Wattsisname

MY Red/White/Gems

Is it going to be a hassle buying the at PCP end? More of a hassle than handing back a leased car and starting again from scratch?It's all about risk

The actuary friends of mine explain it like this:

When a finance looks at a car, they don't have a guess what the price is in 3 years, they have a spread of prices - say a £50k car has a 25% chance of being worth in 3 years £25k, a 50% chance of being woth £28k and a 25% chance of being £30k

On a lease they'll set the payments based nearer the middle - so say 28k, knock a bit of for admin, add interest etc and that sets the price. They win some, they lose some but on average they think know what the car whould be worth.

With PCP, because there is no upside to them if the car is worth more at the end, they set the prices at the lowest end, or 25k. If in the future its at the worst end, they've covered themselves, if it works out in the middle of their range, the person witht he PCP feels great and has a bit of equity and if its much better then the PCP buyer is even happier, but the company providing the PCP doesn't really car about the upside, they generally don;t get any of it, they just need to guard against what the worst case for them is.

So... leases generally have a higher prediction on the future value of the car than PCP for their calculations. which means generally you pay more for a PCP than a lease to cover the difference in future value expectations. What you pay extra is includes the difference between the worst expected future value and a more average one and what is likely to be the equity in the car at the end,

There is no magic bullet here. PCP is great if depreciation turns out to be less than they the expected, if ts pretty much as expected you're in a fairly neutral position but have the hassle of having to buy the car from them or somehow recycle the equity in the car into another deal, and if depreciation is worse than expected you're no different.

Company schemes are complicated differently because of the way VAT works

Take a quick example

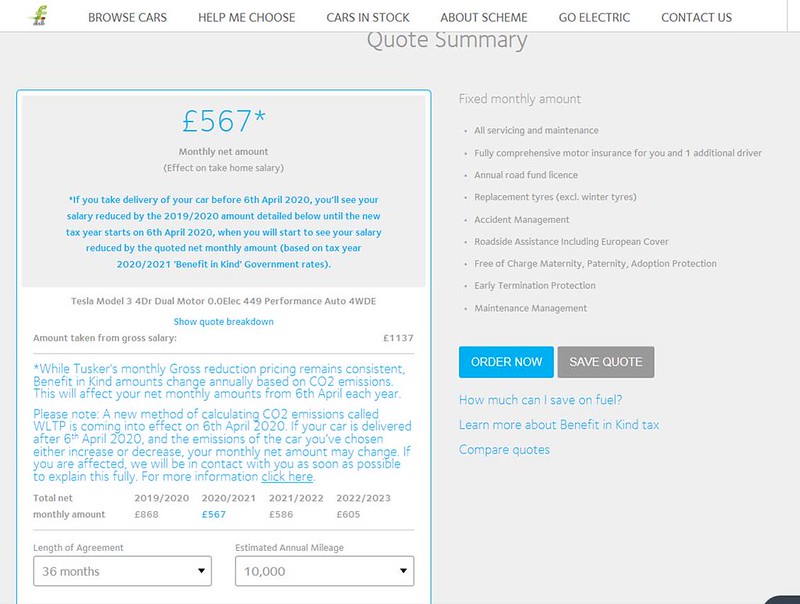

Tesla website - M3 RWD

Personal Lease = £4k + 48 * 567 = £29,500

PCP = £7k + 48 * 538 = £32.800

In 4 years would you be happy if you had £3k equity in the car (ie its value was £3k more than the balloon payment)? You've paid £3.3k more to get there so you'd actually be neutral (give or take a few hundred) . If depreciation was bad, you give the car back but you've still paid that £3.3k extra in the monthly payments, if the depreciation was low, then you've made what ever the extra value was, less the £3.3k you've paid extra over the 4 years. You are taking the risk on the 3k with PCP.

These are genuine questions for clarification rather than an attempt to take issue with your explanation.

I love owning cars but did not particularly enjoy the purchasing process until the Tesla; hassle free buying and financing through Tesla.

Last edited: