Zero data lol. Where did it leave off last trades?

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

Gigapress

Trying to be less wrong

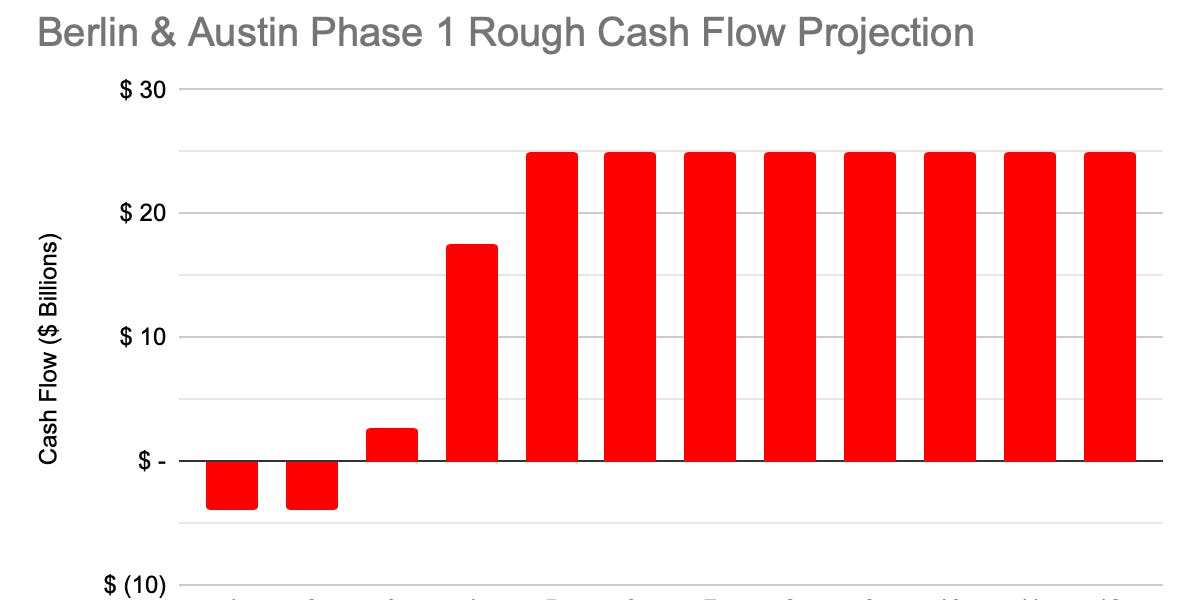

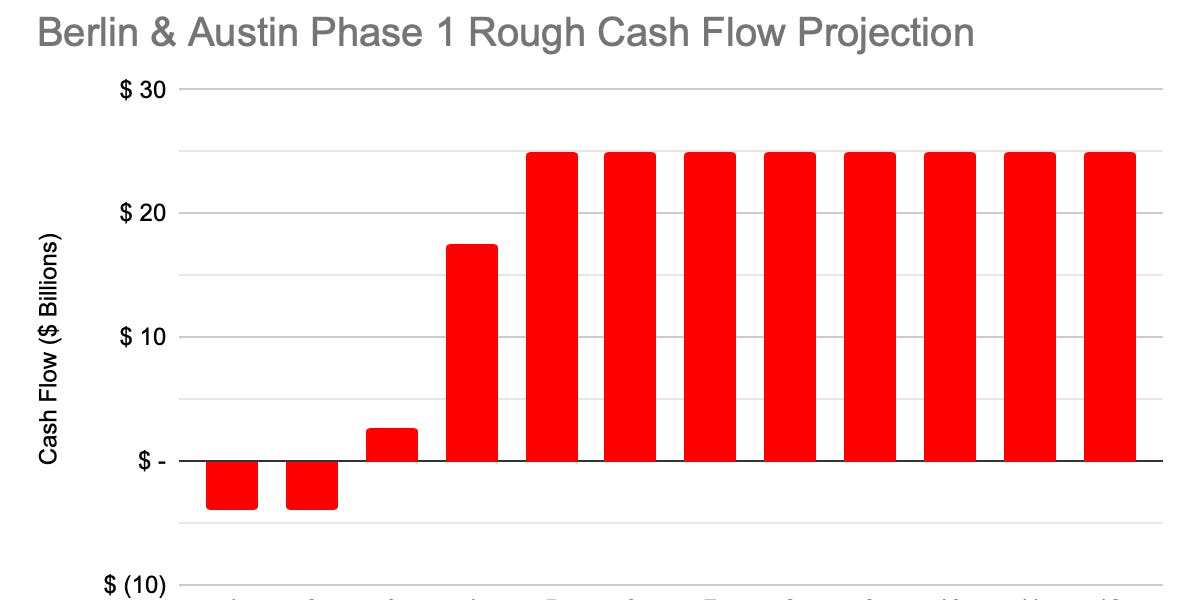

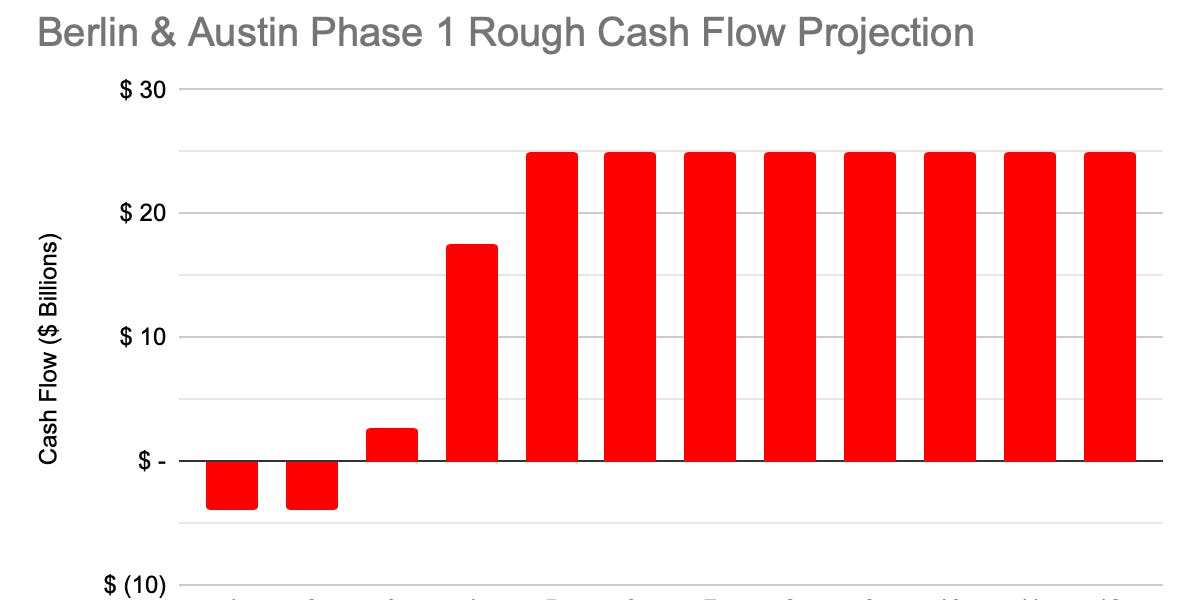

Giga Berlin and Giga Texas will make good ROI, and future expansions and future new factories should be even better.

globaloptimization.substack.com

globaloptimization.substack.com

100% Annualized Return on Investment?

Stunning Gigafactory CapEx Efficiency

Last edited:

larmor

Active Member

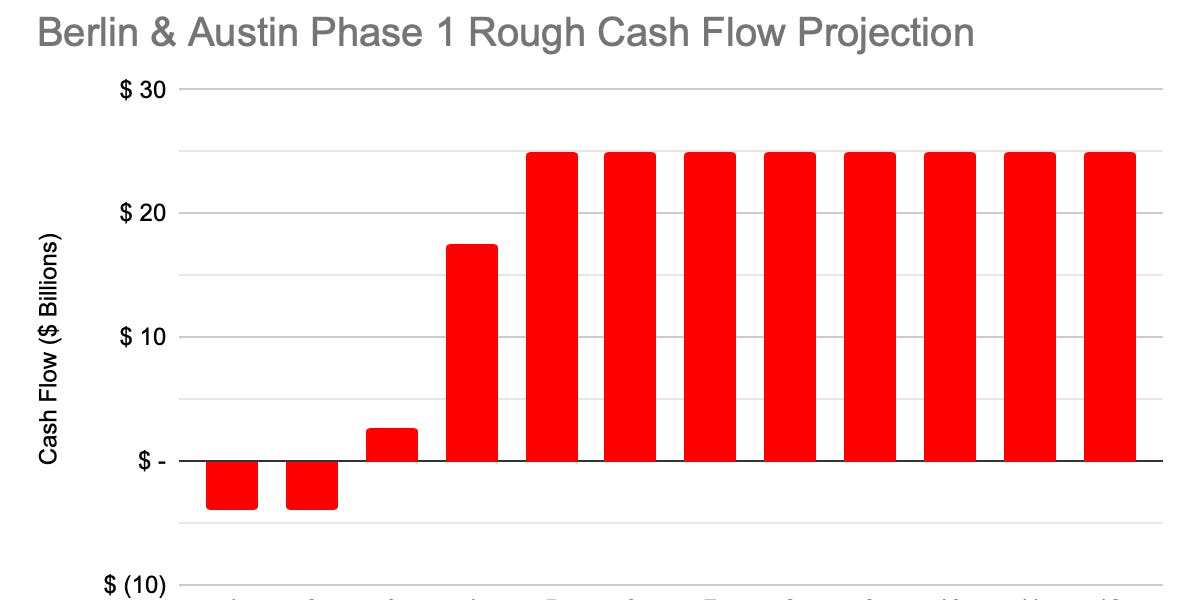

"If we model the factory as needing a few quarters to ramp up and reach this level of production and profitability per car and then lasting 10 years before needing new investment, the cashflows look something approximately like what’s shown in Table 2 below. The factory would break even in just under two years of operation and the internal rate of return overall would be a whopping 49%.Giga Berlin and Giga Texas will make good ROI

100% Annualized Return on Investment?

Stunning Gigafactory CapEx Efficiencyglobaloptimization.substack.com

The IRR estimate is not very sensitive to the expected lifetime. If we model even more conservatively for a five-year life before needing a bunch of new investment, it’s still giving a 41% annualized return on investment, because most of that is coming from the first few years."

So for those who make a business off market gyrations and taking a dip in the regular MMD, might want to re evaluate their ROI. It appears estimats for return of capital investment on tesla is 40 to 49% as modeled in the article would be a better ROI.

On the CEO of TSLA not having to sell.

He hedged his bets months ago to avoid forced sale later, told everyone as much.

A world of fan boys happy to piggyback on anything he touches.

Me thinks Ron Baron a major shareholder now.

Me thinks the SpaceX crowd went along also.

Along with parties unknown.

The picture that Elon puts out of X.com is really huge.

He hedged his bets months ago to avoid forced sale later, told everyone as much.

A world of fan boys happy to piggyback on anything he touches.

Me thinks Ron Baron a major shareholder now.

Me thinks the SpaceX crowd went along also.

Along with parties unknown.

The picture that Elon puts out of X.com is really huge.

Gigapress

Trying to be less wrong

I don't understand what you mean. 40 to 49% is probably way too low of an ROIC estimate. That was assuming Berlin and Texas only make $16k on each Y sold and that it took $10B to get 250k of capacity from each. I was just setting a baseline to demonstrate the ROI is good even with absurdly pessimistic assumptions."If we model the factory as needing a few quarters to ramp up and reach this level of production and profitability per car and then lasting 10 years before needing new investment, the cashflows look something approximately like what’s shown in Table 2 below. The factory would break even in just under two years of operation and the internal rate of return overall would be a whopping 49%.

The IRR estimate is not very sensitive to the expected lifetime. If we model even more conservatively for a five-year life before needing a bunch of new investment, it’s still giving a 41% annualized return on investment, because most of that is coming from the first few years."

So for those who make a business off market gyrations and taking a dip in the regular MMD, might want to re evaluate their ROI. It appears estimats for return of capital investment on tesla is 40 to 49% as modeled in the article would be a better ROI.

Are you saying the Wall Street firms should reevaluate their models and project at least 40% ROIC on future factory investments?

i thought each GF was under 3-4B?Giga Berlin and Giga Texas will make good ROI

100% Annualized Return on Investment?

Stunning Gigafactory CapEx Efficiencyglobaloptimization.substack.com

snellenr

Member

If I recall correctly, last time it was because they were bat guano* crazy...The forest was a planted one anyway intended for paper. Why they keep pissing and moaning about this is interesting. Gets on my nerves.

*Polite euphemism

There are a good many people in analogous positions. It seems that many of us, as HODL advocates, have generally put relatively small amounts in things we regarded as wise risks.Thanks. Except that I didn't put a lot of money into the stock. I put in a small amount (relative to my portfolio) so that I could feel that I was a part of this company. The amount was no big risk for me. I met a guy who put his whole retirement fund into TSLA. But at the time that was an extreme risk. One I was not willing to take. And I'd have had no income to live on.

...

Water under the bridge. I'm not selling now.

With several such choices in my life the losers, in absolute numbers, outnumber the winners. In value the winners have been spectacular, led by TSLA and closely followed by a couple of others. Now, decades later in some, none of mine can be sold and do not need to be because one of them actually pays dividends that I live on.

Those of us who follow venture capital in the early stages (called 'angels' a bit ridiculously) are accustomed to writing off at least two-thirds of their investments. Thus, the initial commitment is generally very small.

Today that logic no longer applies to TSLA but quite a few institutions and more retail investors think of Tesla as a high risk quirky startup.

It really takes serious analysis to understand the reality. Many of us don't understand that, partly because in this forum we aggressively analyze every single thing. Most securities analysts are not idiots, but they also do not have time or inclination to analyze anything in detail. To understand Tesla one needs to understand a bit of metallurgical processes (mining, refining, smelting, presses), manufacturing process control (including robotics, factory OS), distribution, sales, logistics and even politics.

Who among securities analysts go to the huge time and study needed to understand those subjects? ...for ANY company?

Jus too name a few that have been subject to serious misunderstanding, on the way up and on the way down I offer just a few other than TSLA:

AMZN,XRX, KODK, BLIA

Each of these, and many others, had huge potential, huge success, with outlooks that turning bad long before the stock analysts saw, but careful followers all knew before they did.

When we have people here who question every rosy outlook, they are doing a real service by helping us to keep honest. There are ones among us who think competition will not come. Some of us even project Tesla market share of automobiles will not drop. We should be always vigilant to over-optimistic assessments of Tesla future prospects.

That said, if Tesla continues an average 50% per annum sales growth in Automobiles for five years, starting with making 1,500,000 this year they will have annual sales more than those of Toyota last year, about 10.5 million. Tesla would have automotive sales of about 11.4 million then.

Is it plausible that Tesla will accomplish that within five years? How about global infrastructure? How about global distribution?

When Tesla now has the Model Y as the largest selling vehicle in Europe for the last months?

When Tesla is not yet entering the NA biggest market, pickup trucks?

When Tesla consistency has one success following another?

Even the most bullish among us begin to see the limits of ~50% annual growth in vehicle sales sometime within the next decade.

If the absolute vehicle sales limits happen during the next five years, there is still Tesla energy, HVAC, grid services, industrial and residential VPP's plus robotics, FSD and much more not yet imagined.

The question is whether there is a limit to growth? Even if there is, we ignore Tesla huge earnings potential accelerated with huge manufacturing advances that are difficult to match.

Thus, I think of AAPL, that maintains a 42.3% ROS last quarter despite years of projections for their imminent decline. In my mind the Tesla advantages are quite analogous with those of AAPL. Year after year competent analysts think they're beyond their growth. Year after year others say they haven't competitive advantage. The juggernaut goes on...

There are major limitations to the analogy, of course, but AAPL over and over expands products that stay within their 'eco-system'. The range fo offerings continues to grow with subscriptions and repeat sales growing very profitably while their product sales continue with non-customer purchases regularly around 50% or so.

Tesla is doing quite similarly in many respects. The product line grows with seemingly invisible components such as subscriptions (e.g. FSD, Connectivity, VPP supply members) and things like various AI projects (e.g. robots, OS vehicle and factory) parts supplies (e.g motors for SpaceX) and so on.

In conclusion I think Tesla constantly innovates and never stays within the imagined constraints. In that respect it is analogous to AAPL more than AMZN;

AMZN has grown in innovative retailing and the systems needed to support that business, AWS, when then because a business of it's own. AMZN, though, kept concentrating on logistics to support retail sales fulfillment, including wholesaling. That has worked very, very well but is a model that has had quite mixed success for them outside the US. Thus the AWS business is one that can be fairly easily matched by decent competitors. The retailing side is more durably successful but still is subject to serious competitors, Alibaba an illustrative example. AMZN excels in logistics, but really hasn't figured out how to make Amazon Prime an independent subscriber model outside merchandising directly. The scaling ends out eventually absorbing too much resource to deliver consistent high profits.

TSLA is only scratching the surface and is innovating very efficiently in manufacturing, product innovation and logistics. Nobody else has managed all three so well. Thus, I conclude that the error for all of us is that we still tend to think of Tesla as a car company. It hasn't been just that for some time.

Thus HODL, for the volatility will not stop anytime soon.

Gigapress

Trying to be less wrong

Probably. I was being conservative. The numbers are wild even counting that. After fiddling with the numbers I can say that the IRR mainly depends on the speed of factory construction and how fast the factories reach volume production and strong margins. Even at $5B invested to reach 500k annual capacity, it doesn't have a huge effect to reduce the capital investment. Speed is key.i thought each GF was under 3-4B?

Would not be surprised if project Kuiper gets cancelled. The business case was marginal at best. If AMZN’s stock price continues to crater, the board might stop caring that it’s Jeff’s pet project.Would be hilarious if Bezos has to rent space on Falcon 9's to launch his Starlink competition satellites...

Gigapress

Trying to be less wrong

Do you (or anyone else) know if Tesla has given any specific information on this?i thought each GF was under 3-4B?

I was just roughly guessing based on the total capital expenditures during the construction time period and guessing what portion went to starting up Berlin and Austin as opposed to everything else.

Hangover begins

Anybody know if there is a 3 day rule to lift the overhang? Asking for a friend.

I vaguely remember several sources stating that institutional investors are very low-weight in TSLA compared to other high market cap tech stocks and even big S&P stocks in general. Your statement maybe true for retail investors but definitely does not seem to be the case for institutions where the big money is. Not to mention the recent credit rating upgrade that would allow a lot more funds to start buying into TSLA.It's not. Most investors are already invested. What is usually seen is a few MMs and Hedge Funds trading shares to make money on churn.

At a first order, the cost of a gigafactory is the cost of the cell fab. The place to look would be the documents Tesla submitted for German subsidies for the cell fab in Berlin. My guess is that they have subsequently economized, based on the language in the Q3 conference call.Do you (or anyone else) know if Tesla has given any specific information on this?

I was just roughly guessing based on the total capital expenditures during the construction time period and guessing what portion went to starting up Berlin and Austin as opposed to everything else.

I have to wonder how long before Bezos gets bored with his quest to be a better Elon than Elon. I imagine it's hard to keep engaged in a project when you keep failing to achieve your basic goal year after year. Maybe he's already lost interest and these are just zombie projects. Monkeys on his back that he can't figure out how to shake.Would not be surprised if project Kuiper gets cancelled. The business case was marginal at best. If AMZN’s stock price continues to crater, the board might stop caring that it’s Jeff’s pet project.

Yes, I expect Amazon will drop Kuiper. Shareholders and the board will start to get restless. Climbing costs combined with an entrenched competitor with a lower cost structure will put their satellite project in the ground.

Let me finish that thought...."when you don't know what you are doing and just have a lot of money to throw at the project"I imagine it's hard to keep engaged in a project

It's funny, a lot of people assume Bezos and Musk are the same.Let me finish that thought...."when you don't know what you are doing and just have a lot of money to throw at the project"

Personally, I think they are near opposites. Bezos seems very much like a dilettante. He dabbles in a lot of things but doesn't seem to have a deep understanding in many of them. Musk on the other hand develops a deep understanding of all of the businesses he engages in. He may not understand battery chemistry or AI as well as his better engineers, but he clearly understands it well enough to talk to them and make intelligent choices. Likewise rocketry and manufacturing. And often the pieces where there doesn't seem to be any great experts to put in charge, he seems to become the expert until someone else learns to take his place.

Bezos is the billionaire who dabbles in a lot of things that interest him.

Musk is the engineer who has enough money to engage in a lot of projects which he can explore.

Subtle but important difference.

Not fully sure, but IIRC China GF was supposed to be around ~ 2B and chatter was that other GF would/should be in same range. .. ? ..Do you (or anyone else) know if Tesla has given any specific information on this?

I was just roughly guessing based on the total capital expenditures during the construction time period and guessing what portion went to starting up Berlin and Austin as opposed to everything else.

Yep, it does draw a crowd. It’s workingSo, Tesla gets a lot of dramatic marketing for free?

Marketing genius!

Compare mission statements.It's funny, a lot of people assume Bezos and Musk are the same.

“We strive to offer our customers the lowest possible prices, the best available selection, and the utmost convenience.”

“to accelerate the world’s transition to sustainable energy.”

Although I think Tesla's mission statement is now better described as “to accelerate the world’s transition to sustainable humanity.”

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Replies

- 6

- Views

- 5K

- Replies

- 6

- Views

- 11K

- Locked

- Replies

- 27K

- Views

- 3M