Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

- Status

- Not open for further replies.

Mike Smith

Active Member

Today is a battle between profit takers on the one side vs. short coverers and buyers who have been waiting for a pullback on the other. I'm pretty sure there are not only a lot more of the latter, but the profit takers would have acted sooner in the day.

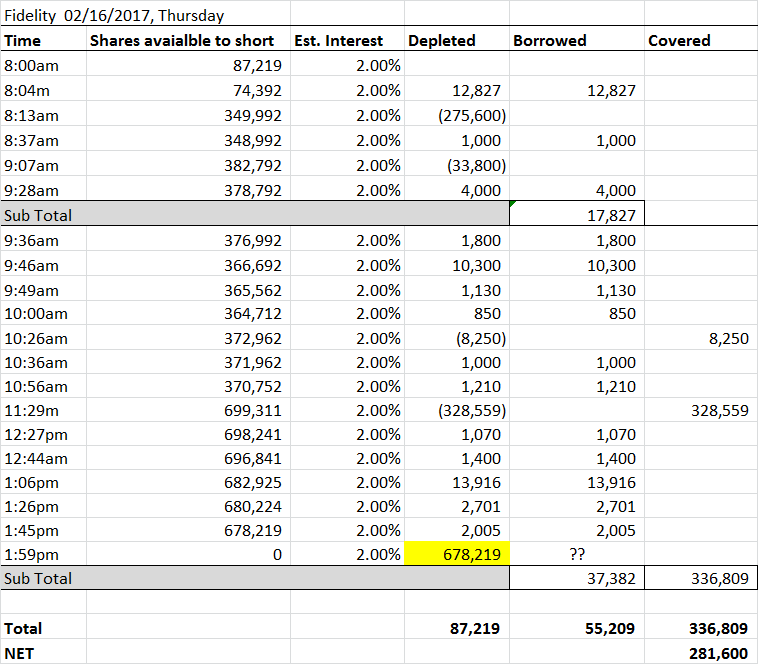

Wow! Do not know what to make of it - in a span of 14 minutes shares available for shoring at Fidelity went from 678k to 0. I can't see so many shares shorted between the 1:45pm and 1:59pm. So either these shares are borrowed and shorting orders are made based on conditions that are not met yet (i.e. so many short cell shares are in the pipe line and could execute later today) or Fidelity for some reason decided to limit shares available for shorting (to 0).

Thoughts?

Thoughts?

Waiting4M3

Active Member

Longs are getting too spoiled lately. It's good to have a dose of reality once a while. I'm fine if it settles into a $270-$275 channel until ER. What do people expect to happen? TSLA isn't going to be $300 in February.

How does Feb-22 lay out on that chart? Bottom of channel at 272-ish?

Last edited:

Vis Fly on The Wall:

UBS put out a note earlier today in which it questioned the fundamental case for the run-up in shares from late November 2016. Price was last at $272.96, down over 2.4% on the day. At that price next support is at $269.23. A move to or below that level would break the uptrend. Resistance is at the $275 area.

Same analyst that make this before M3 revealing last year: UBS continues to say sell Tesla ahead of upcoming Model 3 launch

If someone refused to follow its "fair" analyse and bought Tesla stocks instead, they were, yesterday, gaining almost 100% against his $140 per stock action valuation he made almost one year ago...So, this guy is a "good" bearish analyst who has been constantly working against Tesla and for somebody else than UBS...

-$11 is a pretty significant break for a day with absolutely no news.

The news is once more a "super accurate" valuation of Colin Langan UBS analyst...

Nate the Great

Member

KnowLittle

Member

Wow! Do not know what to make of it - in a span of 14 minutes shares available for shoring at Fidelity went from 678k to 0. I can't see so many shares shorted between the 1:45pm and 1:59pm. So either these shares are borrowed and shorting orders are made based on conditions that are not met yet (i.e. so many short cell shares are in the pipe line and could execute later today) or Fidelity for some reason decided to limit shares available for shorting (to 0).

Thoughts?

View attachment 215115

Here is the IB data -- Looks like lots available right now...

racer26

Active Member

I wouldn't be so sure. If ER has sufficient TE surprise, TM margin surprise, and M3 guidance/progress? It could easily pop +$10-20 on ER. That would put us in spitting distance.Longs are getting too spoiled lately. It's good to have a dose of reality once a while. I'm fine if it settles into a $270-$275 channel until ER. What do people expect to happen? TSLA isn't going to be $300 in February.

Remember - this close to ATH, basically every short is underwater. There is a limit to how much further it can go without triggering the avalanche of margin calls and going parabolic.

Last edited:

How does the Feb-22 lay out on that chart? Bottom of channel at 272-ish?

You can play with the chart here:

http://demo.chartiq.com/widgets/2.0/portal2.html?page=chart

If anyone wants to embed an interactive chart somewhere (not free), ping me

larmor

Active Member

Even positive ER and continued YOY growth has hardly moved the needle for tesla. Definitely needs a surprise TE, and/or M3 appearance and perhaps more info on solarcity--where did it go?

Waiting4M3

Active Member

I would be more than happy if that turns out to be the case. At the end of Dec many were hoping for a delivery beat but I voted for the 22-23K delivery. I just like to temper my expectations.I wouldn't be so sure. If ER has sufficient TE surprise, TM margin surprise, and M3 guidance/progress? It could easily pop +$10-20 on ER. That would put us in spitting distance.

Remember - this close to ATH, basically every short is underwater. There is a limit to how much further it can go without triggering the avalanche of margin calls and going parabolic.

Q4 ER could well also be disappointing, I don't think the car revenue will hurt us since the lower delivery # is already known. In my mind the worst case would be that the late Feb shutdown for M3 pre-production is actually more of a prototype build of <50 cars, and the delay was longer than the 7-10 days because they ran into some issues, so Q1 production is scaled back, and they have some rework to do on the M3. I think right now the expectation for TSLA going forward in 2017 is very high, especially w.r.t. M3, anything that is slightly vague can be construed as potential bad news. Just look at how some people read into it when Elon used the word "maybe" when he described M3 production start at the Abu Dabi event. I'm really hoping they at least announce the M3 Pt3 date at the ER. 400K reservations means a lot of people anxiously waiting, and if there is any perception of delay, the word-of-mouth impact can be huge in the negative direction too.

Even positive ER and continued YOY growth has hardly moved the needle for tesla. Definitely needs a surprise TE, and/or M3 appearance and perhaps more info on solarcity--where did it go?

I'm not so sure about that. I think a decent part of this run up was a delayed reaction to Q3 results, where a few big players waited for the uncertainty with the merger and the election to dissipate before re-entering due to Q3 improvements and gigafactory and Model 3 progress coming shortly.

Runarbt

Active Member

Even positive ER and continued YOY growth has hardly moved the needle for tesla. Definitely needs a surprise TE, and/or M3 appearance and perhaps more info on solarcity--where did it go?

Nah.. a positive ER and YoY 50% growth will eventually have an impact on sp.

-$11 is a pretty significant break for a day with absolutely no news.

Unless:

Can An Idea Known As 'Maximum Pain Theory' Make You Money?

(Max pain friday is 270...)

racer26

Active Member

Didn't see anybody mention it in here. Elon tweetstorm about Dad jokes? Seems like he's in a good mood again...

Didn't see anybody mention it in here. Elon tweetstorm about Dad jokes? Seems like he's in a good mood again...

The most significant news I've seen on $TSLA in weeks!

.

Does it mean SP will likely spring back up next week?

PS: Next week, we have earnings call which could swing the SP further

Does it mean SP will likely spring back up next week?

PS: Next week, we have earnings call which could swing the SP further

- Status

- Not open for further replies.

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Replies

- 6

- Views

- 5K

- Article

- Replies

- 29

- Views

- 6K

- Replies

- 1

- Views

- 866