Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

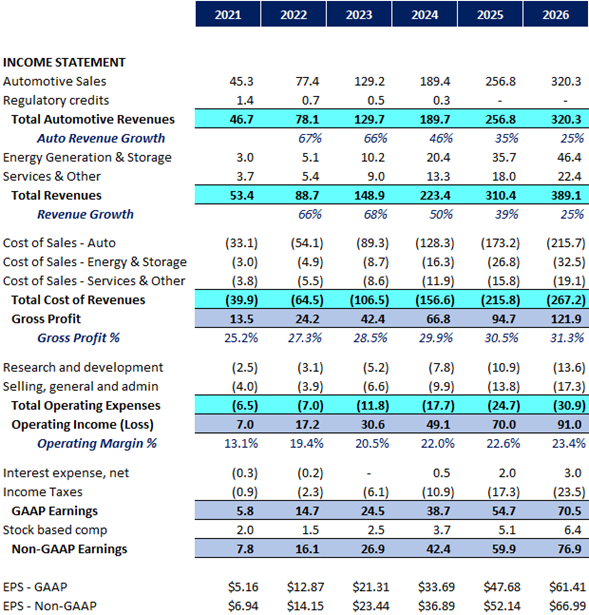

Tesla Valuation Based on 5 Year Outlook

- Thread starter The Accountant

- Start date

7/8 (Financials)

- I assume no Robo-Taxi

- I assume no recognition of FSD Deferred Revenue (to keep things clean)

- I assume no recognition of the Deferred Tax Benefit (to keep things clean)

- I assume no revenues from AI products (robots, etc).

- I assume no Robo-Taxi

- I assume no recognition of FSD Deferred Revenue (to keep things clean)

- I assume no recognition of the Deferred Tax Benefit (to keep things clean)

- I assume no revenues from AI products (robots, etc).

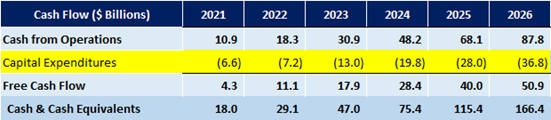

8/8 (Free Cash Flow & Cash Balance)

Artful Dodger

"Neko no me"

Tesla will likely have over $165B in cash by 2026

Wow, that's roughly $140/share in cash on hand (presumably with zero debt) by 2026, even considering healthy levels of dilution for employee SBC.

Does that $140 per share just get added to the share price estimate? How are cash reserves valued by the Market? TIA.

Cheers!

Last edited:

I suspect that the ASP for the Cybertruck will probably be much higher in 2023. With only the quad motor version shipping at first, which is $79k if I recall correctly. (And that assumes that they don't raise the price from the tri-motor variant.)4/8 (Auto Average Selling Price and Cost per Unit)

View attachment 756627

petit_bateau

Active Member

For normal companies they just get fed straight through to the share price (mkt cap) on a 1:1 basis.Wow, that's roughly $140/share in cash on hand (presumably with zero debt) by 2026, even considering healthy levels of dilution for employee SBC.

Does that $140 per share just get added to the share price estimate? How are cash reserves valued by the Market? TIA.

Cheers!

jeewee3000

Active Member

7/8 (Financials)

- I assume no Robo-Taxi

- I assume no recognition of FSD Deferred Revenue (to keep things clean)

- I assume no recognition of the Deferred Tax Benefit (to keep things clean)

- I assume no revenues from AI products (robots, etc).

In my mind this translates to "these numbers are conservative".

I think I speak for many when I say: thank you @The Accountant for your hard work and intelligent insights. Even though I know very little of accounting and financial reports, I've read and even studied your posts in great detail and have learned so much.

new_sneakers

Member

Just posting Steven Mark Ryans's model from his recent video (

) here, as a table, for posterity.

Solving the Money Problem - Tesla model

Solving the Money Problem - Tesla model

| Year | Bear Case (6% chance) | Base Case (60% chance) | Weighted Average | Bull Case (30% chance) | Hyperbull (small chance) | Catalysts |

| 2022 | 1302 | 1713 | 1998 | |||

| 2023 | 2147 | 3445 | ||||

| 2024 | 2976 | 5005 | 1st robotaxi fare, Semi | |||

| 2025 | 3910 | 7906 | Dojo as a service, FSD licensing, Tesla Bot | |||

| 2026 | 4690 | 9946 | $25000 Tesla, half of new vehicles electric: ICE vehicle sales collapse | |||

| 2027 | 5761 | 12917 | 12917 | Insurance annual profits 0.5 billion, Tesla delivers 10+ million vehicles | ||

| 2028 | 16152 | AGI, progress with TeslaBot, gigantic fleet of subscribers to FSD | ||||

| 2029 | 8436 | 21332 | Deliveries of 12-13-14+ million, 0.25 trillion profit | |||

| 2030 | 9930 | 27201 | 15 million vehicles, hundreds of billions of profits, bankruptcy/collapse of other automakers | |||

| 2031 | 11476 | 33659 | 20 million vehicles, fleet of 80+ million, most paying for FSD subscriptions. Not including profits from Robotaxi service |

Olle

Active Member

Interesting to go through this thread and see how the price predictions have changed over the years. To take SMR's example above, in pre split price, TSLA maxed $1085 in 2022 and $880 in 2023. Short of even his bear case for both years, not by a huge amount, but still.Just posting Steven Mark Ryans's model from his recent video () here, as a table, for posterity.

Solving the Money Problem - Tesla model

Year Bear Case

(6% chance)Base Case

(60% chance)Weighted

AverageBull Case

(30% chance)Hyperbull

(small chance)Catalysts 2022 1302 1713 1998 2023 2147 3445 2024 2976 5005 1st robotaxi fare, Semi 2025 3910 7906 Dojo as a service, FSD licensing, Tesla Bot 2026 4690 9946 $25000 Tesla, half of new vehicles electric: ICE vehicle sales collapse 2027 5761 12917 12917 Insurance annual profits 0.5 billion, Tesla delivers 10+ million vehicles 2028 16152 AGI, progress with TeslaBot, gigantic fleet of subscribers to FSD 2029 8436 21332 Deliveries of 12-13-14+ million, 0.25 trillion profit 2030 9930 27201 15 million vehicles, hundreds of billions of profits, bankruptcy/collapse of other automakers 2031 11476 33659 20 million vehicles, fleet of 80+ million, most paying for FSD subscriptions. Not including profits from Robotaxi service

petit_bateau

Active Member

A lot depends on how one expects GM% to develop. The below is assuming max success case in both automotive & storage revenue, with GM% held flat at 18% in both for next 18m, then climbing dramatically to 28% from c.2025 onwards. As you can see it is only from 2025 that EPS really convincingly regains and exceeds the 2022 EPS.Interesting to go through this thread and see how the price predictions have changed over the years. To take SMR's example above, in pre split price, TSLA maxed $1085 in 2022 and $880 in 2023. Short of even his bear case for both years, not by a huge amount, but still.

So rationally the recent past and near term future should be relatively depressed share prices. The rational-perfect-foresight NPV valuation detects that in advance. PE or PEG driven valuations much less so. Always with Tesla share price the exciting time is two years away, or yesterday.

Similar threads

- Replies

- 9

- Views

- 606

- Replies

- 16

- Views

- 583

- Replies

- 8

- Views

- 1K

- Replies

- 97

- Views

- 5K