Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

FreqFlyer

Active Member

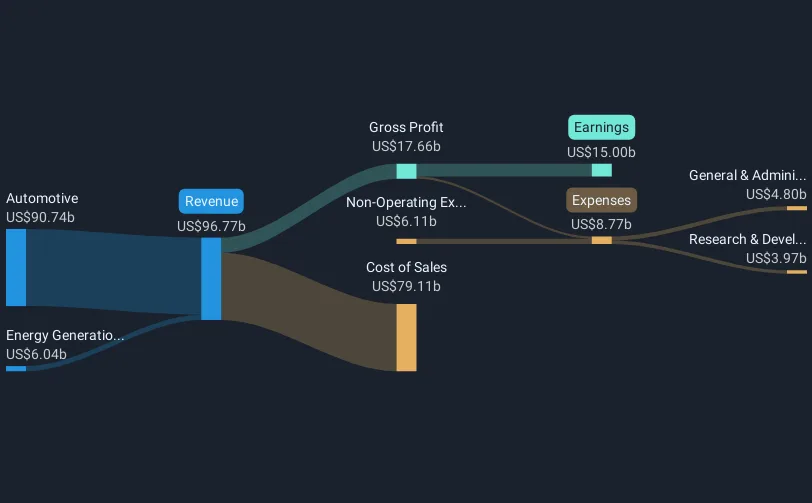

We will see how this chart looks at the end of the year. Energy continues to grow at a rapid pace? Awesome. My point is, looking at Tesla now, it is a car company.

FreqFlyer

Active Member

I thought this happened already. Another round? 22K work in Austin before layoffs. When all is said and done the layoffs will company-wide will be closer to 20% or 25%. Tesla will definitely be leaner.

Holy *sugar*! You gotta be rich as hell right now. Long from 2019-21 and then short? Why aren't you out enjoying your riches?No offense, but I know what's being said. Not just a car company etc etc. I was an investor back in 2019-2021, now I'm shorting the stock. I'm looking at actions, not words.

Cars - no serious volume increase in sight due to no new models being launched. Competition (especially in China) seriously ramping up. But without a serious software component, there's no 450B business in 2024.

Charging network - valuable, but a commodity. Slowing EV adoption slows down revenue growth from supercharging, even without any competition. Essentially you can model their supercharging revenue growth rate by taking new EV sales and applying a correction factor. Someone can probably work it out quite reliably, but it's very low margins since the barier of entry is so low.

Western EV company selling in China - how is that not factored into the price through their sales? Arguably the biggest benefit Tesla is getting out of China is the ability to compete on manufacturing costs with the local manufacturers.

But yes, agree to disagree!

Zaddy Daddy

Member

We will see how this chart looks at the end of the year. Energy continues to grow at a rapid pace? Awesome. My point is, looking at Tesla now, it is a car company.

View attachment 1040941

I think Tesla Energy margins should increase a bit, but hard to see much revenue growth the rest of this year. There will be some from deferred revenue, but Lathrop hasn't expanded 2nd line yet. That means no additional production capacity until 2nd half of this year at minimum, and no increased revenue until 2025 at minimum from it. And Shanghai is now expected to open in Q1 2025, equates to no meaningful revenue from it through most of 2025.

So modeling up to 5 GwH per quarter this year, moving up to 10 toward end of 2025 is sounding more reasonable.

uscbucsfan

Active Member

M3 Performance just went live basically everywhere.

Drumheller

Active Member

uscbucsfan

Active Member

The Canada version says 460hp. Is that normal to have 2 different HP/performance?

I am inherently optimistic, despite all that experience. In a way, because of it. In the worst situations (more than three civil wars during my tenor in odd places, and still can imagine most humans actually want to be better than they appear on the surface. Exacerbating optimism is that superficiality that effectively destroy understanding....

You should know by now, at your mature age, people suck. This thread is a mini version of how the human race moves through its existence. Despite a few bright spots, we are a disgusting species.

Humans seem always to have been like that, or at least Plato and Homer seemed t have thought so.

I still hold on to hope that at least here we can be our better selves.

No doubt, under relentless attacks even Mr. Musk succumbs to less than ideal displays of pique.

My question is whether all this increasing FUD can actually derail objective fact. MY side is not doing well, that I admit.

And Clean Vehicle Credit eligible!

Which makes it cheaper than LR AWD.

Slightly more than Performance Y

Wait... how many times did Gene say "Pressure Point", like about 8 times?Yaay!! Good summary:

Is he under pressure or something?

<Right now I do not have an opinion on the Board's proposal to leave Delaware and reincorporate into Texas, because I don't understand the ramifications. Is there anyone who knows more about this topic?>

Texas is pretty lightly regulated- could being incorporated there help them launch Robo (relative to other states)?

Texas is pretty lightly regulated- could being incorporated there help them launch Robo (relative to other states)?

Buckminster

Well-Known Member

More info here:

The Delaware Chancery Court reorganization effectively destroyed their advantage. OTOH, betting on a new State without an established record and with a distinctly negative attitude towards Tesla from the rarely meeting Texas legislature. That move is done without anything offered from Texas to ameliorate business conduct, specifically sales. That seems odd. Leaving Delaware is simply part of the continuing corporate flight. With a legislature intellectually dominated by auto dealers, is that a wise bet?From what I've read here, Texas is a wild card as they are just now starting to position themselves in league with traditionally preferred states like Delaware (formerly) and Nevada as choice locations for businesses to incorporate.

Texas has yet to prove themselves over time with support of legislators and courts toward providing a safe haven for incorporated businesses.

Boring Co reincorporated in Nevada earlier this year, SpaceX reincorporated in Texas around the same time.

It is curious what led to the choice of Texas for SpaceX and Tesla, other than goodwill towards the state in the hope of reciprocation should push come to shove in the courts. It seems more like a bet more than a strategy, but, is likely still a better wager than either of these companies staying in Delaware.

There is every chance that Texas could earn business-friendly status for incorporation over time.

The blush is off the rose for Delaware, and I expect their time-honored reputation has been irreparably tarnished.

Didn't someone mention recently that if this was the news today, the stock would dump?

No comment, just observing.

FreqFlyer

Active Member

FreqFlyer

Active Member

146.75Didn't someone mention recently that if this was the news today, the stock would dump?

No comment, just observing.

2daMoon

Mostly Harmless

Are you actually serious?

It's very naive to think that anyone would try to influence the market by going on a forum.

It isn't naive to think that anyone would try. "Try" being the operative word. Certainly some would try to do this for any of a number of reasons.

It may be somewhat naive to think that any significant affect on the SP (influencing the market) would result, but that wouldn't be the goal. The goal would be to shake shares from weak hands so fewer synthetic shares are needed to support a campaign of shorting a stock. This a short-term play that doesn't require any significant stock price moves, only daily nudges in one direction or the other.

Having access to any actual shares will always be better than not. And, what is the cost to fund trolling campaigns across a variety of platforms to inspire fear, uncertainty, and doubt in a few of those persons managing an investment?

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Replies

- 6

- Views

- 5K

- Replies

- 6

- Views

- 11K

- Locked

- Replies

- 27K

- Views

- 3M