You'll be here all week? (CueLook, I'm not making any allegations here, but if I were a company with a crumbling growth narrative and my stock price had been pummeled by 70% in the last few quarters and I had a vaporware concept car that I desperately wanted investors to believe was coming out soon, posting a bunch of job openings for producing the car is *exactly* what I'd do to try to trick the market. Do we know anyone who has actually gotten hired for these roles? No? That's what I thought.

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

MartinAustin

Active Member

Who has seen the Cybertruck's massive windshield wiper moving, and been able to see how much of the glass it can sweep clean? Skip to the Cybertruck Windtunnel Test section of this video at 13min:

I would like to think Tesla is way past wind tunnel “testing” Cybertruck. Maybe this is for promotional (not advertising!) and/or web site videos as it moves ever closer to initial production.

Fred42

Active Member

a la Credit Suisse?Rawlinson's smooth accent can't help this dumpster fire anymore. Saudi's will have no choice but to buy them out.

MC3OZ

Active Member

When I watched the video it looked like they were testing the windscreen wiper.I would like to think Tesla is way past wind tunnel “testing” Cybertruck. Maybe this is for promotional (not advertising!) and/or web site videos as it moves ever closer to initial production.

So it seems to be about how well it wipes the screen in high winds... (or when travelling fast)

They might be making small changes to the wiper design between tests, or testing a few candidates.

Yep, except that the oft quoted >$2 million price is low volume with installation.so….10-11 a day = 900-1000 a quarter run rate @ $2 million+ each (plus installation etc). $2 Billion+ quarterly revenue run rate already (and presumably increasing).

Energy revenue is going to surprise some people next week

Units alone are roughly:

1.7-1.8 million at quantity of 1

1.6-1.7 million at quantity of 100

Order Megapack

So, Tesla semi is costing about $250,000 each these days. Not bad. This is a great article, Btw.

Maybe seeing how much the wind affects that big wiper surface. If it affects range (seriously when its down could have impact). And if the wind affects its function at speed? When you make something 12+ inches longer than everyone else's it's possible there are side effects other than internet whining.When I watched the video it looked like they were testing the windscreen wiper.

So it seems to be about how well it wipes the screen in high winds... (or when travelling fast)

They might be making small changes to the wiper design between tests, or testing a few candidates.

Also... whether it knocks down drones or small aircraft. /s

Rob was talking about that. It's not clear if this was the actual cost or just due to the specific grant/ program. Possible Pepsi actually paid more.So, Tesla semi is costing about $250,000 each these days. Not bad. This is a great article, Btw.

Edwards said the use of the state and federal grants was helping PepsiCo move at a more rapid pace to make the transition to non-polluting vehicles. PepsiCo received a total of $15 million in state and local grants for the vehicles and charging infrastructure in both Sacramento and Modesto, plus $40,000 per vehicle from the federal government.

Note the article talks about how much in grants were received, not how much total was spent on the trucks.

For the moment it was very much in Pepsi and Tesla's best interest to get semis on the road and in the public eye. They might cost $1m actual and Pepsi and Tesla would still do it with each covering part of the total cost. Both are enjoying a lot of fantastic PR.

The language in the article is unclear. It arrived at $250k by dividing grant total by the number of trucks. I can’t see a public grant paying 100% of the cost for a big corporation like Pepsi to buy semis.So, Tesla semi is costing about $250,000 each these days. Not bad. This is a great article, Btw.

My guess is the grant covered $250k per truck and Pepsi paid the rest.

I do think actual cost will be in the $250k to $300k range when mass production kicks in

It's what advertisement dollars will buy you. Autoline commented that Lucid and Rivian built quality are trash like Tesla early years. No one is saying a thing on MSM. So like I said, advertisement buys MSM off. It's almost like their tactic to get more revenue. If you don't advertise then they will anti-advertise so they can generate revenue the same with views vs with ads. So either Tesla lose sales on salacious misinformation/over exaggeration or lose money by buying ads. Either way MSM is going to get paid. When tesla's delivery scale was small if may not matter. So now it's a race between Elon trying to destroy MSM before he has to give in on advertisement. This is why he hates them so much because of their BS mafia style tactics.View attachment 928183

Headlines for Lucid when you look up their stock ticker on Yahoo Finance, no mention of:

View attachment 928185

Gotta search deep for that, shouldn't that be the first headline??

Last edited:

GhostSkater

Member

Are you saying there is more demand than there is production at current prices? If that statement is true, why is there a need to reduce prices? Two things happen when there is a lot more demand than there is production - you see backlog that extends to many months, and to reduce the backlog Tesla increase prices and we have seen this in the past. And the opposite happens when demand is less than production at current prices - backlog goes down and Tesla then reduces prices. We have seen this too.6 month wait in Thailand. I talked with a rep in Bangkok yesterday. So there goes your "anywhere" argument.

I am not saying there is less demand because there is a better product out there OR that there is competition for Tesla. My only point is that because of higher interest rates, weak macro economic conditions, increase in production capacity and probably for many other reasons, Tesla at this point in time has more production than demand and is having to reduce prices. Macro is not something that Tesla can control. So it is what it is. ASP in Q4’22 was 52K. My guess for ASP in Q123 is going to be around 48K or less. I am not criticizing Tesla in anyway. I was saying instead of doing only one thing (which is to cut prices), Tesla should also consider doing other things to generate demand which maybe potentially more cost effective and also they serve to inform people who may not be aware of why a Tesla is 1000 times better than everything else - whether that’s Autopilot, FSD, OTA, more range, better performance, superior charging network or so many other things that make Tesla such a no brainer.

Why assume that everyone who is in the market for a car knows that Tesla is a far far superior product? Why not spend some money to dispel the myths around EVs, and also show case the unique things that only a Tesla can do? I find it quite strange that so many people continue to choose BMW, Mercedes, etc. when a Tesla is so much superior in so many ways. How many of those people really know that they are choosing a far inferior product in almost every way (other than maybe better interior material quality)? How many people really know that a Model 3 is cheaper than a Camry when looked at from a TCO perspective? So why not communicate this and generate more demand that way rather than only doing one thing - which is to cut prices? Cutting prices increases affordability, yes, but it doesn’t automatically also convey the facts about why a Tesla is so much superior in pretty much every way, and that there is nothing in the market that even is comparable to a Tesla?

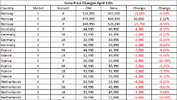

By the way, more price cuts just happened today in many of the European countries once again (not a surprise to anyone who knows the current demand story). Once again, please understand that I am only advocating that informing people via traditional methods is a worthwhile thing to do. The cost of doing so is a lot less and Tesla can exhaust demand at each price point before reducing prices.

Attachments

Last edited:

Zaddy Daddy

Member

I'm sure someone will try to convince themselves that Tesla has just decreased COGS in Berlin by 5-10% to account for this new additional round of price cuts.

How the world has changed in one year. I never thought it imaginable that Tesla Automotive would reach zero growth in earnings so quickly. PE ratio valuation will likely take a hit, down to 30 to 40. Mid $150's might be the share price for a year or so.

How the world has changed in one year. I never thought it imaginable that Tesla Automotive would reach zero growth in earnings so quickly. PE ratio valuation will likely take a hit, down to 30 to 40. Mid $150's might be the share price for a year or so.

Are you seriously that out-of it?I'm sure someone will try to convince themselves that Tesla has just decreased COGS in Berlin by 5-10% to account for this new additional round of price cuts.

How the world has changed in one year. I never thought it imaginable that Tesla Automotive would reach zero growth in earnings so quickly. PE ratio valuation will likely take a hit, down to 30 to 40. Mid $150's might be the share price for a year or so.

Berlin's production is up 40% since the end of last year. Their fixed costs are down massively relative to their production.

No clue what the exact numbers are here, but when production goes up that much, operating margins go up massively. It's called operating leverage.

Are you saying there is more demand than there is production at current prices? If that statement is true, why is there a need to reduce prices? Two things happen when there is a lot more demand than there is production - you see backlog that extends to many months, and to reduce the backlog Tesla increase prices and we have seen this in the past. And the opposite happens when demand is less than production at current prices - backlog goes down and Tesla then reduces prices. We have seen this too.

I am not saying there is less demand because there is a better product out there OR that there is competition for Tesla. My only point is that because of higher interest rates, weak macro economic conditions, increase in production capacity and probably for many other reasons, Tesla at this point in time has more production than demand and is having to reduce prices. Macro is not something that Tesla can control. So it is what it is. ASP in Q4’22 was 52K. My guess for ASP in Q123 is going to be around 48K or less. I am not criticizing Tesla in anyway. I was saying instead of doing only one thing (which is to cut prices), Tesla should also consider doing other things to generate demand which maybe potentially more cost effective and also they serve to inform people who may not be aware of why a Tesla is 1000 times better than everything else - whether that’s Autopilot, FSD, OTA, more range, better performance, superior charging network or so many other things that make Tesla such a no brainer. Why assume that everyone who is in the market for a car knows that Tesla is a far superior product? Why not spend some money to dispel the myths around EVs, and also show case the unique things that only a Tesla can do? I find it quite strange that so many people continue to choose BMW, Mercedes, etc. when a Tesla is so much superior in so many ways. How many people really know that a Model 3 is cheaper than a Camry when looked at from a TCO perspective? So why not communicate this and generate more demand that way rather than only doing one thing - which is to cut prices?

Where did you come up with the idea that prices have been reduced in Thailand? They have not! Trust me, I would know as I obsessively visit the order page waiting for the white interior option to be added to the menu!Are you saying there is more demand than there is production at current prices? If that statement is true, why is there a need to reduce prices? Two things happen when there is a lot more demand than there is production - you see backlog that extends to many months, and to reduce the backlog Tesla increase prices and we have seen this in the past. And the opposite happens when demand is less than production at current prices - backlog goes down and Tesla then reduces prices. We have seen this too.

I am not saying there is less demand because there is a better product out there OR that there is competition for Tesla. My only point is that because of higher interest rates, weak macro economic conditions, increase in production capacity and probably for many other reasons, Tesla at this point in time has more production than demand and is having to reduce prices. Macro is not something that Tesla can control. So it is what it is. ASP in Q4’22 was 52K. My guess for ASP in Q123 is going to be around 48K or less. I am not criticizing Tesla in anyway. I was saying instead of doing only one thing (which is to cut prices), Tesla should also consider doing other things to generate demand which maybe potentially more cost effective and also they serve to inform people who may not be aware of why a Tesla is 1000 times better than everything else - whether that’s Autopilot, FSD, OTA, more range, better performance, superior charging network or so many other things that make Tesla such a no brainer.

Why assume that everyone who is in the market for a car knows that Tesla is a far far superior product? Why not spend some money to dispel the myths around EVs, and also show case the unique things that only a Tesla can do? I find it quite strange that so many people continue to choose BMW, Mercedes, etc. when a Tesla is so much superior in so many ways. How many of those people really know that they are choosing a far inferior product in almost every way (other than maybe better interior material quality)? How many people really know that a Model 3 is cheaper than a Camry when looked at from a TCO perspective? So why not communicate this and generate more demand that way rather than only doing one thing - which is to cut prices? Cutting prices increases affordability, yes, but it doesn’t automatically also convey the facts about why a Tesla is so much superior in pretty much every way, and that there is nothing in the market that even is comparable to a Tesla?

So what does this say about you? It strongly suggests you are a care bear who has more in common with the ill-prepared BBC propagandist who tried to ambush Elon Musk than a real investor doing proper due diligence.

2daMoon

Mostly Harmless

I would like to think Tesla is way past wind tunnel “testing” Cybertruck. Maybe this is for promotional (not advertising!) and/or web site videos as it moves ever closer to initial production.

When Joe Tegtmeyer first spotted the rig he found that it isn't so much a "wind tunnel" as it is a gizmo that creates weather at highway speeds to test things like panel seals, wipers, and similar experiments combining wind and water.

MC3OZ

Active Member

Somehow your posts remind me of the vinyl record, .... I am getting feelings of nostalgia.I'm sure someone will try to convince themselves that Tesla has just decreased COGS in Berlin by 5-10% to account for this new additional round of price cuts.

How the world has changed in one year. I never thought it imaginable that Tesla Automotive would reach zero growth in earnings so quickly. PE ratio valuation will likely take a hit, down to 30 to 40. Mid $150's might be the share price for a year or so.

Earnings will be in a few weeks, I'm not flipping a coin and guessing either way, because I know the odds are exactly that .. a coin toss.

And speaking of being stuck in the groove, I'm the same every earnings call.... so we are both consistent.

I wasn’t referring to Thailand, specifically, which is a brand new market for Tesla. I am referring to overall global prices. I am also not saying Tesla is not a great long term investment- it absolutely is. My only point, once again was that informing people rather than just cutting prices should be considered. Anyway, I will stop this. This is not going anywhere.Where did you come up with the idea that prices have been reduced in Thailand? They have not! Trust me, I would know as I obsessively visit the order page waiting for the white interior option to be added to the menu!

So what does this say about you? It strongly suggests you are a care bear who has more in common with the ill-prepared BBC propagandist who tried to ambush Elon Musk than a real investor doing proper due diligence.

I'm sure someone will try to convince themselves that Tesla has just decreased COGS in Berlin by 5-10% to account for this new additional round of price cuts.

How the world has changed in one year. I never thought it imaginable that Tesla Automotive would reach zero growth in earnings so quickly. PE ratio valuation will likely take a hit, down to 30 to 40. Mid $150's might be the share price for a year or so.

Dude.... there were like 500 people like you on this forum over the last 10 years.

My main concern is not Tesla selling cars but Tesla becoming a monopoly. GM, Ford, VW, Toyota all have insane amount of debt that they are barely capable of servicing now. Legacy auto will be dead without government bailouts. They cannot afford a price war with Tesla. Tesla can and it will be ruthless.

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Replies

- 6

- Views

- 5K

- Replies

- 6

- Views

- 11K

- Locked

- Replies

- 27K

- Views

- 3M