Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

- Status

- Not open for further replies.

Waiting4M3

Active Member

I looked at the rate of reported VIN assignment date by month from the Model 3 Invites google doc:

Dec 17, 69 VIN assignments in 31 or more likely 27 days accounting for holidays, rate of ~2.5/day

Jan 18, 139 VIN assignments in 31 days or 24 days if you count the 1 wk shutdown reported, rate of ~ 4.5-5.8/day

Feb 18, 105 VIN assignments in 28 days, or 24 days if you count the 4 day shutdown, rate of 3.8-4.4/day

Mar 18, 170 VIN assignments in 16 days, rate of 10.6/day

Based on this I think current production rate is 2x of what was in Jan/Feb, between 1000-1500/wk

Dec 17, 69 VIN assignments in 31 or more likely 27 days accounting for holidays, rate of ~2.5/day

Jan 18, 139 VIN assignments in 31 days or 24 days if you count the 1 wk shutdown reported, rate of ~ 4.5-5.8/day

Feb 18, 105 VIN assignments in 28 days, or 24 days if you count the 4 day shutdown, rate of 3.8-4.4/day

Mar 18, 170 VIN assignments in 16 days, rate of 10.6/day

Based on this I think current production rate is 2x of what was in Jan/Feb, between 1000-1500/wk

Yeah but the financial stuff is boring. I'd rather know they're planning to make flux capacitors in 6 years or whateverFinancials include everything else anyway.

I looked at the rate of reported VIN assignment date by month from the Model 3 Invites google doc:

Dec 17, 69 VIN assignments in 31 or more likely 27 days accounting for holidays, rate of ~2.5/day

Jan 18, 139 VIN assignments in 31 days or 24 days if you count the 1 wk shutdown reported, rate of ~ 4.5-5.8/day

Feb 18, 105 VIN assignments in 28 days, or 24 days if you count the 4 day shutdown, rate of 3.8-4.4/day

Mar 18, 170 VIN assignments in 16 days, rate of 10.6/day

Based on this I think current production rate is 2x of what was in Jan/Feb, between 1000-1500/wk

Is there (should there be) a compensation factor due to recent invites being non-owners? I'm on mobile, so it is not easy for me to check the proportion of entries of each type.

Waiting4M3

Active Member

Non-owners got invited starting Feb 22, I think a lot of the March VIN assignments are from the 2/14 invites which are still to previous owners, but also significant #s are from 2/22 invites.Is there (should there be) a compensation factor due to recent invites being non-owners? I'm on mobile, so it is not easy for me to check the proportion of entries of each type.

I also don't know if owners vs non-owners would necessarily cause any bias, or in which direction. Do you think non-owners are ore or less likely to report than for owners? If I had to guess I would say there is a higher % of owners (out of all owners who've received M3 invites) who are TMC members, vs % of non-owners (out of the non-owners who've received M3 invites) who would be on TMC, because owners would have longer history with Tesla and more likely to have been exposed to TMC. Based on that assumption, I think the higher reported # in March is even more encouraging.

Non-owners got invited starting Feb 22, I think a lot of the March VIN assignments are from the 2/14 invites which are still to previous owners, but also significant #s are from 2/22 invites.

I also don't know if owners vs non-owners would necessarily cause any bias, or in which direction. Do you think non-owners are ore or less likely to report than for owners? If I had to guess I would say there is a higher % of owners (out of all owners who've received M3 invites) who are TMC members, vs % of non-owners (out of the non-owners who've received M3 invites) who would be on TMC, because owners would have longer history with Tesla and more likely to have been exposed to TMC. Based on that assumption, I think the higher reported # in March is even more encouraging.

I was also guessing it is more owners than non, so agree that March increase is even better than numbers indicate. Especially given the factory shut down earlier this month which reduces production numbers but increase the effective (when producing) rate.

Waiting4M3

Active Member

Yes, breaking down by day, in late Feb and March we see:I was also guessing it is more owners than non, so agree that March increase is even better than numbers indicate. Especially given the factory shut down earlier this month which reduces production numbers but increase the effective (when producing) rate.

Day, VIN assignments reported

2/27/2018 4

2/28/2018 6

3/1/2018 2

3/2/2018 6

3/3/2018 6

3/4/2018 4

3/5/2018 4

3/6/2018 4

3/7/2018 34

3/8/2018 13

3/9/2018 18

3/10/2018 14

3/11/2018 6

3/12/2018 11

3/13/2018 16

3/14/2018 8

3/15/2018 10

3/16/2018 14

We see a jump starting on 3/7, ~10 days after the Fremont factory M3 production came back online on 2/24. My WAG is that the 1st 10 days cars that came out were the ones that went into production before the shutdown. Then starting on day 11 we start to see the higher production rate starting to come out of the line. Averaging from 3/7-16 is 14.4 VIN/day, so it's almost at 3x of Jan-Feb avg. This could indicate >1500/wk rate, maybe close to 2000/wk.

geneclean55

Active Member

Of the 178 VIN assignment entries that occurred in March, 97 were from non-owners. Essentially 0 entries from non-owners prior to March.

I think folks that are contributing to the spreadsheet, up to and including today are equally rabid, regardless of being an owner or non-owner

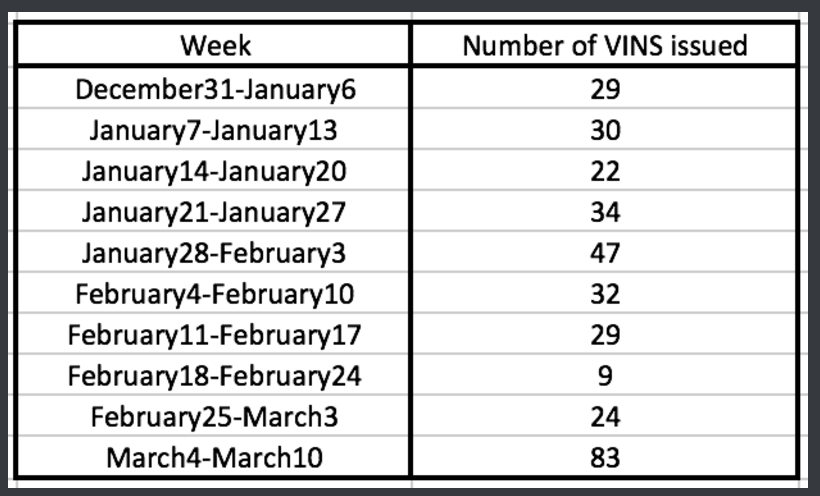

I am glad someone else has cottoned onto the VIN assignment rate. I have been looking at this for a while now. Seems much better than the Bloomberg weekly production tracker in catching real time changes in output. I put this data sheet together last weekend. Notice the lack of ramp during Jan and Feb Very consistent generally around 30 assignments per week. As waiting4m3 points out, the drop around Feb 18-24 is dramatic and clearly correlates with factory shutdown, and the subsequent ramp up is equally dramatic. I am glad to see VIN assignment has been maintained at a high rate for this week also. I would guess that production is ~1500 per week, and has been for a couple weeks

Very consistent generally around 30 assignments per week. As waiting4m3 points out, the drop around Feb 18-24 is dramatic and clearly correlates with factory shutdown, and the subsequent ramp up is equally dramatic. I am glad to see VIN assignment has been maintained at a high rate for this week also. I would guess that production is ~1500 per week, and has been for a couple weeks

I think folks that are contributing to the spreadsheet, up to and including today are equally rabid, regardless of being an owner or non-owner

I am glad someone else has cottoned onto the VIN assignment rate. I have been looking at this for a while now. Seems much better than the Bloomberg weekly production tracker in catching real time changes in output. I put this data sheet together last weekend. Notice the lack of ramp during Jan and Feb

Last edited:

Following up on the VIN posts above, the Bloomberg tracker suffers from two major flaws: (1) entries seem to lag, either because owners are not inputting enough data or Bloomberg is slow to add it to their model and (2) the production gap week appears to have thrown off Bloomberg’s algorithms. In particular, the VIN chart above seems to show VINs nicely curving upwards in the past two weeks but Bloomberg draws a line showing a break downward about two weeks ago. If the curve followed the data the reported rate would be significantly higher. Tom Randall acknowledged that their model could be slow to adjust to increased rates and I think that is happening.

I would guesstimate we are between 1000-1500/week.

Attachments

Last edited:

RobStark

Well-Known Member

Car & Driver Reviews the all new 2012 Tesla Model S.

Vid says 2013 but date of publication is Oct 4,2012 so it has to be a 2012.

Vid says 2013 but date of publication is Oct 4,2012 so it has to be a 2012.

Reciprocity

Active Member

View attachment 287096

Following up on the VIN posts above, the Bloomberg tracker suffers from two major flaws: (1) entries seem to lag, either because owners are not inputting enough data or Bloomberg is slow to add it to their model and (2) the production gap week appears to have thrown off Bloomberg’s algorithms. In particular, the VIN chart above seems to show VINs nicely curving upwards in the past two weeks but Bloomberg draws a line showing a break downward about two weeks ago. If the curve followed the data the reported rate would be significantly higher. Tom Randall acknowledged that their model could be slow to adjust to increased rates and I think that is happening.

I would guesstimate we are between 1000-1500/week.

I agree that the Bloomberg tracker lags. The issue here is that I believe more investors are using it as a guide rather then the more accurate, due to constant updatinng, Google spreadsheet. We should encourage Randall @tsrandall to update the Bloomberg model every hour.. LoL.

Yeah that's what I've seen too, I'm just wondering if they will add the product milestones over time or if it's just financials from here on out. I remember when they put the first package out it was really interesting to see where the company was going in the long term and what products were on the table. IIRC the last tranche ended with the model y so the new could include things past the pickup truck. Maybe Tesla is now just too complex for all the product milestones now or maybe they don't want to make the "game plan" as public now.

No product milestones is no problem. All the milestones currently mapped out are primary drivers of increasing valuation ten fold.

Growth and financials are the bottom line of Musk's comp over next ten years. New future milestones are stacking up like planes in a holding pattern over O'Hare.

Perception is king. If an EV from top respected car manufacturer can catch fire, how can anybody trust a niche manufacturer like Tesla and risk going EV if ICE is safer, cheaper, battle tested for a century and available in a dealership next door today?

Tesla’s and our goal is to make the cake bigger, not have the biggest piece of a small cake.

Much ado about nothing. Large, high tech and high reputation companies like Porsche are not going to sour the public at large on EVs with one off fire incidents.

A year from now Tesla will be cranking out M3s with industry leading performance and autopilot. Each M3 owner sharing their driving experience with family, friends and curious acquaintances. At that point if Porsche or Audi have the occasional fire, the ding will not be against EVs as a whole but against the manufacturer. Why can't ***** make their EVs as fire safe as Tesla's?

Reciprocity

Active Member

No product milestones is no problem. All the milestones currently mapped out are primary drivers of increasing valuation ten fold.

Growth and financials are the bottom line of Musk's comp over next ten years. New future milestones are stacking up like planes in a holding pattern over O'Hare.

Exactly. Impossible to make the financial targets without releasing and producing products on a regular cadence. People to quickly forget that model 3 and gigafactory were pulled forward 18 months and that was probably impossible so model 3 will end up on time or ahead as it relates to the original schedule, which existed for a reason. Also important to note that companies this size don't often grow this fast. At just 2000/w model 3s, Tesla will have grown 50% YoY in just 3 months. With potential to grow closer to 100% YoY by the end of the year with just 200,000 model 3s produced. Potential to grow another 100% next year is all on Tesla increasing production. Most companies have to create both demand and production, but Tesla already has the demand. This demand will only magnify with more model 3s on the road.

I agree that the Bloomberg tracker lags. The issue here is that I believe more investors are using it as a guide rather then the more accurate, due to constant updatinng, Google spreadsheet. We should encourage Randall @tsrandall to update the Bloomberg model every hour.. LoL.

Related to your post, not directed at you:

Two factors in control loops are the rare at which the loop is calculated and the base equation.

In this case having Boomberg update more often won't change their trend, it will only put more points on the line. If they use finer time units, it might improve the line granularity.

By lagging, I think most of us mean that it is putting too much weighting on older data. Compare to the 50 vs 200 day price average for your favorite stock. If there was a bump 200 days ago, then a drop 180 days ago, held steady, and then a sharp rise occurring today: the 50 day would slowly move up, but the 200 might actually move down due to losing the old high data.

By now, everyone is painfully aware that I'm holding out for the end of the pack supply drought step change to arrive. A step change is a real method of testing a control system's response. High bandwidth loops track quickly and may overshoot, low bandwidth lag, all reveal their time constant.

Rather than ramble on, allow me to pose this question: If Fremont paused the 3 line to improve the production rate, is the rate after that pause more likely higher or lower than the rate going into the pause? (And what should the line slope look like in that case?)

Off Shore

Off Topic Member

Ars Technica reviews Ford's electric plans. Takeaway forward-looking quote: "Hybrids for years have been mostly niche products but are now on the cusp of a mainstream breakout," said Jim Farley, Ford president of global markets.

Reciprocity

Active Member

Related to your post, not directed at you:

Two factors in control loops are the rare at which the loop is calculated and the base equation.

In this case having Boomberg update more often won't change their trend, it will only put more points on the line. If they use finer time units, it might improve the line granularity.

By lagging, I think most of us mean that it is putting too much weighting on older data. Compare to the 50 vs 200 day price average for your favorite stock. If there was a bump 200 days ago, then a drop 180 days ago, held steady, and then a sharp rise occurring today: the 50 day would slowly move up, but the 200 might actually move down due to losing the old high data.

By now, everyone is painfully aware that I'm holding out for the end of the pack supply drought step change to arrive. A step change is a real method of testing a control system's response. High bandwidth loops track quickly and may overshoot, low bandwidth lag, all reveal their time constant.

Rather than ramble on, allow me to pose this question: If Fremont paused the 3 line to improve the production rate, is the rate after that pause more likely higher or lower than the rate going into the pause? (And what should the line slope look like in that case?)

The problem is that this is all speculation and you do not know why they paused the line or if it was successful. We do not really know anything except the feedback we get from users as they report. My point with the model 3 tracker is that even looking at the data that is there, its not updated based on their own graphs. The last one in particular where it shows a lot of vins reported in the last week or two and yet the black line is still trending down. You are correct about the 50 vs 200 day moving average analogy, I had not specifically thought it about it that way. Because of that, the faster production grows, the less accurate the bloomberg tracker will be. But also, their methodology should not be that useful for investors for the same reason, the problem is that most investors dont have time to dig into that and find out that the tracker is useless. It will still be showing 1000/W when Tesla hits 2000/w, 2500/W when Tesla hits 5/W and will show 5/W when Tesla hits 10/W because its relies, as you said, on old and less relevant data. But again, people are making financial decisions based on this older and irrelevant data. I want to be clear that the data is not irrelevant as a whole, its just not relevant to determine the pace of production, which is what matters to stock holders at this point. The most important thing to the stock holders should be the pace at which Tesla is producing Model 3s at the moment they deliver the 200,000th car and how quickly they can continue to ramp to maximum output. They should want that pace to be as high as possible so that they can deliver as many people cars in the 90-120 days after that day, and again in the 120 days that follow that for $3850 rebate. I think this fact might be impacting how Tesla is managing the ramp. Its almost as if they are slow rolling to make sure that the day they hit 200,000, they can unleash the hounds. Nothing else really explains why they seemingly have not improved production rates for the last 3 months. Some more recent evidence though does point to a rate closer to 1500, which would be very encouraging.

Exactly. If it is using data older than a month (maybe even three weeks) for trend projection it will be way off.The problem is that this is all speculation and you do not know why they paused the line or if it was successful. We do not really know anything except the feedback we get from users as they report. My point with the model 3 tracker is that even looking at the data that is there, its not updated based on their own graphs. The last one in particular where it shows a lot of vins reported in the last week or two and yet the black line is still trending down. You are correct about the 50 vs 200 day moving average analogy, I had not specifically thought it about it that way. Because of that, the faster production grows, the less accurate the bloomberg tracker will be. But also, their methodology should not be that useful for investors for the same reason, the problem is that most investors dont have time to dig into that and find out that the tracker is useless. It will still be showing 1000/W when Tesla hits 2000/w, 2500/W when Tesla hits 5/W and will show 5/W when Tesla hits 10/W because its relies, as you said, on old and less relevant data. But again, people are making financial decisions based on this older and irrelevant data. I want to be clear that the data is not irrelevant as a whole, its just not relevant to determine the pace of production, which is what matters to stock holders at this point. The most important thing to the stock holders should be the pace at which Tesla is producing Model 3s at the moment they deliver the 200,000th car and how quickly they can continue to ramp to maximum output. They should want that pace to be as high as possible so that they can deliver as many people cars in the 90-120 days after that day, and again in the 120 days that follow that for $3850 rebate. I think this fact might be impacting how Tesla is managing the ramp. Its almost as if they are slow rolling to make sure that the day they hit 200,000, they can unleash the hounds. Nothing else really explains why they seemingly have not improved production rates for the last 3 months. Some more recent evidence though does point to a rate closer to 1500, which would be very encouraging.

We don't know what is happening, but using the wrong type of line fit will give erroneous results.

Linear vs quadratic vs exponential vs stepped. The increasing gap between highest VIN and production indicates a possible issue.

Was there a point you were trying to make? 'Cuz it's lost on me.Car & Driver Reviews the all new 2012 Tesla Model S.

Vid says 2013 but date of publication is Oct 4,2012 so it has to be a 2012.

- Status

- Not open for further replies.

Similar threads

- Replies

- 1

- Views

- 770

- Locked

- Replies

- 0

- Views

- 4K

- Article

- Replies

- 29

- Views

- 6K