Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

Nolimits

Member

Edmunds demonstrates beyond a doubt who they are in the pool with.

View attachment 894352

They know the truth and try to proactively suppress it.

View attachment 894353

But the post is of course pounded by replies saying exactly that.

I guess Edmunds has to work a little harder to earn a buck from GM now.

Great example of how others pay for advertising and tesla benefits.

When’s the super bowl again?

Q1 2022 had $679 million in regulatory credits. Without those, it was a 4% GM decrease QoQ.Fair point, and the maximum drag to GM% from ramp effect in recent years is of the order of 5% :

View attachment 894453

If it is 'only' a 5% drag due to ramp effect then that on its own is no big deal. However if there is reason to think that overall GM% margins will become compressed due to selling price (ARPV) being reduced in order to maintain the volume ramp as competition becomes more of a factor, then that inevitably will lead to less attractive financials.

Whether (if) that combined effect might cause Tesla GM% to fall to 20% or 10% or whatever other number you want to pick is not something we can foresee at this point. Except to the extent that we believe that other auto companies are at best at an approx (say) 5-10% GM% disadvantage to Tesla. I pick 5-10% GM discount because I cannot quickly find a GM% table for the other major automakers, but here is one for NM% that I think is still representative for all (except Tesla) and we can compare that with Tesla's current position. So Tesla is at approx 15% NM in 2022 (my detail forecast is 15.7%) and the 5-year data for other auto makers is showing tops of 7%. ( I know @The Accountant keeps good data on the other OEM GM% so maybe he can chip in if these corresponding NM numbers are no longer representative).

Being forced to look at NM% rather than GM% due to a data shortcut is not entirely a bad thing. After all NM% is pretty close to cash flow, and lack of cash is what drives bankruptcies. Setting aside operating leverage effects this suggests that if a price war were ever to fully break out, then the best competitors would be at breakeven (0% NM) when Tesla would be at 7% NM even with the 'handicap' of funding a 50% yoy manufacturing ramp; and many not-so-good competitors would be operating in that environment at -5% NM losses.

View attachment 894457

View attachment 894456

I personally think that the correct thing for Tesla to do is to go after the volume ramp at the maximum rate possible, however if the scenario of concern does come to pass, then it will inevitably hit TSLA valuation. Well, at least for a few years until all the competitors go bust .... then get bailed out ....

The expansion drag effect should persist at least until the end of this decade. In my modelling I assume that a S-curve kicks in with decellerating auto growth for Tesla later in the decade. That ought to be beneficial in respect of ramp drag at that point, except that non-automotive ramp is becoming much more significant in those years (at least in the Tesla-base case, where energy needs to be ramping strongly). So that ramp drag is something investors need to live with for a long time to come, even if it might be a bit patchy occasionally.

However, looking over a longer time span with regulatory backed out, Q4/Q1 were high water marks

2019: 19% = (4,423−594)÷(20,821−594)

2020: 21% = (6,977−1,580)÷(27,236−1,580)

2021: 27% = (13,839−1,465)÷(47,232−1,465)

Q4 '21: 29% = 1−11,085÷(15,967−314)

Q1 '22: 30% = 1 - (11,322 / (16,861 - 679))

Q2 '22: 26% = 1−(10,521÷(14,602−344))

Q3 '22: 27% = 1−(13,480÷(18,692−286))

cliff harris

Member

Every news report listed on google when I search the stock ticker is absolute FUD> All about Teslas 'terrible year' and 'crisis' and 'problems'. This is all, apparently a reaction to the share price, because it certainly does NOT describe a company growing this fast, with profits rising this fast, whose production is accelerating this fast.

I shouldnt be shocked, having been an investor for over 7 years now, but thge extent to which the medias only 'take' on Tesla is that the company is failing, never ceases to amaze me. Maybe when it literally is the largest company on the planet by market cap, they will finally realize how stupid they look, but I doubt it.

Tesla is currently a vehicle for transferring money from the clueless to the informed.

I shouldnt be shocked, having been an investor for over 7 years now, but thge extent to which the medias only 'take' on Tesla is that the company is failing, never ceases to amaze me. Maybe when it literally is the largest company on the planet by market cap, they will finally realize how stupid they look, but I doubt it.

Tesla is currently a vehicle for transferring money from the clueless to the informed.

I can’t see there are many clueless left…Every news report listed on google when I search the stock ticker is absolute FUD> All about Teslas 'terrible year' and 'crisis' and 'problems'. This is all, apparently a reaction to the share price, because it certainly does NOT describe a company growing this fast, with profits rising this fast, whose production is accelerating this fast.

I shouldnt be shocked, having been an investor for over 7 years now, but thge extent to which the medias only 'take' on Tesla is that the company is failing, never ceases to amaze me. Maybe when it literally is the largest company on the planet by market cap, they will finally realize how stupid they look, but I doubt it.

Tesla is currently a vehicle for transferring money from the clueless to the informed.

Now that automakers have all released 2022 numbers, Farzad made this concise breakdown of what we all see happening to the industry and discuss regularly. I feel like this is a good video to share withhatersnon-believers. Fairly conservative and emotion free analysis. With charts.

TLDW; in 2030 if current market growth rate trends continue, China and Tesla will share 75% EV market share and everyone else will be fighting for the scraps.

That's a good video. Even if the growth percentages change over the next decade, some might go higher and some lower, the video nicely shows how the current rates play out over the course of many years, and the end result is what's very interesting yet not intuitively understood by most people. This end result is why legacy auto is in trouble, even if it may not be clear why today.

Last edited:

raffiniert

Member

Loads.I can’t see there are many clueless left…

Can’t see it myself , perhaps to stop them buying but no clueless left holding at this price.Loads.

I can’t see there are many clueless left…

I'd wager over half of America is still clueless about EV's in general, Tesla included.

Pretty much all of my right leaning friends totally believe the following:

- The US government is trying to force us all into EV's.

- Tesla has only survived this long due to government hand outs.

- Tesla cars are junk.

- If EV's sell a lot they will crash our power grid and doom us all.

- EV's are less green than ICE due to coal and oil powering the grid.

- EV's are a left wing fad and we'll all be back to ICE soon enough.

I will say this though, a few of my right leaning friends who have dared to look at my Model Y and go for rides in it have started to question the FUD feed they regularly hear about EV's and Tesla. So there is some hope yet for the clueless.

Every time I do a road trip in my Tesla I get questions from strangers about my car, and I'm always shocked how many of them know nothing at all about EV's. Some of the questions I get are hilarious.

A few months ago I was at the local grocery store and I was putting bags in the frunk when a stranger two cars over asked me if I needed help. I told him I was fine as I put another bag in the frunk. He looked puzzled and asked my why I was putting groceries under the hood? I told him that's where I always put my groceries, then I closed the frunk, got in the MY and drove away. A few minutes later I realized that the stranger probably thought I was having engine trouble, that's why he asked me if I "needed help"!!!!

There are still a lot of clueless people about...

Olle

Active Member

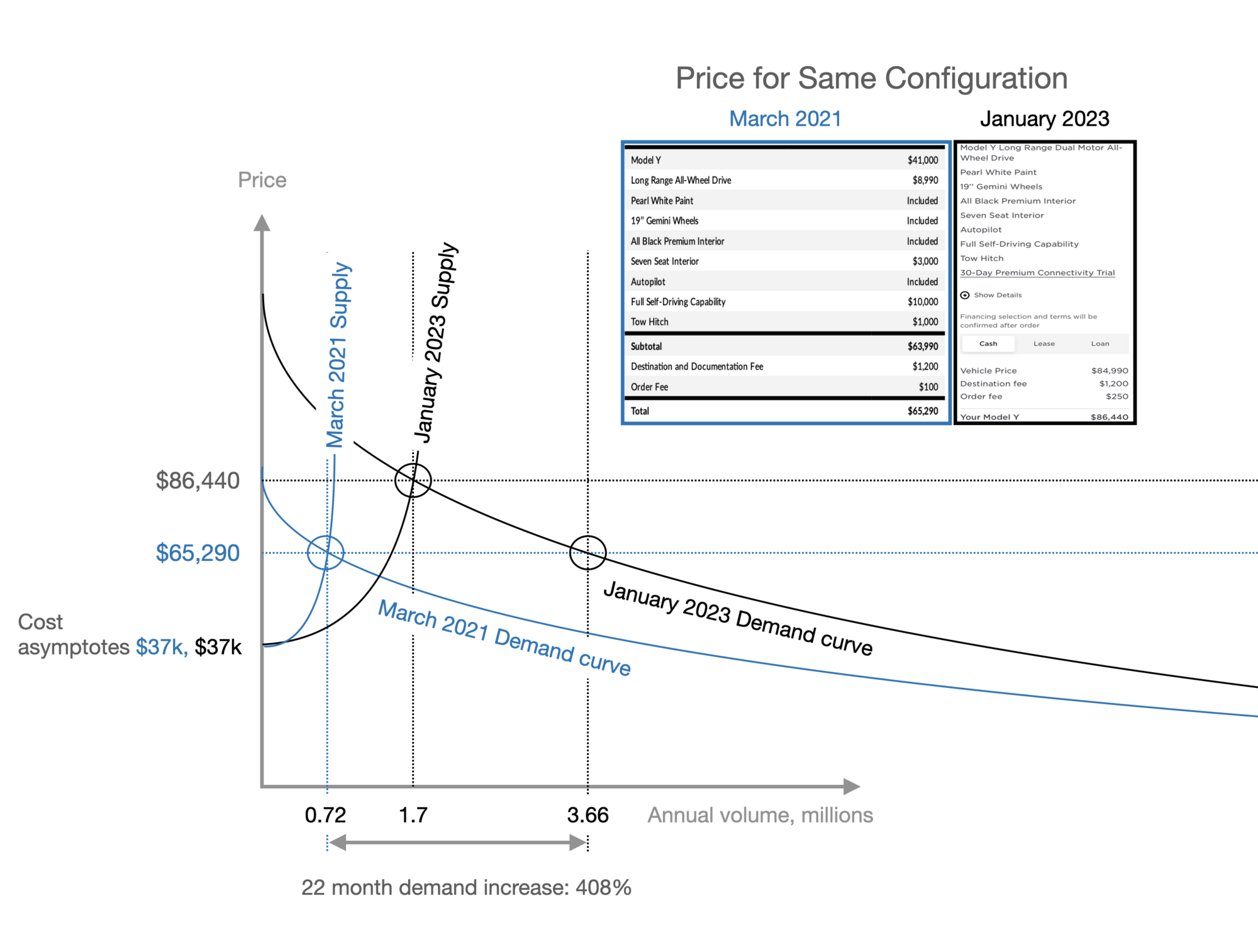

I wanted to give some perspective to the sentiment about "collapsing demand". I got inspired to do this when I happened to look at my 2021 MY purchase order and noticed that you can still specify the exact same configuration, which I did and used as a basis for this exercise. Tesla doesn't report Y production separately, but since Y is their biggest seller and my configuration is kind of middle of the road, I think this comparison works as an extrapolation to total Tesla car sales.

As usual in micro economics, demand curves are asymptotes of the price axis at 0 volume and asymptotes of the volume axis at total saturation, which I set to 67 million (=2021 global auto sales), meaning the demand curves here approach $0 at the saturation, outside of the chart. The supply curves are not needed since we are only using one point of each, but I threw them in there for fun. They are asymptotic with the marginal production cost and a number just above production at each time, since the factories were mostly maxed out and expanding at maximum rate.

Now to the point. If you follow the March 2021 price to its intersection with the January 2023 demand curve, you will see that demand is up 408% over those 22 months.

As usual in micro economics, demand curves are asymptotes of the price axis at 0 volume and asymptotes of the volume axis at total saturation, which I set to 67 million (=2021 global auto sales), meaning the demand curves here approach $0 at the saturation, outside of the chart. The supply curves are not needed since we are only using one point of each, but I threw them in there for fun. They are asymptotic with the marginal production cost and a number just above production at each time, since the factories were mostly maxed out and expanding at maximum rate.

Now to the point. If you follow the March 2021 price to its intersection with the January 2023 demand curve, you will see that demand is up 408% over those 22 months.

Woah, is THIS where the new 9000t IDRA press is destined for?!?!?

Nah! They will need to build the factory first!Woah, is THIS where the new 9000t IDRA press is destined for?!?!?

Too early for thatWoah, is THIS where the new 9000t IDRA press is destined for?!?!?

They provide impetus to design new transportation systems.So do hiccups in transportation systems benefit new transportation designs?

Artful Dodger

"Neko no me"

Somebody started buying at 7am eastern.

Yes, that's the time when the previous day's TSLA Open Interest (OI) is published. Look how the SP reacted by 07:10 a.m.

NOTE: OI is updated just once per day at 07:00 ET

Options represent ~20x the trading volume of TSLA shares (and half of all the Options traded in the entire Market).

People don't pay enough attention to Options, especially to intraday Options Volume (which is updated about once per hour at the link above during the main session).

The tail does indeed wag the dog, at least when it comes to TSLA Options.

Cheers!

ElectricIAC

Good-Natured Rascal

If you’re in a middle lane flanked by vehicles on both sides and you crank the wheel hard right or left, why not have the system detect it and stop you from turning into your neighbours?

Artful Dodger

"Neko no me"

A few minutes later I realized that the stranger probably thought I was having engine trouble, that's why he asked me if I "needed help"!!!!

On Sunday afternoon (after a drive in the country), I stopped for a L3 charge at a CCS Combo station operated by FLO. There was a Kona EV there charging when I arrived, and I got to chatting with it's new Owner (car was only 5 days old, it's 1st L3 charging session).

After a while, I asked to see her Kona's 'frunk', then I showed her my Model Y...

Does this make me a bad person?

Cheers!

TX expansion

oh my the poor people begging and screaming for buybacks

what are they to do?

gary, Ross (BOD lololol) and blathering Leo

and let’s not forget the illiterati of tmc

it all comes down to the big dreaming laid out on battery day

and what needs to be done to get there.

FOOLS

tony Saco demand destruction?

tesla, without marketing has captured the hearts and minds of the youth, each of who, will end up with buying power to buy the car.

old people coming around to the idea more, remember their own rides, and insist that there is a tesla phone available for sale…

china cars as competitor?

they gonna sell them at harbor freight or northern tool?

build dealerships next to the other fine china autos?

remind me of those brands here in us? Are they In Europe? Anywhere?

bill miller as short seller

i dont trust

blue bird distraction?

horse tonky

it is exposure

”no such thing as bad press”

someone else similarly hated won a major election…

my finger on the pulse read of things is that long term, this is a positive. The pseudo exposure of behind the scene, only helps to bring the gun toting cig smoking bibel thumping un colored segments into the musk camp. They love the guy and everything he has done and is doing.

and the cyber truck will blew Oval their toughness.

and the next model?

stop asking for a yth8ng suckie to be made

gimme the roadster!

and now we’ve got people rumoring final details of an Indonesian plant?

No! Halt the expansion and do a buyback…

i sure would not invest in a new fund from such whiners

it all comes back to what they said on battery day.

and the comment about 4T mkt cap

bigger than Apple Aramco

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Replies

- 6

- Views

- 5K

- Replies

- 6

- Views

- 11K

- Locked

- Replies

- 27K

- Views

- 3M