I had considered how FSD could supplant medium haul air travel, but for some reason I hadn't thought about how the savings from plane tickets (especially for a whole family) could offset the price of FSD. Cool.The killer application for me is medium haul travel in the US. Right now if I want to visit FL I can drive 17 hours (meh) or pay for 3 plane tickets ($600-$2k), and a rental car ($500). Or once we have full FSD I can load the car up, watch a few movies. Stop for dinner while the car charges, get back in and wake up in FL. (presumably waking up a few times on the way but still). Bam. Avoided the TSA, flight delays, Covid-23 (you know it's gonna happen) and I have my own car with my own crap in it.

I'd easily pay 20k for this functionality right now.

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

This is evident in any investment bank...You think GS makes all their $ from underwriting a IPO? Im sure the 'backdoor shares' that were allocated is their unreported honey in their gigantic moat.

shootformoon

Member

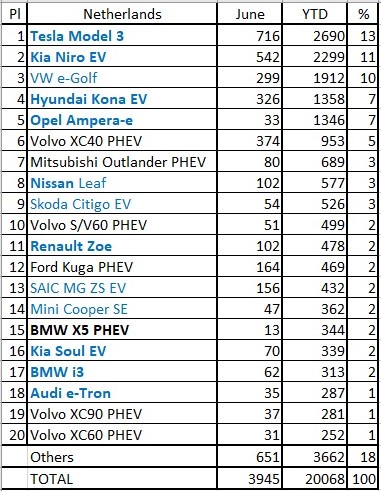

Model 3 (2700) vs bmw 3 series(2000) still have relative similar sales number. But BMW 3 series have worse pricing(considering Netherland incentive for EV), acceleration and tech and almost everything against model 3. What are the incentive for BMW 3 series buyers? The only thing I can imagine is the relative charging inconvenience of model 3 since lots of people live in apartment?

lafrisbee

Active Member

and as to you seeing this as "Spikey spike spike?"Next spiky-spike-spike in progress. Transitioning to a spiky-spike-spike-spike pattern. Wonder how long this can go on before one side has a hernia.

Tesla is not a $300 stock. a $10 movement is virtually flat with a volatile stock at $1400/share. Even $50 is not really a thing.

Artful Dodger

"Neko no me"

No. no chance at all. No Long sale is done in this fashion. If you dump shares and burn through the order book, you are costing yourself gains as a Long seller. Long's sell slowly to avoid this.Could be a large institutional investor cashing in gains too though, right?

Only Short sellers gain by driving down the SP by burning through the Order Book with a large dump of shares.

Dude, its a good thing you're not a Trader...

Cheers!

Having just reached the (temporary) end of this Internet, I wonder if any of you has seen or heard of @bonnie lately?

Her last tweet https://twitter.com/bonnienorman/status/1260208910805299200 was on May 12, after having been very prolific with weekly cooking and baking contests.

It worries me a bit. Hope she is alright!

Her last tweet https://twitter.com/bonnienorman/status/1260208910805299200 was on May 12, after having been very prolific with weekly cooking and baking contests.

It worries me a bit. Hope she is alright!

ByeByeJohnny

Active Member

The killer application for me is medium haul travel in the US. Right now if I want to visit FL I can drive 17 hours (meh) or pay for 3 plane tickets ($600-$2k), and a rental car ($500). Or once we have full FSD I can load the car up, watch a few movies. Stop for dinner while the car charges, get back in and wake up in FL. (presumably waking up a few times on the way but still). Bam. Avoided the TSA, flight delays, Covid-23 (you know it's gonna happen) and I have my own car with my own crap in it.

I'd easily pay 20k for this functionality right now.

True, but you probably wouldn't rent a robotaxi if it's $1/mile. That would cost you something like $2k. This is why I can't see robotaxi replace most privately held cars unless it's much cheaper.

Say you need to make a 500 mile round trip over two days?. If you rent a car today you could probably do that for $200 including gas. That's something like $0.4/miles. And most people won't give up their private car even knowing they can do this.

The cost per mile need to go way down from that discussed $1/mile for 'most' people that have a need for a private car today to give it up.

Thumper

Active Member

I don't mind a period when the SP stays flat at 1400ish. This cements into the common investor mind that this is what TSLA is "worth". We can then move up on good financial or innovation news. This is healthy growth.

mekberg

Member

I don't mind a period when the SP stays flat at 1400ish. This cements into the common investor mind that this is what TSLA is "worth". We can then move up on good financial or innovation news. This is healthy growth.

And it gives me more time to acquire shares. I’m panicking like a cat who has just heard a vacuum.

RT will be more like people use Uber today. Going to the bar, or going to work in a place where owning a car doesn't make sense. (cheap robotaxis will change that math). Private car ownership won't go away for sure, it will just be somewhat less common.True, but you probably wouldn't rent a robotaxi if it's $1/mile. That would cost you something like $2k. This is why I can't see robotaxi replace most privately held cars unless it's much cheaper.

Say you need to make a 500 mile round trip over two days?. If you rent a car today you could probably do that for $200 including gas. That's something like $0.4/miles. And most people won't give up their private car even knowing they can do this.

The cost per mile need to go way down from that discussed $1/mile for 'most' people that have a need for a private car today to give it up.

Renting a car for mileage is cheap, but at least in my experience I'm not renting miler, I'm renting time. I could rent a car, and drive to my destination and return it, but usually you want a car while you are someplace. I just rented one for a 10 day trip in CO. I doubt I will drive more than 200 miles total, but it's costing me about 500 bucks plus fuel. Now that's where RT would be awesome.

Krugerrand

Meow

as we say in dutch: Ohhh dat gaat lekker! (translated in: that is nice) or something like it.

Tesla China sold 14,954 Model 3 vehicles in June, up 35% on the month

Start your rocket engines $TSLA! Will it be a wet dress rehearsal or do we skip the testing and fly off into space?

None of that. Market has control of TSLA again and currently it’s being allowed to follow macros down. The party is over for the time being.

Upper BB is at 1357.11, I will just go out on a limb and say that’s our next stop. Paging @Artful Dodger for confirmation

She was being attacked by the same people who are suing Elon and Omar ("Steve Jobs' Ghost"), I wouldn't be surprised if she just gave up on Twitter. I, too, hope she's fine. One of my favorite people in Meatspace.Having just reached the (temporary) end of this Internet, I wonder if any of you has seen or heard of @bonnie lately?

Her last tweet https://twitter.com/bonnienorman/status/1260208910805299200 was on May 12, after having been very prolific with weekly cooking and baking contests.

It worries me a bit. Hope she is alright!

Edit: oops, original post accidentally tagged a completely different TMC user. Sorry about that.

Todd Burch

14-Year Member

No. no chance at all. No Long sale is done in this fashion. If you dump shares and burn through the order book, you are costing yourself gains as a Long seller. Long's sell slowly to avoid this.

Only Short sellers gain by driving down the SP by burning through the Order Book with a large dump of shares.

Dude, its a good thing you're not a Trader...

Cheers!

Roger that...I have made zero attempt to really learn all the details of trading. As my wife says, I'm long.

Krugerrand

Meow

It's very odd that Tesla reduced prices vs increasing service centers as a demand lever when management talked about the surge in demand a service center creates on a conference call.

The reality is people who need to travel hours for a service are less forgiving with poor customer service due to the added stress from the inconvenience. So I rather Tesla add service centers as top priority due to all the positive upsides it bring for Tesla.

And yet they had the choice of not buying a Tesla until a service center near enough to them to not cause inconvenience was built.

It’s really that simple. No excuse to feel inconvenienced when the choice was their’s to make. Personal responsibility and all that good stuff, you know?

adiggs

Well-Known Member

Next spiky-spike-spike in progress. Transitioning to a spiky-spike-spike-spike pattern. Wonder how long this can go on before one side has a hernia.

Historic TSLA evidence suggests one answer is ~5 years.

I think it can't go on 5 years this time, but .. there are reasons why it can go on longer than a few days.

adiggs

Well-Known Member

I had considered how FSD could supplant medium haul air travel, but for some reason I hadn't thought about how the savings from plane tickets (especially for a whole family) could offset the price of FSD. Cool.

I'm fond of the "avoid TSA" dynamic.

Sudre

Active Member

I am trying to catch up with posts but they keep running ahead as fast as I get time to read.I know everyone's getting all excited and frothy, but unless something dramatic happens, we're closing just below $1400 this week.

Yesterday was a fine example of the MM's capability - 20m shares traded, yet they capped the stock most of the day...

The 1400 strike Call options have an interesting message between yesterday and today.

Yesterday we opened with about 6500 Calls with a strike price of $1400.

Today we woke up to 5400 Calls with a strike of $1400.

THEY are covering.

That info tells me THEY are scared and don't trust they can hold it down. We can see signs they are working hard to push it down. I think these last few days they are working really hard to drop the price and it's not working for them. Be warned the reason I am not betting on $1400 being the top is because THEY seem nervous. $1400 is where they want it. Can they hold it?

humbaba

sleeping until $7000

Honestly, folks cashing in gains don't drop the SP $7 in 75 sec before the bottom of the hour like happened at 10:30 today.

That's shorting.

Word.

For those who doubt the evidence of the present stock action being shorting activity consider past performance (which is no predictor of the future, yet we all do it).

Earlier this year (Jan 31) the shorts hit their limit: $15B in value at risk. Two weeks later it had only declined slightly amid furious short covering. (Actual amounts were $14.8B and $14.7B.) They then successfully rode the COVID-19 dip (covering/buying on the way down, shorting/selling on the way up). But then it happened again, that $15B limit, peaking Apr 15 at $14.7B. The shorts (in aggregate) covered, but once the value at risk dropped enough ($13B, May 15) they started building up the value at risk again. Which peaked Jun 15 at $15B.

While the amount of losses has (so far) not found a limit, the value at risk does not exceed $15B. Instead, it bounces off (they cover) and then start shorting again. We do not yet have the end of June short data, but given the current evident shorting activity they must have covered.

An alternate explanation, that $15B is not in fact a cap for the value at risk, is certainly possible but given the information at hand is less probable. But trying to say it isn't shorting? If it looks like a duck and quacks like a duck -- yeah, sure, it might not be a duck, but that *does* seem to be the probable explanation.

The point here is that -- despite the high stock price -- new shorting is enabled by covering since June.

Finally, I'm sure someone will bring up @ihors3 fantasies. He has projected short interest at substantially more than $15B. And he was wrong. At the beginning of the activity I mentioned above, @ihors3 claimed it was more, $16B and then, when it was actually falling due to significant short covering, he claimed it rose even higher, to $17.5B. He again claimed $16B for Jun 15 which, predictably, was again exaggerated by ~$1B.

To be clear, I am using value at risk for the above and because @ihors3 is... inventive... about how he reports short interest if you look up his tweets you will find the numbers vary a bit. That's because he chooses an undisclosed stock price to calculate the value at risk. For the foregoing I have used the closing price and his claimed shares shorted. I do that because he reports value at risk, shares shorted and percent short interest. The latter is just another way of expressing shares shorted and the official figures are expressed as shares shorted so shares shorted is how I track short interest. The reason I used value at risk here is because shorting behavior appears to vary by the value at risk -- in particular the $15B limit.

ByeByeJohnny

Active Member

RT will be more like people use Uber today. Going to the bar, or going to work in a place where owning a car doesn't make sense. (cheap robotaxis will change that math). Private car ownership won't go away for sure, it will just be somewhat less common.

Renting a car for mileage is cheap, but at least in my experience I'm not renting miler, I'm renting time. I could rent a car, and drive to my destination and return it, but usually you want a car while you are someplace. I just rented one for a 10 day trip in CO. I doubt I will drive more than 200 miles total, but it's costing me about 500 bucks plus fuel. Now that's where RT would be awesome.

Yeah we seem to agree. Your 10 day trip is a perfect example. The need for longterm rental cars will be way down as one robotaxi could probably replace 5-10 of those so Hertz bankruptcy is coming one way or another. Also I see some people driving to work now and having the correct mixture of distance and parking cost could give up a car for a robotaxi if their other driving is suitable for not having a car in their own driveway.

But even this would still mean most people (80-90%?) with a car today will still keep one unless cost for robotaxi goes down to probably something like $0.2-0.3/mile and a five minute wait time at most.

Because of this I think many are overestimating how many robotaxis could be run profitable.

Similar threads

- Locked

- Replies

- 0

- Views

- 4K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Replies

- 11

- Views

- 10K

- Replies

- 6

- Views

- 5K

- Locked

- Poll

- Replies

- 1

- Views

- 12K