Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

-

Tesla's Supercharger Team was recently laid off. We discuss what this means for the company on today's TMC Podcast streaming live at 1PM PDT. You can watch on X or on YouTube where you can participate in the live chat.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

Featsbeyond50

Active Member

I just bought 20. I was planning to holdout until it went under 220 but it's gone down 5 days straight and most of the last month. Had to step in because, you know, it can't keep going lower.

Featsbeyond50

Active Member

At this point it wouldn't surprise me if all the OEMs decided to ditch their plans to transition to EVs and just milk the ICE market for everything they can until the milk runs dry.Haha, guess Jaguar has known for a while, wot?

Electric car amibitions will be stifled by fines for missing targets, Jaguar warns | via The Telegraph (January 15, 2023)

"Stifled" by an inferior product?

Because it's true. It's ok to admit that demand ebbs and flows.Everything and nothing.

Wow! You really said it.

2daMoon

Mostly Harmless

Because it's true. It's ok to admit that demand ebbs and flows.

That's enough ebb. Somebody turn on the flow.

The spice must flow!

bkp_duke

Well-Known Member

When did Tesla start worrying about resale values?. And why should they? If they did that will be the wrong strategy.

When they slashed Model Y prices in Q1 did they worry about resale values? If they want to be a niche player like Porsche that makes sense. A volume player should only focus on moving metal at decent sustainable profit.

Because Tesla is . . . the largest reseller of used Teslas.

insaneoctane

Well-Known Member

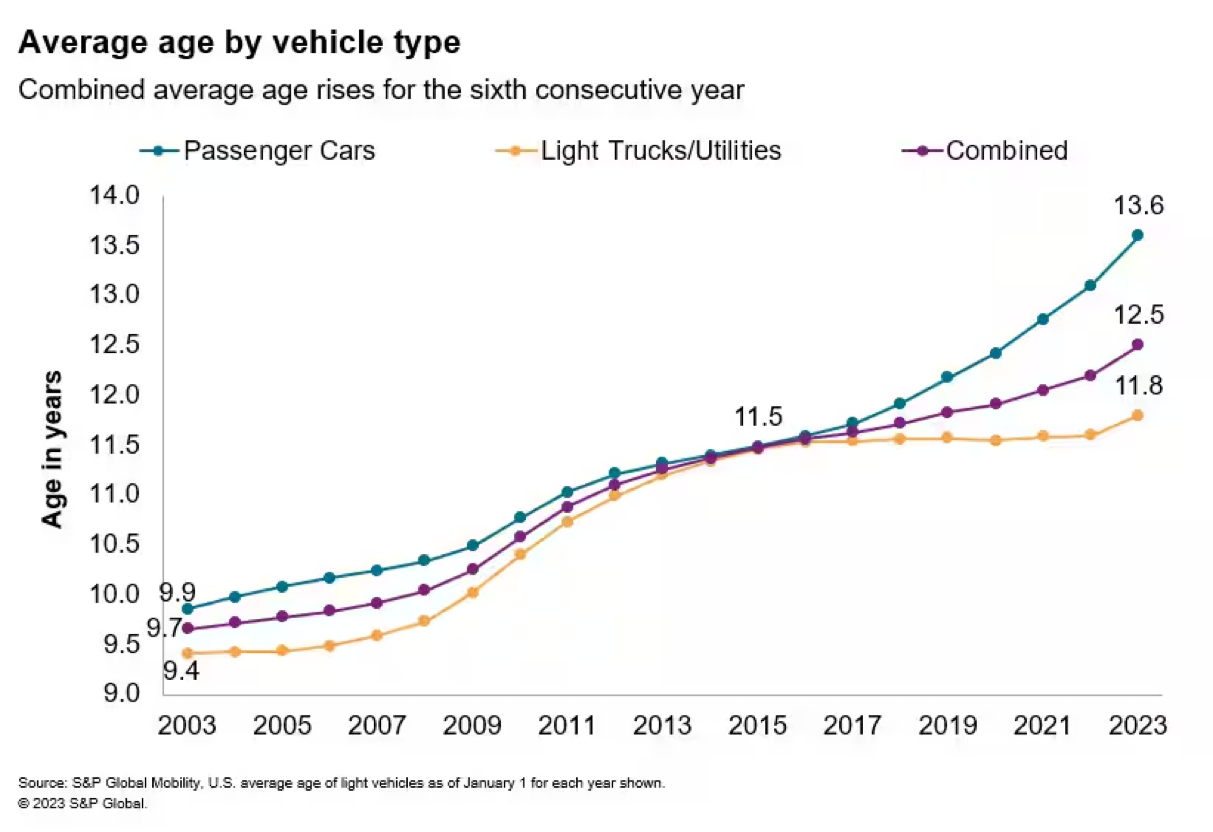

Sorry to repost the same chart that I shared yesterday, but I think our SP is where it's at because of the mission. Really, no other company would build out capacity at as-fast-as-humanly-possible speed in the middle of an economic slowdown with feverishly increasing interest rates. This chart illustrates that buyers are holding back in this challenging macro environment, delaying vehicle purchases longer than ever. This is opposite of what you need as you are trying to double your production because of, you know, supply and demand? The other issue with the plentiful product saturating the market is that resulting lower ASP impacts existing inventory and past buyers as it increases TCO with increased depreciation. None of this was an unknown to Tesla when they decided mission over profit. I'm sure it all works out, but it's painful today.

Krugerrand

Meow

Sure. Ok. But it mostly feels like you just want me to have even more money to bury in my CyberTruck with me when I die.Because it's true. It's ok to admit that demand ebbs and flows.

Krugerrand

Meow

Consider that Tesla wants as many people as possible to be able to afford an EV. Lower used Tesla vehicle prices actually feeds into their mission. Perhaps zero margins for new and used is where they’re headed.Because Tesla is . . . the largest reseller of used Teslas.

bkp_duke

Well-Known Member

Consider that Tesla wants as many people as possible to be able to afford an EV. Lower used Tesla vehicle prices actually feeds into their mission. Perhaps zero margins for new and used is where they’re headed.

Given the trade-in quotes I've seen a few people pass on, Tesla is making very good bank on used Teslas. Probably as much % as a new car in most instances.

UkNorthampton

TSLA - 12+ startups in 1

When the coffee price is low, people switch to other crops. When it's high, they plant coffee. Takes 3-5 years to start producing a crop. By which time coffee prices are low.Sorry to repost the same chart that I shared yesterday, but I think our SP is where it's at because of the mission. Really, no other company would build out capacity at as-fast-as-humanly-possible speed in the middle of an economic slowdown with feverishly increasing interest rates. This chart illustrates that buyers are holding back in this challenging macro environment, delaying vehicle purchases longer than ever. This is opposite of what you need as you are trying to double your production because of, you know, supply and demand? The other issue with the plentiful product saturating the market is that resulting lower ASP impacts existing inventory and past buyers as it increases TCO with increased depreciation. None of this was an unknown to Tesla when they decided mission over profit. I'm sure it all works out, but it's painful today.

View attachment 965579

Best time to plant coffee is when demand is lowest, then you're ready for the good times.

Best time to buy microchips is during a pandemic panic it seems, definitely don't cancel orders.

Tesla building out capacity is great for the future and (in my opinion) bearable/good now. They might take advantage of excess raw materials & batteries unbought by original car companies.

Drumheller

Active Member

That sounds awesome! Where could I see something that cool? And would you describe yourself as being closer to 20 or closer to 90? Just curious.Sure. Ok. But it mostly feels like you just want me to have even more money to bury in my CyberTruck with me when I die.

Zaddy Daddy

Member

So price cuts on Model S/X in the U.S. Then price cuts on Model S/X in China yesterday.

Price cuts on some Model Y in China too.

As I predicted, based on Tesla used car prices tumbling in June and July. Luckily, it looks like the decrease rate is starting to slow down. Maybe we will stabilize later this quarter...

Honestly, it could have been much worse. We aren't seeing any massive cuts to the bread and butter Model 3/Y across continents.

So it seems like ASPs will yet again be lower this quarter vs Q2, but hopefully a bit lower COGs... EPS might be flat or a bit lower.

This is likely why there is a decent sell off, people realized Tesla isn't currently growing profits.

I guess this towel will boost margins.

Price cuts on some Model Y in China too.

As I predicted, based on Tesla used car prices tumbling in June and July. Luckily, it looks like the decrease rate is starting to slow down. Maybe we will stabilize later this quarter...

Honestly, it could have been much worse. We aren't seeing any massive cuts to the bread and butter Model 3/Y across continents.

So it seems like ASPs will yet again be lower this quarter vs Q2, but hopefully a bit lower COGs... EPS might be flat or a bit lower.

This is likely why there is a decent sell off, people realized Tesla isn't currently growing profits.

I guess this towel will boost margins.

Stretch2727

Engineer and Car Nut

If you can get behind the paywall a mostly positive article on the solar roof from the WSJ. Only negative pointed out was the wait.

www.wsj.com

www.wsj.com

Inside the Slow, Yet ‘Incredible’ Installation of a $78,000 Tesla Solar Roof

Long Island homeowner Winka Dubbeldam describes it as a tedious process that in the end helped lower her electric bill while maintaining the appearance of her Cape Cod-style home.

Artful Dodger

"Neko no me"

That sounds awesome! Where could I see something that cool? And would you describe yourself as being closer to 20 or closer to 90? Just curious.

Never ask a Woman her age, a Man his salary, or a Cat about their Monday...

What's really interesting is making any profit at all on new vehicle sales, which is not how legacy car makers operate and might be why Elon is so willing to entertain the idea of selling at zero margin.Given the trade-in quotes I've seen a few people pass on, Tesla is making very good bank on used Teslas. Probably as much % as a new car in most instances.

Elon has talked about this before, how "the greatest auto investor" explained the dynamic to him one day wherein legacy car makers sell new cars at zero profit but make their money through servicing etc over the life of the vehicle -- and this was the major hurdle Tesla needed to jump to be successful where so many others failed. As a new car maker, it's extremely difficult to survive against the OEMs who have those service/maintenance revenue streams and sell new cars at cost.

cliff harris

Member

As people's ICE cars age, and the up-front costs of an EV decline, I think we will eventually see a big mood shift away from "I cant afford an EV right now!" to "I cant afford to keep driving this maintenance-heavy help of junk right now!".

I think that change is coming very soon. There are just so many EVs now, that anyone who wants a real-world opinion on them probably knows somebody who has one. No amount of FUD can win against your next door neighbor clearly being super pleased with their EV! And nobody is ramping up BEV production like Tesla.

Of course wall st will be the last to realize what is happening, but that is why it is sensible to be an investor, not a trader in Tesla stock.

Don't forget:

I think that change is coming very soon. There are just so many EVs now, that anyone who wants a real-world opinion on them probably knows somebody who has one. No amount of FUD can win against your next door neighbor clearly being super pleased with their EV! And nobody is ramping up BEV production like Tesla.

Of course wall st will be the last to realize what is happening, but that is why it is sensible to be an investor, not a trader in Tesla stock.

Don't forget:

- Highland Imminent

- Cyber Truck Imminent

- Battery storage production is ramping like crazy and nobody has noticed.

- FSD & Bot still wildcards.

bkp_duke

Well-Known Member

What's really interesting is making any profit at all on new vehicle sales, which is not how legacy car makers operate and might be why Elon is so willing to entertain the idea of selling at zero margin.

Elon has talked about this before, how "the greatest auto investor" explained the dynamic to him one day wherein legacy car makers sell new cars at zero profit but make their money through servicing etc over the life of the vehicle -- and this was the major hurdle Tesla needed to jump to be successful where so many others failed. As a new car maker, it's extremely difficult to survive against the OEMs who have those service/maintenance revenue streams and sell new cars at cost.

It's part of how Tesla does "service" in their accounting. Used car sales are bundled in with Service charges, and without the used car sales Tesla would probably book a loss in this category.

I’m back. What have you guys been up to?

In for 130sh today. Screw it.

In for 130sh today. Screw it.

Quote from El Fredericko, so I won’t put the link, but evidently Texas is requiring NACS on chargers if they want subsidies .

Texas has officially approved a new requirement that will force charging stations to have Tesla’s NACS connector if they want to get access to over $400 million in subsidies.

The Feds still only require CCS, but states can add their own requirements on top.

That’s the right move from Texas. If the federal government doesn’t do it, other states should follow or they simply won’t be spending that money efficiently.

Texas has officially approved a new requirement that will force charging stations to have Tesla’s NACS connector if they want to get access to over $400 million in subsidies.

The Feds still only require CCS, but states can add their own requirements on top.

That’s the right move from Texas. If the federal government doesn’t do it, other states should follow or they simply won’t be spending that money efficiently.

Similar threads

- Locked

- Replies

- 0

- Views

- 4K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Replies

- 11

- Views

- 10K

- Replies

- 6

- Views

- 5K

- Locked

- Poll

- Replies

- 1

- Views

- 12K