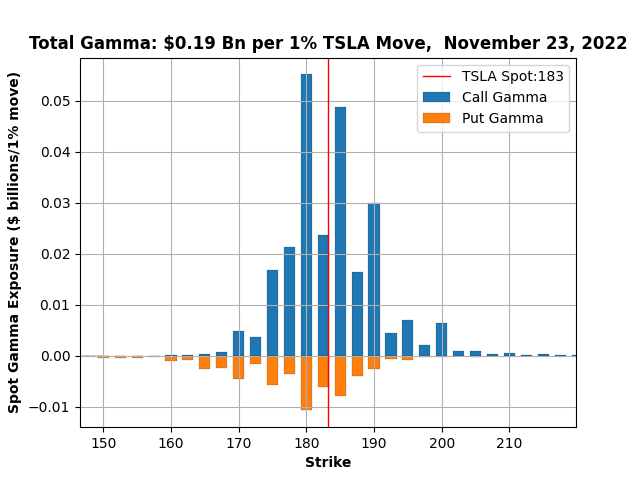

Ok color me bullish. This is what a clean impulsive structure looks like. I've not seen this in over a year. If we can break above 181.5, I think we'll top out ~ 183-185 before pulling back to 172.5 area next week before taking off for good.

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Wiki Selling TSLA Options - Be the House

- Thread starter adiggs

- Start date

Ok color me bullish. This is what a clean impulsive structure looks like. I've not seen this in over a year. If we can break above 181.5, I think we'll top out ~ 183-185 before pulling back to 172.5 area next week before taking off for good.

View attachment 877585

Oooh! So no mid-2023 revisit to lows? That’s fab for those of us bagholding (me from $300) flying too close to the sun with margin.

"If"Oooh! So no mid-2023 revisit to lows? That’s fab for those of us bagholding (me from $300) flying too close to the sun with margin.

"If"

Just two letters that equal a bucket of stomach acid ;-)

FOMC minutes fairly dovish - especially when considering that the release of Oct CPI / PPI data (which was released after the meeting) substantiated some of the dovish comments in the minutes. Good opportunity for a bit of a rally here.

BTC the 15x 2/12 -p180's I had rolled yesterday for 50% gains - will usually take those if presented within 24 hours, put a sell order for the same premium at -p170 in case of a post-FOMC dump, but clearly has gone the other way. Not only that, but TSLA is building on earlier gains, while SPY and QQQ keep bouncing off resistance at 289 and 402

Glad to be out of the puts with profits, some of which were rolled down from -p200 over a few weeks, won't write any more until I've de-risked to cash the recently assigned puts

Shame the markets are closed tomorrow and half-day Friday

Glad to be out of the puts with profits, some of which were rolled down from -p200 over a few weeks, won't write any more until I've de-risked to cash the recently assigned puts

Shame the markets are closed tomorrow and half-day Friday

juanmedina

Active Member

Any concerns about the Tesla Semi reveal on the 1st that might push the stock up? or it will the usual sell the news event? I think I might until next to sell more call but it is really tempting after the huge beat down that we have seen.

It will be a non-event.Any concerns about the Tesla Semi reveal on the 1st that might push the stock up? or it will the usual sell the news event? I think I might until next to sell more call but it is really tempting after the huge beat down that we have seen.

Downside is Elon says something stupid at the event. Biggest Upside is just seeing him back to work at Tesla, that is probably more important than the Semi deliveries. If a new roadster comes out of the back of every Semi then we are going to the moon!Any concerns about the Tesla Semi reveal on the 1st that might push the stock up? or it will the usual sell the news event? I think I might until next to sell more call but it is really tempting after the huge beat down that we have seen.

@dl003 Is it really a gap if we traded there the day before yesterday ?

I understand that there was a gap between yesterday closing and today opening, which was not revisited during the day, but that price range has been traded through on the way down just the day before (Monday).

I understand that there was a gap between yesterday closing and today opening, which was not revisited during the day, but that price range has been traded through on the way down just the day before (Monday).

by that definition, 99.99% of gaps will cease to exist lol.@dl003 Is it really a gap if we traded there the day before yesterday ?

I understand that there was a gap between yesterday closing and today opening, which was not revisited during the day, but that price range has been traded through on the way down just the day before (Monday).

I wouldn't be worried about the gap fill. It will happen for technical reason but the structure is bullish. Most bullish setup I've seen in a while.

Analyst will be aghast that Tesla was able to produce the Semi's even when EM seemed fully focused on TWTr.It will be a non-event.

Could rally, if macros favor, just because it has taken such a bad beating recently.

If Q4 numbers also comes in good, will prove TSLA can do it's thing without EM's 24/7 presence at TSLA.

it was quite a turkey run, now let's we if it turns into Santa rally

Of course, just when I got comfortable holding 6x 175CC for this week, I got run over. Closed them at a loss but then sold 3x 12/30 200CC to split and roll forward some DOTM BPS. Happy to have reduced leverage and get some margin breathing room, wherever we go from here.

Strict approach? Who do you think we are? A bunch of doctors and pilots?

Lol, my CCs strike price selection is based on resistance levels. However, they get blasted through like they don’t exist. In bear markets, resistance and support are lost like tears in rain.

intelligator

Active Member

We blew past the probable pivot at 172 +/- $5. Open interest spiked at 180c and 185c, around and in between at 177.5c (what I sold with the thought it would expire worthless) and 182.5c, and 187.5c, don't know what to make of the 190c. Looks like I'll need to roll to next week, not interested in going further out at this time. Maybe I'll max credit at same or a strike above if we settle down Friday.

I rolled my 50X 170CC for this Friday to 175 for next week. The roll had a slight debit which I paid for by selling the Protective Puts I had for this Friday at 167.5.

Now I have 100X 175CC for next week. I have 50X 172.5 Protective Puts that are losing value, but I can sell for some credit to help roll the CC higher. I also sold 50X 160 Puts for next Friday for almost $2 early in the day to generate more money for the roll. I hoping the SP doesn't get away from me. I can sell 150X new CCs to help pay for the roll of these 100X calls, but I need to make sure the new CCs don't go in the money too.

Dan Shapiro called the SP action perfectly again today. He thinks that the market will gap up in pre-market on Friday. He also thinks we are going to have a Bull run for the next month or so (although CPI and Fed meeting in 3 weeks could change everything) because the QQQ held the 50 day MA (as did SPY). The last time this happened (in July I think) there was a month+ long Bull run before the Bear market that ended with the latest CPI.

I'm cautiously optimistic that the Bear market is coming to an end. A recession could obviously change everything though. We probably need the Russian war to end, and for China to end their Covid policy to ensure a sustained Bull market.

Now I have 100X 175CC for next week. I have 50X 172.5 Protective Puts that are losing value, but I can sell for some credit to help roll the CC higher. I also sold 50X 160 Puts for next Friday for almost $2 early in the day to generate more money for the roll. I hoping the SP doesn't get away from me. I can sell 150X new CCs to help pay for the roll of these 100X calls, but I need to make sure the new CCs don't go in the money too.

Dan Shapiro called the SP action perfectly again today. He thinks that the market will gap up in pre-market on Friday. He also thinks we are going to have a Bull run for the next month or so (although CPI and Fed meeting in 3 weeks could change everything) because the QQQ held the 50 day MA (as did SPY). The last time this happened (in July I think) there was a month+ long Bull run before the Bear market that ended with the latest CPI.

I'm cautiously optimistic that the Bear market is coming to an end. A recession could obviously change everything though. We probably need the Russian war to end, and for China to end their Covid policy to ensure a sustained Bull market.

I should add that I have cash sitting there to buy another 6,000 shares, but I haven't pulled the trigger yet because I need that cash to avoid a Margin call if the SP drops to new 52 week lows. As nice as the price action was today, I'm not convinced we can't go back down. That is also why I'm trying not to panic on my 175CC for next week.

Similar threads

- Replies

- 50

- Views

- 7K

- Replies

- 10

- Views

- 4K

- Replies

- 106

- Views

- 10K

- Replies

- 5

- Views

- 5K