I think if Q1 is just decent that will be a big win. Longs are so traumatized to expect horrible Q1 numbers and shorts are betting on it.That's what I don't understand. How can 1Q20 look anything but amazing? Imagine how the algos are gonna react relative to 1Q19 with 1Q20 numbers plugged in AND the current chart action AND the level of short interest AND all the upgrades. That's pretty much a perfect storm for May without any real effort or announcements.

I think Battery Day on top of all this is really gonna blow the lid off. And I'm not a rocketship SP guy. I think our rational range for 2020/21 is $380-680 depending on macros. We may crush that by the 4th of July if these idiots are really still short.

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

gerebgraus

Member

It would not surprise me if Fremont had major upgrades with significant downtime and thus lower production in Q1.They're convinced that Q1 is going to be horrible, a repeat of Q1 last year.

This is going to be glorious

And maybe Blackrock might also be interested in defending their position by countering the manipulation to screw up their tests.

New boss in town.

CCN - yesterday: Why BlackRock May Pump Tesla’s Stock to the Moon

Reuters - today: BlackRock beats profit estimates as assets swell to record $7.43 trillion

EDIT: Corrected CNN to CCN thanks to @EVMeister

Last edited:

Hock1

Member

If Bloomberg wanted to be more accurate (and they don't), the Headline would have read "Tesla in talks to buy cobalt from Glencore". Tesla is not buying the Glencore's cobalt company.You have to have a supplier until then. It's also in the goals for Tesla to make its own cells, yet they're still using LG in China.

Edit: I see now that another has made the same point.

JusRelax

Active Member

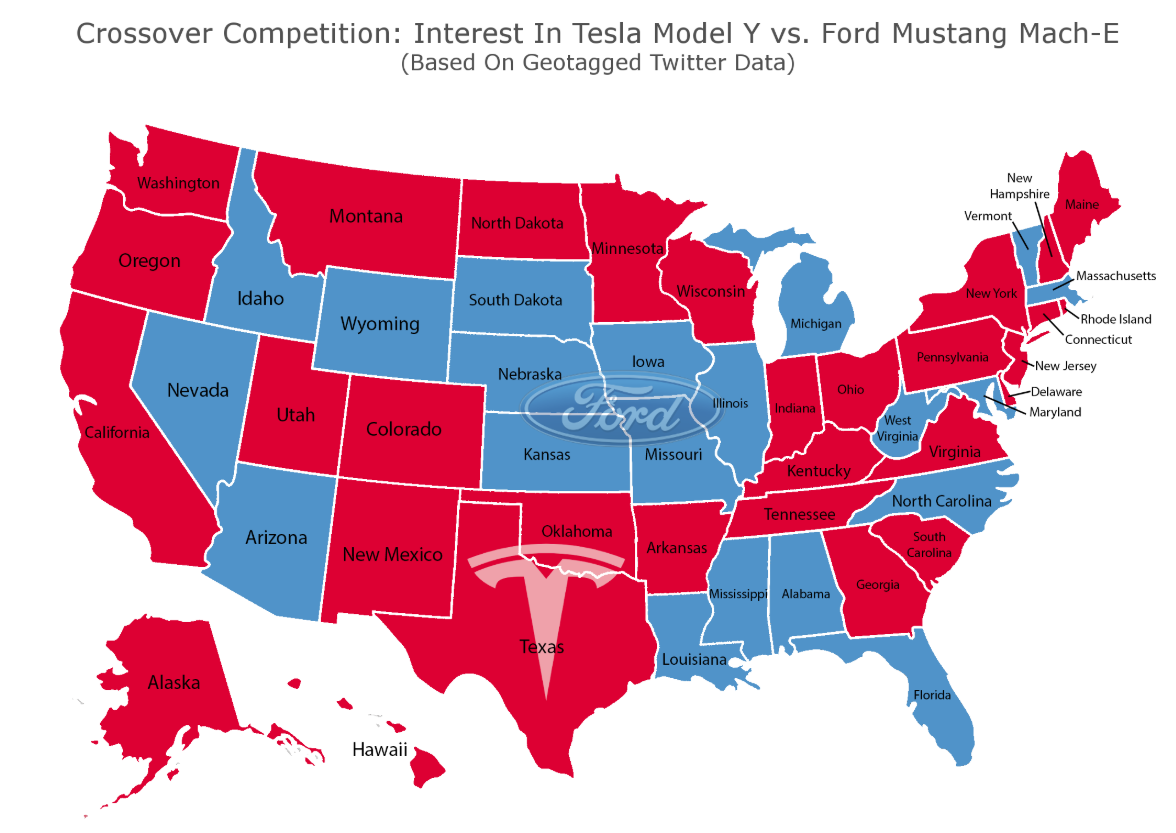

Geotagging data shows Tesla Model Y vs. Ford Mach-E interest for each US state

Geotagging data shows Tesla Model Y vs. Ford Mach-E interest for each US state

Geotagging data shows Tesla Model Y vs. Ford Mach-E interest for each US state

Artful Dodger

"Neko no me"

Half-time Report:

So that 12:45 EST (half-time) spot price was 'XACTLY == VWAP

Yeah, TSLA on Wall St is just...

Cheers!

SP: $531.82

Vol: 10.0m Shares

Update:Vol: 10.0m Shares

VWAP: $531.8177

Volume: 10,045,653

Traded: $5,342,456,319.87

Volume: 10,045,653

Traded: $5,342,456,319.87

So that 12:45 EST (half-time) spot price was 'XACTLY == VWAP

Yeah, TSLA on Wall St is just...

Cheers!

Last edited:

I think it will be model A. To complete the "s3xy cars" lineup. Cybertruck, model A, roadster, semiHow about borrowing names from SpaceX? Falcon or Dragon? Names like 1 or C may be taken, even if not in use, could be trademarked, like the Model E name. So C1 might be an option. Conjecture about conjecture at this point.

graphilwar

Member

Copying this post from a thread I posted on Twitter. Reflex Research on Twitter

Key variables for Tesla’s 2020 earnings are: Maximum potential production, Demand and like for like production cost reduction.

What production capacity is Tesla building in 2020?

Tesla ended Q4 with an annualised production rate of 344k Fremont Model 3s (up 40% yoy) & 72k S&X. This is relative to Fremont Model 3 capacity of 350k & S&X 90k (likely constrained from 100k by cell supply) or a total 440k disclosed in the Q3 report.

The key question for 2020 is how much production capacity will be added with GF3 Model 3 & Y & Fremont Model Y.

Production capacity can be measured as: A) Current quarterly production, B) Current maximum burst rate per hour achieved, C) Max capacity on current equipment once ramped, D) Max capacity in current footprint with extra capex.

GF3

Phase 1 of GF3 is 150k annual Model 3s & has already run at this rate on an hourly basis.

Both the Shanghai government & Elon have said GF3 targets 500k capacity long term. I guess this is 250k Model 3 & 250k Model Y.

I guess each GF3 line is 150k initially & upgradeable to 250k in the same footprint with extra capex.

But how many can be produced at GF3 in 2020? This depends how quickly the 3 line is ramped to 3k/week & potentially on to 5k/week.

In my model I have ~100k produced in 2020.

MIC Model Y looks to be running around 1 year behind MIC 3, so there is unlikely to be meaningful production in 2020, but it could finish the year with 150k or 250k installed capacity.

Back to Fremont.

What is Model Y capacity & will it reduce 3/S/X capacity?

We know from internal plans leaked to Business Insider in late 2018 Tesla initially planned to produce 7k/week Model Y at GF1 by Dec-2020 & 5k/week Model Y at GF3 by Feb-21. Leaked documents reveal Tesla had an aggressive production ramp for its Model Y — but the company says that its plans have changed

So Tesla designed the Model Y line for 7k capacity & likely ordered parts of the line at this stage, but did designs change when location moved from GF1 to Fremont?

I guess Tesla reduced the US Y capacity to ~5k/week while accelerating plans for EU GF4.

But alternatively it might only add 3k/week & take 3k of the 7k/week Model 3 - leaving 7k Y capacity & 4k 3. And maybe it is just adding the full 7k new capacity - leaving 7k 3 & 7k Y?

Will addition of Y capacity at Fremont reduce Model 3 from its 7k/week capacity?

On the Q3 call regarding Model Y Elon said: "Yeah, the body line is separate, the paint line is -- basically we do not expect it to interfere with Model 3.”

On the Q1 call, Elon said: “We are trying to decide whether Model Y vehicle production should be in California or Nevada.. But in the meantime, we have ordered all of the tooling and equipment required for Model Y. So, we don’t expect this in anyway to delay production of Model Y”

This suggests Y will not cannibalise Model 3 production & the lines will be separate & not flexible between 3/Y. But how much space is there really at Fremont?

I think many of the Model 3 sub-lines were designed for 5k per week - they were waiting on hitting the 5k level before signing off on more capex to duplicate parts of the production line. But instead the China trade war caused Tesla to accelerate GF3 - so Tesla spent limited capex pushing the Fremont line past 5k/week to 7k/week while building 3k new capacity in China. So there was likely still space in Fremont set aside for stage 2 of the Model 3 program & Tesla is also removing old storage & service space to make way for Y.

Some parts of the Model 3 line were built for the full 10k/week initial target (likely stamping & paint shop). Is there space to expand the stamp/paint shop etc capacity from 10k per week to 12k (7k 3, 5k Y) or 14k (7k 3, 7k Y)?

I don’t know, but I don't think Tesla would have decided to build Model 3 at Fremont over GF1 if there wasn't space to solve all production bottlenecks. I’m going with a base case that Tesla is building 7k/week Model 3 & 5k/week Model Y capacity at Fremont.

Installed capacity at the end of 2020:

So by the end of 2020, maximum production capacity potentially looks like:

Fremont: Model 3 360k, S/X 90k, Y 250k, Roadster 10k.

GF3: Model 3 150k. Model Y 250k.

GF1: Semi 25k.

Total: 1,135k.

But the reality could be anywhere from 900k to 1,500k.

Note this is not a 2020 production estimate or even a weekly run-rate for Dec-2020 - it is just how much can be built eventually per year on the equipment installed at this date.

This 1,135k capacity would require battery GWh capacity of ~65GWh in the US and ~28GWh in China.

In terms of actual annual production, I think Tesla could produce anywhere from 500k to 700k in 2020, potentially with Q4 production at ~190k.

Consensus is currently for ~450k deliveries in 2020.

I think Tesla could announce 2020 deliveries guidance of 550k-600k.

600k 2020 production would require ~39GWh of battery Cells at Fremont (vs ~35 GWh capacity at GF1 & ~8GWh S/X cell capacity in Japan) and ~7GWh of cell production in China.

By the end of 2021 I think Tesla is potentially aiming for production capacity of ~1.7 million cars (710k Fremont, 400k GF3, 250k GF4, 300k GF1(or GF5 US). This could potentially correspond to 2021 production and deliveries of ~1.1 million.

Remember @elonmusk told @ARKInvest in early 2019 he expects Tesla to hit an annualised production rate of 1.5 million vehicles sometime in 2021 and 3 million in 2023. And on the Q3 call he said his long term target for Tesla is around 20 million per year.

Clearly all this requires a lot of work to grow demand from the ~450k annualised level of 4Q19 (though it could be higher as we do not know the change in net order book).

Key levers to increase demand are:

- Growth of the customer car fleet which drives word of mouth marketing as ~99% of surveyed Model 3 customers would recommend to friends & family.

- Expansion of the Service centre & Supercharger network.

- Launch in new regions & countries.

- Scaling back up the customer referral program.

- Lower pricing (both due to production cost savings and localised production savings tariffs & delivery costs)

- Free media & social media marketing from launch events, Autopilot features, tweets etc.

- Advertising if necessary to increase awareness of the advantages of EVs & cost of ownership savings.

- More supportive government EV policy.

I was thinking about this very informative post and out of curiosity ran some back of the envelope calculations to get a sense of the scale of ambition implied by Elon’s comments in interviews.

1. 1.5M vehicles in 2021 and then 3M in 2023 is approx 41% compounded growth in production in Elon’s mind.

2. Elon then says he thinks “long term” production is 20M. So then I wondered, if you simply continued 41% compounded, how long would it take to hit 20M starting from 3M in 2023? I got roughly 5.5 years, but rounded that to 6 years...then rounded 2029 to 2030 to just say it will be by the end of the decade.

3. Then I pulled an ASP out of thin air of $40K for the 20M cars in 2030 and then got a ridiculous number for revenues: 800B in revenue.

4. Then I said what if there’s 20% margin? And I got a crazy number: $160B.

5. Then I made up another number for SG&A and R&D spending of 40B annually in 2030, and got $120B.

6. Then I said ok what if there’s a 20x multiple on that? And I got $2.4T.

7. Then I said ok what if there’s 300M shares outstanding then? What’s the share price? And I got $8000 per share.

8. And then I said: oh, I forgot about Tesla Energy, the FSD revenues in each car, the revenues from Tesla’s share of the robotaxis network, Supercharger revenues, insurance, and any Services Revenue...and then my brain melted.

9. Another thing is that if ~600K cars requires 39GWh batteries, then 20M cars (33x) requires 1.3TWh of batteries. So right now I’m in a bit of disbelief about these ridiculous numbers from these back of the napkin calculations. Looking forward to Battery Investor day to see what the path is to that level of production.

CNN - yesterday: Why BlackRock May Pump Tesla’s Stock to the Moon

That's CCN, not CNN. A source I see as unreliable and almost jokeworthy, who feed off thier name being similar to CNN. Although I guess to some they're on par with CNN.

MarketWatch - 14 minutes ago: Elon Musk stands to get even richer if Tesla’s market cap tops $100 billion

It would not surprise me if Fremont had major upgrades with significant downtime and thus lower production in Q1.

What kind of major upgrades? We know Model Y will be built on a seperate line, so it should not be necessary to shut down the Model 3 line for longer periods.

pretty interesting but the colors seem backwardsGeotagging data shows Tesla Model Y vs. Ford Mach-E interest for each US state

Geotagging data shows Tesla Model Y vs. Ford Mach-E interest for each US state

View attachment 500497

All posts referencing a color that post should be should be turquoise.

Mod: enough color nonsense. --ggr

Last edited by a moderator:

StealthP3D

Well-Known Member

Agreed. From my understanding, this stock is trading somewhat like one headed for a blow-off top, where the pullbacks are short and shallow. I think there are valid reasons for that based on circumstances surrounding the stock, ie. fundamental developments and short interest, but nevertheless it bears watching.

Well, I don't think the term "blow-off top" describes what I'm seeing. The share price would have to be a LOT higher than where it is for that to happen, IMO. It's trading more like it's being artificially held down, not over-speculation to the upside. If so, that means any downward corrections in the short term would be less than 10% (and probably a lot less).

woodisgood

Optimustic Pessimist

I was thinking about this very informative post and out of curiosity ran some back of the envelope calculations to get a sense of the scale of ambition implied by Elon’s comments in interviews.

1. 1.5M vehicles in 2021 and then 3M in 2023 is approx 41% compounded growth in production in Elon’s mind.

2. Elon then says he thinks “long term” production is 20M. So then I wondered, if you simply continued 41% compounded, how long would it take to hit 20M starting from 3M in 2023? I got roughly 5.5 years, but rounded that to 6 years...then rounded 2029 to 2030 to just say it will be by the end of the decade.

3. Then I pulled an ASP out of thin air of $40K for the 20M cars in 2030 and then got a ridiculous number for revenues: 800B in revenue.

4. Then I said what if there’s 20% margin? And I got a crazy number: $160B.

5. Then I made up another number for SG&A and R&D spending of 40B annually in 2030, and got $120B.

6. Then I said ok what if there’s a 20x multiple on that? And I got $2.4T.

7. Then I said ok what if there’s 300M shares outstanding then? What’s the share price? And I got $8000 per share.

8. And then I said: oh, I forgot about Tesla Energy, the FSD revenues in each car, the revenues from Tesla’s share of the robotaxis network, Supercharger revenues, insurance, and any Services Revenue...and then my brain melted.

9. Another thing is that if ~600K cars requires 39GWh batteries, then 20M cars (33x) requires 1.3TWh of batteries. So right now I’m in a bit of disbelief about these ridiculous numbers from these back of the napkin calculations. Looking forward to Battery Investor day to see what the path is to that level of production.

I stopped doing napkin calculations a while ago (no more brain left to melt) and decided I need to get as much money into TSLA as possible. Being relatively young I don't have the retirement funds built up that many do, so need to figure out how to leverage what I do have responsibly. It truly feels like a once-in-a-lifetime opportunity.

Sometimes I think that Blackrock is somehow in on all the backroom manipulation. If so, why now? (TSLA News is on fire maybe.)CCN - yesterday: Why BlackRock May Pump Tesla’s Stock to the Moon

Reuters - today: BlackRock beats profit estimates as assets swell to record $7.43 trillion

EDIT: Corrected CNN to CCN thanks to @EVMeister

They wouldn't dare dump some of it would they... say right after Q4 Earnings?

Paranoid (but "Only the Paranoid Survive")

So, all the highly populated states go to Tesla, sparsely populated go to Ford??Geotagging data shows Tesla Model Y vs. Ford Mach-E interest for each US state

Geotagging data shows Tesla Model Y vs. Ford Mach-E interest for each US state

View attachment 500497

Sorry to be so super-pedantic, but in this permit shouldn't "extent" be "extend"?

gerebgraus

Member

How can you be so pessimistic??! Until now, Tesla made cars with more expensive tech. (BEV) than competitors. Moreover they had much lower scales than legacy makers. So it was miracle that they could make 20%ish gross margin. Tesla soon has the biggest scale and will produce by far the lowest cost and highest quality cars. That would make possible to achieve Musk's declared goal of 50% monopoly type gross margin.I was thinking about this very informative post and out of curiosity ran some back of the envelope calculations to get a sense of the scale of ambition implied by Elon’s comments in interviews.

1. 1.5M vehicles in 2021 and then 3M in 2023 is approx 41% compounded growth in production in Elon’s mind.

2. Elon then says he thinks “long term” production is 20M. So then I wondered, if you simply continued 41% compounded, how long would it take to hit 20M starting from 3M in 2023? I got roughly 5.5 years, but rounded that to 6 years...then rounded 2029 to 2030 to just say it will be by the end of the decade.

3. Then I pulled an ASP out of thin air of $40K for the 20M cars in 2030 and then got a ridiculous number for revenues: 800B in revenue.

4. Then I said what if there’s 20% margin? And I got a crazy number: $160B.

5. Then I made up another number for SG&A and R&D spending of 40B annually in 2030, and got $120B.

6. Then I said ok what if there’s a 20x multiple on that? And I got $2.4T.

7. Then I said ok what if there’s 300M shares outstanding then? What’s the share price? And I got $8000 per share.

8. And then I said: oh, I forgot about Tesla Energy, the FSD revenues in each car, the revenues from Tesla’s share of the robotaxis network, Supercharger revenues, insurance, and any Services Revenue...and then my brain melted.

9. Another thing is that if ~600K cars requires 39GWh batteries, then 20M cars (33x) requires 1.3TWh of batteries. So right now I’m in a bit of disbelief about these ridiculous numbers from these back of the napkin calculations. Looking forward to Battery Investor day to see what the path is to that level of production.

tinm

2020 Model S LR+ Owner

. . . In it, Orozco is depicting the dry, sterile, dead outcome of mere book-learning.

[Some book-learning is a good thing though.

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Replies

- 11

- Views

- 10K

- Replies

- 6

- Views

- 5K

- Locked

- Poll

- Replies

- 1

- Views

- 12K