Maybe a little OT but still relevant to TSLA given the amount of FUD directed at Elon in particular.

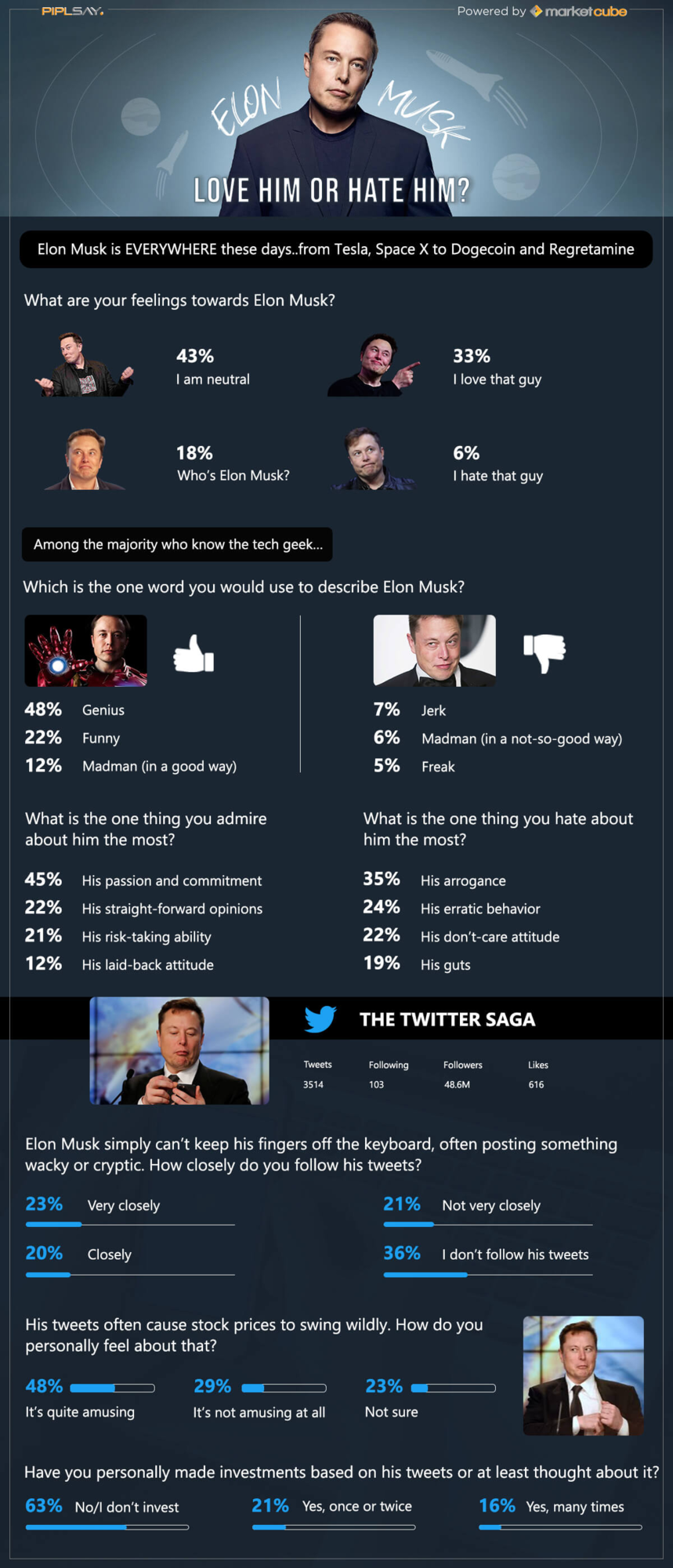

I noticed this link to a survey of 30,400 Americans opinions of Elon Musk in a @KarenRei/Nafnlaus tweet. Shows that even a massive amount of FUD can have limited impact.

The Musk factor What do Americans think of the Tesla guy? - Piplsay

I noticed this link to a survey of 30,400 Americans opinions of Elon Musk in a @KarenRei/Nafnlaus tweet. Shows that even a massive amount of FUD can have limited impact.

The Musk factor What do Americans think of the Tesla guy? - Piplsay