Heck, I even corrected you on what battery "cycle life" meant here.

I was indeed wrong about that PbC life cycle thing. It's not that I did not know what cycle life is, but I did not know those "cycles" they measured in the micro-hybrid test were only a few %. And I have acknowledged my error and the fact that you were right.

That's just as bad. Petersen has been seriously wrong about battery costs, material shortages, battery pack safety, wisdom of using 18650s, product appeal, financing options available to the company - just to name several off the top of my head.

As for "facts," Petersen himself said on May 11: "The fact is Tesla was a great short in the mid-$30 s and its an incredible short in the high $70s." That's clearly wasn't a "fact."

Unless there is some miracle in Li-ion tech, there will be material shortages before Tesla's cars will touch even a few % of the market to matter in the environmental debate. Talking about a short candidate is more a statement about future prices. Even if viewed as a "weighting" of the company at the present time, a bubble in the stock does not mean the stock is not over-valued, on the contrary.

Not true. Even JP has to acknowledge that demand is at least so far keeping pace with demand and that Tesla's financing moves were brilliant.

The word "delivered" should make you think both production and demand (not to say the demand was accumulated over more than two years).

Actually, you're more than pretending - you're insisting. Your turkey analogy, for instance - we all know that Thanksgiving turkeys do get slaughtered, so you're saying Tesla stock owners will get slaughtered. That's "will," not "might." Bad analogy. Bad prediction. You've been predicting a tank in TSLA stock since it broke $50. Despite actually authoring an article on a "looming short squeeze," you started bailing at a 2X price increase, and were self-reportedly almost completely out within a week after the Q1 announcement. That means you left a subsequent 3X price appreciation on the table.

I'll go on record predicting that Tesla won't ever drop below the $51 price point at which you started selling and telling others to sell.

You seem a smart guy (even if a bit obnoxious) but sometimes you insist in not understanding things (if you let me quote JP here, I can explain things to you but I cannot understand them for you). The analogy is with this over-repeated argument, "look ma', huge profits". It only proves there is a bubble going on and you were in the right place at the right time, not that you are a genius who predicted the future (if you do that repeatedly and consistently, you should start thinking you are genius indeed). And the fact that everything worked okay until now, does not mean anything for the future.

As for my trades in TSLA, if you are really interested, I have posted almost everything in almost real time on traderhood.com (you enter TSLA on the left and then trades are in a different color). I still had in April about 1/7 of the # of calls that expired in March and about 1/18 of the # of calls that expired in January. Those that I got left were Jan 14 calls and I was already on margin due to AAPL so I could not continue my strategy with the short squeeze. When it started climbing, I knew it could be it, and I may have advised people to take some profits, because it was not sure. It may have been just a wave. I kept cashing out call spreads and every $20-$30 up I was cashing out completely a small double digit percentage of the remaining calls. Around $60-$70, my wife started to call me crazy for keeping them open and I kept insisting I have huge trust in human nature: "believe me baby, people are crazy! if they pushed it up to here, there is no hard limit !". At some point (end of May or early June) I have exchanged all my calls to Jul 20 calls (wanted my time premium in cash and more liquid calls for spreads plays - better prices for the same strike spreads), I could not believe the craziness could last longer than that (so I was contradicting myself, because people ARE crazy !). So I milked then until $129.9 and lost a few thousands in unrealized profits the last week when it took a dip.

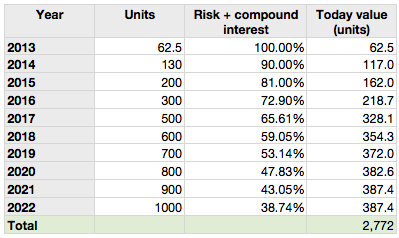

Now if you insist, let me ask how do you think Tesla could justify a $20B valuation. I hope you know the basic rule of investing, that the intrinsic value of the company are future profits discounted for interest and risk. The stock price will oscillate from undervalued to overvalued and back around intrinsic value (which also moves by itself as the company realizes or not its goals, risks change etc.). While we are living in very low interest times, it will change, and at least 5% compound should be used for the long term, at least for inflation. But then including risk separately would be too hard to explain without an Excel table. So let's say we use 10% compound to include risk (It should be much more IMO). Tesla aims to have about 12% of operating margin on a Models S or around $10k. Same for Model X. About 10% OM or about $4k on a Model E. Or 2.5 high end cars for a standard car, that will be our unit (U). So lets's say 62.5k U in 2013, 130k U in 2014, 200k U in 2015, 300k U in 2016, 500k U in 2017 and another 100k U extra every year until 2022. 10 years out is more than anyone would count for valuation of a young growth company. My assumption are great success, no hiccups or delays, no demand problems or costs increases, not much risk.

You get to a total present value of around 2.772M units, or at $4k / unit in operating profits a total of $11.1B. Even today when the company is still small, they burn about $400M per year in R&D and S,G&A. Let's assume that by some miracle it does not increase with several factories around the world, super-charger networks on three continents and so on. That's about $4B expenses in 10 years. About 25% of the remaining $7.1B go to the tax man. So with the best assumptions in the world, you get a $5.3B company, not a $20B one. How do you hope to get another double or two from here? Do you really think it will become obvious Tesla is a $50B company faster than the market changing hats and start perceiving a $5B company as a $2B or $3B company when there will be some dark clouds gathering around?

- - - Updated - - -

the company who has already achieved the "impossible" will also be able to implement mass-manufacturing cost-effectively.

I never said Tesla is a bad company (unless I was drunk, which as far as I remember was not the case during the last three years). I have even said they have done the impossible. The problem lies with valuation and the hopes people put into a stock that has almost no room to grow in the short term and on a rational basis, but can go much lower without being out of touch with reality.

- - - Updated - - -

but we are supposed to ignore that and just use him as a data source. Please help explain that.

John has 10 years of experience in the battery industry as an insider. He has recently been invited to give talks to some of the most prestigious battery conferences, both lead-acid and Li-ion. He meets the CEOs of the largest companies in these industries and shares with SA readers their broad views about the evolution of their industry. If you think you can get that anywhere else and on top of that for free, be my guest.

TSLA is very probably a bad investment today (again, because of valuation, not the company). Nobody knows for sure if it is so, but the market is a weighting machine and will give us the answer, even if it takes longer than shorts can stay solvent.