Just wondering, does anyone else trade just using the TSLA summary chart? I think it's quite simple with less noise.

Tempt me more bastards!!!

Tempt me more bastards!!!

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

Obviously there was going to be a delicious dip when my account is tied up in transfer.

At this point I agree with @Todd Burch - the AH action is a head fake and irrelevant. This stock will DEFINATELY be above $900 before this week is over. Those who invest based on fundamentals just got their case strengthened on so many fronts.

Cheers @Johan

I was going to reply to you... at the end of market today

No, but shortzes are working to get 800 to crack in a few minutes. Hunting the stops.

glad we got those stop losses at 800 out of the way. can we move back up now?

People are still setting stop losses at prices like 800? I really don't get it, Tesla might not have stock price exponential growth anymore but surely it looks like it can grow into the current price now. I'll never understand their psyche and luckily I'm just a hodler so I don't really have to.Indeed, weak longs (includes day traders) with tight round number stop loss limits are being harvested by short selling hedge funds. The cascading effect is much like toppling dominoes. So far $800 and $790 limits have cracked, but near $780 has brought in buyers. Getting back above $790 may inspire the hedge funds to cover their shorts at a profit.

Wow, I thought I caught the low. Nice job!Bought 20 @ $785 which makes me very happy. Glad I was patient. Thanks to @Artful Dodger for reminding me of the $800 trigger when my finger was hovering at $805

Damn, can I get this guys couch?!?welp let's see how my knife-juggling skills are.

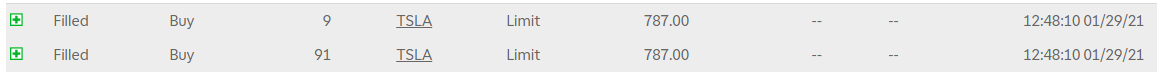

View attachment 631966

What I don’t understand about shorting is how someone can borrow a share of stock and sell it, while the original owner can also sell it. Seems to me that if a share is truly borrowed, then the lender should not be able to sell it until the borrower gives it back. This would discourage people from lending shares in the first place unless they want to take that risk. They should also be compensated by borrower to guard against this risk. eg I lend you one share and get back 1.1 shares.

Um, there’s an implicit axiom that the rounder the number the less precise it is?I’m on my anti-impossibly-precise bandwagon again today (am thus only on days ending in “y”).

Who wants to criticize Oppenheimer’s Colin Rusch, with his Street-high target for TSLA of $1036?

I do.

Mr Rusch: if Tesla split 10:1, would you give a target if $103.60?

You cannot induce accuracy with precision.

Correct, but precision is not accuracy. Not even in TSLA.Um, there’s an implicit axiom that the rounder the number the less precise it is?