Wooloomooloo

Member

Ok I'll bite.

Great! What use is a forum without some back and forth eh?

1) 3dfx simply was dead the moment true 3d geometry acceleration became available. I remember the day I bought my first GeForce 256 and switched our engine to OpenGL to take advantage of Hardware T&L. It was day and night. 3dfx continued with completely unneccessary products that were the equivalent of a flip-phone in the smartphone era, i.e. the Voodoo 4. By the time the Voodoo 5 was able to somewhat compete with the GeForce 256, the GeForce 2 GTS was already on the market and wiped the floor with that 2D card. Because that's what the 3dfx cards really were: 2D accelerators. They had no notion of 3D, you had to do every step (Rotate, Translate, Project) yourself on the CPU.

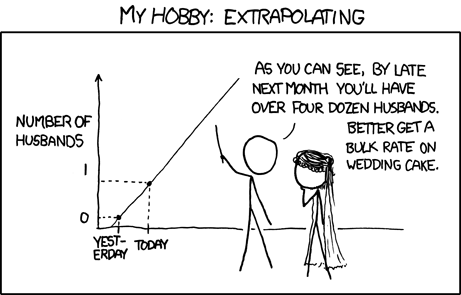

All true - although back in 1996 the difference between a Voodoo board and a TNT2 board on Quake was also night and day. The point is, a company can be fixated on something, thinking it's all important (like z-buffering, SST1, alpha-blending, leave the triangles to the CPU) and suddenly someone else invents T&L and then pixel shading. Oops.

2) I'm driving the Model 3. A car that everyone said would never exist, and certainly not in Europe. Is it perfect? No. But I have to nitpick to find faults. It's a joy to drive, it's insanely performant, it has amazing range, amazing charge rate, the infotainment is second to none. Tell me again how Tesla doesn't deliver. Or how there's "no demand". Mistakes? Absolutely. On time? Not really, no. But my point stands.

I'm also driving a Model 3 - but I don't remember "everyone" saying it would not exist. In fact I don't remember anyone saying it would not exist. I do remember Elon saying I would have it in 2017 (I actually got it on Oct 5th 2018) and I remember being told I'd have my spoiler "within 2 - 3 months" (I still don't have it) and I paid $5000 more for my car than people who got it 4 weeks later than me, and $10,000 more for my car than people who are buying it now. Am I complaining? No. But are all the price changes and backtracking a sign of internal turmoil at Tesla? Quite possibly...

The reason is that trillions of dollars are slipping from certain people's grasp if Tesla succeeds, and you'd be naive to think that they won't put up a fight, using any means neccessary. The reason is not that Tesla is shooting itself in the foot like 3dfx. 3dfx had no product that could compete anymore and their technology was a complete dead end.

Just like the other car manufacturers.

Tesla is not helping itself - of course I agree it has many enemies and entrenched industries that have a vested interest in its failure, but almost no one thinks the future of cars is anything other than electric. So the biggest threat to Tesla isn't big oil backed shorts, it's someone else a bit more organized with a clearer vision of the future getting into the game. Like when nVidia ate 3dfx's lunch.