OMG, Katy Tur has that lying slime Lopez on and she's again saying sugar she knows nothing about. Losing a bit of respect for Katy, unless mgmt forced her to do it...

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

insaneoctane

Well-Known Member

Twitter overhang gone and we can't even make our beta... WTF?

Krugerrand

Meow

Saw a SA article headline this morning. And I quote: Tesla clears Twitter deal overhang - the next hurdles could be a DOJ probe, China lockdowns and US recession.Twitter overhang gone and we can't even make our beta... WTF?

I’m interested in knowing when everyone who said once the Twitter overhang is over blah, blah, blah; TSLA will be free to rise because institutions yadda, yadda, yadda will realize the SP isn’t about any of it. That it’s all just made up bs to suck in people who can’t think enough for themselves and make them believe

For intelligent people, you (and you know who you are) are incredibly gullible.

Could it be that the long Twitter nightmare is over? At least for a little bit?

Now the "Elon makes controversial decision at Twitter" nightmare begins!

KEEP IT SIMPLE:Twitter overhang gone and we can't even make our beta... WTF?

Just buy $TSLA stock like it's your savings account. What's so difficult about that??

Don't overthink it. BUY AND HOLD, BUY AND HOLD.

I'm really glad SA is now paywalled (at least for me), now even if I'm tempted I can't read the articles. I do miss the comments though...Saw a SA article headline this morning. And I quote: Tesla clears Twitter deal overhang - the next hurdles could be a DOJ probe, China lockdowns and US recession.

I’m interested in knowing when everyone who said once the Twitter overhang is over blah, blah, blah; TSLA will be free to rise because institutions yadda, yadda, yadda will realize the SP isn’t about any of it. That it’s all just made up bs to suck in people who can’t think enough for themselves and make them believeis happening because of this, this and that.

For intelligent people, you (and you know who you are) are incredibly gullible.

A savings account? I wish my returns this year were that good! (just joking, it will get back up eventually, big time)KEEP IT SIMPLE:

Just buy $TSLA stock like it's your savings account. What's so difficult about that??

Don't overthink it. BUY AND HOLD, BUY AND HOLD.

I've got havoc and hoax? Does that count?Now the "Elon makes controversial decision at Twitter" nightmare begins!

Elon Musk's first day owning Twitter leads to havoc and a possible hoax about layoffs

Musk completed his $44 billion acquisition of the company this week.

228.52 eh? Was hoping for more, but better than the MMD this morning.

Last edited:

What all tech companies do when a new leader comes in...."The previous engineers/leaders before me were gunslingers in the wild wild west, i assure you these mixups will never happen again",Wouldn't it be fun, if Elon's old tweet "considering to take Tesla private at $420" suddenly re-surfaced as new tweet and broke the MSM / shorts ?

Then Elon could come out (few days later) and say, sorry, goofed up some software tweek, its not new tweet just the same old.

You know, how the MSM posts baseless FUD / fake news time to time and then removes it later when the damage is done...

Meanwhile, $TLSA trading at $420.69 at the time of Musk's tweet

2daMoon

Mostly Harmless

Yippee!

My 1-2% per day gains expectations are off and running.

Next, going for two consecutive days!

My 1-2% per day gains expectations are off and running.

Next, going for two consecutive days!

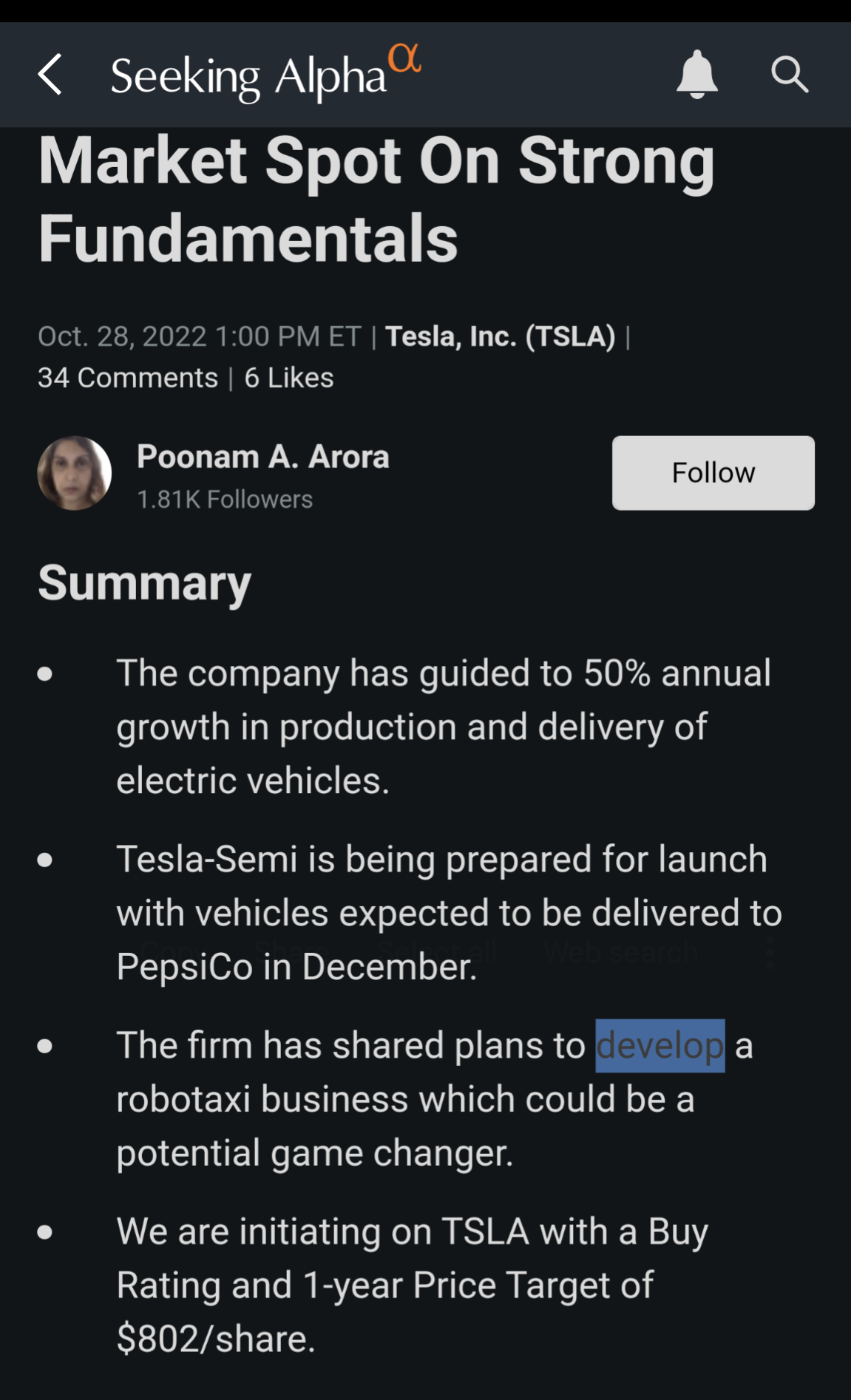

But then every once and awhile, SA comes out with stuff like this (really wish I could read the comments on this one):

Bet TSLA

Active Member

This nonsense keeps being repeated. It reveals a profound ignorance of Elon to imagine that he would want a bean counter to be CEO of Tesla. Zach is a great Tesla CFO. I hope he continues being a great Tesla CFO for a long time. Becoming CEO would be a disaster for both him and Tesla.That has been Zach IMO and he has been doing great on the calls. I'm happy to have Elon let him take more of the spotlight.

Financial stuff is in service to engineering and manufacturing. The moment that flips, the company is screwed. Why would anyone imagine Elon doesn't understand this?

BitJam

Active Member

Optimeer

Member

As of today, the EU is one step closer to ban new combustion cars by 2035:

EU reaches deal to ban new combustion engine cars by 2035 – DW – 10/27/2022

A provisional deal reached by the European Parliament and European Council calls zero emissions from new cars and vans as of 2035.amp.dw.com

In my opinion, this is important, as this communicates to the industry, to the banks, to the public and to governments that combustion cars will be replaced by electric cars and that any investment in a soon to be obsolete technology is at risk.

Further, as the green line in the graph below indicates, the existing emission targets are sharpened starting 2026 (source of image). Since the potential efficency gains for gas cars are limited, soon later it might be almost impossible to meet the emission targets with gas cars, which will be costly. It may still be possible to optimize/cheat the efficiency ratings with hybrinds, I don‘t know honestly. Nevertheless, I expect that many existing car models will disappear from the European market end of this decade.

View attachment 868171

The EU has a long term demand for about 14 million cars per year (Source). I guess that the demand for electric vehicles in the EU will be about 10 million cars in 2030.

There is also a similar legislation for vans. Further, being Swiss, I expect that Switzerland will largely adopt the EU legislation, possibly with a slighly more „economy friendly“ Swiss finish.

When I read more about the sharper EU targets, I learned that I was overly optimistic in my post yesterday. As indicated in the picture below (source), the introduction for sharper limits is now staged and happens every 4-5 years while former sharper targets were introduced yearly.

The new target of -55 % compared to 2021 is only set in place in 2030 and stays in place until 2034. This is too late to make an impact.

The existing target of 119 g CO2/km WLTP is reduced by only 15% in 2025 and stays there until 2029. In 2025 also the new emission rules EURO 7 shall be introduced, however it is not defined yet what they contain. Lobbying efforts were sucessful lately and only some little improvements for diesel cars may be introduced. This would be not a big issue since diesel cars are anyway less relevant every year in Europe.

It seems that the auto industry has a grace period until the end of 2029 from a regulatory perspective.

There are a good many people in analogous positions. It seems that many of us, as HODL advocates, have generally put relatively small amounts in things we regarded as wise risks.

With several such choices in my life the losers, in absolute numbers, outnumber the winners. In value the winners have been spectacular, led by TSLA and closely followed by a couple of others. Now, decades later in some, none of mine can be sold and do not need to be because one of them actually pays dividends that I live on.

Those of us who follow venture capital in the early stages (called 'angels' a bit ridiculously) are accustomed to writing off at least two-thirds of their investments. Thus, the initial commitment is generally very small.

Today that logic no longer applies to TSLA but quite a few institutions and more retail investors think of Tesla as a high risk quirky startup.

It really takes serious analysis to understand the reality. Many of us don't understand that, partly because in this forum we aggressively analyze every single thing. Most securities analysts are not idiots, but they also do not have time or inclination to analyze anything in detail. To understand Tesla one needs to understand a bit of metallurgical processes (mining, refining, smelting, presses), manufacturing process control (including robotics, factory OS), distribution, sales, logistics and even politics.

Who among securities analysts go to the huge time and study needed to understand those subjects? ...for ANY company?

Jus too name a few that have been subject to serious misunderstanding, on the way up and on the way down I offer just a few other than TSLA:

AMZN,XRX, KODK, BLIA

Each of these, and many others, had huge potential, huge success, with outlooks that turning bad long before the stock analysts saw, but careful followers all knew before they did.

When we have people here who question every rosy outlook, they are doing a real service by helping us to keep honest. There are ones among us who think competition will not come. Some of us even project Tesla market share of automobiles will not drop. We should be always vigilant to over-optimistic assessments of Tesla future prospects.

That said, if Tesla continues an average 50% per annum sales growth in Automobiles for five years, starting with making 1,500,000 this year they will have annual sales more than those of Toyota last year, about 10.5 million. Tesla would have automotive sales of about 11.4 million then.

Is it plausible that Tesla will accomplish that within five years? How about global infrastructure? How about global distribution?

When Tesla now has the Model Y as the largest selling vehicle in Europe for the last months?

When Tesla is not yet entering the NA biggest market, pickup trucks?

When Tesla consistency has one success following another?

Even the most bullish among us begin to see the limits of ~50% annual growth in vehicle sales sometime within the next decade.

If the absolute vehicle sales limits happen during the next five years, there is still Tesla energy, HVAC, grid services, industrial and residential VPP's plus robotics, FSD and much more not yet imagined.

The question is whether there is a limit to growth? Even if there is, we ignore Tesla huge earnings potential accelerated with huge manufacturing advances that are difficult to match.

Thus, I think of AAPL, that maintains a 42.3% ROS last quarter despite years of projections for their imminent decline. In my mind the Tesla advantages are quite analogous with those of AAPL. Year after year competent analysts think they're beyond their growth. Year after year others say they haven't competitive advantage. The juggernaut goes on...

There are major limitations to the analogy, of course, but AAPL over and over expands products that stay within their 'eco-system'. The range fo offerings continues to grow with subscriptions and repeat sales growing very profitably while their product sales continue with non-customer purchases regularly around 50% or so.

Tesla is doing quite similarly in many respects. The product line grows with seemingly invisible components such as subscriptions (e.g. FSD, Connectivity, VPP supply members) and things like various AI projects (e.g. robots, OS vehicle and factory) parts supplies (e.g motors for SpaceX) and so on.

In conclusion I think Tesla constantly innovates and never stays within the imagined constraints. In that respect it is analogous to AAPL more than AMZN;

AMZN has grown in innovative retailing and the systems needed to support that business, AWS, when then because a business of it's own. AMZN, though, kept concentrating on logistics to support retail sales fulfillment, including wholesaling. That has worked very, very well but is a model that has had quite mixed success for them outside the US. Thus the AWS business is one that can be fairly easily matched by decent competitors. The retailing side is more durably successful but still is subject to serious competitors, Alibaba an illustrative example. AMZN excels in logistics, but really hasn't figured out how to make Amazon Prime an independent subscriber model outside merchandising directly. The scaling ends out eventually absorbing too much resource to deliver consistent high profits.

TSLA is only scratching the surface and is innovating very efficiently in manufacturing, product innovation and logistics. Nobody else has managed all three so well. Thus, I conclude that the error for all of us is that we still tend to think of Tesla as a car company. It hasn't been just that for some time.

Thus HODL, for the volatility will not stop anytime soon.

Thanks. That's very interesting. Not surprisingly, I guess most of the folks in this thread are far more like you than like me. I know, with absolute certainty, one thing about the stock market: That I am incapable of assessing the prospects for any stock. How well a company is likely to do is only one factor in how well the stock does. A stock can be overpriced if the market is overenthusiastic about the company, and can be underpriced if the market underestimates the company. An extremely successful company can be overpriced. That's been my concern about Tesla. I believe in the company, but I have no idea what the stock should be worth.

And I'm too old to be investing for the future.

Anyway, I just jumped in here to kvetch. Maybe if it hits $400 again I'll put in a stop-loss order and get out. Still love my Model 3. Best car on the road. I'm not expecting to see a Level 5 autonomous Tesla in my lifetime. But if they do achieve it, I'll buy one.

Maybe because it's 23C right now in NW Europe, which is ironically probably due to burning too much of the stuff in the pastInteresting twitter thread about the reduction of gas usage in Germany:

Households are currently using 41% less gas than the average of the last few years, while the industry uses 24% less.

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Replies

- 6

- Views

- 5K

- Replies

- 6

- Views

- 11K

- Locked

- Replies

- 27K

- Views

- 3M