Did someone say few days back that NZ is the new Norway

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

thesmokingman

Active Member

In the next few days...Isn't Biden supposed to put pen on paper for the new Bill today?

Krugerrand

Meow

Yup, Elon’s fault. All of it. The cookies I was baking yesterday got burned. Also Elon’s fault.Not sure why you’re down on the overall markets performance. Looks like we’re having a intraday test of the 13k level in the Nasdaq to try and clear out the stop losses.

But as for TSLA, very disappointing it can’t break the high from Aug 4th and likely means more underperformance to continue. To me at least, Elon has successfully killed any institutional investor buying interest for TSLA at this valuation at this point in time. Now after Q3 earnings, that will change. But for the time being, there’s nothing to cause a breakout, including the split

willow_hiller

Well-Known Member

In the next few days...

Today at 3:30 PM EDT. Here's the livestream:

thesmokingman

Active Member

Oh look, the capping or whatever is weakening.

Drumheller

Active Member

Why do you have to post something so sad?The cookies I was baking yesterday got burned.

StarFoxisDown!

Well-Known Member

Haha not sure how anyone can say Elon’s actions haven’t had an impact on the stock in the past 2 weeks. I definitely think it’s caused some loss of investor confidence right now. But it’s just temporary. Just need Q3’s earnings to get here that shows Tesla as a business is above whatever antics Elon decides to do.Yup, Elon’s fault. All of it. The cookies I was baking yesterday got burned. Also Elon’s fault.

You have valuations of many other companies that are much higher than Tesla’s nowadays. Large cap companies. I’m not talking market cap but in terms of metrics of valuation. It tells me currently, investor confidence is still more correlated to Elon’s antics than it is Tesla as a business and thus it’s valuation

Last edited:

I honestly hope ADAS was not involved in this as it looks like people were harmed. Dan has some serious negative karma built up however.Not self driving. Level 2 using Green Hills Software. View attachment 841535

It was horrible when the Uber crash happened years ago.

growler23

Member

Today at 3:30 PM EDT. Here's the livestream:

I did a bit more detailed looking at reports on this bill. Slightly but not totally OT.

There are significant cash rebates for some things I am interested in and I think others here might well be, as many investors here mentioned they have solar, battery, and therefore lots of electric power:

- All electric home heat pump: $8000 rebate

- Electric heat pump water heater: $1750 rebate

- Electric induction cooktop: $840 rebate

- up to $9,100 for improvements to electric panels, wiring and home insulation

These are described (WaPo, paywalled so I doubt a link would work but plenty of other folks spilling ink on this) as rebates, not tax credits, which I think is a positive. I may very well be diving in on one or more of those in my own puny attempt to...

Keep pushing the Transition.

Todd Burch

14-Year Member

This seems like it was a typical ~10:30am Eastern MMD.

Artful Dodger

"Neko no me"

Isn't Biden supposed to put pen on paper for the new Bill today?

Biden set to sign ‘IRA,’ affecting your energy bill, pharmacy costs, investments | Marketwatch

Biden has signed the Inflation Reduction Act. Here's MarketWatch's rundown of how it will affect your energy bills, investments and drug costs.

President Biden on Tuesday signed into law the Inflation Reduction Act, Democrats' big economic package. Here's a guide, through MarketWatch reporting, of...

thesmokingman

Active Member

Locked and loaded waiting for Thursday!Green

Reupped the powder keg for 50 more chairs.

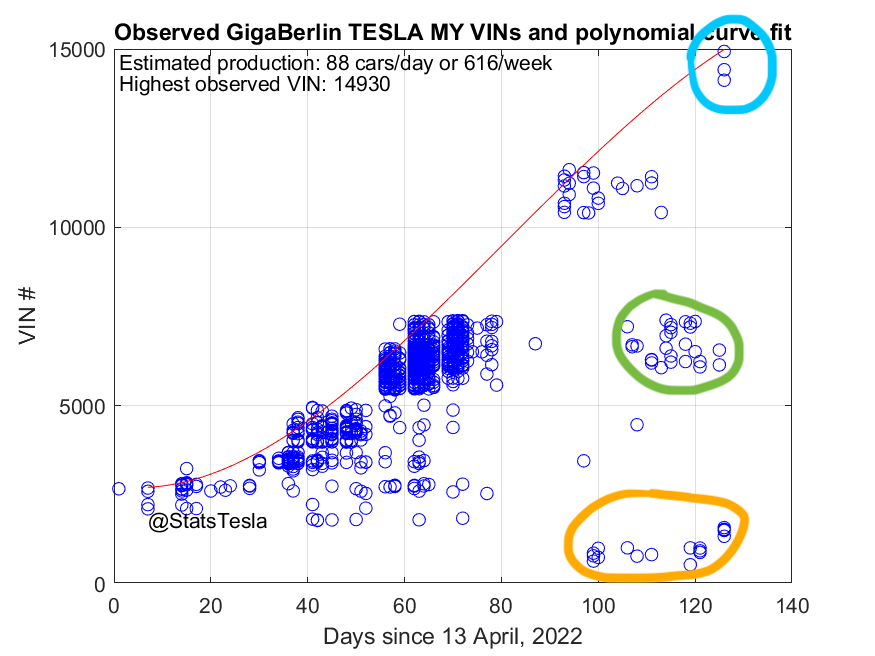

Updated Giga Berlin VIN analysis (Norway deliveries) with some markup by me: You can see

Source:

- current production after factory shutdown for upgrades

- late delivery of cars with drive unit problem after gap in deliveries and presumably fixing it

- delivery of pre-production cars that were built before production permit was received and they only were allowed to sell a short time ago

Source:

Last edited:

TheTalkingMule

Distributed Energy Enthusiast

- Electric heat pump water heater: $1750 rebate

In Texas this one is a no brainer. I have one in Philly and it's amazing in the summer. Pulls heat from the ambient air in the house and pumps out cool dry air.

You can even duct it short distances. I hope to duct mine straight up one floor as the living room is directly above my utility room.

I have solar on the roof, and now this pump directly offsets a LOT of my air conditioning peak in the summer. Basically shaves off 20% of my electricity summer peak while also heating my hot water with far less electricity than a normal hot water heater. Double savings.

TheTalkingMule

Distributed Energy Enthusiast

Meme stocks going bananas. Hopefully this a hedgie-wide short squeeze fueled by the "inflation peak" reversal and strong market-wide buying pressure.

Iran looking willing to reopen a deal. Huge for oil. Bears across the board should be freaking out.

Capping oil futures means plemmetting oil futures IMO. And it's my guess that is the Fed's primary goal. Break this fossil reopening price gouging.

Still tons of uncertainty, but literally all factors are trending nicely.

Iran looking willing to reopen a deal. Huge for oil. Bears across the board should be freaking out.

Capping oil futures means plemmetting oil futures IMO. And it's my guess that is the Fed's primary goal. Break this fossil reopening price gouging.

Still tons of uncertainty, but literally all factors are trending nicely.

Small addendum for the amount of $ we talk about as i think it sheds a bit more insight on the usual "why does the SP X?"Don't forget: this week is monthly expiration .. meaning much more contracts on average ..

5-6x the amount of sold options this week than next. So each $ above 900 hurts 5x as much as letting it run after friday.

You can think of it like you want .. as long as there is a financial incentive to have the SP at a given price at a given time, there will be participants who "make" it so.. or at least try

every $ above 900 costs "the market" (aka whoever sold the options that went in the money) roughly 7.5 million around 900. It gets WORSE the higher you go. Around $1000 SP we talk about 18.3 million $ in payouts for every $ TSLA closes higher.

Therefore the always mentioned "max pain" that produces the most losers in the options-game (i.e. the least amount of money changing hands) is at 860.

At 950 we talk about 1.8 billion dollar changing hands this friday.

So if you want to accumulate, better do it before friday .. as these things are "in the past" on monday.. and for next friday we only talk about a measly 450m changing hands at SP of 1000...

So.. there is roughly a 1.5b "incentive" to keep the SP below 950 until next week .. you go figure out what that does to the SP..

If these things "get out of control" and one participant can see that they do have to pay up .. they start to cover their position (i.e. buy shares at 930 to let them "go" at 950 still making a killing)... but that pressure brings the SP higher. SAME EFFECT DOWN. If you are on the hook for shares @950 and we started today with 930->944 you tend to get nervous .. and more relaxed on the way down < 910.. and maybe unload "protection" to "buy it cheaper" or "not needing it anymore" ..

Same rigged game. If you can "just" hodl and are not dependend on dividends/your portfolio growing/"earning" a living via options .. then this is a nice side-show

Grab some popcorn, enjoy the ride! Or maybe grab the option to have some popcorn in the future ..

Similar threads

- Locked

- Replies

- 0

- Views

- 4K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Replies

- 11

- Views

- 10K

- Replies

- 6

- Views

- 5K

- Locked

- Poll

- Replies

- 1

- Views

- 12K