World population is 8B people. Number of humans on Twitter is 250M (excluding bots and such). That’s like 3% of the world. Even if we want to be generous and say there are 400M people on Twitter, that’s still just 5% of the world. Twitter is an extremely niche social network…it’s not like Facebook or Instagram which have multi billion users that comprehend almost a 3rd of the world.

Total world population is an extremely irrelevant comparison for evaluating the reach of various Tesla marketing options, because only a privileged, affluent minority of the global population is buying new cars. Almost 3 billion people still don’t even use the internet at all. The estimate of 3 to 5% is off by an

order of magnitude for Tesla’s target audience.

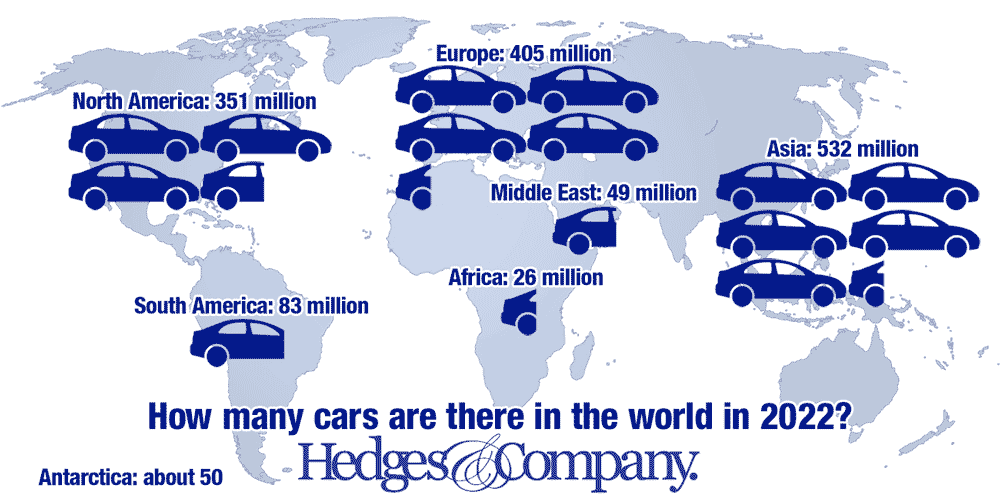

The vast majority of cars and trucks are sold in the rich parts of North America, Europe and east Asia. Of the cars sold in the Global South, much of them are used cars coming from the wealthier northern markets. In the price segments Tesla will be serving for the foreseeable future (including the Gen 3 from GigaMex) this will still be the case. You can see this indirectly via Tesla’s charger network map. In North America, it mostly covers the wealthy coastal cities and the interstate highways through the middle, plus southern Canada and the richest part of Mexico. In Europe, it’s concentrated in the wealthier western and northern parts of the continent with few chargers east of Austria and Czechia. In Asia, it’s almost entirely Japan, South Korea, Taiwan, and the wealthy coastal cities of China. Meanwhile, Tesla does not even sell in India (1.4B population), Africa (1.3B), South America (420M), Indonesia (280M), Pakistan (220M), Bangladesh (160M), Russia (140M), the Philippines (110M) or Vietnam (100M). These areas alone contain 51% of the human population.

source

Tesla with Gen 3 will be selling to the richest billion people, not all eight billion of us. Except for China which has a ban on Twitter, the percentage of the population using Twitter in Tesla’s primary markets is much higher than 3%. In the USA — Tesla’s first, biggest and most profitable market and the one which will likely be the primary customer for GigaMex’s output — approximately 20 to 25% of adults use Twitter and this percentage is currently rising rapidly after having stagnated for the last decade prior.

Source

Among the younger generations who will be Tesla’s main customer base 10+ years from now, when most of the big sales volume is going be happening, the usage rate is much higher. In 2021, Pew Research surveys found that 42% of American adults less than 30 years old reported being Twitter users. Pew also found a strong positive correlation between income and Twitter usage, and we know there’s also a strong positive correlation between income and likelihood to buy any new car in general as well as Tesla cars in particular. I would guess this relationship holds in other countries but I didn’t look it up.

Source

Source

All the usual issues and caveats with surveys apply, but these are simple, unambiguous questions about simple, non-controversial facts and it’s coming from Pew which is a reputable, skilled and generally impartial survey organization, so I think the results are pretty well indicative of reality.

As of now, Twitter definitely does not have the reach of YouTube, Facebook or Instagram, but it’s a difference only of about 2-3x. Twitter is not an “extremely niche social network” by any stretch of the imagination. If it were then why would anyone care so much about this acquisition or how Elon has approached it, for better or for worse? More important still is to evaluate the long run trajectory; it remains to be seen how the recent developments in AI, in how Twitter is handling bots and human verification, and in other aspects of this Nov 2022 change in management might result in changes to the relative popularity and engagement of the top social media networks in the coming years. Opinions and predictions on whether this whole acquisition is good or bad really belong in the Twitter thread or on Twitter itself because TMC mods have mandated it due to such discussions spiraling out of control and resulting in beating of dead horses, but let’s at least get objective facts right.