This would make the shortage worse. Because now most of the electronics in those microwaves are put to waste or out of circulation, so they can get a few high power chips out of them.Isnt there a rumor BMW bought tens of thousands of microwaves to remove chips from them for cars (and will put them back later..)

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

Yes. Every time I'm in North-America I'm in this bizarro land where 'beer' costs $10 a can and you can't have it open in the car or even in a park. Or you can only buy them at designated licensed monopolies (depending on state/province), and not just walk in a supermarket or fuel station shop.Hold on, you can do that in Belgium?

Belgium did make beer sales through unattended vending machines illegal though, so there's that. But I remember you could roll up at night and buy beer at these vending machines without showing ID

Anyway, back to our regular programming of watching the stock ticker (up to 1027 pre-market) and discussing if/when Elon's done selling.

@Artful DodgerTaxes are done on the 2019 lot, and @winfield100's spreadsheet is correct that there are still 1.5 million shares vested but not yet exercised (2021 lot 11). Per the 2019 Form 2: 22,862,050 vested shares were still unexercised.

It's late, so I may be messung this up:

As to taxes, the 2019 had a cost of

31.17*175,000 = $5,454,750 of the $20.4M, so $15M of tax on $30.5M of gain = 50%.

From that point (assuming held over a year), it would be capital gains on the growth or 0.8 (ish) net.

This is actually worse than waiting to execute, if having cash was not dependant on the exercise.

While further earnings are taxed at a lower rate, the amount that experiences growth is reduced by the exercise tax rate.

Better to have 53% tax on everything, than only 20% tax on top of 50%.

Net=(base*(1-short term tax))+(base(1-short term tax)*growth*(1-long term tax))

Super rough numbers:

Waiting:

875,000x$1000 = 875M * (1-0.53) = $376M net

Plus 15M (if put in TSLA) x 25 = $375M * (1-20%) = 1.7B

=$2.1B

Exercise in 2019:

875,000x$(1000-41)=834M * (1-0.53) = $394M net

+875,000x41=$36M

= $440M

Knew I messed up somewhere:

Gain from 2019 on cash in TSLA is 1000/41 or 25ish, not 1000/8.

Super rough numbers:

Waiting:

875,000x$1000 = 875M * (1-0.53) = $376M net

Plus 15M (if put in TSLA) x 25 = $375M * (1-20%) = $300M

=$676M

Paying long term capital gains tax instead of short term is advantageous, but long term on top of short term is not.

Ford will almost certainly make more than 15,000 in 2022. They keep raising production capacity, and they know they have a huge hit in their hands. Regardless Cybertruck sales will be 0 in 2022 so I don’t think we should bash Ford too muchSorry for but all the hype that Ford has been pushing and all the fake promises that have been made......15,000 is a joke. I don't think 15,000 is a decent effort. A decent effort would have been to secure battery supply 2 years ago for at least 25,000-50,000 for the first year.

They simply desperately wanted some of Tesla's valuation after TSLA's epic 2020 year, with no planning on their part, made a lot of hype and noise in "beating" Tesla to the punch in who delivers their truck first, and then silently slip in that production volumes (like we all here knew) are going to be pathetic. They likely won't even hit that 15,000 number.

@Artful DodgerSo a lot of commenters seem to be under the impression that Elon must sell some addtional shares to pay the taxes on the 1st tranche of shares that he acquired on May 21, 2019.

I don't think this is the case. Here is Elon's May 21, 2019 SEC Form 4:

SEC FORM 4.Elon Musk.2019-05-21. Part 1 of 1

Scan down to the comments section, where you'll see this:

The Income Taxes owed for executing these share options were payable back in 2019 (no exceptions). The Form 4 clearly states that Elon DID NOT sell any newly acquired shares to pay those taxes, so he MUST have paid for them in cash. Elon likely borrowed against his shares to pay the taxes.

- Represents an exercise of options for which the reporting person paid the related exercise price to the Issuer in cash. No shares were sold by the reporting person to generate funds to pay the exercise price or underlying tax obligations, totaling approximately $20.4 million.

This is reasonable. Keep in mind the Closing SP for TSLA on May 21, 2019 was only $205.08 (pre-split) adjusted to $41.016 (post-split):

View attachment 747258

The May 21, 2019 Form 4 tells us that Elon's cost to exercise the share options was $31.17 per share, granting him an Income for tax purposes of $173.91 per share (my estimate only; not sourced) on 175K shares for a total income for tax purposes of just $30,434,250 on those shares.

However, the 2019 Form 4 does go on to tell us explicitly that Elon did "pay the exercise price or underlying tax obligations, totaling approximately $20.4 million." So my calculation above is rough (IANAA) but in the ball park, and are an obvious bargain on taxes compared to selling those shares at today's Closing SP (which would have about $875M in taxable income at the 53.6% tax rate).

I reckon Elon saved himself about $450M in income taxes by executing that one single tranche back on May 21st, 2019 verses executing them in Dec 2021.

Or, alternatively, Elon cost himself about $4.5B in EXTRA income taxes by NOT executing all those vested options back during the lows in May 2019.

TL;dr I think Elon ALREADY paid the taxes on the 1st tranche of share options back in 2019, and he doesn't have to sell any shares in 2021 (or ever) to pay them twice. If that's the case, ELON may be done selling ALREADY.

@mongo Please to check my maths.

Cheers!

it was over 2.5 years ago, the 875,000 is there to balance numbers, i seem to recall taxes are paid or withheld pretty immediately, on those sales from readings, i completely agree with you here.

i personally think we should focus on several to me salient things,

1) Elon's "game on" tweet with the ESA folks and "race to Mars"

2) the upcoming vesting of 101 million more shares with accompanying sales (4-5x this set of tranches) and Elon ending up with _another_ 50-60 million shares as he has ~175 million now.

Tesla stock will be at a premium as SpaceX continues to ramp and people invest in Elon and "positive dreams of the future, realized"

('If I can't buy/invest in SpaceX, I _can_ buy/invest in Tesla')

Starship is about to do a possible launch from Boca Chica and orbit and landing in a few months near Kaua'i, Hawai'i

and

Lunar base in next ==>> 2-3 years <==, with possible orbital refuelings, $$$$$ spent, and, earned

(possibly next things will be asteroid mining for volatiles for reaction mass and "dirty fuel" as a side gig)

===>>>{{{A MOON BASE IN 2-3 YEARS!!!}}}<<<===

"once you are in orbit, you are (almost)1/2 way to anywhere"

LEO to Low Lunar Orbit Delta V is 4.04 km/sec...

LEO to Mars Transfer Orbit is only 4.3 km/sec..

LEO to escape velocity is only 3.2 km/sec... remember that LEO velocity = 17,000 mph, escape velocity is only 25,000 mph

refueling Starships

Last edited:

Buckminster

Well-Known Member

The ex TMC GOAT (Factchecking aka Tesla_Truth) hasn't been nearly as good on Twitter as he was here. That's because he has mostly been combatting FUD. A worthy cause. However, he is starting to get into his stride - harder to communicate complex stuff in a few words. Last few tweets cover Austin, Berlin and LEAPS/margin. Follow him.

It must feel lonely on Twitter with all the FUD and Tesla haters replying to every comment. Spiegel seems to have time to reply on every tweet about how great the ID.4 is compared to the Model Y. Sometimes seeing someone fighting FUD is like watching someone out in the jungle alone combating predators. You know they will prevail in the end but all that work you have to put up to. Here it’s easier to get a nice fresh confirmation bias served on a golden plate until StrongGuy3 who forgot his password to StrongGuy2 comes back in the house to tell us he bought back at $800 like he told us to.The ex TMC GOAT (Factchecking aka Tesla_Truth) hasn't been nearly as good on Twitter as he was here. That's because he has mostly been combatting FUD. A worthy cause. However, he is starting to get into his stride - harder to communicate complex stuff in a few words. Last few tweets cover Austin, Berlin and LEAPS/margin. Follow him.

Last edited:

The fully diluted share count includes all obligations including unvested ones. Elon's exercise will not directly impact those earnings numbers.When Tesla reports earnings per share did the share count already include the unexercised options since they were fully vested or do those only count as outstanding shares once they’ve been exercised?

From 10Q:

Net Income per Share of Common Stock Attributable to Common Stockholders

Basic net income per share of common stock attributable to common stockholders is calculated by dividing net income attributable to common stockholders by the weighted-average shares of common stock outstanding for the period. Potentially dilutive shares, which are based on the weighted-average shares of common stock underlying outstanding stock-based awards, warrants and convertible senior notes using the treasury stock method or the if-converted method, as applicable, are included when calculating diluted net income per share of common stock attributable to common stockholders when their effect is dilutive.

tivoboy

Active Member

My OEM channel checks are showing similar.. we’re getting down to a pretty small supply of a LIMITED number or specific chips. At the big OEM I have connections with, they say regular production will be able to resume prior levels by End of Q1’22 due to supply regaining prior levels or having sought alternatives in some cases.Quick update on the semiconductor shortage from my neck of the woods.

Nothing makes sense. We’re a big purchaser of all the typical modern workplace products. They’re really hard to get. Months long waits for not a small company.

We’re exploring hardware options for a new product. All the same chips we’re starved for are abundantly available on other equivalent boards.

Like, we found a board that’s more capable for a new product we’re developing than we need. And it’s cheaper. And it’s available in volume. And it shares the same Amlogic chips we’re backlogged on right now.

My best guess is there’s artificial scarcity on top of organic scarcity. Overbuying.

Buckminster

Well-Known Member

SP 1 day ago - 966

SP 1 week ago - 994

SP 1 month ago - 1109

SP 1 year ago - 646

SP 10 years ago - 5.58

SP now - 1020

SP 1 week ago - 994

SP 1 month ago - 1109

SP 1 year ago - 646

SP 10 years ago - 5.58

SP now - 1020

Knightshade

Well-Known Member

I just noticed not all the tranches have wested. When updating my spreadsheet to account for that it looks like it is only 1.5 million shares left for him to exercise, should be done in one day.

Yeah the last one requires consecutive margins >30% for 4 quarters.

It remains unclear last I knew if that requires JUST auto margins that big (in which case he technically has a shot to still earn that last tranche if Q4 as well as Q1/Q2 2022 are >30% as Q3 was) or company-wide margins in which case he does not.

Spiegel seems to have time to reply on every tweet

I mean what else does he have to do? Surely people stopping giving him money to manage years ago right?

Creekstalker

Member

https://twitter.com/DKurac

https://twitter.com/DKurac

This seems wrong to me but might explain the drop in premarket?

Moneyball

@DKurac

·

10m

Tesla #China Nov production: 35,428 Model 3: 25,202 Model Y: 10,303 (GASGOO)

Same account posted the following a few days ago:

Tesla #China Nov production: 56,965. (CPCA via 163)

https://twitter.com/DKurac

This seems wrong to me but might explain the drop in premarket?

Moneyball

@DKurac

·

10m

Tesla #China Nov production: 35,428 Model 3: 25,202 Model Y: 10,303 (GASGOO)

Same account posted the following a few days ago:

Tesla #China Nov production: 56,965. (CPCA via 163)

6 months ago TSLA (we were, since _we_, as stock holders are a part of Tesla) were at ~$600/share

TSLA has gone up 2/3 to $1,000/share, (yes it hit $1,200) drifted up and down a trifle (imagine calling $100's a "trifle" once upon a thyme)

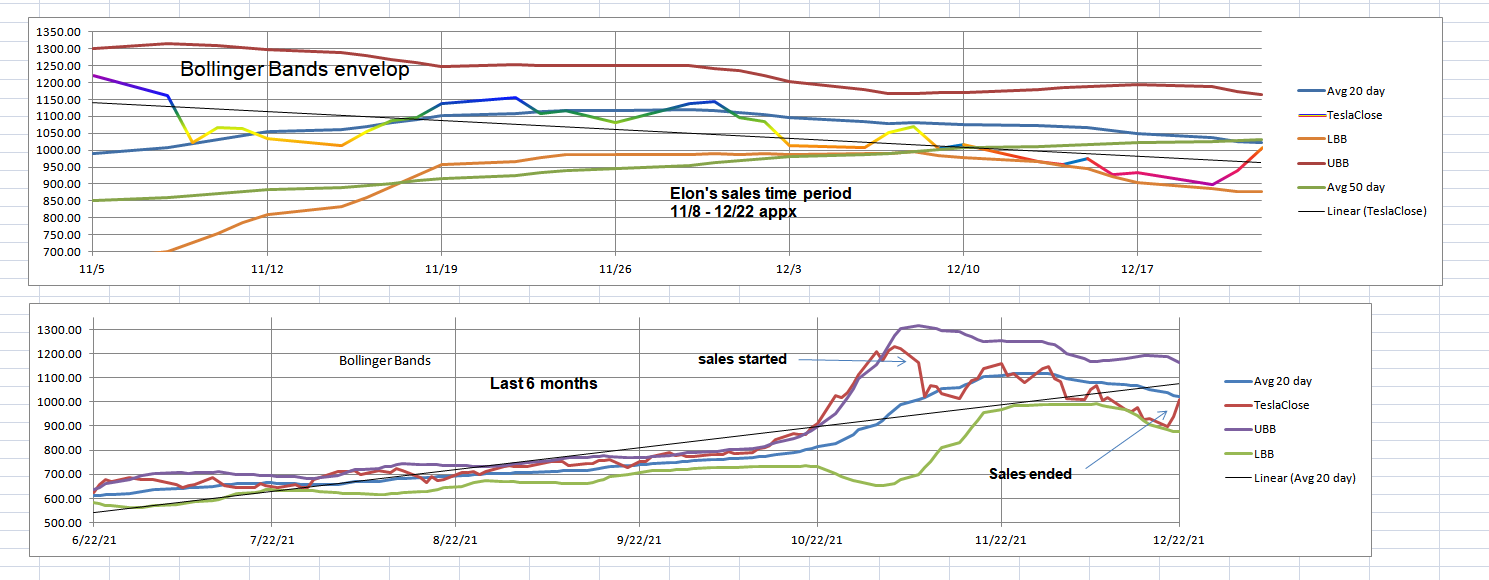

to give perspective, the first graph is the last 6 weeks, the 2nd graph is the last 6 months, the long term linear regression trend line is UPwards

Merry Christmas, Happy Holidays, Happy Solstice, happy "any excuse for an all inclusive party"

TSLA has gone up 2/3 to $1,000/share, (yes it hit $1,200) drifted up and down a trifle (imagine calling $100's a "trifle" once upon a thyme)

to give perspective, the first graph is the last 6 weeks, the 2nd graph is the last 6 months, the long term linear regression trend line is UPwards

Merry Christmas, Happy Holidays, Happy Solstice, happy "any excuse for an all inclusive party"

S

Sofie

Guest

Drop in premarket? Looks good to mehttps://twitter.com/DKurac

https://twitter.com/DKurac

This seems wrong to me but might explain the drop in premarket?

Moneyball

@DKurac

·

10m

Tesla #China Nov production: 35,428 Model 3: 25,202 Model Y: 10,303 (GASGOO)

Same account posted the following a few days ago:

Tesla #China Nov production: 56,965. (CPCA via 163)

Don't count on it, the whole market might start the supposed 'Santa Clause rally' today (or continue it from yesterday) which is supposed to last into early Jan.Drop in premarket? Looks good to me

I'm watching $1020 as a support level today and Max Pain is showing that $1100 might be target today as there is a higher wall. This post may not age well though

Artful Dodger

"Neko no me"

TSLA Pre-Market Quotes

Data last updated Dec 23, 2021 09:30 AM ET.This page will resume updating on Dec 27, 2021 04:00 AM ET.

| Consolidated Last Sale | $1,006.22 -2.65 (-0.26%) |

|---|---|

| Pre-Market Volume | 924,269 |

| Pre-Market High | $1,027.94 (04:50:34 AM) |

| Pre-Market Low | $1,004 (09:29:39 AM) |

Note that we did not reach the 50 day moving average in the Pre-market, but are now seeing some selling pressure at the Mid-BB. Let's see how much buying interest appears in this last session before Christmas.

Cheers!

Last edited:

TheTalkingMule

Distributed Energy Enthusiast

Certainly doesn't look like MM's are gonna hold $1000, the algos are making an effort but volume is too high. Maybe they fall back to $1020. I doubt a mega-capitulation to $1100 is in the cards today, or even the larger $1050 call wall.Don't count on it, the whole market might start the supposed 'Santa Clause rally' today (or continue it from yesterday) which is supposed to last into early Jan.

I'm watching $1020 as a support level today and Max Pain is showing that $1100 might be target today as there is a higher wall. This post may not age well though

I was not clear in my request ... this request is to celebrate the end of the Elon selling obsession not ATHDon't cheapen the @Curt Renz brand. Those strike up the band moments are special and occur when ATH is reached. They are worth the wait.

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Replies

- 6

- Views

- 5K

- Replies

- 6

- Views

- 11K

- Locked

- Replies

- 27K

- Views

- 3M