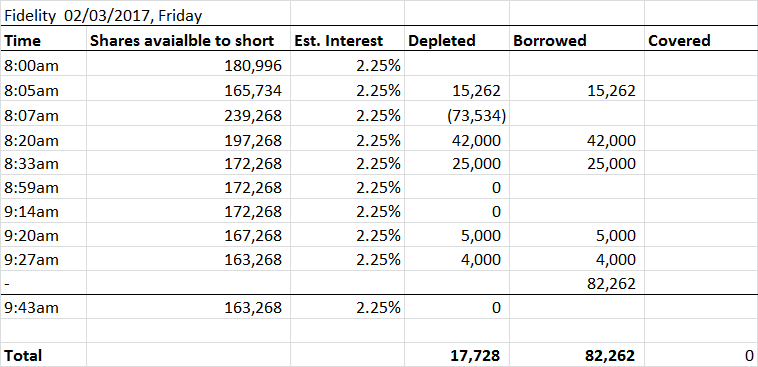

There was significantly less shares borrowed pre-market today as compared to yesterday: 82k vs. 130k. Not much appetite from the short sellers... Interest rate remains at 2.5%.

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

- Status

- Not open for further replies.

neroden

Model S Owner and Frustrated Tesla Fan

That affects the cash flow, not the earnings.

There is a possibility that the market is only looking at the cash flow and not at the earnings, in which case an earnings beat won't have any positive effect. But I do think there will be an earnings beat.

I'm thinking guidance, M3 schedule tidbits, details on SCTY finances and plans, TE surprises, that sort of thing during ER will swing SP more so than a slight EPS profit or loss... Yeah, they have to have a lot of capex for M3 and gigafactory, and people know that.

T3slaTulips

Member

It's running very slowly.I am having trouble accessing maximum-pain.com. Anybody able to see what is max. pain today?

I used to work at Qualcomm, and watched the stock price closely back then. (Not as much as I watch TSLA now...) Anyway, QCOM would often beat the average Wall St estimates for growth, revenue and income, and then the price would drop the next day, because "The market already priced in a beat, and they didn't beat enough". I don't know what the market in general thinks about TSLA at the moment, but hopefully not that. I expect a beat, myself, but still have no idea what the stock will do.

it just hangs....I am having trouble accessing maximum-pain.com. Anybody able to see what is max. pain today?

T3slaTulips

Member

Crap, I refreshed and then noticed the table had filled in but the chart wasn't done. Waiting again....it just hangs....

Interest rate remains at 2.5%.

Is the interest rate 2.25% like you show in the chart or 2.5% like you said above the chart?

T3slaTulips

Member

My bad - it was 2.25%, and now dropped to 2.0%, with 0 shares available for shorting at Fidelity at 10:22amIs the interest rate 2.25% like you show in the chart or 2.5% like you said above the chart?

The average analyst's estimate for Q4 is -0.44/share. The low estimate is -2.13/share, and the high is 0.41/share. Translating by 161.09 million shares, these equate to estimates of

$343 million loss (low)

$71 million loss (average)

$66 million profit (high)

Tesla Q3 net income: $21.8 million

SolarCity Q3 net income attributable to shareholders: $53.1 million

Amount of Powerpack/Powerwall profit assumed by analysts' estimates: $0

It seems extremely likely that Tesla will beat the average analyst's estimate. The high estimate is the plausible-looking one.

When Tesla beats the average analyst's estimate, will the stock go up? Maybe not. But that does happen fairly often in stocks.

P.S. Yes, the delivery miss will cut profits: 2300 cars less than Q3 * $90K ASP * 23% gross profit margin = $47 million down. To make a $71 million loss, SolarCity would also have to fall back into substantial loss though; Musk said he expected it to be at least breakeven. I personally think TSLA wil show a profit in Q4, but even if it shows a loss, I am pretty sure it will beat the average estimate.

Are you pricing in less on ZEVs for Q4?

MitchJi

Trying to learn kindness, patience & forgiveness

What are the chances that they can and will sell off enough SCTY loans to fund M3 cap ex? It sounds like their capital needs are either probably less than you and the market think, or Elon and Jason have been lying on the cc's.@neroden:

Don't forget that there ought to be increased CapEx in 4Q16 (and 1/2Q17 as well).

At some point, if WS doesn't start seeing Tesla spending bags of cash to get ready for Model 3, they're going to react negatively.

If they do that I believe that the combination of not needing a raise plus the complete undoing the theory that the SCTY purchase was a bailout would trigger a nice SP bump.

I used to work at Qualcomm, and watched the stock price closely back then. (Not as much as I watch TSLA now...) Anyway, QCOM would often beat the average Wall St estimates for growth, revenue and income, and then the price would drop the next day, because "The market already priced in a beat, and they didn't beat enough". I don't know what the market in general thinks about TSLA at the moment, but hopefully not that. I expect a beat, myself, but still have no idea what the stock will do.

In those cases, it was a market darling with sky high expectations. TSLA is a dog with low expectations (in the market). So positive results should cause TSLA to trade higher, Q3 2016 notwithstanding (fake! engineered!)

racer26

Active Member

Oh I agree. But WS doesn't and that's the point.What are the chances that they can and will sell off enough SCTY loans to fund M3 cap ex? Their capital needs are probably less than you think, or Elon and Jason have been lying on the cc's.

If they do that I believe that the combination of not needing a raise plus the complete undoing the theory that the SCTY purchase was a bailout would trigger a nice SP bump.

I still think buying SCTY when we did will go down as one of the most brilliant business moves in history.

SCTY looked like a cash burning barrel fire of a company, but in reality it was a company with a large pile (~$4B) of poorly thought out debt, backing a virtually guaranteed future cashflow over the next 20 years of ~$6B, meaning there is $2B in profit or so if you do nothing but just collect the outstanding cashflows.

When TSLA bought SCTY, SCTY's market cap was only right around $2B. - Basically, it was borderline a good idea to simply buy SCTY to close the doors and collect the future cashflows, never mind what the value of being the number 1 solar installer in the US is.

SCTY had some problems because the model was predicated on cheap access to large amounts of capital, and as the banks started to get skittish about solar companies, that made things much harder for SCTY.

TSLA has access to large amounts of cheap capital, fixing that problem. TSLA also has a need for cash now to make M3 and other products happen. That $2B in future profit over 20 years will be mouse nuts to TSLA by then, but could be sold off now for easy money to fund M3, MY, Roadster, Semi, Pickup, etc, instead of doing a debt or equity offering.

In those cases, it was a market darling with sky high expectations. TSLA is a dog with low expectations (in the market). So positive results should cause TSLA to trade higher, Q3 2016 notwithstanding (fake! engineered!)

I agree. IMO back to back positive earnings would be a big positive, since Q3 results were discounted as engineered. If can add in solid information on Model 3 progress and a few other unexpected positives (increased 3/S/X capacity?) could be even better. I have no idea whether we'll see positive earnings though.

racer26

Active Member

FWIW, new North American MX orders are out in May now.

Certainly seems like demand is definitely not an issue.

Certainly seems like demand is definitely not an issue.

MitchJi

Trying to learn kindness, patience & forgiveness

I partly disagree with that statement. I believe that the recent bump would not have happened without the excellent Q3 ER.I agree. IMO back to back positive earnings would be a big positive, since Q3 results were discounted as engineered. If can add in solid information on Model 3 progress and a few other unexpected positives (increased 3/S/X capacity?) could be even better. I have no idea whether we'll see positive earnings though.

- Status

- Not open for further replies.

Similar threads

- Locked

- Replies

- 0

- Views

- 4K

- Locked

- Replies

- 0

- Views

- 6K

- Replies

- 6

- Views

- 5K

- Article

- Replies

- 29

- Views

- 6K

- Replies

- 1

- Views

- 891