Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

2024 Insurance Costs

- Thread starter yessuz

- Start date

Zilla91

Active Member

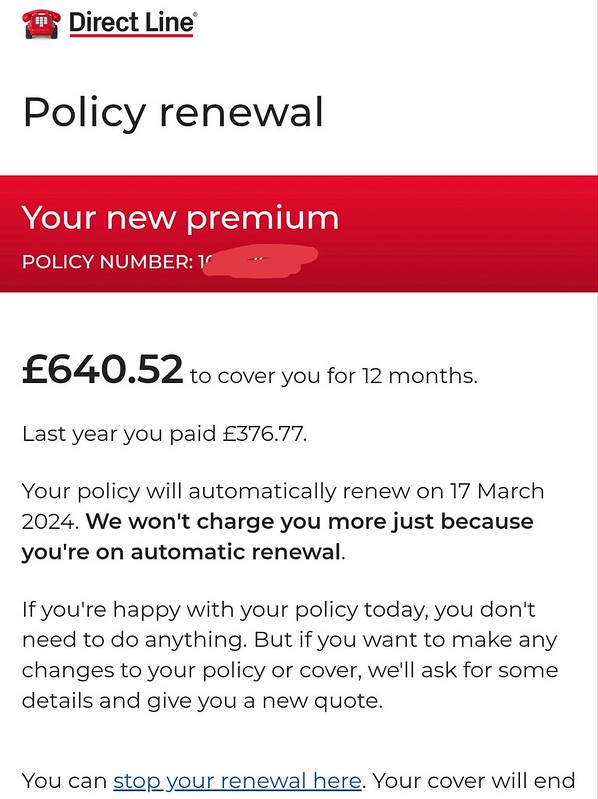

Renewal came in for the M3P, up to 1100 from 660 last year. Direct Line.

Can’t wait for the MYLR renewal next month…

Can’t wait for the MYLR renewal next month…

Zilla91

Active Member

Negotiated down to 930. What a bloody rip off.Renewal came in for the M3P, up to 1100 from 660 last year. Direct Line.

Can’t wait for the MYLR renewal next month…

Cardo

Active Member

21Has anyone worked out the optimum numbers of days to get quotes before the due date?

Pink Duck

Active Member

NewbieT

Active Member

GoldenOne

Member

My previous year was £1700 through DirectLine.

This year they wanted £3000! When asking why the massive increase they said it was because I'd had a claim, which was for a chipped windshield and shouldn't affect NCD or premiums as I understood it but seemingly DirectLine felt otherwise.

Swapped to Admiral at £2200 this year :/

This year they wanted £3000! When asking why the massive increase they said it was because I'd had a claim, which was for a chipped windshield and shouldn't affect NCD or premiums as I understood it but seemingly DirectLine felt otherwise.

Swapped to Admiral at £2200 this year :/

Billionaireboy

Member

Before you finished the call, I hope you were able to ask them how they were able to lower their quote over £700 on the basis of a phone call.I paid £983 for 23/24 with Direct Line - they want £2250 for 24/25. I checked on Go Compare, like for like with Admiral came up to £1060 (with EV Perks) - told Direct Line, they said the best they could do is £1536. I was like "Goodbye"

Recommend checking on Admiral

Legalised scamming. We need a regulator with some teeth in this country.

More regulators? They are a complete waste of paper and serve nothing but their so called members.Before you finished the call, I hope you were able to ask them how they were able to lower their quote over £700 on the basis of a phone call.

Legalised scamming. We need a regulator with some teeth in this country.

They are there solely it seems to give the pretence of being on the side of the consumer, literally useless.

We don't need them IMO, in fact I wouldn't be surprised if they are the reason for half of our bills, because someone needs to pay for them.

Good christ. Yes mate, that's exactly why he rang up and got offered a £700 discount out of thin air.

I just find it weird to think that it would make any difference, there are already regulators for just about every service in the UK and not one of them seems to make the world a better place for us that's what I was getting at.

I specifically said "a regulator with teeth" - a functioning regulator. At no point did I say we need more regulators.I just find it weird to think that it would make any difference, there are already regulators for just about every service in the UK and not one of them seems to make the world a better place for us that's what I was getting at.

The answer is not let an industry with no demonstrable history of transparency do whatever it wants and self-regulate.

Pink Duck

Active Member

My immaculate 2018 S with all upgrades is a worthless £18,220 valuation this year from GoCompare, yeah.right! Entered more reasonable £32,000 self-valuation based on real used models online of similar nature. For those interested, today’s comparison results:

Tue 20th Feb (26 days to go):

Confused.com Admiral Essential £463.99 (valuation £22,680, £250 vol, £300 comp, no windscreen/glass cover)

CompareTheMarket Admiral Essential £465.51 (valuation £19,260, £300 compulsory, no windscreen/glass cover)

MoneySuperMarket Admiral Essential £475.19 (valuation £19,350, £300 compulsory)

GoCompare Admiral Essential £479.00 (valuation £18,220, £250 vol, £300 compulsory)

DirectLine Essentials £843.36 (£300 compulsory)

Aviva £1,634.00 (down from £1,714.00 59 days out)

WhatsApp’d current insurer Churchill to let them know of policy change not in their online self-service admin, turns out had zero impact on their renewal offer of £639.82 (£427.25 last year) that retentions wouldn't budge on, so byeee…

Tue 20th Feb (26 days to go):

Confused.com Admiral Essential £463.99 (valuation £22,680, £250 vol, £300 comp, no windscreen/glass cover)

CompareTheMarket Admiral Essential £465.51 (valuation £19,260, £300 compulsory, no windscreen/glass cover)

MoneySuperMarket Admiral Essential £475.19 (valuation £19,350, £300 compulsory)

GoCompare Admiral Essential £479.00 (valuation £18,220, £250 vol, £300 compulsory)

DirectLine Essentials £843.36 (£300 compulsory)

Aviva £1,634.00 (down from £1,714.00 59 days out)

WhatsApp’d current insurer Churchill to let them know of policy change not in their online self-service admin, turns out had zero impact on their renewal offer of £639.82 (£427.25 last year) that retentions wouldn't budge on, so byeee…

MrBadger

Badger out

Pink Duck

Active Member

Personal belongings cover is non-existent and for that not Defaqto 5* rated, but courtesy car and uninsured driver promise is included. Depends on view of utility in event of claim or just a government taxation pushed upon us to legally suffice that’s gone up through factors outside our control.

Similar threads

- Replies

- 93

- Views

- 11K

- Replies

- 12

- Views

- 1K

- Replies

- 21

- Views

- 2K

- Replies

- 89

- Views

- 8K