I'm glad all those institutional investors stepped up to the plate after the investment grade rating, otherwise the stock price would really be in the toilet

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

I have not heard of this before. I wonder if I have Tesla components in my little RAVioli!Would you count the earlier projects like the RAV-4 or Smart partnership a decade ago?

StarFoxisDown!

Well-Known Member

I should say, there's good and bad with that production number though.Was just about to post this.

Given the production number now combined with the domestic/export numbers, the "Great China demand collapse of 2022"..........is in fact false.

There was maybe 10k cars in transit at Shanghai factory/at docks. Essentially 3 days worth of production. Given the last 2 days of Shanghai's production is impossible to deliver, even locally, we're talking about a day of production that got sent to export instead of domestic.

The good is that it means either Fremont, Berlin, or Austin did better than expected on production in Q3.

The bad is that I would have expected much higher production out of Shanghai for Sept. Much higher. As in above 90k at least. Maybe the Typhoon did indeed take Shanghai production offline for a couple of days and then there were some supply issue. Very strange that Y production was actually down from Aug.

Which makes the rumored 495k for just the Y/3 delivery goal for Q4 seem entirely out of reach.

I would have Q4 at -

Fremont 150k - ( minus 25k S/X)

Austin - 30k

Berlin - 42k

Shanghai - 270k (If they can do 90k/month which seems possible but not as certain as I once thought)

Add in the 20k from "in transit" from Q3 and you get 487k

Oh wait......I just proved it's actually possible

Last edited:

Artful Dodger

"Neko no me"

I'm glad all those institutional investors stepped up to the plate after the investment grade rating, otherwise the stock price would really be in the toilet

Yeah, this is those big investment banks trying (hard) to get all the money back that they've lost over the years shorting TSLA. I'll just toss out a few names: Bernstein, RBC, JPMorgas, Roth Capital Partners, to name a few.

It's not a coincidence they're appearing daily on CNBC, now pushing Putin FUD (despicable).

The only thing less ethical than Russia and Big Oil is Big Money on Wall St. Today's FUD was the moral equivalent of sending missiles against civilian targets.

Wall St. decided years ago to 'play the man, not the ball' when it comes to Tesla. They're still trying to break Elon. It won't work of course, but they are breaking many low-information investors.

Last edited:

Have you said why you think Tesla would NOT do this method? (I'm curious).I understand and agree with your point. There is one buyback scenario that does align with the mission but I don't think Tesla would deploy it . . .but it's a valid approach as many companies have done this in the past (very popular in the 80s & 90s).

It goes as follows:

Tesla buys back $50B of stock. They don’t retire the shares but rather keep them as Treasury Stock (available to be reissued). In time as the share price rises, these Treasury Shares grow in value say from $50B to $150B. Tesla makes an acquisition (e.g. mining company, AI company, etc) using shares. They can purchase a company for up to $150B for what cost them $50B. In a way, a companies shares can act as currency. Buy it when it is cheap and then reissue when it gets pricier.

Maybe it has some con's that some of us are not aware of? I'm guessing that if they don't need some amount of cash and you think the SP will be much higher in the future, then why not do this method?

The pro's seem nice though, assuming they aren't trying to catch the proverbial 'falling knife' with timing the SP bottom.

Why do I keep hearing "Eight Days a Week" playing in my head?

Picked up 50 more shares in last minutes. Can’t help it!

Something is off with how we are tracking shipments out of Shanghai. I would assume the 5k worth of export happened beginning of Sept vs last few days as that would make the most sense. Given their production and China deliveries, this one boat load of cars wouldn't seem to be some kind of emergency pivot trying to unwind the wave. Perhaps everyone made up this China demand narrative and looking at all these ships out of Shanghai thinking local deliveres would shrink down to 60k or something and they had to get those cars out asap or production was over 95k and they had to get a bunch of cars out asap. Seems like neither is true and Shanghai was just production constraint.I should say, there's good and bad with that production number though.

The good is that it means either Fremont, Berlin, or Austin did better than expected on production in Q3.

The bad is that I would have expected much higher production out of Shanghai for Sept. Much higher. As in above 90k at least. Maybe the Typhoon did indeed take Shanghai production offline for a couple of days and then there were some supply issue. Very strange that Y production was actually down from Aug.

Which makes the rumored 495k for just the Y/3 delivery goal for Q4 seem entirely out of reach.

I would have Q4 at -

Fremont 150k - ( minus 25k S/X)

Austin - 30k

Berlin - 42k

Shanghai - 270k (If they can do 90k/month which seems possible but not as certain as I once thought)

Add in the 20k from "in transit" from Q3 and you get

Oh wait......I just proved it actually possible

Like I said, I think people are focusing on the wrong continent when given what Tesla wrote about unwinding the wave.

StarFoxisDown!

Well-Known Member

Pretty muchSomething is off with how we are tracking shipments out of Shanghai. I would assume the 5k worth of export happened beginning of Sept vs last few days as that would make the most sense. Given their production and China deliveries, this one boat load of cars wouldn't seem to be some kind of emergency pivot trying to unwind the wave. Perhaps everyone made up this China demand narrative and looking at all these ships out of Shanghai thinking local deliveres would shrink down to 60k or something and they had to get those cars out asap or production was over 95k and they had to get a bunch of cars out asap. Seems like neither is true and Shanghai was just production constraint.

Like I said, I think people are focusing on the wrong continent when given what Tesla wrote about unwinding the wave.

Thekiwi

Active Member

Remember the line upgrades weren’t officially finished until Sep 18th, and the “testing” of the upgrades was going to take until Nov 30th (by which I interpret that is how long it might take at most to reach maximum planned output speed of 22,000 per week, which is ~95k month)I should say, there's good and bad with that production number though.

The good is that it means either Fremont, Berlin, or Austin did better than expected on production in Q3.

The bad is that I would have expected much higher production out of Shanghai for Sept. Much higher. As in above 90k at least. Maybe the Typhoon did indeed take Shanghai production offline for a couple of days and then there were some supply issue. Very strange that Y production was actually down from Aug.

Which makes the rumored 495k for just the Y/3 delivery goal for Q4 seem entirely out of reach.

I would have Q4 at -

Fremont 150k - ( minus 25k S/X)

Austin - 30k

Berlin - 42k

Shanghai - 270k (If they can do 90k/month which seems possible but not as certain as I once thought)

Add in the 20k from "in transit" from Q3 and you get 487k

Oh wait......I just proved it's actually possible

philw1776

Member

TSLA drops much more and I might buy up to 51% and control the company! Just sell my 401K and...

Wait! Just looked at the 401K #s. Forget it. My bad.

Wait! Just looked at the 401K #s. Forget it. My bad.

The Accountant

Active Member

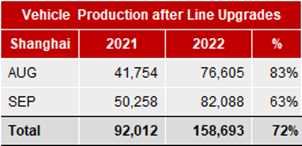

After some downtime in July upgrading the Model 3 & Y production lines, Shanghai delivered 72% production growth over prior year for Aug/Sep.

And just to be crystal clear here, the Toyota/Merc stuff was a 'partnership' and NOT a 3rd party contractual sale via a 3rd party market. The article makes it sound like the latter rather than the former. Again, I'll wait for more critical details to know if this even true or maybe the start of a brand new revenue stream for Tesla.Yep, it was a ton of engineering that Tesla was doing to integrate their drivetrain into the 3rd party sub-systems. And yes, it was filled with ridiculousness, but we learned a lot. My buddy ran the Toyota one and the stuff he put up with was waaaaay worse than my 3rd party engineering woes.

According to the article, this is just parts, nothing more. Doesn't even talk about the inverter...so I'm on the fence about if this is true or maybe they are just missing critical details...

And, if this were true, don't you think Tesla would have a page on their site that mentions this 3rd party channel? The more I think about this, the more it sounds SUS! (like my kids like to say

Knightshade

Well-Known Member

This would be the first instance of Tesla selling *just* components to 3rd parties. I'd assume, if true, that Tesla would mention this as a source of future revenue during Q3 earnings.

The max they can legally make under the Low Volume Vehicle Manufacturers Act is 325 a year.

I wouldn't expect that to contribute a material amount of revenue if all they are buying is drive units.

It's a tiny enough # that if not for the fact it's a restricted part I'd think they were just ordering them at retail from Tesla service centers.

Many have said it here over the years - it ain't going to be easy for a long, long time. Long time.

They can create wars and other disturbances. They control media and governments.

All of the stellar predictions here have failed. Only bad ones hold true.

Don't just count on numbers and their extrapolations to assume 50% YOY growth. Hopeuflly, @Gigapress will never be right with his 0.1% prediction from today. Reminder, probability outcome ranges from zero to one.

I hope for a sunny day eventually.

They can create wars and other disturbances. They control media and governments.

All of the stellar predictions here have failed. Only bad ones hold true.

Don't just count on numbers and their extrapolations to assume 50% YOY growth. Hopeuflly, @Gigapress will never be right with his 0.1% prediction from today. Reminder, probability outcome ranges from zero to one.

I hope for a sunny day eventually.

StarFoxisDown!

Well-Known Member

The confusion is coming from the fact that Model Y production actually dropped in Sept verses Aug.Remember the line upgrades weren’t officially finished until Sep 18th, and the “testing” of the upgrades was going to take until Nov 30th (by which I interpret that is how long it might take at most to reach maximum planned output speed of 22,000 per week, which is ~95k month)

You would have assumed that Model Y production would have at least stayed consistent from Aug, which would have brough the production total up to 87k. So then there would have to have been another reason for the hiccup in production

Captkerosene

Member

Tesla is not Ford. Tesla will continue to earn massive profits recession or not. Tesla will have access to capital in the unlikely event things get really, really bad.Apple waited until they had over 200 Billion in cash before they started a stock buyback. It's usually an indication that the company has run out of ideas. That last part is never going to happen as long as Elon is there!

The reason Ford didn't go bankrupt along with the rest of Detroit it because they got a ton a loans right before the crash in 2008, and had the cash to weather the storm. Knowing and reference this often, why would Elon/Tesla, on the brink of a possible really bad recession, get rid of cash?

Maybe put in a guideline of 15% of sales as a minimum cash level. Anything above that is "available" for repurchases.

I'm expecting great financials next week accompanied with bullish comments on how production is ramping across all GFs and demand is still off the charts.

That, of course, will be countered by "macro" and Elon making true whatever the Onion has written about him recently.

That, of course, will be countered by "macro" and Elon making true whatever the Onion has written about him recently.

Hmm.I'm expecting great financials next week accompanied with bullish comments on how production is ramping across all GFs and demand is still off the charts.

That, of course, will be countered by "macro" and Elon making true whatever the Onion has written about him recently.

I've heard this so many times.

"... off the charts..."

"... going to pop..."

Just a couple weeks ago deliveries were supposed to cause the SP to explode.

Right now I'm expecting nothing but pain. Any good news will likely cause things to be flat at best. We'll drift sideways for some time yet.

Only surprises will be positive.

Artful Dodger

"Neko no me"

After some downtime in July upgrading the Model 3 & Y production lines, Shanghai delivered 72% production growth over prior year for Aug/Sep.

View attachment 862721

Indeed, and the Model 3 line at Giga Shanghai didn't restart until the 2nd week of August:

James Cat on Twitter: "Post-update, Giga Shanghai is pumping out 2k Model Ys/day. Model 3 line still down for upgrades and will resume on Aug 8. $TSLA https://t.co/7zF6SpwVHi" / Twitter

With current Model 3 production rate at 1K/day, that adds at least 8K per month going forward. In fact, that's a 90K/mth run rate, for 270K possible production at Giga Shanghai in Q4.

How do you say "unmöglich" in Chinese?

Cheers to the Longs!

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Replies

- 6

- Views

- 5K

- Replies

- 6

- Views

- 11K

- Locked

- Replies

- 27K

- Views

- 3M