Yeah, I can tell you from firsthand experience that FSD has become tremendously better in the last 18 months. Plenty of others here will tell you the same thing.How can you say FSD v12 is barely better than it was a few years ago? And how can you say Optimus is DECADES behind anyone else?!?!?

Okay, I see you are either ignorant or letting emotions blind your judgement. I'm not sure which it is, but I see there's no point in discussing things further with you currently.

Good luck!

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

Drumheller

Active Member

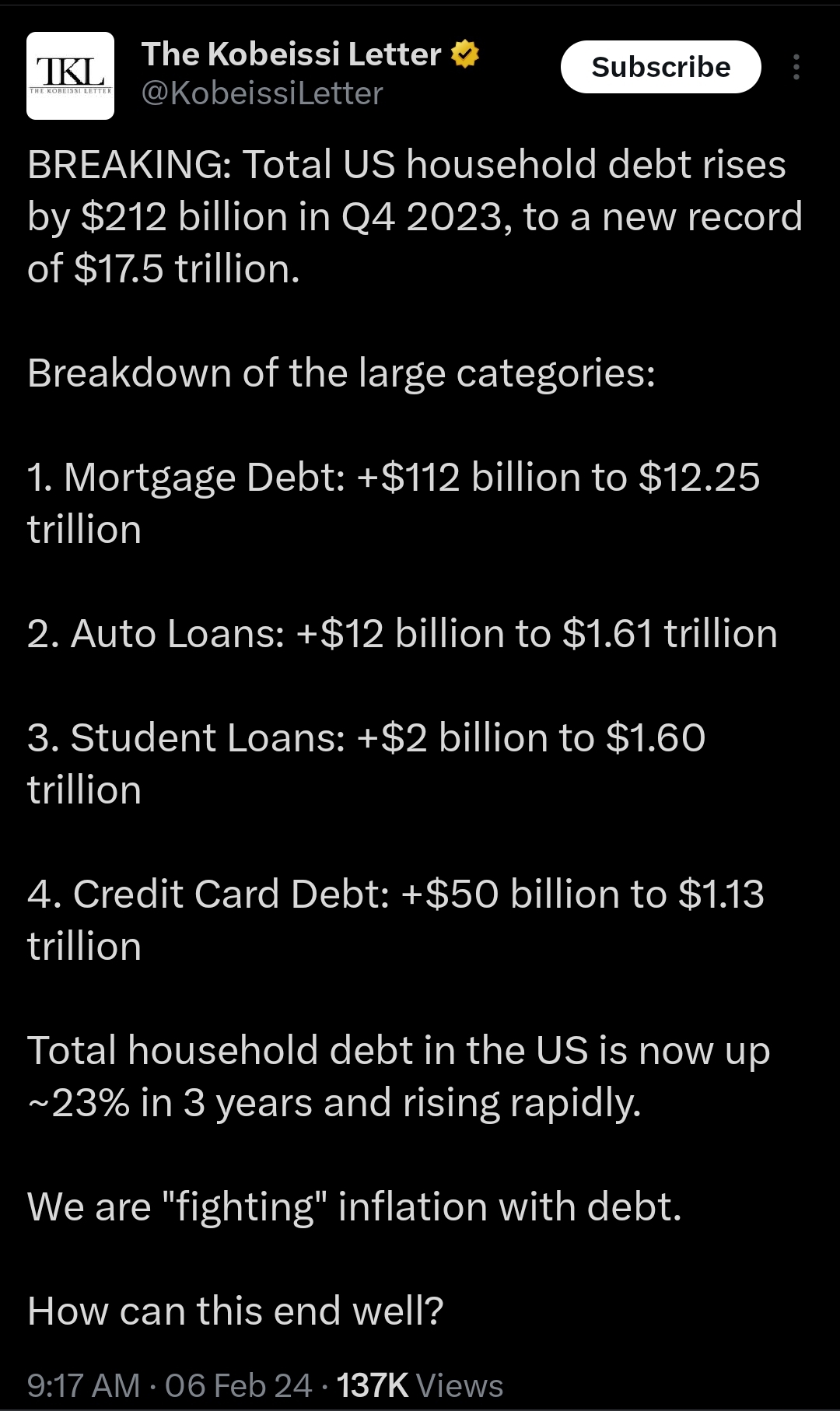

I see posts about how the USA economy is doing well. I disagree. I personally know exactly zero people that feel the economy is doing well. But feelings and all that... here is some data.

More comments and data in the thread

More comments and data in the thread

Is +1.2% in a quarter > the moving average growth rate?I see posts about how the USA economy is doing well. I disagree. I personally know exactly zero people that feel the economy is doing well. But feelings and all that... here is some data.

View attachment 1015951

More comments and data in the thread

Wow! There sure has been a lot postings since I last tuned in over my morning coffee a few hours ago.

Can't wait to see what exciting news everyone's talking about today...

Can't wait to see what exciting news everyone's talking about today...

Krugerrand

Meow

Thank you for your concern that I may have missed it - though I didn’t. This just makes your job harder. You should sell that Jeep and buy some demand shares. Is advice.

Interestingly, coincidentally, serendipitous my demand shares have always be bought on the cheap over the years. Strange that.

ZeApelido

Active Member

Mods don't want you to know how to reduce the # of pages you need to read with this one simple trick.

Mods don't want you to know how to reduce the # of pages you need to read with this one simple trick.

Bonus: all one's thoughts are original.

Pedantic: the method to which you allude reduces posts, not pages...

Krugerrand

Meow

The only major exception is the model Y, and that shared much of its design with the model 3.

Did it now?

Sweet mother of ghod!Enlighten me then.

can we get some "adult time outs for trolls" PLEASE

Krugerrand

Meow

No problem. Then do your job and admonish all the other insufferables, disparagers, and backhanders that are here constantly. And don’t forget to start with yourself.You are being even more insufferable than ever; you now are offering others little more than showing how one can be a jerk. Instead of taking the easy way of putting you on a vacation that the rest of this community desperately deserves, I’m placing this warning on open forum: no more disparaging others and their opinions, either openly or in backhanded fashion.

They share 75% of their parts according to Tesla themselves... so yes?

Did it now?

Probably continuing this discussion will inevitably go off-topic, so I'll not respond other than to state that retail, wholesale and securities operations of Federally chartered banks are quite separate, partly because these are all very, very large and diverse places so the imagined collusion is most evident as a possibility between securities analysts and securities underwriters. There, there are distinct abuses sometime prosecuted, usually not anything significant.It seems important to draw a line between the Central Bank policies, and the other set of rules governing its member banks that operate in the retail space. It seems like sometimes these are pointed at as if they are same thing under the term "banking" and it might warrant a closer look at which is in a position to most effectively affect the markets.

Specifically in regard to the market investments and the banks being allowed to trade on both sides of the aisle with the pretense of a legally required separation between those functions to prevent malfeasance due to information sharing between departments.

Yet, don't the players on both sides of the aisle within the bank take coffee in the same break room, or lunch at the same deli?

Maybe their "Chinese Wall" isn't really all that 'great' for their retail customers and the previous rules should have been left in place preventing these banks from holding positions in the market on their own behalf.

It wasn't bad enough that these banks are allowed to create money and add it to the supply through loans made without any basis in bank reserves, devaluing the dollars they hold for their customers in the process, now, they can use the customer's money held in trust by the bank to place bets that can work against the customer's investments as well.

This seems more like where the finger should be pointing in regard to banks and significant negative effects on retail investment.

Until Tesla came along I avoided anything to do with the rigged game that is Wall Street. Even now, TSLA is the only holding I have ever held in the market, other than where my employer had put the 401K contributions prior to me reaching 59.5 years of age when it all went into TSLA, and dabbling in Ark with leftover money that wouldn't buy a full TSLA share.

The disruptive nature of Tesla's mission, engineering, and production capabilities seemed like something that might grow fast enough to evade the snares. I still think this is true, though it continues to be a roller coaster ride. I'll continue to keep my seat belt buckled and the safety bar latched in place and try to enjoy it. But those Carneys in the big banks make me nervous.

HODL

Yeah, I can tell you from firsthand experience that FSD has become tremendously better in the last 18 months. Plenty of others here will tell you the same thing.

Are there any non-shareholders that hold that view?

Yes, just like every other OEM, often calling then 'concepts' then later showing what they really expect.Honestly, no I don't think it's possible. This company is famous for showing products before they're ready (cybertruck and roadster being the most recent examples) and hyping up capabilities they don't actually have (FSD, optimus, etc)

Tesla is actually less prone to that habit than are several others.

Tesla is actually less prone to that habit than are several others.

Mods should just lock this thread for a few hrs until people cool off. This thread has gone off the rails..

Krugerrand

Meow

They don’t.They share 75% of their parts according to Tesla themselves... so yes?

Knightshade

Well-Known Member

They share 75% of their parts according to Tesla themselves... so yes?

Your facts continue....not to be.

Tesla Giga Shanghai’s Model Y Teardown Shows the Crossover SUV Is World's Most Integrated EV

Recently, Zhihu Automobile teardown of made in China Tesla Model Y and carried out a comprehensive analysis in terms of body construction technology, internal interaction, electrical system, battery safety, etc., and concluded that Tesla Model Y is undoubtedly the most integrated electric...

Previously, it was believed that the level of joint use of parts of Model 3 and Model Y reached 70%, however it turned out that this is not the case. In fact, the cars appeared to share about only 25% of similar parts

Drumheller

Active Member

It would give us another data point on if that helps push tsla greenMods should just lock this thread for a few hrs until people cool off. This thread has gone off the rails..

That's the only source that seems to be claiming that. I see many claiming 75%Your facts continue....not to be.

Tesla Giga Shanghai’s Model Y Teardown Shows the Crossover SUV Is World's Most Integrated EV

Recently, Zhihu Automobile teardown of made in China Tesla Model Y and carried out a comprehensive analysis in terms of body construction technology, internal interaction, electrical system, battery safety, etc., and concluded that Tesla Model Y is undoubtedly the most integrated electric...www.tesmanian.com

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Replies

- 6

- Views

- 5K

- Replies

- 6

- Views

- 11K

- Locked

- Replies

- 27K

- Views

- 3M