I just updated my TurboTax and it now says the 8936 is/will be available March 1. No clue what the deal is, since nothing should have changed since last year.

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

boonedocks

MS LR Blk/Blk 19”

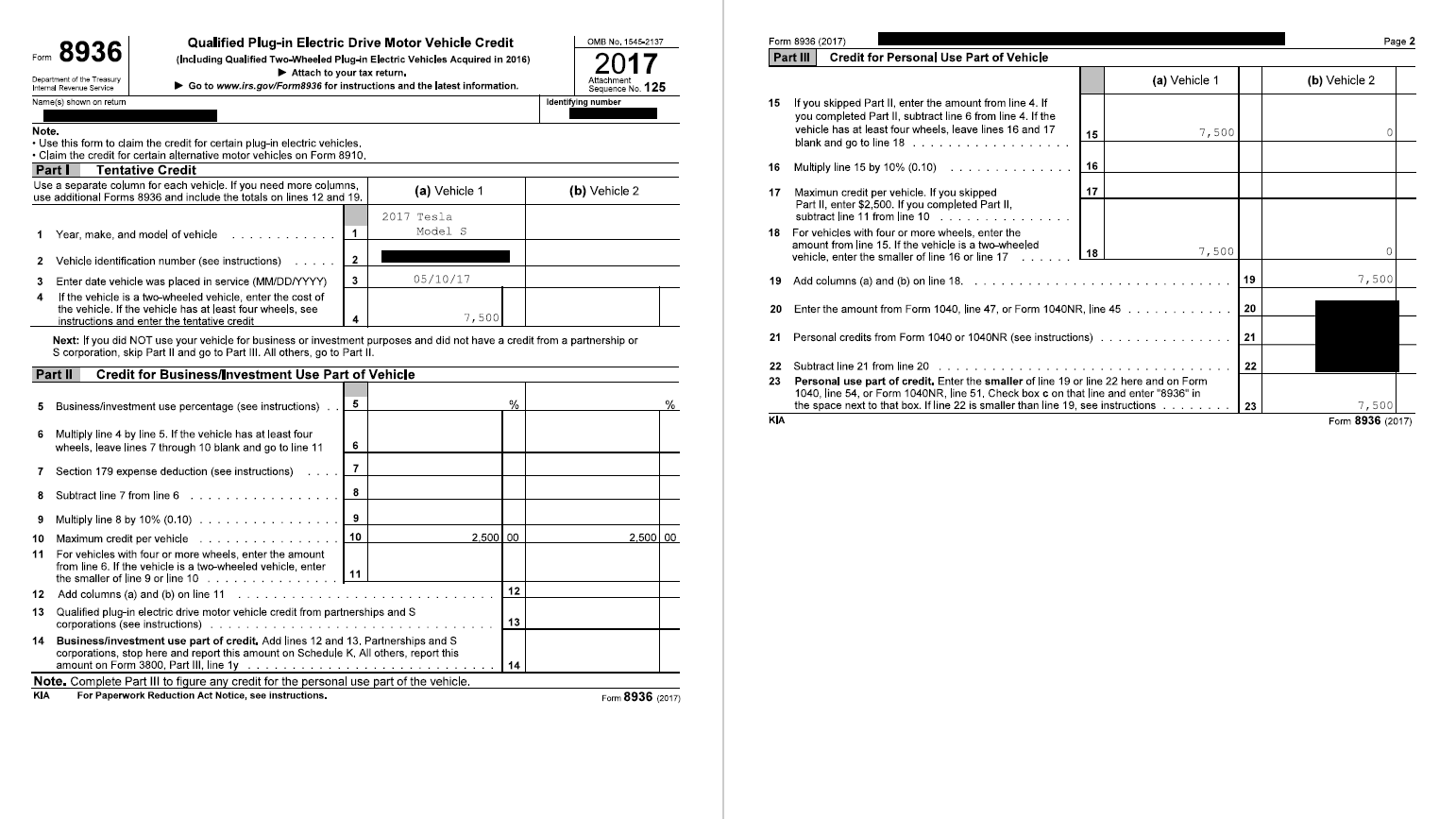

It looks like H&R attached the current 8936 to my tax return. I still won't know if it works for another week or two. I hate the IRS and their forms.

That screen shot is really interesting. It clearly states “Vehicles Acquired in 2016”. That form should say “in 2017”. The plot thickens....

Tam

Well-Known Member

...The plot thickens....

I think some sofware companies would use old 2016 forms and change to the year to 2017 as long as there's no change in the law that would affect the calculation.

That seems to work well as others have reported of getting the money back already!

While others would prefer to wait for official 2017 forms even there's no change in the law or calculations. I don't see why you have to wait when the system doesn't work for you this way!

DarkMatter

Active Member

That line is there because the plugin credit for motorcycles was made retroactive to 2016. Notice the word 'including'.

My tax return included the 2017 form. Is it official? No idea. I filed a couple of weeks ago, and the money came back last week.

My tax return included the 2017 form. Is it official? No idea. I filed a couple of weeks ago, and the money came back last week.

SilkySmooth

Member

Technically, they screwed up but it 'probably' won't matter. The form is definitely not ready and the IRS is pretty darn explicit about not using draft forms. Here are the publication dates List of Available Free File Fillable Forms | Internal Revenue Service

8936 still shows as 3/1 unfortunately (I'd really like that refund).

Someone posted a question in the turbotax support forums about this very issue (vs H&R block in fact):

I need form 8936. Why isn’t it ready? H&R Block has it for efi... - TurboTax Support

8936 still shows as 3/1 unfortunately (I'd really like that refund).

Someone posted a question in the turbotax support forums about this very issue (vs H&R block in fact):

I need form 8936. Why isn’t it ready? H&R Block has it for efi... - TurboTax Support

DarkMatter

Active Member

Go with whatever risk level you are comfortable with. My refund came back quicker than promised with no additional communication from the IRS.

dbldwn02

Active Member

It looks like my refund was just approved with a deposit date of 22 Feb. I was the one who posted a screen shot of my form. Don't worry about the 2016 at the top...that was just for motorcycles, retroactive. The fact that it shows that, tells me the 2017 form that HR Block used, is current. I'd hate to have to wait till end of March to get my money back.

boonedocks

MS LR Blk/Blk 19”

It looks like my refund was just approved with a deposit date of 22 Feb. I was the one who posted a screen shot of my form. Don't worry about the 2016 at the top...that was just for motorcycles, retroactive. The fact that it shows that, tells me the 2017 form that HR Block used, is current. I'd hate to have to wait till end of March to get my money back.

With TWO $7,500 rebates this year I’m almost tempted to trash my TurboTax return that is in limbo and make the switch to H&R Block. It’s all just ridiculous that your return is approved and will be deposited in days and TurboTax users won’t be able to file until 3-1-18 AT BEST

MattMatt

Member

With TWO $7,500 rebates this year I’m almost tempted to trash my TurboTax return that is in limbo and make the switch to H&R Block. It’s all just ridiculous that your return is approved and will be deposited in days and TurboTax users won’t be able to file until 3-1-18 AT BEST

I don' understand this at all. The IRS itself says the form is not ready. Turbotax is following the rules set by the IRS. But instead you would go to a company this is NOT following the rules, and possibly have tax return implications down the road? Personally it reassures me that TurboTax is the better option, I don't want a shady company doing shady thing on my taxes that I have to sign swearing they are accurate and true. YMMV

Matt

dbldwn02

Active Member

I don' understand this at all. The IRS itself says the form is not ready. Turbotax is following the rules set by the IRS. But instead you would go to a company this is NOT following the rules, and possibly have tax return implications down the road? Personally it reassures me that TurboTax is the better option, I don't want a shady company doing shady thing on my taxes that I have to sign swearing they are accurate and true. YMMV

Matt

Yea, this is all really weird. My tax form clearly shows 2017 at the top. I would hope that HR wouldn't just photoshop the 2017 onto last year's form. The fact that it shows the 2016 retroactive 2-wheeled tax credit, tells me that this is a real IRS form. If it wasn't a real form, I would assume the IRS would have simply denied my return. It was awaiting approval for over 2 weeks.

I think the risk in using HR is very minimal. They have the same guarantees as TT. I used TT for about 8 years but switch to HR in 2016. Their software offers free audit defense if the software determines you are a "low" risk. This is something TT was charging $40 for.

I DID run into one issue with HR. The software didn't submit the EV tax form for my Colorado State refund. Colorado sent me a declination letter, asking for it. I filled it out, scanned it in, and sent it digitally. I got notification from the DOR that my check is being mailed this week. I'm a little peeved at HR about not filing the extra Colorado EV form. #firstworldproblems

I don' understand this at all. The IRS itself says the form is not ready. Turbotax is following the rules set by the IRS. But instead you would go to a company this is NOT following the rules, and possibly have tax return implications down the road? Personally it reassures me that TurboTax is the better option, I don't want a shady company doing shady thing on my taxes that I have to sign swearing they are accurate and true. YMMV

Matt

Agreed. The IRS site itself makes it pretty darn clear that the form is not ready. TurboTax is correctly adhering to that. I'll wait.

Yea, this is all really weird. My tax form clearly shows 2017 at the top. I would hope that HR wouldn't just photoshop the 2017 onto last year's form. The fact that it shows the 2016 retroactive 2-wheeled tax credit, tells me that this is a real IRS form. If it wasn't a real form, I would assume the IRS would have simply denied my return. It was awaiting approval for over 2 weeks.

They had to have effectively done just that. They used the draft form.

See Draft Tax Forms

That's the list of 'draft forms'. Download the f8936--dft.pdf document. It's very explicit about not using draft forms. The attached form looks like yours and by all accounts 'likely' won't change, but considering they've pushed back the date multiple times (the IRS themselves) is a bit concerning. The links provided on the first page (where to go to get 'final' forms) also show that the 2016 version is all that's available officially right now. H&R Block is rolling the dice on this one - or they somehow 'know' it won't change (yet still technically violating policy by submitting anyway). For all we know the 'form' is just delayed because the IRS doesn't have final numbers from the manufacturers for the prior year to determine EV credit worthiness.

dbldwn02

Active Member

They had to have effectively done just that. They used the draft form.

See Draft Tax Forms

That's the list of 'draft forms'. Download the f8936--dft.pdf document. It's very explicit about not using draft forms. The attached form looks like yours and by all accounts 'likely' won't change, but considering they've pushed back the date multiple times (the IRS themselves) is a bit concerning. The links provided on the first page (where to go to get 'final' forms) also show that the 2016 version is all that's available officially right now. H&R Block is rolling the dice on this one - or they somehow 'know' it won't change (yet still technically violating policy by submitting anyway). For all we know the 'form' is just delayed because the IRS doesn't have final numbers from the manufacturers for the prior year to determine EV credit worthiness.

That makes sense. Seems kind of illegal to photoshop a draft tax form and submit it.

In my case it was more important to file early. I had the joy of "someone" doing my taxes for me the last two years, so the earlier I get in, the safer I am. I'll let HR deal with the consequences, should an audit come up. It's easier than arguing with the IRS that someone has all my info and that they stole my refund. Took 5 months to get my refund last year. The bummer part is, the ID theif was able to get an $18000 refund but I only got $800.

I had the joy of "someone" doing my taxes for me the last two years, so the earlier I get in, the safer I am.

If that happened I'm surprised the IRS wouldn't have switched you over for the next year to being a confirmed identity theft victim. Once signed up, the IRS will mail you a pin number that has to be subsequently used when filing your taxes.

dbldwn02

Active Member

If that happened I'm surprised the IRS wouldn't have switched you over for the next year to being a confirmed identity theft victim. Once signed up, the IRS will mail you a pin number that has to be subsequently used when filing your taxes.

Yup. They gave me a pin for 2016 but not one for 2017. And someone was still able to file for me. Initial theft was in 2015. I hate them.

Sorry to take this off topic...Just really really hate the IRS.

Yup. They gave me a pin for 2016 but not one for 2017. And someone was still able to file for me. Initial theft was in 2015. I hate them.

Ouch - you're definitely supposed to receive one every year (Dec or Jan) once you're signed up.

Frequently Asked Questions about the Identity Protection Personal Identification Number (IP PIN) | Internal Revenue Service

I just think it's stupid you have to go so far out of your way to even get signed up for it. It should just be automatic.

They're at least doing things like this: IRS, Partners Move to Strengthen Anti-Fraud Effort with Form W-2 Verification Code | Internal Revenue Service

that will help.

Thanks for the heads up on the electric vehicle charging station install deduction being extended for 2017. That is great.According to Electrek, charging station installs have been retroactively made deductible for 2017 as well. I use TurboTax and this is not even addressed in the software yet (much less having the form available). If you installed a charging station in 2017, you may want to wait even a bit longer after form 8936 becomes available to see what must be done to receive this deduction as well.

I don't mind waiting for TT to get the form correct, some of my investment tax forms don't arrive until mid-March anyways.

Similar threads

- Replies

- 20

- Views

- 1K

- Replies

- 17

- Views

- 834

- Replies

- 1

- Views

- 851