+1, but as an explanation: meanwhile people have become much more skeptical about the future of EVs (much more because of Leaf and Volt than because of Tesla). Tesla's present situation cannot yet counteract that.

A valid point.

I am new to investing, but I would imagine the reason its not 30+ is because of the delays. While its out of Tesla's hands, delays are delays. So people are playing the caution game I think.

Morgan Stanley, after release of 2nd quarter 2012 TM report predicted that TM will deliver 230 cars in Q3 and 2000 cars in Q4. Tesla outperformed Q3 prediction by delivering "over 250" cars:biggrin::wink:

Generally delays are priced into shares already. But they do not matter much. I mean will TM produce #5000 car by the end of this year or that would be delayed by 3 months (end of March 2013) dose not matter because that would indicate problem with production, as an opposite to demand constrained problems companies usually face. And Tesla production rate/supply chain problems will be fixed eventually.

Basic fundamentals that affect price, will Tesla get 200 millions or 400 millions gross margins next year? Will they produce 15,000 or 25,000 cars next year? Will gross margin percentage be 10% or 25%?

Depends on how we look at it, worst case scenario (15,000 cars, $65k unit price on average, 10% gross margin) is ~

100M, best case (25,000 cars, 75k unit price, 25% gross margin) is

468M.

Current delays in production rate could be compensated by increased production rate in second half of 2013. There would be more then enough time to do it. AS LONG AS THERE IS DEMAND.

Now we can estimate earnings. It is rather realistic to expect that TM would be able to get 150M in 2013. With P/E around 20 that would justify share price of $26.54. P/E around 40 would give us $50+, and P/E 10 will justify $13 price per share. You can do the math for 200M or 300M.

Anyhow, dividends wont happen - I would expect CAPEX for year 2013 to be around 250M. Plus R&D expenses still growing. Etc. But by looking at Q1 2013 report, investors will get the idea of what gross margin percentage realistically reachable for TM. And another huge question, is there a continuous demand for Model S? That would be answered(to some degree) by number of reservations tracked here, on TMC site...

Sure, this is still oversimplification, you have to look beyond 2013, and even beyond 2014 to properly estimate fair value of the stock. But most crucial question marks will be answered in several months time frame. That would be demand and gross margin questions, not production rate.

My back of envelope calculations say that we will hit Morgan Stanly and Maxim Group $50 price target after Q1 report release(April 2013). Lots of assumptions here, so more like educated guess

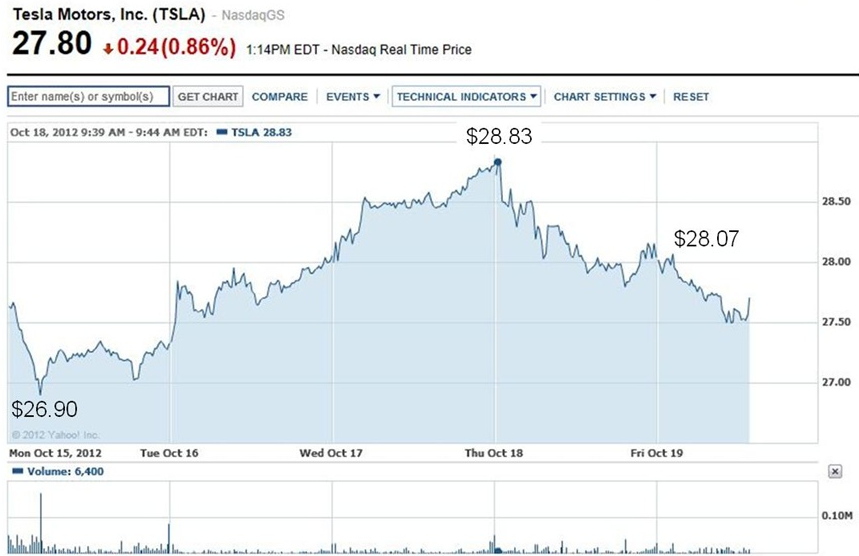

As for short term fluctuations, it is all randomness. This or that fund decided to sell out or buy half a mil or million shared

today... Barely connected to published news, but sure news to a degree create some downward or upward pressure.

Just my humble opinion:redface:

PS. Positive cash flow in November was a very bold prediction Elon Musk made.