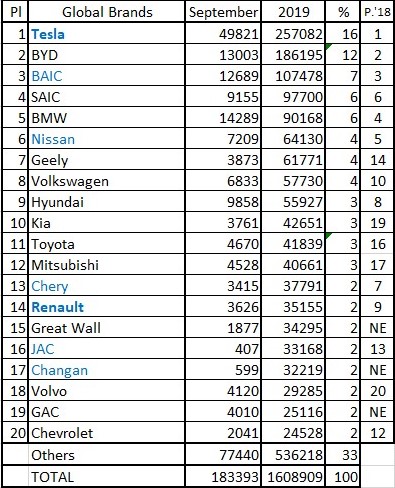

EV Sales: Norway August 2019

Norway August results. Ytd, PEV market share is 55% and Tesla claims 25.4% share of the PEV market. This also means Tesla has a 14% share of the auto market in Norway.

PHEV, HEV, diesel ICE and gasoline ICE are all losing market share. In August, BEV registrations were up +13% y/y, while the market as a whole was down -17% y/y.

I think we should not be shaken by a declining auto market. Rather is is a huge opportunity for BEVs and Tesla to gain market share. The overall decline in demand means that supply constraints on the BEV side are not nearly as much of a barrier for grabbing market share as they usually are. So we get a better picture of relative demand when BEV supply is not so disadvantaged. Surprise, surprise, 14% of Norwegian auto buyers demand a Tesla.

How does Tesla hold onto and build a 14% market share as the market recovers over the next few years? They've got to keep cranking up production volume, and they need to add more models to their line up. Norway will be hungry for Model Y. Tesla sales 47% more Model X than Model S. This suggests to me an appetite for a more affordable crossover vehicle. Model 3 commands 11.6% share of the market. The Model Y could match this. So maybe once there is adequate supply of Model Y it gets 12% share, Model 3 10%, Model S/X 3%. This gets Tesla to a combined 25% share (of total auto market).

This level of market share, 14% to 25%, sets Tesla up as the dominant automaker in Norway. Tesla infrastructure (charging and service networks) will lock in a durable advantage. It's hard to fathom just how ubiquitous Superchargers could be in a land where Tesla has 25% market share. The network could be as dense as any retail fueling network. Or consider that for the moment ICE (both diesel and gasoline) are just 20% market share. So over the longer run Tesla could be filling more vehicles than all petrol stations combined. At any rate, grabbing market share now helps lock in infrastructural and network advantage for the longer term.