As long as VW/Ford/Daimler/Toyota/GM are still making DOZENS OF BILLIONS OF DOLLARS IN PROFITS, selling gasoline cars, we're far from the end.

While technically true, there's three major flaws in this line of argument:

1)

The problem with ICE automotive are the profit margins, which are atrociously low at 6%, which makes them fragile to even small fluctuations in demand.

I.e. they are only making 'dozens of billions of dollars in profit', because they have an even higher revenue base.

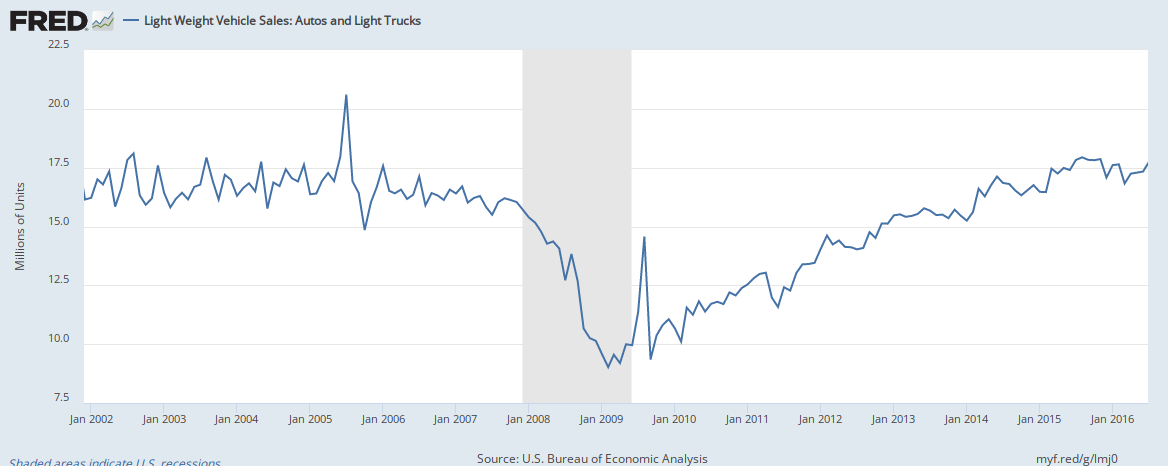

A comparatively small drop in demand can cripple them - as it did around 2009 when every U.S. car companies went bankrupt, except Ford and Tesla, because consumers mostly

voluntarily reduced their consumption due to economic uncertainty and deleveraging:

And that was a temporary drop in demand everyone knew would recover within a couple of years - while the EV related drop in demand is going to be permanent, it's never going to recover once gone. 90%+ of the customers who buy Teslas never buy an ICE car, ever again.

2)

But it gets worse: to ICE carmakers every EV sale made is a lost ICE sale. So by converting to EVs they lose the profits from their highly optimized ICE products unexpectedly early, years before expected end of life, reducing margins and forcing eventual write-offs.

This creates a catch-22 problem: they rely on ICE sales and profits for their valuation and for the continuation of their business, but by reducing ICE sales they lose valuation. There's a lag of at least 3-5 years before they can mass-manufacture the entirely new technology - during which time they are exposed to the drop in demand, drop in valu

3)

ICE carmakers are new to the EV world, it's a largely new industry to them, where they don't know how to scale up and don't want to scale up due to problems #1 and #2.

So even if they enter the "we have to build EVs" phase, just about now, they are in a fundamentally disadvantageous position not just competitively but from a fundamental business model point of view.

And they cannot just change the business model, unless they are willing to write off hundreds of billions of dollars of ICE equipment within the next couple of years. So the only path they have forward is an expensive, painful 'conversion' and dual-technology ICE/EV manufacturing process - which might or might not work out in the end, plus they have to hope ICE demand doesn't deteriorate.