Johann Koeber

Happy Owner

Something's up:

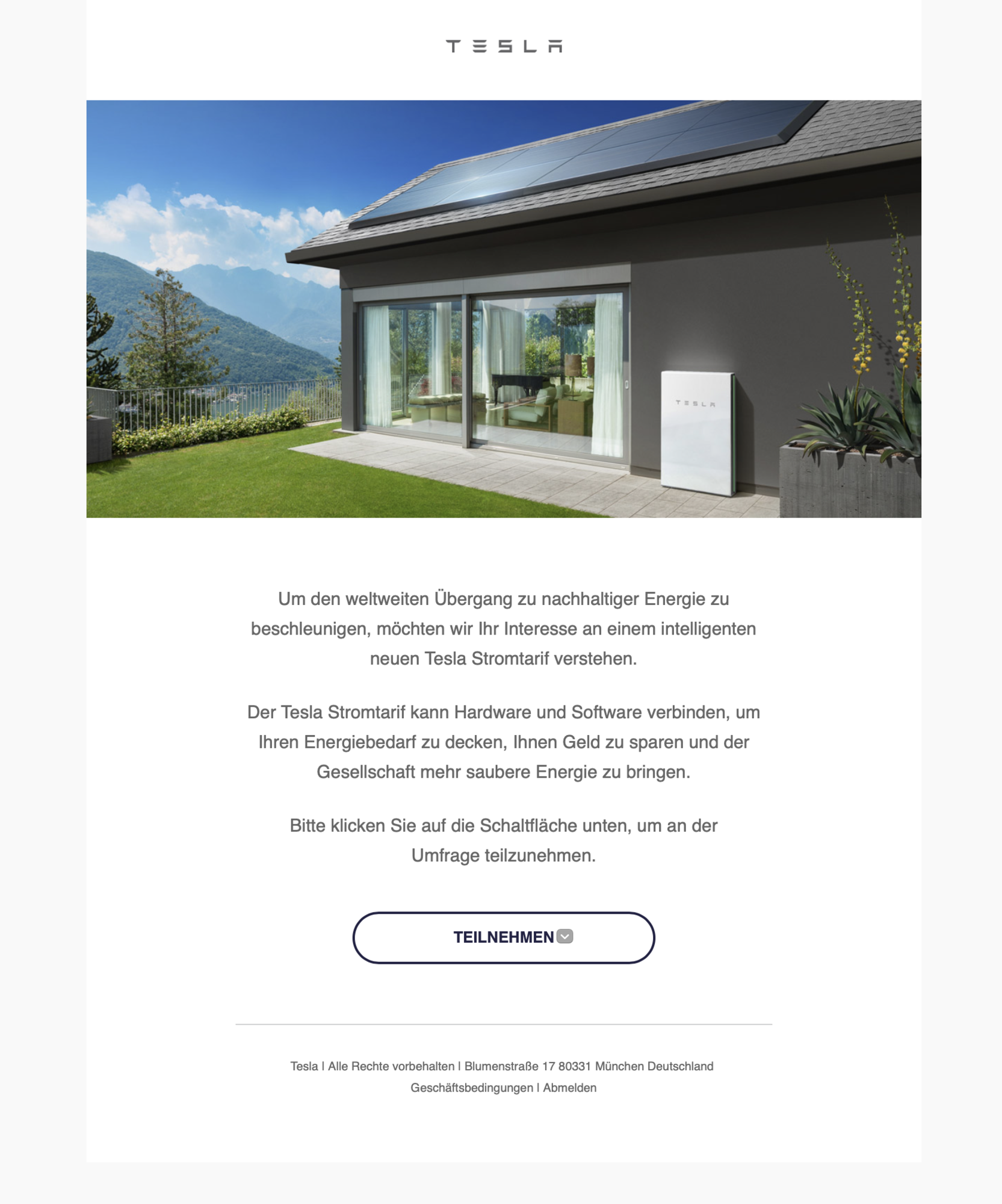

Just got an Tesla survey email. They are inquiring if I want a TESLA energy provider contract. They would deliver the electricity using solar, powerwall etc and I only pay per use.

Looks they are preparing to become a utility in Germany.

Or they are just doing a survey ..

Just got an Tesla survey email. They are inquiring if I want a TESLA energy provider contract. They would deliver the electricity using solar, powerwall etc and I only pay per use.

Looks they are preparing to become a utility in Germany.

Or they are just doing a survey ..