If we can pause endless rehashing of the same old political conversations, here’s something else to ponder.

Tesla Energy’s opportunity is a direct function of the total addressable market for kWh of electricity. We also need to stop, in Elon’s words, “the dumbest experiment in history” of rapidly increasing the CO2 concentration in our atmosphere and oceans, and we need to do this as quickly as possible. Oil and gas are mostly used for burning, but our civilization’s sustainability is also threatened by our utter reliance on mined hydrocarbons for chemical production.

It doesn’t have to be this way much longer. Synthetic hydrocarbon production from CO2 capture and solar power can solve both of these problems and I believe the capital markets have not done the math on the gigantic amount of demand for electricity this will create once solar and battery power reach sufficiently low prices. We already today have the ability to remove CO2 from the atmosphere, but the fundamental reason why all solutions thus far have failed economically is that CO2 at 420 ppm needs a lot of energy to be captured and an order of magnitude more energy to be ripped apart and reassembled into useful products like methane or ethylene. Doing this with renewable energy such that the overall process is carbon-negative has been prohibitively expensive.

Has been. If we extrapolate the solar and battery cost trends another 5-10 years out, in certain markets we will reach a tipping point—a disruption moment—in which synthetic hydrocarbon production will be cheaper than fossil-derived sourcing of the same chemicals. IRA subsidies for clean energy, clean hydrogen production and carbon sequestration suddenly pulled this schedule forward for American production by several years, maybe even by a decade. Likewise did the invasion of Ukraine and boycotting of Russian gas for European production.

But the plot is thicker. Interestingly, there is a single US state endowed with all of the following:

- Strong sunshine

- Abundant cheap, flat land

- The fastest rate of solar power development in the nation

- The biggest hydrocarbon chemical sector in the nation

- Eastward-facing coastline that’s nearly at tropical latitudes

- Deepwater ports to the Atlantic Ocean ideal for shipping

- The headquarters of every Musk company including Tesla and SpaceX

Texas.

Texas and its Gulf Coast neighbor Louisiana account for a whopping 70% of American primary petrochemical production according to the US government in this

report.

View attachment 898156

Was this opportunity to advance sustainability and make even more money an unsaid reason in favor of moving Tesla and SpaceX to Texas? I don’t know because Elon has never mentioned this in public to my knowledge. However, I do know that SpaceX is already getting involved in direct air capture of CO2, water electrolysis to produce green hydrogen; and Sabatier reactors in order to produce methane for rocket fuel. This is required for sustainable rocket fuel on Earth, but it will also be required from Day 1 of fuel production on Mars, because Mars has no natural gas. I also would note that the Musk Foundation has offered a $100M prize for carbon capture technology, indicating Elon is thinking about this and believes it’s very important.

The big question in my mind is,

will SpaceX just stop at making methalox fuel, or will they (or their sister company Tesla) expand deeper downstream in this vertical by making stuff out of the methane? Methane and hydrogen are commodities and there’s nothing special nor unique about rocket fuel methane or the hydrogen used to synthesize it. With methane and hydrogen as building blocks, any hydrocarbon chemicals can be assembled. In fact this basic chemistry is how biologists believe life on Earth began, in deep-sea thermal vents where photosynthesis was impossible and there was no other source of chemical energy. For human industrial production, it would likely come from Fischer-Tropsch synthesis. The implication for the role it must play in a hypothetical self-sustaining civilization on Mars is obvious, which is why I still think SpaceX has got to be thinking about this for the long-term plans. Their mission requires refinement of this technology to have any practical chance of success. How else could a Martian colony produce its own fuels, plastics, fertilizers, lubricants, pharmaceuticals and everything else an advanced civilization needs to survive and terraform an entire planet?

SpaceX also needs enormous amounts of capital to fund this development. They hope to make big bucks from Starlink and from orbital transportation services, but these markets are tiny in comparison to the opportunity in the chemicals sector. At some point, money might be the limiting factor on making humanity a multiplanetary species.

Terraform Industries is the most credible startup outside SpaceX in my opinion and they are openly pursuing these goals for chemical production for something other than just Starship flights. They released a new white paper today with a lot more numbers and technical detail.

Fuel from the sky: Cheap hydrocarbons from CO2 direct air capture and sunlight. terraformindustries.com At Terraform Industries, we believe our species and civilization should survive climate…

terraformindustries.wordpress.com

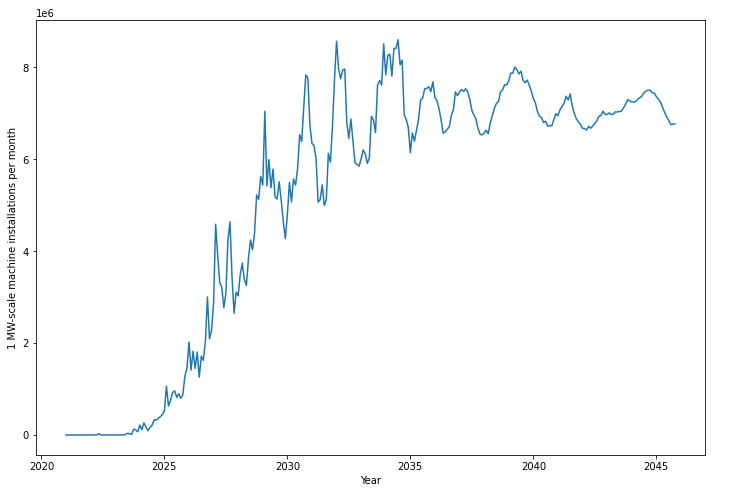

I hope some of you, especially the scientists and engineers, will read it closely and tell me if it’s as technically and economically feasible as it sounds. I have not seen analysis from any other TSLA investors except me on this topic and it’s such a humongous long-term opportunity if it actually is viable. On the other hand, I’m wondering if batteries will be irrelevant to this industry. Terraform’s white paper indicates that they’ll only be operating the hydrolyzers during daylight hours. If steady 24/7 operation is not the goal then this might not mean much for Megapack demand in the coming decades.

Here is their basic thesis which I currently believe is probably correct:

I even think that that last bullet point is probably right on. This industry at scale might use the majority of the world’s electricity in the future. Why is no one talking about this?

Wow, and thank you for a huge boost in the signal to noise ratio these days!

I admit, a lot of this is beyond me (and I suspect many in this thread) but there are parts that resonate and I will address them.

I will guess many of us are focused on the next few years, and I think much of what you refer to here are 10-50 year timeframe. This is good, and big picture, but may explain why many of us might read this and move on.

First, I will second one of the other posters (sorry, lost the message) who pointed out that growing / maintaining our biosphere does a lot of this Terraform-factory stuff already, and has additional crucial benefits: reducing species loss, increasing transpiration, retaining and improving soil quality. A fine link

here to those who want a well researched perspective about how simply stopping our ongoing destruction of the Earth's most ernergy-and-life-productive habitats (the tropical forests) would stop climate change in its tracks. Best I can tell (there may be Unknown posters here with better insight), there is not enough political will to do that, at least in the Americas right now. Let us hope (and take actions that we can) to assist in stopping that destruction. If we stop that, we need to build a lot less mechanical solutions, and the best part is no part.

Second, I am intrigued by the Terraform whitepaper, but I sure do get a red flag or two, such as

CO2 production strongly correlates with economic growth and reduction of poverty so is not a moral failing, per se. Extraction of fossil hydrocarbons to fuel CO2 production is subideal, however.

Huh? I mean, that seems at best really disingenuous. Good Lord,

CO2 does not cause economic growth, the energy (literally in physics: the ability to perform work) does. CO2 has been a side effect of our cheap mass energy production, and that's what we are trying to get away from, yes? So "energy use strongly correlates with economic growth" would make we worry a lot less about Terraform's perspective than their rejoice, "CO2 is not a moral failing". Egads. But I wonder if that is perhaps window dressing for their expected audience.

It is also unclear to me why they declare that poor electrical efficiency is good - I could not gather that explanation from the paper. As an engineer, statements like that also perk up my BS-detector a bit.

As I understand the Terraform paper, they would not be sequestering any carbon, they would just be pulling it from the atmosphere, to be burned and released back into the atmosphere. Agreed that is exactly what we hope SpaceX and the rest of the rocket fuel industry is doing. Everything that cannot be run off of batteries should be doing this. Currently consensus is this includes long haul shipping and long flight aviation. We STILL need to be sequestering carbon like mad though, sure seems like. Or stop cutting down the tropical forests that, you know, do that for us, today, for free while filtering our water and creating habitat, preserving biodiversity and moving climate-cooling moisture into the jet stream...

It does seem that their idea will be a parallel race down the cost curve against battery and electric motors, at least for transport (thinking of natural gas vehicles here). For other uses of methane (home heating for example), I do have the concern that the average consumer would be easily misled into thinking that their dirty (underground) methane might be "clean", since this "clean" (from atmosphere) technology exists, so no need to worry, do anything, or investigate an alternative supplier. Basically I fear that the existence of a Terraform running a few plants producing and marketing from-atmosphere methane might produce enough "halo effect" for the natural gas industry that all sense of urgency from the public for a switch is undermined... while Terraform only produces a few percent of what we need.

To say some positive things, they seem very focused on helping by removing "crust to atmosphere" transport of carbon, which is fantastic and at least a huge part of what we need (stop adding to the problem). And they seem very focused on cheap, scalable, as-simple-as-possible construction.

Oh, and yes, Texas is set up to be the Saudi Arabia of sunshine. We are hopefully headed that way - as many have noted and graphed, solar construction is booming here. Politically though, fossils still rule the lege and governorship here (we recently disallowed developers of new neighborhoods from banning natural gas, for example, guaranteeing decades of more fossil demand (maybe Terraformed?), and famously punished any investment company that badmouths fossil fuels via ESG by giving them no state retirement money to invest). We already do very well with wind - I still love seeing all those turbines when I go to West Texas. And in recent years, more sprouted when I go to the Gulf coast (lower wind speeds but far more reliable, as I know from my windsurfing days). So the picture in Texas is still very mixed.

All that said my personal experience has still been weeks and in fact months of delay for the City to come and approve us flipping a switch to get our second inverter back online. Wish we could improve that. Things look good for the 10+ year timeframe, I think? We shall see. I still also get a kick seeing the completed solar panels on Giga Austin. Fan - effing- tastic. Anyone know the status of the megapack rumored to be put in to support that?

Anyway, cheers, good discussion for a weekend!