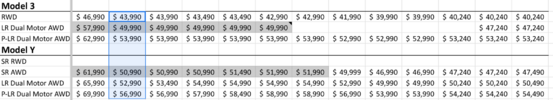

I would be much more optimistic if the price cuts and discounts were that limited. On average, each car sold this quarter is about $4k cheaper than one sold last quarter - I estimated this from the US price cuts; if you have data from other markets that significantly deviates from this estimate, please do share. On 450k deliveries, this results in a $1.8B hit to gross profit, which is 40% of last quarter gross profit and 60% of income before taxes. This has not taken into account the $2k-$3k inventory discounts that Tesla is currently implementing on the Model 3 RWD in the US, but I supposed these are offset by the Berlin and Austin ramp that you brought up. The additional IRA credits amount to, what, $100M this quarter? Small amount relative to the hit from the price cuts.

The long-term implication of the margin reduction is the commoditization of the Model 3 and the Model Y, leading to a lower P/E. Lower earnings and lower P/E mean lower stock price. EPS last quarter was 85 cents, and I believe analyst consensus this quarter is around 80 cents? This is way too optimistic.