Words of HABIT

Active Member

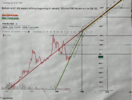

@Sofie, My thinking was that the the current new trend line has the share price catching up with the old trend line that held from January 2020 to March 2022 to account for the hooliganism that has taken place in the past six months. Once this happens January 2023, the old trend line is restored and maintained for at least the next couple of years until 50% growth is no longer achievable. Something like this:I feel like the top portion of this chart is missing and essential. Do you have the top half?

If today's price lift-off action is any indication, my prediction may be overly pessimistic. Time will tell.

Attachments

Last edited: