Hi everyone,

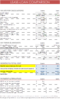

I got my leasing application approved by Tesla today (Model S 60) after weeks of back and forth and I was wondering if you guys could give me your input on the estimates they gave me (see attached picture). I find the cap cost reduction quite high. I am fairly new to car leases since this would be my first vehicle, so any input you could provide would be very helpful. I would be going for the 15,000 miles deal (California).

Thanks in advance!

____________________________________________________________________________

A bit of background, 26, female, single, no dependants, salary 110K /yr, no student loans, debts, or mortgages. In case is relevant, I am not planning on changing my martial status or purchasing/investing on properties any time soon. Corny or not, my main motivation behind getting a Tesla (aside from all the plus the car comes with) is for the environment. There are enough gas vehicles out there and I really want to make a difference. The carpool stickers are also a big plus as I have a long commute.

So I applied for the Tesla leasing program about 3 weeks ago and Tesla got back to me about a week and a half after to let me know that they could not approve my leasing application due to my lack of credit history, which made sense since I recently moved to the US from Canada. They however strongly encouraged me to apply for financing instead.

I replied back and said I wasn’t interested in financing the vehicle at all and that I was only interested in leasing. I told them that if we could workout a prepaid lease or monthly security deposits arrangement that I would be happy to discuss and also asked if they could run the credit report on my Canadian accounts instead.

I heard back from them the day before the order was finalized (step before you get the VIN assigned). They told me that they ran my Canadian credit report and that unfortunately they could not approve the leasing (I am positive I have an excellent credit score in Canada though but oh well…). Once again they strongly encouraged me to apply for financing or to contact AutoFlex, a third party leasing company. Since I only had a couple of hours to make a decision and AutoFlex did not contact me back, I asked the Tesla owner advisor if adding a co-signer would help in reconsider my leasing application. Later that night, Tesla confirmed that I could add a co-signer, asked me to submit proof of income and bank statements and asked me to re-apply for the leasing once again.

So I added my uncle as a co-signer, re-submitted the application and today I was notified that my leasing application had been accepted. The first sentence in the email was : "Please note the $11,130 cap cost reduction required + fees = $13996 for delivery.” followed by a long explanation on why the financing option is better than the leasing one etc.

As of today, my Tesla has already been assigned a VIN number. In the first estimate I received, the down payment was $5,000 and the amount due at signing was $7,678. I guess it makes sense that they doubled the down payment because of my lack of credit history? What do you guys think? Am I getting ripped off or is this a fair deal? I also feel like they are pushing the financing option a bit too much despite the fact that I have made it clear that I am not interested.

Due to all the back and forth that went on during the application process, can I still negotiate the cap cost reduction amount or is this now a take it or leave it? I wouldn't mind paying more per month.

I got my leasing application approved by Tesla today (Model S 60) after weeks of back and forth and I was wondering if you guys could give me your input on the estimates they gave me (see attached picture). I find the cap cost reduction quite high. I am fairly new to car leases since this would be my first vehicle, so any input you could provide would be very helpful. I would be going for the 15,000 miles deal (California).

Thanks in advance!

____________________________________________________________________________

A bit of background, 26, female, single, no dependants, salary 110K /yr, no student loans, debts, or mortgages. In case is relevant, I am not planning on changing my martial status or purchasing/investing on properties any time soon. Corny or not, my main motivation behind getting a Tesla (aside from all the plus the car comes with) is for the environment. There are enough gas vehicles out there and I really want to make a difference. The carpool stickers are also a big plus as I have a long commute.

So I applied for the Tesla leasing program about 3 weeks ago and Tesla got back to me about a week and a half after to let me know that they could not approve my leasing application due to my lack of credit history, which made sense since I recently moved to the US from Canada. They however strongly encouraged me to apply for financing instead.

I replied back and said I wasn’t interested in financing the vehicle at all and that I was only interested in leasing. I told them that if we could workout a prepaid lease or monthly security deposits arrangement that I would be happy to discuss and also asked if they could run the credit report on my Canadian accounts instead.

I heard back from them the day before the order was finalized (step before you get the VIN assigned). They told me that they ran my Canadian credit report and that unfortunately they could not approve the leasing (I am positive I have an excellent credit score in Canada though but oh well…). Once again they strongly encouraged me to apply for financing or to contact AutoFlex, a third party leasing company. Since I only had a couple of hours to make a decision and AutoFlex did not contact me back, I asked the Tesla owner advisor if adding a co-signer would help in reconsider my leasing application. Later that night, Tesla confirmed that I could add a co-signer, asked me to submit proof of income and bank statements and asked me to re-apply for the leasing once again.

So I added my uncle as a co-signer, re-submitted the application and today I was notified that my leasing application had been accepted. The first sentence in the email was : "Please note the $11,130 cap cost reduction required + fees = $13996 for delivery.” followed by a long explanation on why the financing option is better than the leasing one etc.

As of today, my Tesla has already been assigned a VIN number. In the first estimate I received, the down payment was $5,000 and the amount due at signing was $7,678. I guess it makes sense that they doubled the down payment because of my lack of credit history? What do you guys think? Am I getting ripped off or is this a fair deal? I also feel like they are pushing the financing option a bit too much despite the fact that I have made it clear that I am not interested.

Due to all the back and forth that went on during the application process, can I still negotiate the cap cost reduction amount or is this now a take it or leave it? I wouldn't mind paying more per month.