Yeah, and if radio-active is bad for you, just imagine how bad it is to watch Netflix in the car!I think today's rise was because everyone saw how great my Model 3 handled in the snow yesterday here in the Midwest.

Well heck, if windmill noise causes cancer imagine what filling the country with EVs would do!

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

This is where the rubber meets the road right? Any shorts that aren't insane have to be terrified or trying to get out. Surely those who are sticking to their guns are the crazy ones.

My POV is that sunsetting and not extending FED credits is a benefit to Tesla. They already cut their costs enough and don't need prop ups.EDIT: democrat Senator from Michigan saying EV credit facing huge resistance from Trump, not likely to be included.

The less of these credits the competition can benefit from, the sooner the competition is for real.

No credits is fine by me, not a problem.

I think it was the just released Bloomberg article saying:

if this report in fact turns out not to be true, I would think there is a chance Dana Hull gets referred to the SEC for investigation. (LOL - like that would ever happen)

EDIT: democrat Senator from Michigan saying EV credit facing huge resistance from Trump, not likely to be included.

My POV is that sunsetting and not extending FED credits is a benefit to Tesla. They already cut their costs enough and don't need prop ups.

The less of these credits the competition can benefit from, the sooner the competition is for real.

No credits is fine by me, not a problem.

I too really don't believe that a tax credit extension is needed to drive continued US demand for Tesla cars. But for many Tesla bears it is a prime thesis, since they can't understand why a Tesla would be desirable with no tax credit. So we might see some more share price wiggling as we get related updates from Congress, but the uptrend may be ultimately irreversible. Let's keep in mind that outside of the US this congressional tax credit debate is completely irrelevant.

Last edited:

Tslynk67

Well-Known Member

Haven't been able to read up, but - the Netherlands have severely miscalculated. They've been preparing for rising sea levels with big investments along the coast - alas, the country is currently on course to being submerged in Teslas.

Personenauto Kentekenregistraties

Antbrain Wahlman: "Tesla Model 3 only 36th top selling car in the Netherlands in October as demand fears become reality"

Can anyone remember any time there has been this much volume when there is basically no news?

JRP3

Hyperactive Member

Not according to my portfolioDiversification is a good thing.

Causalien

Prime 8 ball Oracle

Someone bought 3000 contracts of 15 Jan 2021 400C at 11:11:47 PST. Then immediately, saw the 300K shares dump on TSLA. Does that mean someone bought 3000 contracts so that they can short sell 300K shares on TSLA?

It's a nice straddle to play the Q4 release number, not necessarily a short. Also probably because whoever it is can use a lot more leverage than your average player and borrowing money cost less than the premium on tsla options.

tinm

2020 Model S LR+ Owner

There’s one here who’s not on the block list!

JRP3

Hyperactive Member

MarketWatch - 14 minutes ago: Tesla’s stock zooms toward two-year high on China factory optimism

woodisgood

Optimustic Pessimist

I hope Chanos still has as large of a short position as he was vaguely insinuating in that recent short-seller-fellation interview.

Of course he can’t be that dumb.

Of course he can’t be that dumb.

Haven't been able to read up, but - the Netherlands have severely miscalculated. They've been preparing for rising sea levels with big investments along the coast - alas, the country is currently on course to being submerged in Teslas.

Personenauto Kentekenregistraties

It's getting crazy over here. I live in Amsterdam and the place is literally getting "swamped" with new Tesla's. My street alone has gotten a few more in the past week and December is just half way through. Even though tax benefits get a big cut starting jan 1st, I think the impact of so many new owners spreading the word is going to be huge for 2020

RobStark

Well-Known Member

I take objection to you calling my post “deeply misleading”. I said there might be a potential rush for Teslas, based on the fact a brexit could well mean car import tariff increases (as the UK negotiates trade deals from the countries it imports cars from).

The UK government has designated the UK car industry as one of the few “protected” local industries in any post-brexit trade agreements, which for example meant that in various proposed deals this year in Europe-UK trade talks, the UK has included an increased tariff to 10% on cars imported from the EU.

I find this statement you made, which I have bolded below, which you are stating as fact, is in fact merely an opinion of yours;

As far as I’m aware no US-UK trade deal has been signed and announced with the details released, and no guarantees have been made that it will be zero tariffs on cars. So I would look at your own posts first before calling out someone else’s posts as misleading.

Now zero tariffs could indeed happen, which would be great for tesla, even if only for EVs, but we should be weary of thinking its an expected automatic outcome when the UK has stated the UK car manufacturing industry in particular as one of the areas it wants to protect after brexit.

Tesla already pays a 10% tariff on cars imported into the UK.

Putting a 10% tariff on European made cars imported into the UK would be relative advantage to Tesla. At least until GF Berlin is running.

One of the easiest points of trade negotiation between the US-UK will be low tariff for American made cars shipped into the EU and low/zero restrictions on UK Financial services in the USA.

Britain doesn't own Nissan,Jaguar, Land Rover, Mini,Bentley,Rolls Royce.

Governments do defend domestic manufacturing of foreign owned companies but not nearly to the degree if they are domestically owned.

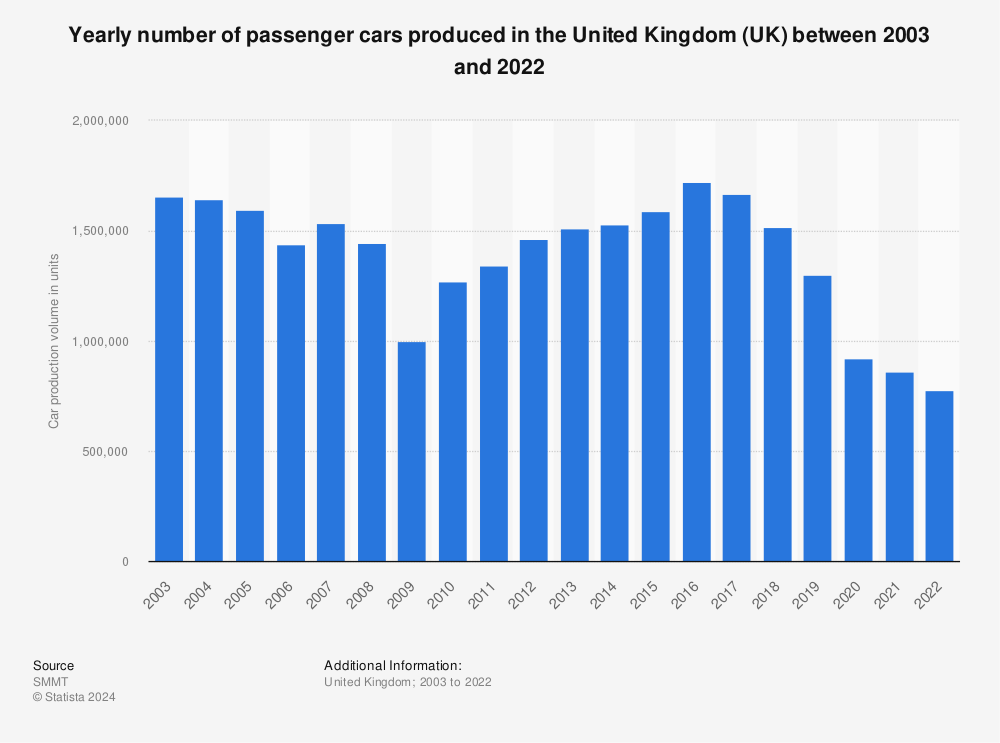

In any event, the UK consumes(~2.5M) about 1M more cars per year than it manufactures(~1.5M)

my Tim Seymour prediction:

“I’m glad you asked me about my Tesla short position, because today’s trading is a really teachable moment, and, no I didn’t close my position.

In the market you have to be flexible.

I saw Tesla pushing up to my $370 number this morning. I also saw all over the financial media reports that Tesla was going to get a massive handout from the US government with an extension of tax rebates for wealthy people who buy their cars.

Now, I’d had $370 as the point I would close my position based on the charts.

When I saw this move was all based on a ton of media hyping of a pipe dream of a Tesla rescue, I had to be flexible and see more than the charts.

By the afternoon word was getting out that this Tesla subsidy extension has no chance, the stock started giving back its gains.

So, still short this overvalued company... Melissa, I mean everyone here, and everyone in the street knows it’s overvalued.

Again, today’s lesson, don’t be married to charts, be flexible.”

“I’m glad you asked me about my Tesla short position, because today’s trading is a really teachable moment, and, no I didn’t close my position.

In the market you have to be flexible.

I saw Tesla pushing up to my $370 number this morning. I also saw all over the financial media reports that Tesla was going to get a massive handout from the US government with an extension of tax rebates for wealthy people who buy their cars.

Now, I’d had $370 as the point I would close my position based on the charts.

When I saw this move was all based on a ton of media hyping of a pipe dream of a Tesla rescue, I had to be flexible and see more than the charts.

By the afternoon word was getting out that this Tesla subsidy extension has no chance, the stock started giving back its gains.

So, still short this overvalued company... Melissa, I mean everyone here, and everyone in the street knows it’s overvalued.

Again, today’s lesson, don’t be married to charts, be flexible.”

Can anyone remember any time there has been this much volume when there is basically no news?

I want to attribute some of it to EV tax credit talk

Based on past jumps (like today) what has Tesla generally done on day 2 ?

JRP3

Hyperactive Member

Dude...So was Hitler. And Stalin (twice).

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Replies

- 6

- Views

- 5K

- Replies

- 6

- Views

- 11K

- Locked

- Replies

- 27K

- Views

- 3M