Tesla guided for 'tiny profits' in Q1, but I believe that constraint

necessarily results in free cash flow north of $500m, even if they make a small GAAP loss.

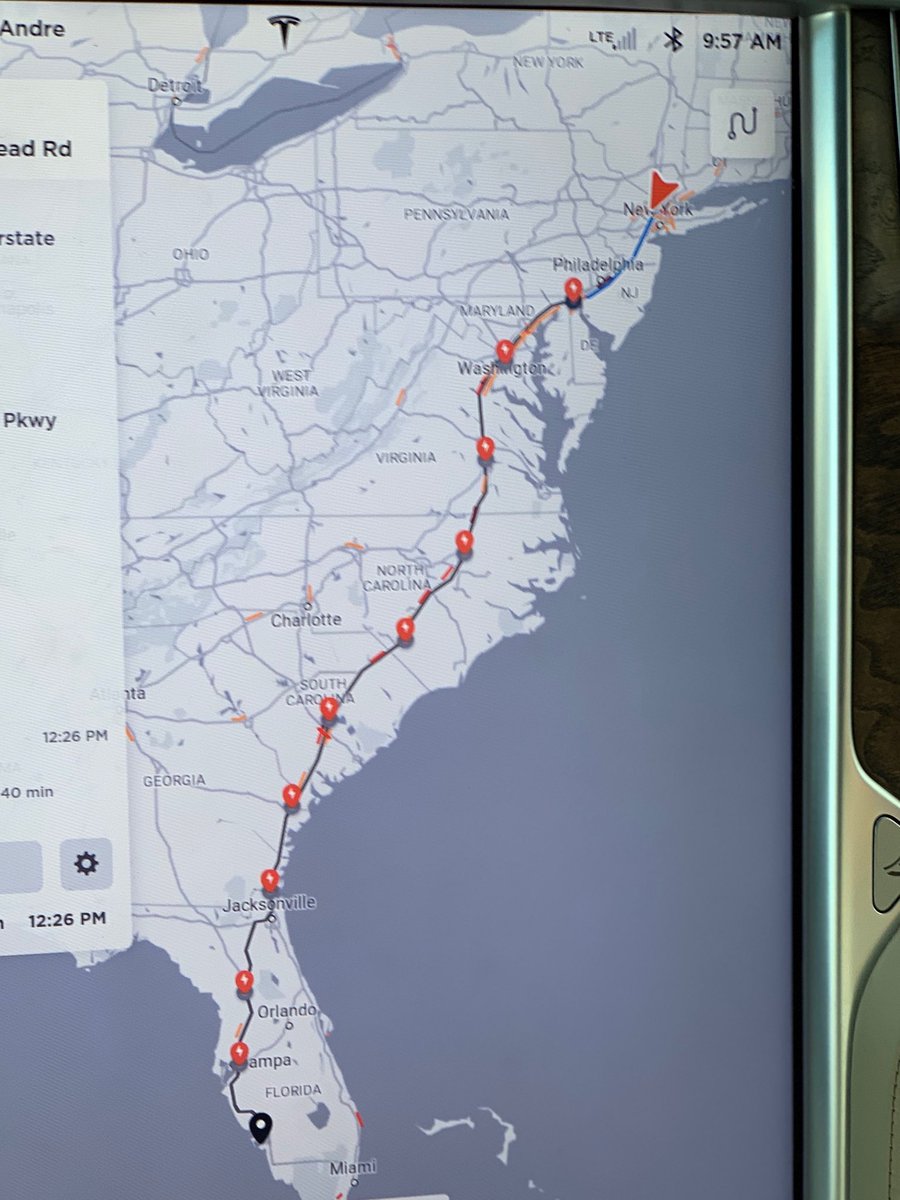

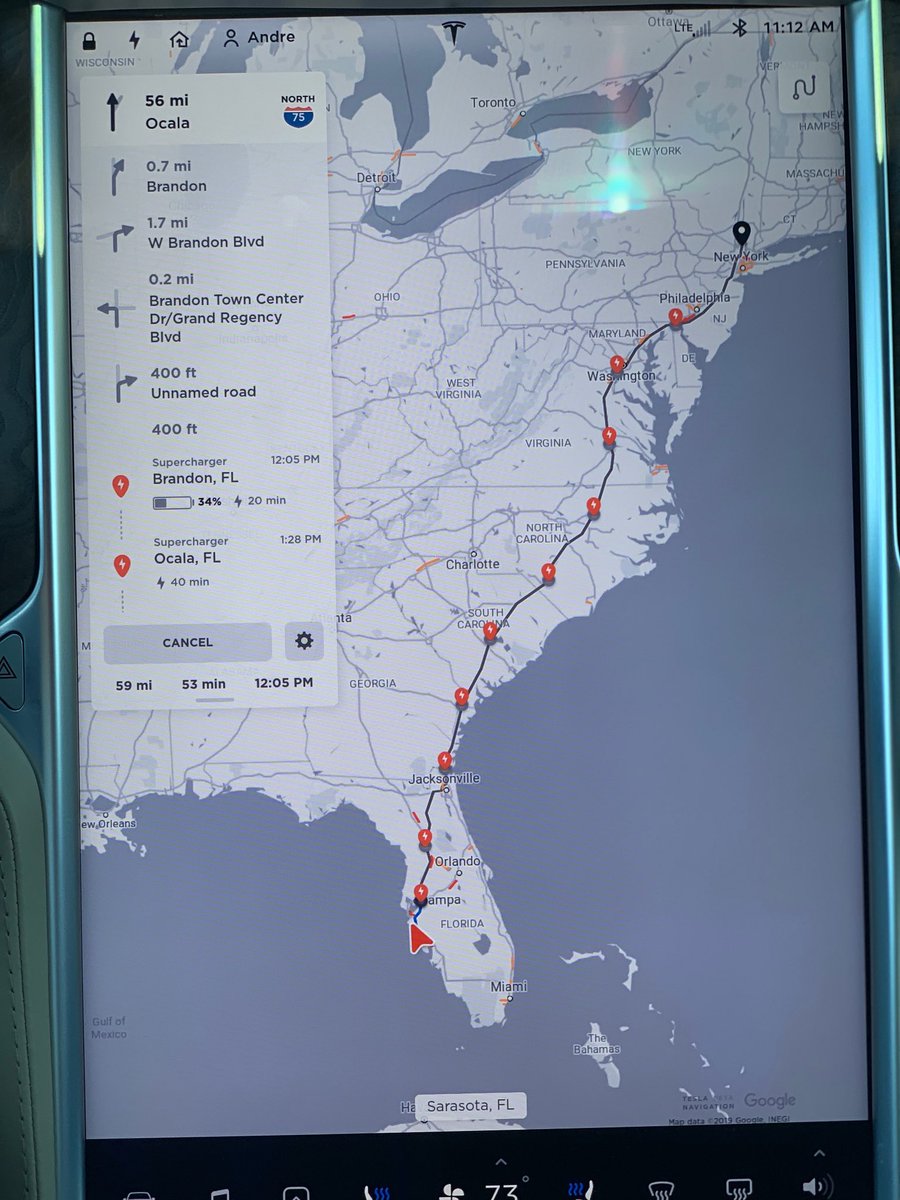

They guided for 10,000 vehicles in transit. In Q1 2018 they had 4,060 S+X vehicles in transit, so if in Q1'19 S+X in-transit levels are roughly similar, this means that there are going to about 6,000 extra Model 3's in transit, about 1,000 in the U.S. similar to Q4, and about 5,000 high ASP configurations en route to Europe and China - about ~2 GLOVIS ships worth of Model 3's.

So the differential increase in inventory in Q1 is going to be about 5,000 high-ASP cars: at an ASP of $60k that's about $300m reduction in revenue and an about $100m-$150m reduction in profits (hence the 'tiny profits' guidance).

But the impact to free cash flow should be similar: at most $300m of cash income "missing", all other things equal. Q3 and Q4 had FCF of $881m and $910m,

so Q1 would map to $580-$610m of FCF, very roughly estimated.

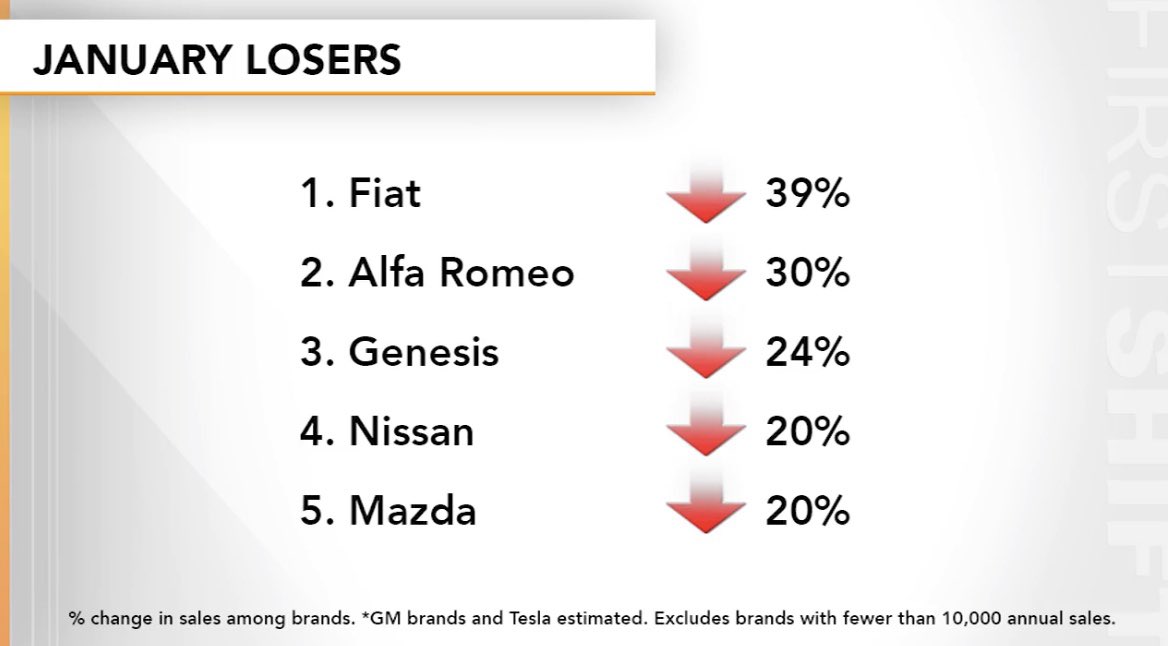

Lower FCF would only be possible if other parts of the business are shrinking in an unexpected fashion, or if there's some unexpected delay in European and Chinese Model 3 deliveries, increasing "vehicles in transit" to well beyond 10k units. More than 20k undelivered units would be required to wipe out all FCF I believe.

Also, if Tesla slows down production in March then there might be a further 'accounts payable' compression effect from January and the first couple of weeks of February payments becoming due before end of Q1. This shouldn't go beyond $200m-$300m even in the worst case I believe.

(Maybe

@ReflexFunds can point out which assumptions are correct or false.)

Vincent @vincent13031925

Vincent @vincent13031925

Greg Wester @gwestr

Greg Wester @gwestr Andre Lev @AndreyATC

Andre Lev @AndreyATC