Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

CPUC NEM 3.0 discussion

- Thread starter jjrandorin

- Start date

h2ofun

Active Member

nutsI did not read the fine print, but is it safe to assume as a solar and battery back up owner, that my yearly bill go from about $100 to over $1,000 under this new measure?

sorka

Well-Known Member

About $1200.I did not read the fine print, but is it safe to assume as a solar and battery back up owner, that my yearly bill go from about $100 to over $1,000 under this new measure?

I did not read the fine print, but is it safe to assume as a solar and battery back up owner, that my yearly bill go from about $100 to over $1,000 under this new measure?

Yes, If your family income is over $180k per year.

sorka

Well-Known Member

Yes, If your family income is over $180k per year.

Which is nearly everyone in the bay area.

Yep. That really sucks.Which is nearly everyone in the bay area.

Received an email from Tesla asking me to add pw with 500 off, or I will be cancelled. Did not make nem2.

BUT, we are a CARES house (disabled person in the home). I was able to read the proposal for the new monthly fee and lower kWh (pge) rate being proposed. If it comes to fruition even close to the proposal, Solar is a loser for us as our current bill is projected to drop 48%. Simply not enough bill, even if we get to net zero, to pay back Solar in even 20 years.

BUT, we are a CARES house (disabled person in the home). I was able to read the proposal for the new monthly fee and lower kWh (pge) rate being proposed. If it comes to fruition even close to the proposal, Solar is a loser for us as our current bill is projected to drop 48%. Simply not enough bill, even if we get to net zero, to pay back Solar in even 20 years.

Last edited:

sorka

Well-Known Member

Received an email from Tesla asking me to add pw with 500 off, or I will be cancelled. Did not make nem2.

BUT, we are a CARES house (disabled person in the home). I was able to read the proposal for the new monthly fee and lower kWh (pge) being proposed. If it so we to fruition even close to the proposal, Solar is a loser for us as our current bill is projected to drop 48%. Simply not enough bill, even if we get to net zero, to pay back Solar in even 20 years.

If you're on CARE I would not get solar or storage....maybe storage if you want a backup for power outages.

Have had gen available for backup for years, or just get in the Motorhome. One psps outage, and none expected in the future after the updates to the switches and such.

CARE is currently 35%. The doc suggests that won’t change on the kWh and we will get a lower monthly fee for a 48% overall compared to non cares in the proposal.

Even with the fed credit and possibly CA covering most of the pw (sale price restricted home) the ptb made Solar a non starter for us.

CARE is currently 35%. The doc suggests that won’t change on the kWh and we will get a lower monthly fee for a 48% overall compared to non cares in the proposal.

Even with the fed credit and possibly CA covering most of the pw (sale price restricted home) the ptb made Solar a non starter for us.

Last edited:

Which is nearly everyone in the bay area.

What's worse is that $180k cannot buy a median-priced single family home in the Bay Area.

$180k over 12 months is $15k per month. Most lenders will not allow the mortgage (principal, interest, and escrow for property tax and insurance) to exceed 43% of this gross. Naturally this means the borrower has zero student loans, no car payments, and no unsecured personal loans. That's $6,450 per month.

The median bay-area home is around $1,250,000. If a buyer puts 20% down, the resulting payment at today's rates is $8,200.

Here's a random listing today... no clue who lives here lol.

If someone thought it was tough to get a home already, this crap sure won't help.

Indeed. Being interest rate, equity, property tax, and appreciation “hostage” is a real thing for many long time ca home owners.

Prop 13… and a desirable area. We paid <1/4 what the same plan and lot was bought for a year ago. Our tax is about 2k, per year. Of course, prop 19 has locked one of our kids here when we are gone as they cannot inherit and rent compared to the savings from living here.

The point is this is all self caused by voting or not. We are our own worst enemies.

Prop 13… and a desirable area. We paid <1/4 what the same plan and lot was bought for a year ago. Our tax is about 2k, per year. Of course, prop 19 has locked one of our kids here when we are gone as they cannot inherit and rent compared to the savings from living here.

The point is this is all self caused by voting or not. We are our own worst enemies.

Last edited:

sorka

Well-Known Member

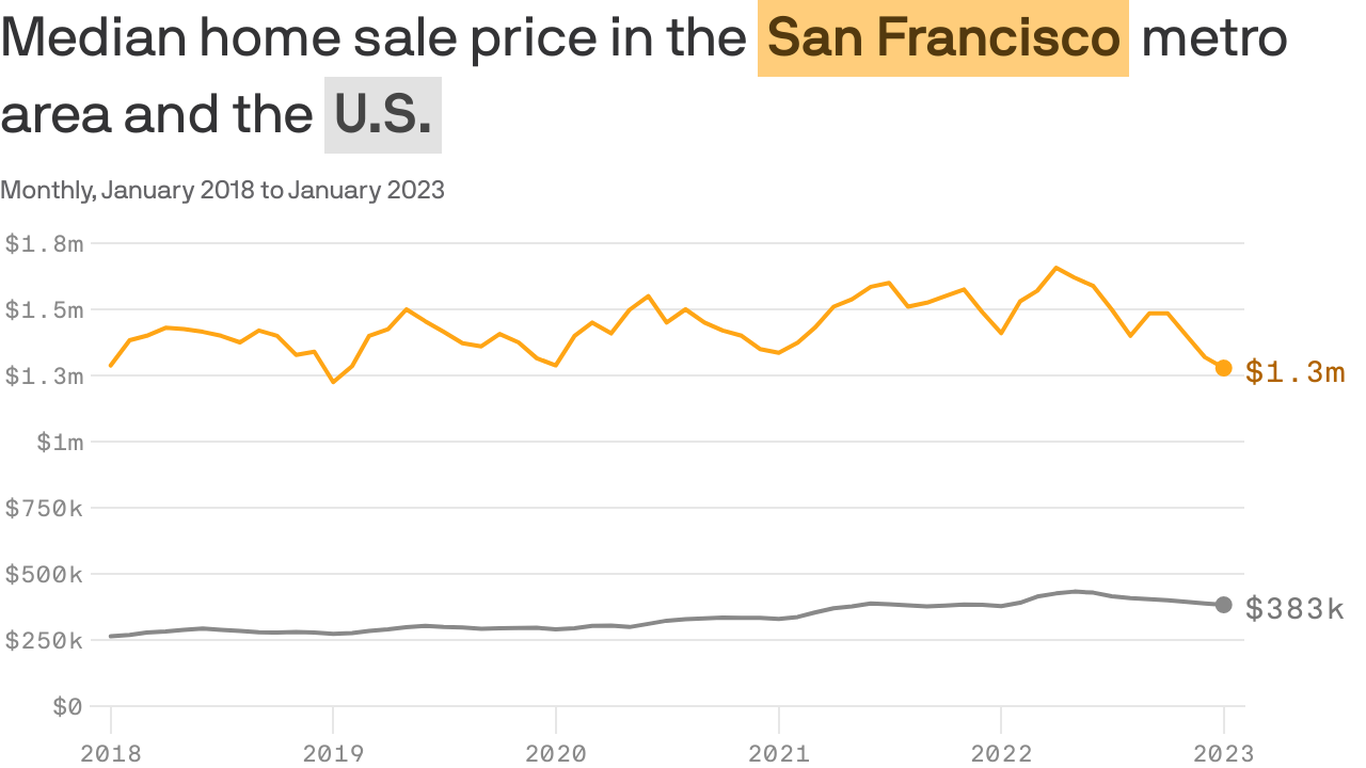

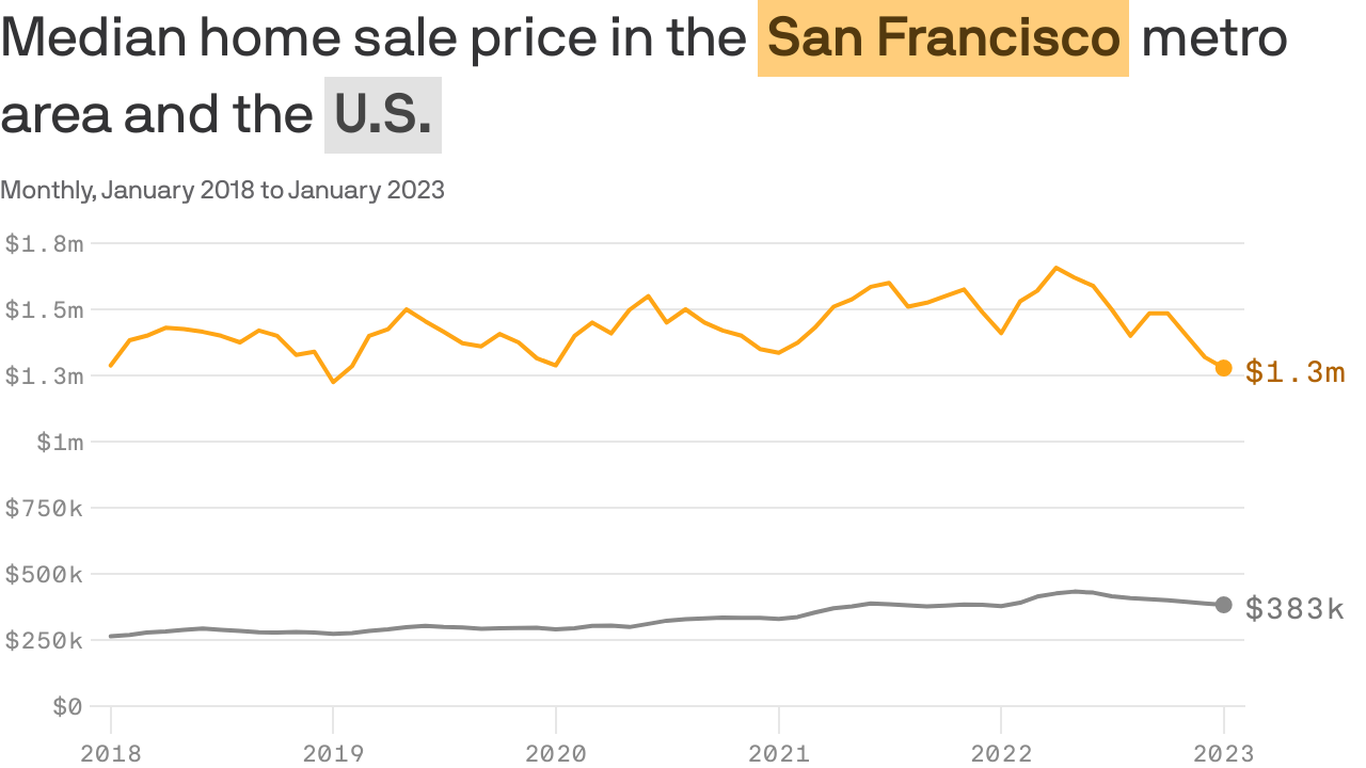

What's worse is that $180k cannot buy a median-priced single family home in the Bay Area.

$180k over 12 months is $15k per month. Most lenders will not allow the mortgage (principal, interest, and escrow for property tax and insurance) to exceed 43% of this gross. Naturally this means the borrower has zero student loans, no car payments, and no unsecured personal loans. That's $6,450 per month.

The median bay-area home is around $1,250,000. If a buyer puts 20% down, the resulting payment at today's rates is $8,200.

Here's a random listing today... no clue who lives here lol.

View attachment 929581

If someone thought it was tough to get a home already, this crap sure won't help.

That jives with most sources when googling:

San Francisco Bay Area housing market still cooling

The median home sales price in the San Francisco metro was $1.3 million in January, down 9.36% from last year .

$1.3 Million average price which is DOWN more than 9% since last year. Totally nuts.

Most buyers won't be able to afford 20%. They'll do 10% and pay PMI additionally which brings a $1.3 million home at 6.9% to $10K per month which is $4K more than the $6K your left with after taxes on $180K / year salary.....assuming your credit score is above 800.

This is an excellent example of how NEM3.0 and the proposed base fees only further discourage the adoption of renewable energy, especially among lower income households.If you're on CARE I would not get solar or storage....maybe storage if you want a backup for power outages.

Make it cheap enough to suck off the grid and very few people will be motivated to go solar, with or without batteries.

This is exactly what the utilities want.

That jives with most sources when googling:

San Francisco Bay Area housing market still cooling

The median home sales price in the San Francisco metro was $1.3 million in January, down 9.36% from last year .www.axios.com

$1.3 Million average price which is DOWN more than 9% since last year. Totally nuts.

Most buyers won't be able to afford 20%. They'll do 10% and pay PMI additionally which brings a $1.3 million home at 6.9% to $10K per month which is $4K more than the $6K your left with after taxes on $180K / year salary.....assuming your credit score is above 800.

Nah, most first time homebuyers need $ from their relatives to get them in. But if they're too poor, law/policy makers want the government to take the role of the rich relative. Once a poor person gets subvented into a single-family home, those same politicians don't want that family to install solar. Such a decision will hurt the poor.

California legislators want to help you buy a house with down payment, ‘shared equity’

Legislators propose a $1-billion-a-year down payment program for first-time buyers, given the high cost of housing and rising mortgage interest rates, in exchange for a partial stake.

First-time buyers often rely on family gifts to afford the down payments on their homes. Now California Legislators want the government to fill the role of generous relative.

PS, wife and I didn't get help from parents, relatives, or the government.

Income is irrelevant if you are in an ev plan. The lower kWh makes Solar a non starter for us.

Not sure I follow what you mean. Are you saying that you're on EV2-A or EV-B; so you think solar won't help you?

With time shifting, and the new lower kWh likely coming, break even is too far out for us. And with us being care rate; the payback is never.

Plus, for Tesla Solar; their new info is pw is required. We were going to go panels only and it would be break even about 15 years.

Ev2, care. We are at roughly .17 off peak and .28/.29 part and full peak (winter). Ev is charged off peak. Pool and spa are heated off peak. A/c is managed to pre cool off peak. New cool roof has helped too. Tesla offered about 9300 kWh per year Solar as max on our roof. Even an over calc at .30 is more than 10 year payback. With required pw, it is a money loser. Come 2025, kWh will be lower. Our summer peak will be 65% of about .56. 2025 the summer peak is being predicted as .31 before the care discount.

Care is via disabled family member in the home. We will likely get the 30 monthly access.

Likely good calc is our solar generated over a year will be in the .22 to .23 range, so $200 a month. Even if kWh cost doubles over panel life, it makes no sense for us. Our power usage is dropping each year, we charge the ev for free about town most of the time, and the pool and spa will likely go away in a few years.

Point is, for those with care, Solar is likely a loser. For the rest, the 10 year payback is pure guess, if rates increase, if usage increases, if battery lasts well past warranty, etc.

Maybe there will be new credits, cheaper lfp pw3, but not today.

Plus, for Tesla Solar; their new info is pw is required. We were going to go panels only and it would be break even about 15 years.

Ev2, care. We are at roughly .17 off peak and .28/.29 part and full peak (winter). Ev is charged off peak. Pool and spa are heated off peak. A/c is managed to pre cool off peak. New cool roof has helped too. Tesla offered about 9300 kWh per year Solar as max on our roof. Even an over calc at .30 is more than 10 year payback. With required pw, it is a money loser. Come 2025, kWh will be lower. Our summer peak will be 65% of about .56. 2025 the summer peak is being predicted as .31 before the care discount.

Care is via disabled family member in the home. We will likely get the 30 monthly access.

Likely good calc is our solar generated over a year will be in the .22 to .23 range, so $200 a month. Even if kWh cost doubles over panel life, it makes no sense for us. Our power usage is dropping each year, we charge the ev for free about town most of the time, and the pool and spa will likely go away in a few years.

Point is, for those with care, Solar is likely a loser. For the rest, the 10 year payback is pure guess, if rates increase, if usage increases, if battery lasts well past warranty, etc.

Maybe there will be new credits, cheaper lfp pw3, but not today.

Indeed. Being interest rate, equity, property tax, and appreciation “hostage” is a real thing for many long time ca home owners.

Prop 13… and a desirable area. We paid <1/4 what the same plan and lot was bought for a year ago. Our tax is about 2k, per year. Of course, prop 19 has locked one of our kids here when we are gone as they cannot inherit and rent compared to the savings from living here.

The point is this is all self caused by voting or not. We are our own worst enemies.

Not that I'm an advocate of tax shenanigans, but many older homeowners I know have done the following. Whether this works is ¯\_(ツ)_/¯

1) Put the house into a living trust

2) Near the end (but before it goes to probate or anything sad)... they "rent the home"

3) Living trust transfers to the kid(s) who can continue to "rent it out" without having to pay capital gains tax or estate tax since the trust was gifted within the IRS limits.

I think the Prop 13 benefit goes away, but hey, almost free house?

PS, I am an idiot. My avatar is a disconnect and I cannot read good. So maybe this particular post is total trash? Who knows.

We considered all options. We are in a desirable area and at least one of our kids is wants to reside in the home. With prop 19, as long as the resident has any ownership share, prop 13/19 are not an issue. They may even sell and buy a luxe condo, with prop 13/19 benefits.

We considered all options. We are in a desirable area and at least one of our kids is wants to reside in the home. With prop 19, as long as the resident has any ownership share, prop 13/19 are not an issue. They may even sell and buy a luxe condo, with prop 13/19 benefits.

Sounds like one of your kids is about to become a "renter" of the home from the other kid hah.

Similar threads

- Locked

- Replies

- 68

- Views

- 9K

- Replies

- 5

- Views

- 5K

- Replies

- 700

- Views

- 90K

- Replies

- 108

- Views

- 14K

- Replies

- 65

- Views

- 20K