevin Paffrath provide insight on the state of the stock market on 'Making Money.'video.foxbusiness.com

Or if you want to support Kevin rather than Fox, the clip is included on Kevin's channel:

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Replies

- 6

- Views

- 5K

- Replies

- 6

- Views

- 11K

- Locked

- Replies

- 27K

- Views

- 3M