And train derailment in Utah....Don’t forget Suez Canal blockage…..

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Current Delivery Times

- Thread starter sloth

- Start date

Anteojito

Member

It seems to me that most of the VINs that are coming in the last few days are for East Coast/Midwest. Looking forward to seeing more West Coast deliveries soon.

Does anyone agree with my back-of-the-envelope analysis?

Does anyone agree with my back-of-the-envelope analysis?

You Know Who

Member

I accidentally clicked the link to "cancel" while I was waiting for a refresh, and there was no confirmation to stop that process. My profile looks the same as yours, and my EDD really hasn't changed at all since that happened. It doesn't look like it affects anything.

bluesfanatic

Member

I'm hoping the same. As long as I get it by the end of the year, I'll be happy. Yesterday would make me happy too.I hope it stays the same or moves up earlier. Mine went from December to Nov 7-27.

Crew Dragon

Ordered 5/20: MYLR 5-seat W/W No FSD, 19”, no tow

Something to think about while you wait...

Once you get your car, prepared to wait even more!

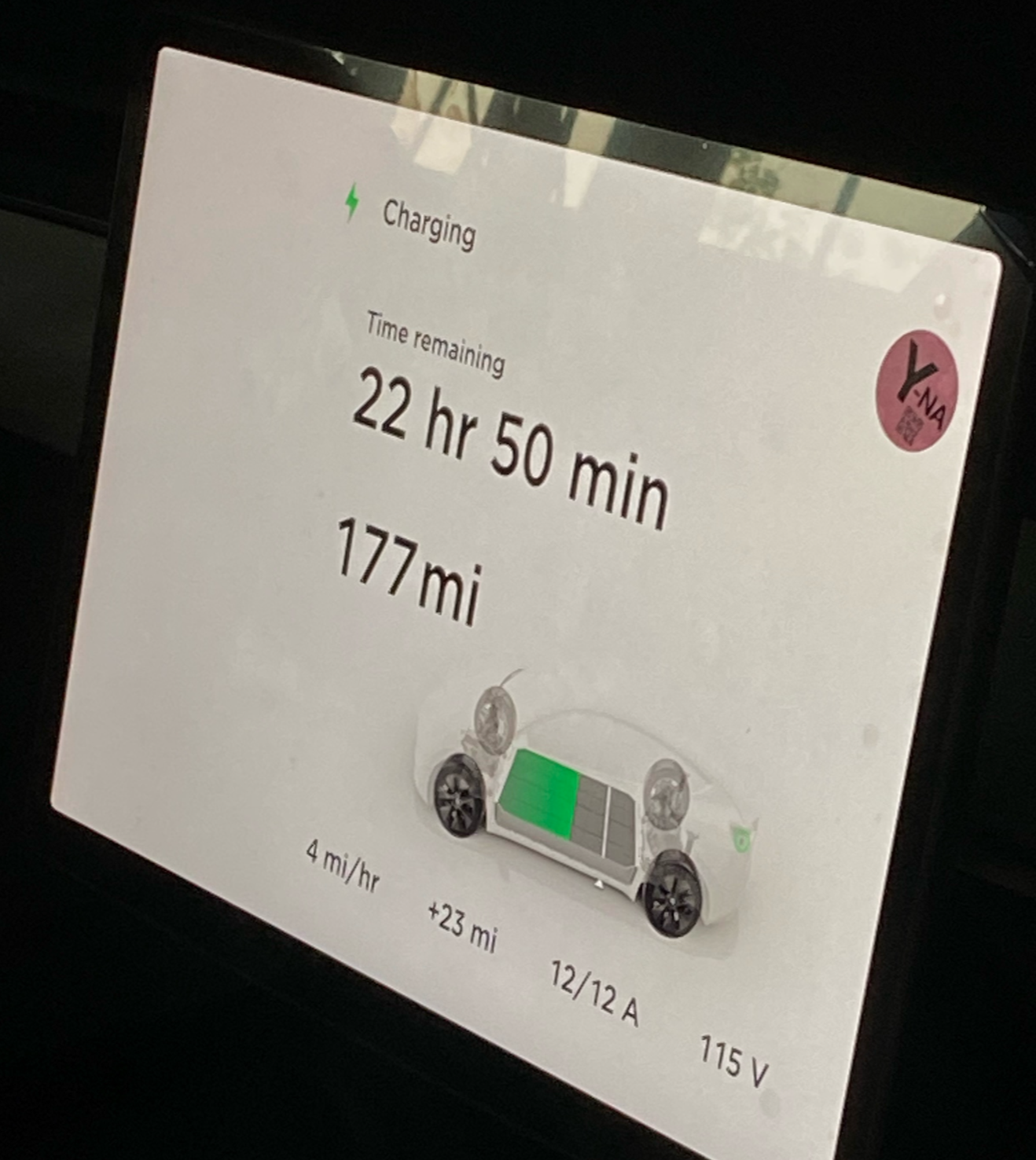

I had several months to research charging the Model Y. No big bucks for a Level 2 charger for me, a wall charger is all I should need. I can get 4-5 miles per hour from the wall.

I figured, if I could wait to get the car, I could wait while it slowly charges from my regular wall outlet. Waiting for it to charge is hard to!

Here is what it looked life after plugging in following my long ride home (and a few test rides):

Once you get your car, prepared to wait even more!

I had several months to research charging the Model Y. No big bucks for a Level 2 charger for me, a wall charger is all I should need. I can get 4-5 miles per hour from the wall.

I figured, if I could wait to get the car, I could wait while it slowly charges from my regular wall outlet. Waiting for it to charge is hard to!

Here is what it looked life after plugging in following my long ride home (and a few test rides):

Someone posted once that they tend to do the longer range--east coast--deliveries earlier in the quarter and then as the time gets short focus more and more on the shorter delivery times so they could squeeze in as many as possible at the end of the quarter.it seems to me that most of the VINs that are coming in the last few days are for East Coast/Midwest. Looking forward to seeing more West Coast deliveries soon.

Does anyone agree with my back-of-the-envelope analysis?

jpy1980

Member

A quick google search shows that dcu is digital credit union. Is that true? DCU | Personal & Business Banking

Where’s my car

MYLR5, white, black, induction 20” tow 4/3

Me too! Looked them up and the best rate was 1.49%, ( much better than 2.49%) but it’s my understanding that if You’re referred you may receive a 1.24% rate. Please send the referral link, code, email if you have it.I need a referral and a link to dcu. What is DCU? d… credit union?please and thank you!

jpy1980

Member

I just asked a member for it so let’s see if they can send me one. I need to know if I just apply through the regular link?Me too! Looked them up and the best rate was 1.49%, ( much better than 2.49%) but it’s my understanding that if You’re referred you may receive a 1.24% rate. Please send the referral link, code, email if you have it.

ev_ts_newbie

Member

I am going to hire a new financial advisor and NO brownies for guessing who it is.That's just normal historical S&P returns--I do better than that, but it's fine to just say 8% - 10% and not have to dicker abut my personal returns. But in fact this year I'm up 18.59% so far, last year I was up 26%, the year before it was up 33%, the year before down 5%, the year before up 29%, etc. Why in the world would I want to pull $60K out of that to save 2%?

CSTARZZ

Member

I personally think it is. I have HK and the Harmony System is more clear at louder volume.BTW how is the sound system in Model Y? Is it on par with BMW harmon kardon sound system?

OptionalUpgrd

Member

Something to think about while you wait...

Once you get your car, prepared to wait even more!

I had several months to research charging the Model Y. No big bucks for a Level 2 charger for me, a wall charger is all I should need. I can get 4-5 miles per hour from the wall.

I figured, if I could wait to get the car, I could wait while it slowly charges from my regular wall outlet. Waiting for it to charge is hard to!

Here is what it looked life after plugging in following my long ride home (and a few test rides):

View attachment 695389

Truth! Maybe this is Elon just conditioning us all to wait.

Truth is, in 2011 I had a financial advisor (from USAA) who told me where to invest my cadet loan money…and then I read the book “Millionaire Teacher” about how a school teacher became a millionaire through frugality and index funds by the age of 40. It blew my mind, and planted the seed. I discussed the topic with a couple of my econ professors, other cadets, and with a little more reading and research, came to some conclusions.I am going to hire a new financial advisor and NO brownies for guessing who it is.

It made me realize that my USAA financial advisor was seriously ripping me off, as most financial advisors do. There’s an entire community of public service professionals (teachers, govt, first responders, etc.) and other modest income people who retire with multi-million dollar portfolios by stashing their Roth IRAs and TSPs (401k for federal employees) with continual contributions into low cost, widely diversified index funds. I’m glad I learned those lessons at age 20, and it’s one of the reasons why I’m in a financial position to buy a Tesla at age 30.

I understand why someone would avoid car debt, even at a greater opportunity cost. There’s great peace of mind of not having a car loan. I respect that. Just don’t justify your decision to do so by saying 5% to 10% annual return investments are hard to come by. Full disclosure, across my three Vanguard index funds I average 13.6% per year, from March 2012 to present. Their fund performance (and cost basis) is no secret, and open to everyone. My TSP has done marginally better, but that’s just for military and feds.

thewhitewolf

Member

Update: even when you get a VIN, you don’t get to sign agreements and feel like the car is in your hands yet. Haha. Probably going to call my local shop tomorrow about delivery.

chaos99

Member

If you still need a referral, PM meI need a referral and a link to dcu. What is DCU? d… credit union?please and thank you!

Where’s my car

MYLR5, white, black, induction 20” tow 4/3

If you get it, please share. I’m always down for saving money!I just asked a member for it so let’s see if they can send me one. I need to know if I just apply through the regular link?

JaeTheDev

Active Member

mparrish03

Member

I spent my USAA loan on a motorcycle and wrecked it. Shows my frugality. LolTruth is, in 2011 I had a financial advisor (from USAA) who told me where to invest my cadet loan money…and then I read the book “Millionaire Teacher” about how a school teacher became a millionaire through frugality and index funds by the age of 40. It blew my mind, and planted the seed. I discussed the topic with a couple of my econ professors, other cadets, and with a little more reading and research, came to some conclusions.

It made me realize that my USAA financial advisor was seriously ripping me off, as most financial advisors do. There’s an entire community of public service professionals (teachers, govt, first responders, etc.) and other modest income people who retire with multi-million dollar portfolios by stashing their Roth IRAs and TSPs (401k for federal employees) with continual contributions into low cost, widely diversified index funds. I’m glad I learned those lessons at age 20, and it’s one of the reasons why I’m in a financial position to buy a Tesla at age 30.

I understand why someone would avoid car debt, even at a greater opportunity cost. There’s great peace of mind of not having a car loan. I respect that. Just don’t justify your decision to do so by saying 5% to 10% annual return investments are hard to come by. Full disclosure, across my three Vanguard index funds I average 13.6% per year, from March 2012 to present. Their fund performance (and cost basis) is no secret, and open to everyone. My TSP has done marginally better, but that’s just for military and feds.

Similar threads

- Replies

- 9

- Views

- 432

- Replies

- 18

- Views

- 1K

- Replies

- 16

- Views

- 741

- Replies

- 8

- Views

- 382